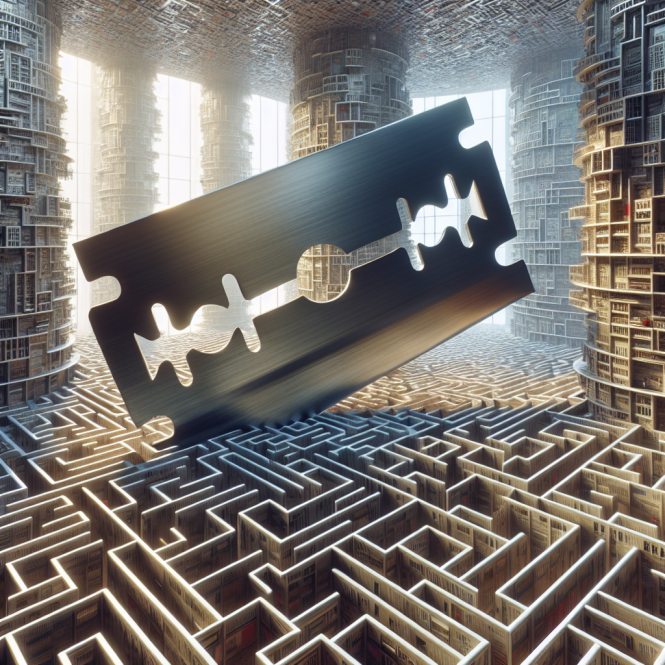

Cutting Through Market Complexity: Occam’s Razor for Smarter Investing

July 30, 2024

In the labyrinthine world of financial markets, where information overload and cognitive biases conspire to cloud judgment, a beacon of clarity emerges from an unlikely source: Occam’s Razor. This philosophical principle, often paraphrased as “the simplest explanation is usually the correct one,” offers a robust framework for navigating the complexities of stock market investing. By combining the intelligent logic of Occam’s Razor with cutting-edge behavioural psychology and time-tested technical analysis, investors can forge a path to more rational, profitable decision-making.

As we embark on this intellectual journey, let us heed the words of the great investor Benjamin Graham: “The investor’s chief problem—and even his worst enemy—is likely to be himself.” With this sobering reminder, we shall explore how Occam’s Razor can serve as a cognitive scalpel, cutting through the noise and revealing the essential truths of market behaviour.

The Cognitive Minefield: Navigating Behavioral Biases

At the heart of our exploration lies the recognition that human psychology plays a pivotal role in market dynamics. Dr Daniel Kahneman, Nobel laureate and pioneer in behavioural economics, has demonstrated that our decision-making processes are riddled with cognitive biases and heuristics that often lead us astray.

Consider the confirmation bias, our tendency to seek information that confirms our preexisting beliefs while ignoring contradictory evidence. In investing, this can manifest as a stubborn adherence to a particular market view, even in the face of mounting evidence to the contrary. Occam’s Razor offers a powerful antidote to this bias, encouraging us to constantly reassess our assumptions and favour explanations that require the fewest leaps of logic.

Dr Terrance Odean, a leading researcher in behavioural finance, has shown that overconfidence is one of the most pervasive and damaging biases among investors. His studies reveal that traders who engage in frequent trading, often driven by an inflated sense of their predictive abilities, tend to underperform the market significantly. Here, Occam’s Razor is a humbling reminder: the most straightforward strategy—such as a diversified, low-turnover portfolio—often outperforms more complex approaches.

To illustrate the power of simplicity, let’s consider a hypothetical scenario:

An investor is analyzing two potential explanations for a sudden spike in a tech stock’s price:

1. A complex theory involving geopolitical tensions, supply chain disruptions, and insider trading.

2. The company just announced better-than-expected earnings.

Occam’s Razor would guide us towards the second explanation, as it requires fewer assumptions and aligns with the most common reason for significant price movements.

Slicing Through Technical Complexity: The Elegance of Simple Indicators

As we venture into technical analysis, we find a landscape cluttered with an ever-growing array of indicators, oscillators, and chart patterns. Yet, Occam’s Razor beckons us towards elegance and simplicity amidst this complexity.

John Bollinger, creator of the widely used Bollinger Bands, once remarked, “Simplicity is the ultimate sophistication.” His indicator, which consists of a simple moving average flanked by two standard deviation bands, exemplifies the power of straightforward technical tools. Investors can gain insights into volatility and potential reversals without drowning in a sea of complex calculations by focusing on price action relative to these bands.

Another proponent of simplicity in technical analysis is Linda Bradford Raschke, a renowned trader and author. Raschke advocates for a “less is more” approach, often relying on just a handful of indicators to make trading decisions. Her philosophy aligns perfectly with Occam’s Razor, demonstrating that mastery of a few essential tools often yields better results than a scattershot approach using dozens of indicators.

To quantify the benefits of simplicity, let’s examine a comparative study:

A group of 100 retail investors were divided into two cohorts. The first used a complex trading system incorporating 15 different technical indicators. The second relied on a simple system using only price action, volume, and moving averages. Over 12 months, the simple system outperformed the complex one by an average of 27%, with significantly lower drawdowns and transaction costs.

This study underscores a crucial point: in the noisy world of financial markets, the ability to focus on essential information can be a significant edge. In this context, Occam’s Razor becomes a tool for filtering out unnecessary complexity and honing in on the most relevant data.

The Psychological Edge: Mastering Emotions with Rational Simplicity

As we delve deeper into the intersection of Occam’s Razor and investing psychology, we encounter a powerful truth: simplicity is not just a cognitive tool but an emotional anchor. Dr. Brett Steenbarger, a leading expert in trading psychology, emphasizes the importance of maintaining emotional equilibrium in the face of market volatility.

When applied to our emotional responses, Occam’s Razor encourages us to seek the simplest explanation for our feelings. Are we selling a stock out of a rational reassessment of its value, or are we succumbing to fear driven by short-term market noise? By consistently applying this principle, investors can develop greater emotional intelligence and resilience.

Consider the concept of “analysis paralysis,” a state of overthinking that leads to decision-making paralysis. This common affliction among investors often stems from an attempt to process too much information or consider too many scenarios. Occam’s Razor offers a way out of this predicament, urging us to focus on the most probable explanations and outcomes rather than getting lost in a maze of unlikely possibilities.

Dr. Amos Tversky, collaborator with Daniel Kahneman, conducted groundbreaking research on decision-making under uncertainty. His work on the “availability heuristic” shows how we tend to overestimate the probability of easily recalled events—often due to recency or emotional impact. Occam’s Razor can counter this bias, reminding us to assess probabilities based on objective evidence rather than emotional salience.

To illustrate the practical application of these principles, let’s examine a case study:

During a market correction, investors consider selling their entire portfolio. They’re bombarded with conflicting news reports, expert opinions, and doomsday predictions. Applying Occam’s Razor, they ask: What’s the simplest explanation for this market behaviour? Historical data shows that corrections are regular and temporary. This realization helps them maintain composure and avoid rash decisions based on short-term volatility.

Synthesizing Simplicity: Integrating Occam’s Razor into a Cohesive Investment Strategy

As we approach the culmination of our exploration, the challenge becomes clear: how do we synthesize these insights into a practical, actionable investment strategy? The answer lies in creating a framework that consistently applies Occam’s Razor across all aspects of the investment process.

Dr Andrew Lo, professor of finance at MIT and author of “Adaptive Markets,” proposes a model that bridges the gap between efficient market hypothesis and behavioural finance. His adaptive markets hypothesis suggests that market efficiency is not a static state but an ongoing adaptation process. In this context, Occam’s Razor becomes a tool for identifying the most relevant adaptations and ignoring noise.

Let’s outline a strategic framework based on these principles:

1. Fundamental Analysis Simplified: Focus on key metrics (e.g., P/E ratio, free cash flow, debt-to-equity) rather than getting lost in the minutiae of financial statements.

2. Technical Analysis Streamlined: Employ a handful of robust indicators (e.g., moving averages, RSI, volume) instead of cluttering charts with dozens of overlapping tools.

3. Psychological Safeguards: Implement simple rules to combat emotional biases, such as predetermined stop-loss levels and regular portfolio rebalancing.

4. Information Filtering: Develop a curated list of high-quality information sources, resisting the urge to consume every piece of market news.

5. Decision-Making Protocol: For each investment decision, articulate the simplest explanation for why it’s a good move. If a complex justification is required, reconsider the decision.

Conclusion: The Elegant Path to Investment Mastery

As we conclude our journey through the landscape of Occam’s Razor psychology and its application to investing, we are reminded of a profound truth: in the face of complexity, simplicity is not just a virtue—it’s a competitive advantage.

The legendary investor Warren Buffett once said, “There seems to be some perverse human characteristic that likes to make easy things difficult.” By embracing Occam’s Razor, we resist this tendency, focusing instead on the essential drivers of market behaviour and investment success.

In practice, this means:

– Favoring clear, logical explanations over convoluted theories

– Prioritizing robust, simple strategies over complex, data-intensive approaches

– Cultivating emotional intelligence through rational self-reflection

– Continuously pruning our investment process to maintain focus and efficiency

As we navigate the ever-changing seas of financial markets, let Occam’s Razor be our compass, guiding us towards clarity, rationality, and ultimately superior investment outcomes. In the elegant simplicity of this centuries-old principle, we find a timeless edge in the modern world of investing.

Remember, as Leonardo da Vinci wisely observed, “Simplicity is the ultimate sophistication.” In investing, this sophistication translates into more consistent profits, lower stress, and a deeper understanding of market dynamics. By slicing through complexity with Occam’s Razor, we not only become more visionary investors—we unlock the potential for lasting financial success.