Smart Money Getting Trounced by Dumb Money

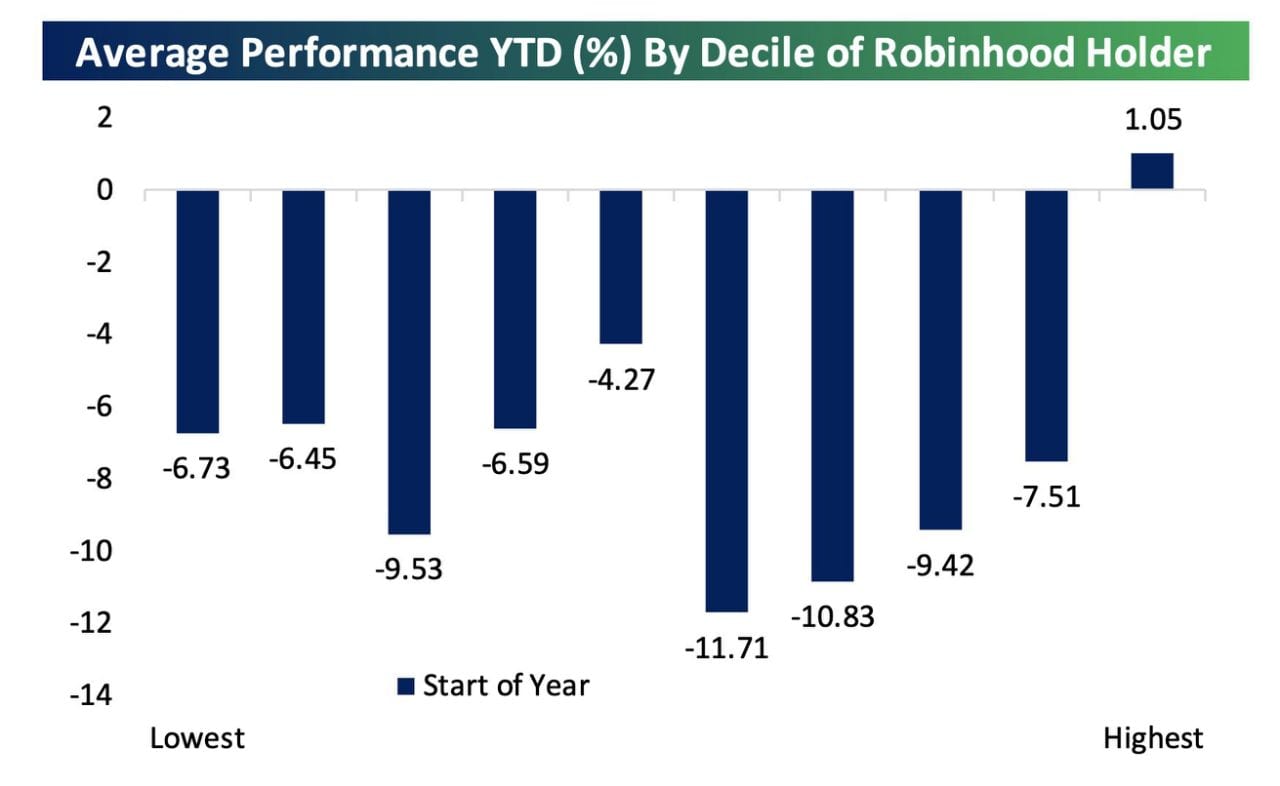

As evidenced by the image below, the average holdings of Robinhood traders are up by 1.5% on average. However, some traders have made fortunes by buying right at the bottom when so-called experts like Buffett, that represent the smart money panicked like sheep. Buffett appears to have lost his touch, reacting like a lemming and dumping his airline stocks right at the bottom. Secondly, instead of buying the panic as he was so fond of proclaiming the best, he panicked and fled for the hills.

He has also made many questionable investment decisions and lagged the SP 500 for years. What we stated is coming to pass, that many so-called experts will be left in the dust and follow the path of the dinosaurs. Right now, the small guy is thrashing big players like Buffett, and these small chaps, as evidenced by trades on Robinhood, are buying low and selling high, which seems to be eluding Buffet and other experts that keep proclaiming this market is destined to crash.

Many experts seem to agree that Dumb Money is beating the Smart Money

“While commission-free, low-dollar traders are often viewed as a group who tend to do the opposite of the right thing (to be a little more derisive, ‘dumb money’), the Robinhood data actually suggests the opposite,” George Pearkes, a macro strategist at Bespoke, wrote in a report.

“People are very dynamic in the way they trade,” Primozic said in an interview with Bloomberg Television. “They’ll jump on news very quickly — like, as it happens — so people are definitely, they have their ear to the ground and they’re trying to make the best trading decisions they can throughout the day.”

“It’s not unusual for us to see our clients rotating in and out of stocks after they make a run,” said Cruz. “They’ll take profits and find something that’s a little more beat-up and rotate into that.” Yahoo Finance

The market disorder leads to opportunity

In this environment of financial disorder, it feels almost natural to give in and state that resistance is futile. Well, that is exactly what the nefarious players at the top are hoping for. However, it makes sense if one looks at the situation with clear eyes by removing the emotional factor. Once fear takes over and starts talking, logic does the walking and end result is destruction, as in loss.

This is why the so-called wise money is paying the price, for they assumed it was different this time. Instead of taking their advice, they acted like the masses. When it comes to the markets, one has to adapt or die. There is no middle ground. We use the word the so-called smart money because they are not the real smart money, the real top players are the ones that orchestrated this coronavirus pandemic crash, and when the markets were crashing, they came in and scooped up everything in sight. At this point, any monkey with a dart could beat 90% of stock market experts and do so with ease.

It started in 1973 when Princeton University professor Burton Malkiel claimed in his bestselling book, A Random Walk Down Wall Street, that “A blindfolded monkey throwing darts at a newspaper’s financial pages could select a portfolio that would do just as well as one carefully selected by experts.”

“Malkiel was wrong,” stated Rob Arnott, CEO of Research Affiliates, while speaking at the IMN Global Indexing and ETFs conference earlier this month. “The monkeys have done a much better job than both the experts and the stock market.” Forbes

Astute Trend Players

There exist skilled trend players among the top individuals in the market, although they may not receive much public attention. Unfortunately, they also possess a deep understanding of Mass Psychology. The most effective way to deceive someone is to make them believe they have a limited set of choices, all leading to adverse outcomes while creating the illusion of choice. Breaking free from this cycle requires looking beyond the presented choices. How can one achieve this? Firstly, by not accepting everything promoted by the media. The media’s primary role is to convince the masses that the false narrative is true. Once that belief is established, the masses are left with no real choices, only the illusion of choice.

The onslaught against the masses is expected to be severe in nature. Therefore, it is essential to be prepared for a significant amount of negativity and hyperbolic predictions that suggest the end of the world.

Interesting take on the mass mindset

The individuals who labour in our offices and factories often remain unaware of their enslavement. If they harbour any aspirations, they merely revolve around finding ways to enhance their servitude: enjoying a pleasant Sunday, attending an evening dance, dressing in a more refined manner, or earning more money. Even if they feel dissatisfied with their lives, their thoughts are limited to reducing work hours, increasing salaries, and obtaining more vacation time—essentially seeking the trappings of a socialist utopia. They could never entertain the idea of rebelling against work itself, not even in their minds.

Work is their deity, and they dare not oppose it, even in their thoughts. However, Hugh possessed a different nature. He abhorred slavery. He consistently claimed that being enslaved to work was a manifestation of divine anger. Every fibre of his being trembled with an awareness of this pervasive monster, tightening its grip on him. Moreover, he was never inclined to embellish his enslavement, nor did he deceive himself with trivial distractions . Extracted from talks with the devil

Stock market sentiment indicates Smart Money is wrong

The crowd is in a state of disarray, including anyone and everyone sitting on the sidelines with cash. As uncertainty is in the air, the astute investor should use every sharp pullback to load up on quality stocks.

Tactical Investor Take

Insiders have taken advantage of this significant market pullback to acquire shares, and one way to gauge the intensity of their buying is by examining the sell-to-buy ratio. A reading of 2.00 is considered normal, while a ratio below 0.90 is exceptionally bullish. Currently, the ratio stands at a remarkable 0.35, indicating that these insiders are eagerly purchasing shares.

Let’s look at today’s readings. With a notably high transaction volume, Vickers’ benchmark NYSE/ASE One-Week Sell/Buy Ratio stands at 0.33, and the Total one-week reading is 0.35. Insiders are not only buying shares but actively devouring them. We have observed similar behaviour from insiders in the past, such as during the late December 2018 market crash, the early 2016 correction, and the depths of the Great Recession correction in late 2008/early 2009. Those were exceptional times to buy stocks. Insiders seem to be signalling that the current situation presents a similar opportunity. . https://yhoo.it/2TV0cE2

The Fed has pulled a Houdini

The injection of excessive money into the markets has led to demand destruction in various sectors. Fear has been effectively utilized as a powerful tool by the top players, with astonishing precision. While this is distressing news for the general public, it presents an advantage for astute investors. Unfortunately, not everyone can emerge victorious in life and general investing.

There is a strong possibility that the Euro may not only reach parity with the dollar but even fall below it. However, that is a topic for another discussion. It is important to remember that all this influx of free money comes at a cost. And what is that cost, you may ask? Personal freedom. When the printing press runs rampant, Gestapo-like forces begin to emerge. Consequently, the United States and many other supposedly desirable retirement destinations will continue to decline in rankings. Fiat money and freedom are not compatible partners.

Our Indicators are trading in the extremely oversold ranges

Our indicators are now dangerously close to moving into the extremely oversold ranges. So it’s just a question of when a Mother of all buy signals is generated. As we stated before, the FOB (father of all buys) is a rare event, so we will not hold out for it. If it happens, it happens, if not, a MOB signal is not something to ignore.

The markets mounted an incredibly strong rally, so in light of that, we are going to adjust the universal trigger. The new universal trigger entry points for the Dow fall in the 20,550 to 21,000 ranges. Positions can be opened in all the pending plays we don’t have a position in. So, we have two trigger points; the first trigger point is for the stock to trade in the suggested ranges. The second trigger is for the Dow to trade in the above-suggested ranges. Market Update May 2, 2020

Wisdom in Words: Compelling Articles for the Thoughtful Reader

Quantitative Easing: Igniting the Corruption of Corporate America

Blooms and Busts: Navigating the Tulip Bubble Chart Phenomenon

Uranium Market Outlook: Prospects for a Luminous Growth Trajectory

Stock Investing for Kids: Surefire Path to Success!

An Individual Who Removes the Risk of Losing Money in the Stock Market: A Strategic Approach

Palladium Forecast: Unveiling the Stealth Bull Market

I Keep Losing Money In The Stock Market: Confronting the Stupidity Within

Analyzing Trends: Stock Market Forecast for the Next 6 Months

AMD Stock Forecast 2024: How MACDs & RSI Signal a Bottom

Market Mastery: The Best Investing Books for Your Success

Example of Groupthink: Mass Panic Selling at Market Bottom

Contrarian Thinking: The Power of Challenging the Status Quo

Mastering Technical Analysis Of The Financial Markets

Contrarian Outlook: A Pathway to Breakthrough or Breakdown