Some people drink deeply from the fountain of knowledge. Others just gargle.

Grant M. Bright, British-born American Engineer

Uranium Spot Price Chart: Shaping Supply, Demand, and Prices

Updated May 31, 2024

Uranium, the lifeblood of nuclear power, is witnessing a significant shift in its market dynamics. A confluence of factors is reshaping the uranium price and supply landscape, hinting at a potential upswing in its value. As we look towards 2030 and beyond, the interplay of supply and demand and mass psychology presents a compelling investment opportunity.

Historically, the uranium market has weathered stress, primarily due to inadequate investment in new production capacity. This underinvestment resulted from the low uranium prices after the Fukushima disaster. The concentration of mines in specific geographic regions further compounded this issue, creating a natural delay in introducing a new primary supply. Recent geopolitical events and disruptions induced by the COVID-19 pandemic have added another layer of complexity to the supply landscape.

On the demand side, nuclear power is a cornerstone in the global clean-energy strategy, steadily gaining momentum. Projections suggest that global energy consumption will nearly double over the next two decades, fueled by rapid population growth and economic expansion. With the world’s pursuit of carbon-free energy sources, nuclear power is well-positioned to meet the need for baseload power, thereby driving up the demand for uranium.

Moreover, advancements in Small Modular Reactor (SMR) technology have expanded the scope of nuclear power applications beyond electricity generation. These applications include water desalination, hydrogen production, and heat generation. This diversification is expected to further boost the demand for uranium in the foreseeable future.

As we enter the 21st century, the uranium market continues to evolve. The advent of Fourth-Generation nuclear reactors, which promise higher efficiency and safety, could further stimulate uranium demand. Additionally, the global push towards decarbonization and the Paris Agreement’s ambitious climate goals have placed nuclear power and uranium at the forefront of the energy transition.

The uranium spot price chart reflects current market dynamics and predicts future trends. It’s a barometer of the delicate balance between supply and demand, geopolitical influences, technological advancements, and environmental considerations. As such, it is a crucial tool for investors, policymakers, and industry stakeholders.

Illuminating Rare Trends: Uranium Spot Price Long-Term Shifts

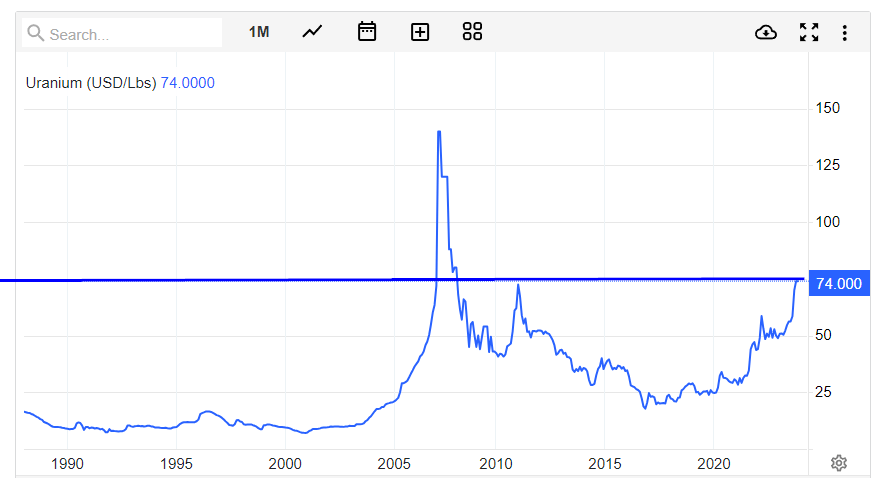

Uranium is painting a striking and formidable pattern, shattering all zones of prior resistance. The key lies in a monthly close above $75, preferably $78, to pave the way for a journey to $141 and beyond, reaching new all-time highs. From a long-term perspective, investors should eagerly anticipate sharp pullbacks, seizing the opportunity to buy when they materialize.

Supply and Demand Dynamics: A Future Outlook

The supply and demand dynamics of uranium are set to undergo significant changes as we approach 2030 and beyond. According to the World Nuclear Association, demand for uranium in nuclear reactors is expected to climb by 28% by 2030 and nearly double by 2040 as governments ramp up nuclear power capacity to meet zero-carbon targets. This surge in demand is driven by the increasing adoption of nuclear power as a reliable and clean energy source.

However, the supply side tells a different story. Global uranium production dropped by a quarter from 2016 to 2020 and has only slightly recovered. The gap between production and consumption is projected to widen, with uranium production expected to reach 87.6kt by 2029, lagging behind estimated consumption of 94.6kt. This imbalance in the uranium market is expected to persist long term, as supply struggles to keep pace with the growing demand.

Mass Psychology and Market Sentiment

Mass psychology is crucial in shaping market sentiment and influencing uranium prices. Investors’ collective behaviours, attitudes, and reactions can drive significant price movements. For instance, during extreme fear, such as geopolitical tensions or economic downturns, investors may rush to sell, leading to oversold conditions. Conversely, during periods of euphoria, such as breakthroughs in nuclear technology or favourable regulatory changes, investors may rush to buy, driving prices to new highs.

Understanding these mass emotional states can help investors identify opportune moments to act. When euphoria grips the market, it often leads to overbuying, inflating prices beyond their actual worth. While it might be tempting to go with the flow, experienced investors know this could be a bubble about to burst. Conversely, prices often plummet when panic seizes the market as investors rush to sell. This fear-driven sell-off can create opportunities to buy quality stocks at lower prices.

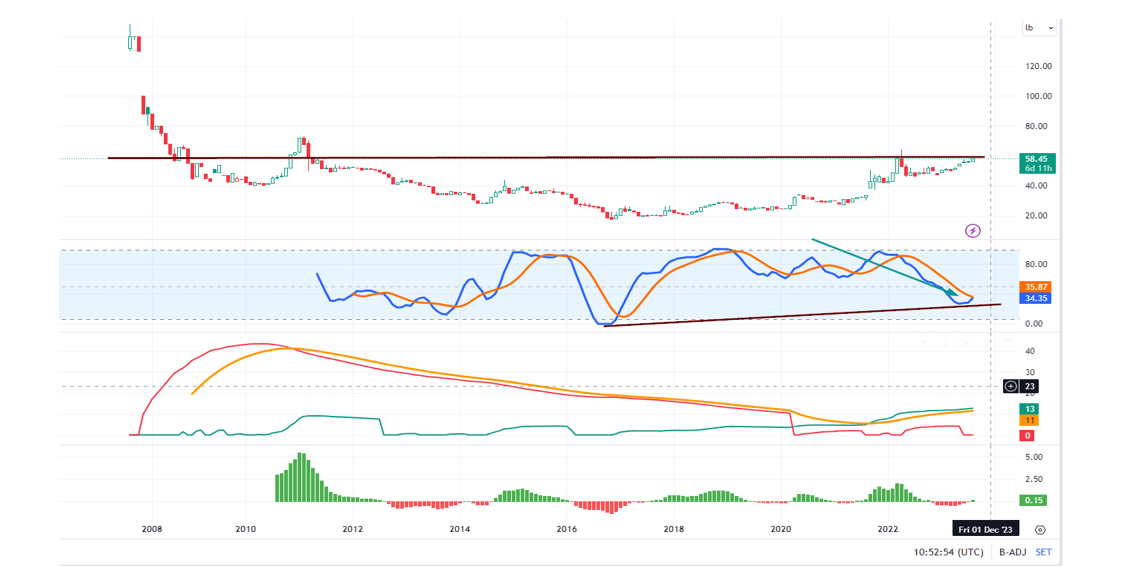

Analyzing the Uranium Spot Price: The Monthly Outlook

The uranium sector shows an intriguing pattern that has captured our attention. If this pattern unfolds as anticipated, it could create a new and significant trend.

This pattern is fascinating because Uranium is currently challenging long-persisted resistance levels. At the same time, the technical indicators suggest that the market is oversold. Considering all these factors, it becomes evident that Uranium is on the verge of a significant upward movement, with the potential to surpass the $120.00 mark before this upward cycle concludes.

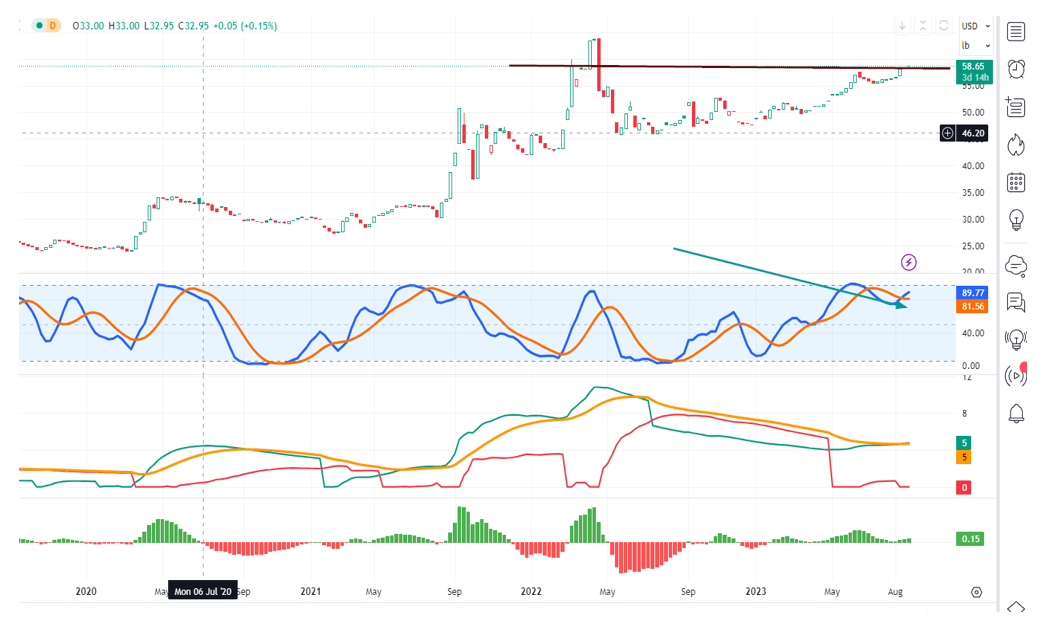

Analyzing the Uranium Spot Price: A Weekly Outlook

The weekly uranium spot price chart outlook suggests that uranium (the metal) trades in highly overbought territory. However, it could intensify its upward trend cycle if it achieves either of the following conditions before undergoing a pullback: securing a weekly close at or above 58.75 or experiencing a surge to new highs, which would necessitate surpassing the 63.85 threshold.

Should it fall short of these objectives, there will be no alterations. The long-term perspective remains profoundly bullish. As previously mentioned, the only variable that might be affected is the speed at which it tests and surpasses the 120.00 level.

Conclusion

The uranium market is at a pivotal juncture, experiencing a remarkable transformation in response to various market forces. The challenges it has faced, including underinvestment, geographic concentration of mines, and supply disruptions, have created an environment of uncertainty and complexity.

On the demand side, nuclear power is gaining prominence as a critical component of the global clean-energy strategy, driven by the need for baseload power to meet the rising global energy consumption. Additionally, advancements in Small Modular Reactor (SMR) technology are expanding nuclear power applications, further bolstering uranium’s demand outlook.

As we analyze the uranium spot price charts, both monthly and weekly, we see intriguing patterns that hint at significant potential. Uranium is poised to challenge long-standing resistance levels, and technical indicators suggest an oversold market. This combination of factors indicates the possibility of a substantial upward movement, with the potential to surpass the $120.00 mark soon.

In essence, the uranium market is on the cusp of a transformative journey driven by shifting dynamics in supply and demand. The path ahead holds promise, and careful observation of market trends will be key to successfully navigating this evolving landscape.

Moving forward, we will analyze the price action in the context of historical data. This allows us to review our real-time decisions and reminds us that failing to learn from history can lead to its repetition.

Uranium Spot Price: The Stealth Uranium Bull Market

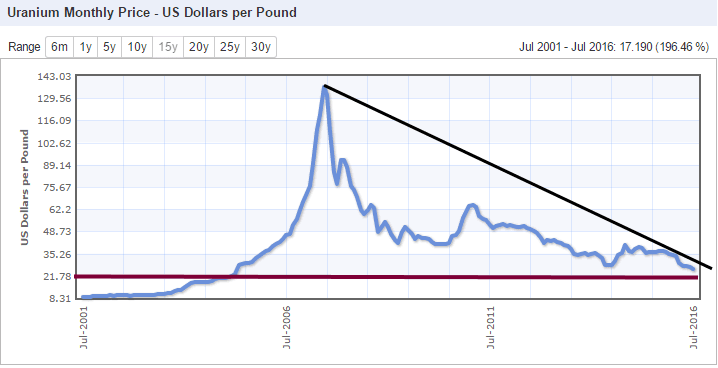

A glance at this chart reveals that uranium has a considerable distance to cover before reaching the highs set in 2006. The genuine bullish phase is anticipated to commence when these previous highs are surpassed. Without this achievement, one could make a technical argument that the current uptick is merely a temporary recovery within a long-term secular bear market.

Our perspective is grounded in the belief that this market still holds substantial untapped upside potential. A key factor contributing to this optimism is the relatively limited public attention it has received thus far. While the topic occasionally surfaces, it has yet to become the focal point of mainstream discussion.

Source:www.indexmundi.com/

Strategic Approach to the Uranium Market: Navigating Mass Psychology for Success

We will approach this market differently. When uranium finally reaches the front pages of major magazines and newspapers, many will rush to bail out. However, this won’t be the ideal time to exit at TI, where we heavily focus on mass psychology. At this stage, we expect a mass feeding frenzy to begin, leading to a highly volatile ride upward that could yield additional gains of up to 500%. We plan to ride this wave until our psychological indicators indicate that bullish sentiment has reached an unsustainable level, and then we will strategically exit the market.

As we’ve emphasized, every potentially significant sector is filled with exciting opportunities, but it’s crucial to know when to position oneself in these opportunities. Today’s leaders may not be tomorrow’s leaders, and some stocks may ultimately end up as losers. For instance, consider MYNG in the Gold Sector; despite reaching a high of 30 cents in October 2003, it’s now trading at just 1 cent, even as gold has gone on to achieve a series of new 52-week highs.

Uranium Spot Price & Bull Market Update Aug 2018

CCJ’s recent drop to and below $8.50 presented a significant opportunity for those who followed our suggestions. Now, let’s examine the outlook for uranium.

The weekly chart above shows that CCJ is approaching a robust resistance zone. If it manages to close above $12 on a monthly basis, the previous resistance will transform into support, opening the path for a potential climb to multi-year highs. A monthly closing above $12 could also set the stage for CCJ to reach the $20 range, possibly even overshooting to $26.00.

Sharp pullbacks can be opportune moments for savvy investors to establish positions in strong stocks like CCJ. Remember, in the investing world, it’s often said that “the trend is your friend,” while everything else can pose challenges.

The need for expansion is as genuine an instinct in man as the need in a plant for the light, or the need in man himself for going upright. The love of liberty is just the instinct in man for expansion.

Matthew Arnold 1822-1888, British Poet, Critic

Discover Unique and Valuable Articles for Your Interest