Inflation Is High: An Unconventional View on Economic Indicators

April 10, 2023

Inflation is High: A Misleading Indicator

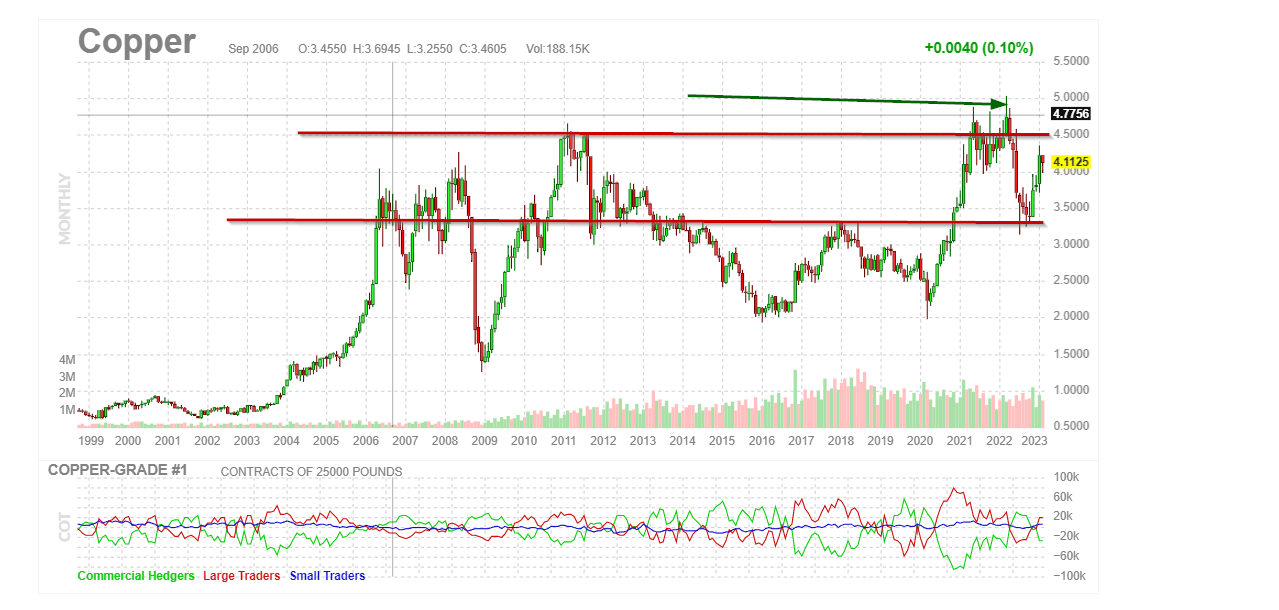

As the price of copper rises, many start to worry about the inflationary pressure it may cause. However, looking at the issue from a different perspective reveals a different story. Historically, higher copper prices were a sign of an improving economy and higher stock market prices. Thus, we can view the rise in copper prices as another ingredient calling for higher stock market prices rather than a sign of imminent inflation.

The Fed’s Actions: An Unpredictable Outcome

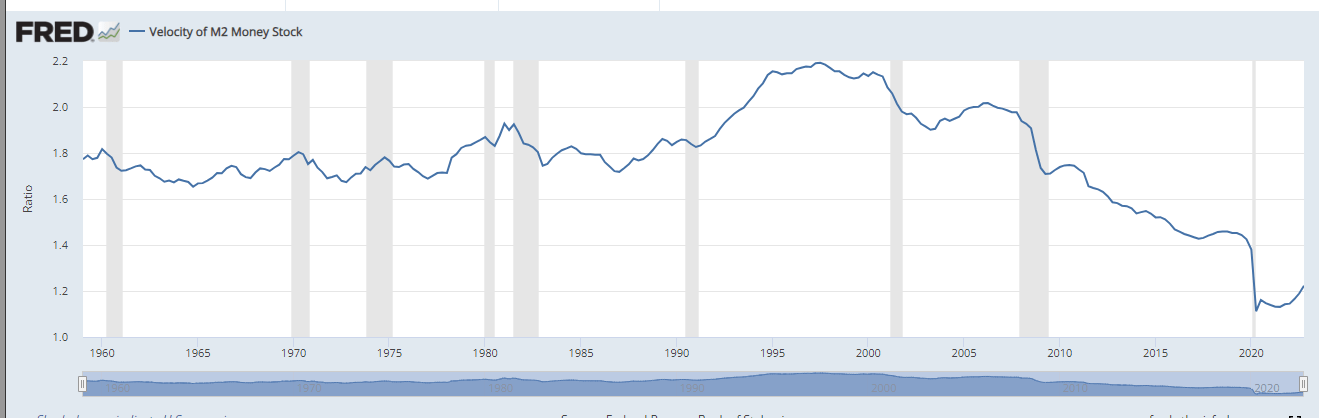

In these times of uncertainty, the Fed’s actions have opened Pandora’s box, and we cannot expect the usual outcomes. While the velocity of M2 money stock continues to trend downwards, we cannot predict how inflation will behave until it starts trending upwards. We must also consider the various deflationary factors, such as the grocery wars and the rise of automation and AI, which can impact the economy.

The Rise of AI: A Challenge to the Labor Market

AI technology will revolutionize the labour market and replace many high-skilled jobs, such as fund managers, credit analysts, and engineers. Meanwhile, low-skilled jobs like cleaning and gardening will be more challenging to automate. This trend will exacerbate the wage gap between high- and low-skilled workers, which may lead to social unrest.

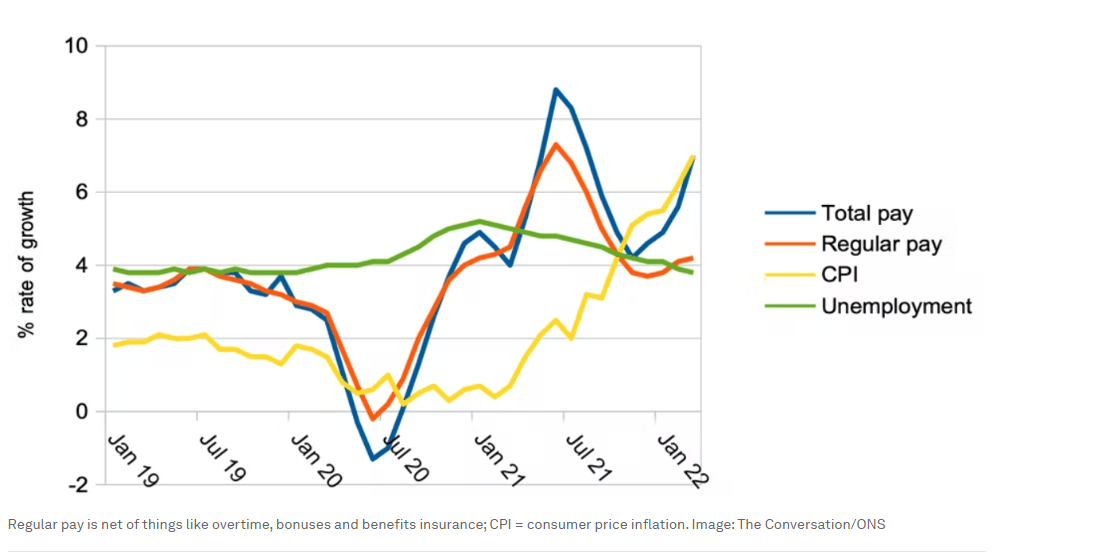

The Illusion of the Phillips Curve: Low Unemployment and Low Wages

Source: www.weforum.org/

Economic theory tells us that low unemployment leads to higher wage inflation, but the reality is different. Despite low unemployment, workers are experiencing cuts in their actual pay with no prospect of wages catching up with headline inflation. The International Labour Organization warns that the crisis is reducing the purchasing power of the middle class, hitting low-income households particularly hard.

The Global Wage Report 2022-2023 estimates that global monthly wages fell in real terms to minus 0.9 per cent in the first half of 2022, marking the first time this century that real global wage growth has been negative. Inflation is high, but workers do not see their wages rise, highlighting the need for change.

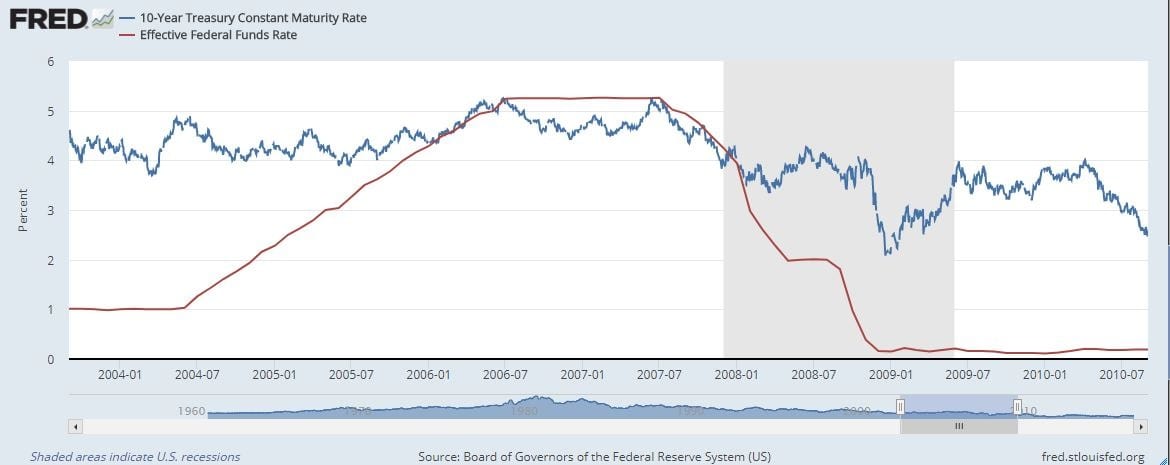

Greenspan raised rates from 1% in 2004 to 5.25% in 2006, and long-term rates hardly budged. The Fed today is in no position to act as aggressively, and on a worldwide basis, central bankers are preparing for deflation instead of inflation.

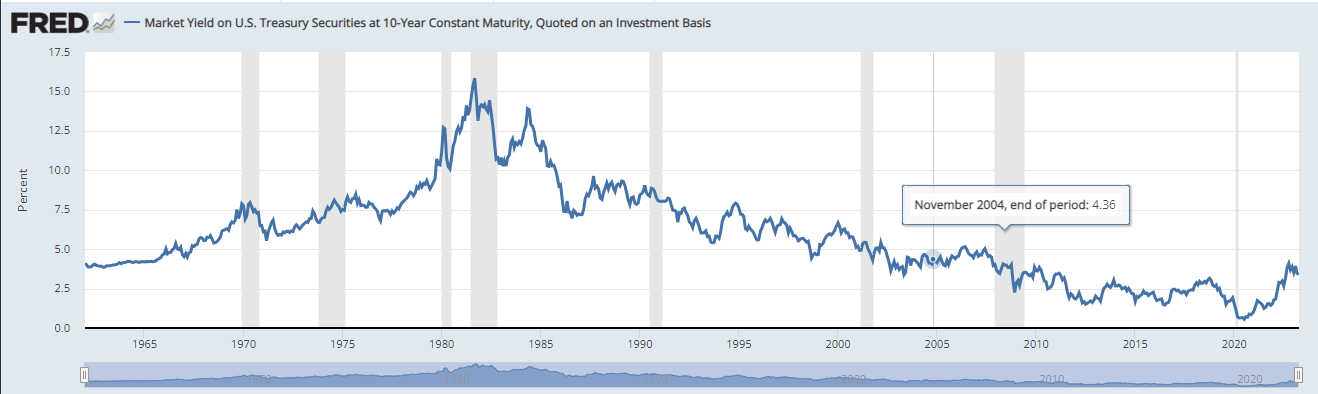

Long-term rates are trending upwards, but the Fed has already changed its tune and appears to be taking a more dovish stance. In a twist, the bond market did not trade to new lows after the last rate hike. It put in a higher low and has been trending upwards. It’s acting as if the previous rate hike never took place.

Long-term rates are trending upwards, but the Fed has already changed its tune and appears to be taking a more dovish stance. In a twist, the bond market did not trade to new lows after the last rate hike. It put in a higher low and has been trending upwards. It’s acting as if the previous rate hike never took place.

Lastly, the velocity of M2 stock continues its downward march, and until it reverses course, inflation is unlikely to be a long-term threat.

Summary:

- Higher copper prices historically signal an improving economy and higher stock market prices.

- The actions of the Federal Reserve have created unpredictability in the usual outcomes.

- Deflationary factors such as grocery wars and AI’s rise can impact the economy

- AI technology threatens to replace high-skilled jobs, worsening the wage gap between high- and low-skilled workers.

- Lower unemployment no longer guarantees higher wage inflation

- Workers face cuts in their real pay, despite a jobs-rich economy and low unemployment

- The Global Wage Report 2022-2023 warns of a decline in global monthly wages and the negative impact on purchasing power

- Income inequality and poverty will rise without maintaining the purchasing power of the lowest-paid workers

Other Articles of Interest

BIIB stock Price: Is it time to buy

Next Stock Market Crash Prediction

Dow theory no longer relevant-Better Alternative exists