Shorting The Market: A stupid move at best

As we warned in early 2019, the political landscape would look like something out of the twilight zones. One almost feels compelled to subject those individuals to some form of shock therapy, but I digress; in short, this is just the beginning of the mad comedy show that will continue Until Nov. A polarised person is very easy to manipulate and hence as the levels of polarisation are soaring we expect this to feed into the markets. This should make the media’s job easier in terms of triggering the herd. However, any panic based action should be viewed through a bullish lens, unless the trend changes.

It is, therefore, possible that the crowd might start acting in a manner that defies logic; responding to good news in a bad way and reacting to bad news in a good way. There is also a possibility that the markets could experience two pullbacks; one could be minor and the other sharper in nature. We can’t predict the order, but needless to say, we view all sharp pullbacks through a bullish lens while the trend is up.

Zacks on why shorting the Market is dangerous

You could get tied up in a short squeeze

A “short squeeze” happens when prices move up substantially, causing panic among short-sellers, who then go into the market to buy shares back. The resulting demand raises prices even more. This vicious cycle strikes fear into the heart of any short seller. Because there is no cap on the upward price movement of a stock or bond, a short squeeze can represent an unlimited risk to the short seller.

Or receive the dreaded Margin call

If you short $1 million in Treasury bonds, the initial margin requirement is $1.5 million. You must thereafter maintain your margin level at 100 per cent. If T-bond prices rise and your short position is now worth $1.2 million, you will quickly receive a margin call from your broker to put up extra margin, in this case, an additional $200,000. If you don’t, your broker will liquidate your position, locking in your loss. Zacks

Investors Business Daily on Shorting the Market

Shorting a stock, also known as short selling, is a distinct trading technique used by investors that can provide big returns when done right but also carries the risk of big losses. That’s the reward part. The risky part is that, rather than going down in price, the stock rises. If a stock starts to rise and the upward trend escalates, short-sellers can be pressured to get out. That can lead to what’s called a short squeeze. As more short sellers cover their position by purchasing the stock, the increased volume can push the stock price higher. That can lead to big losses. Investors.com

The weekly chart of the Dow

The media could still succeed in stampeding the masses via the Coronavirus story or some other issue. Just remember the ploy is always the same; trigger the masses to dump everything based on events that amount to nothing (over the long run). The smart money then swoops in and picks up these bargains; this nefarious, albeit deviously smart strategy has been employed for generations and has one of the most stellar records out there in terms of success. Once again while it might be tempting to think about Shorting The Market, only the most nimble of players should ever attempt this, as the markets tend to reverse course extremely rapidly. A short position could turn into a sea of pain if not timed properly.

The mass mindset is hard wired to panic. One can overcome this shortfall by observing this behaviour impartially and then ask this simple question “why am I doing something that has never led to a positive outcome”. Secondly, as we have advocated for years, one should maintain a trading journal and the best time to put pen to paper or fingers to a keyboard is when the markets are tanking. Make a note of the emotions that are swirling through your mind. Jot down some of the headlines the media is pushing out and observe the reactions from your fellowman. This information will prove to be priceless in the weeks, months, years and decades to come.

The monthly chart of the Dow

There is plenty of room for the markets to run-up based on the monthly charts. When the Trend is positive, and the markets are trading in the oversold ranges, every pullback should be embraced. From a long term perspective, this is the best time to invest in the markets. While the ideal setup calls for the markets to let out a large dose of steam, we would be equally content if our indicators pulled back on the weekly charts and the markets only let out a small dose of steam. We feel the odds are above 75% that the market will experience at least one strong correction this year.

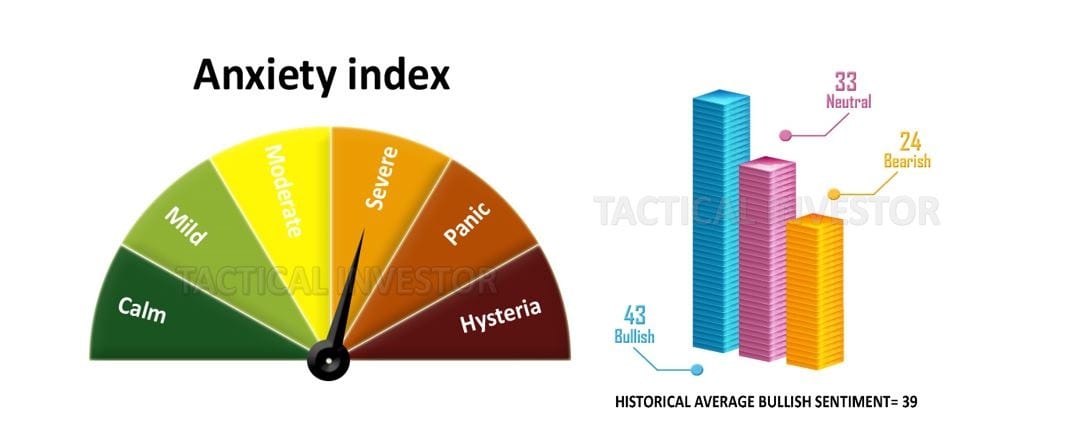

Looking at the sentiment below; the only consistency we can find is that there is no consistency. Market Update Feb 11, 2020

The masses remain inconsistent as ever, and we know the chorus is going to respond by saying “what gives”. Take a close look at the data above; if the masses had any conviction the number of individuals in both the neutral and bearish camps would decline significantly, and bullish readings would soar past 55 and hold at that level for weeks on end. Bullish sentiment rose (9 points) but notice the uptick in neutral sentiment too. If the masses were certain, neutral sentiment would dip, but that’s not the case. This is a positive development for until the masses embrace this bull market like they would a lost love; it is going to continue trending higher. For the record, every bull market ends with a “feeding frenzy” stage, and this bull market has yet to experience that kind of action.

Conclusion on Shorting The Market

As we have stated, in the past, we won’t tell the markets what to do or hope for a given outcome. We will continue doing what we have done since the inception (with some refinements to take into account the higher V-readings) of this bull market; looking for plays where the risk to reward factor is in our favour. Market Update Feb 11, 2020

Overall our long term market outlook remains unchanged; hence Shorting The Market is not an option as the trend is still strong. Therefore pullbacks ranging from mild to wild should be embraced. Forget the Fear factor and focus on the opportunity factor.

The markets are expected to trend higher. On the intermediate timelines, we are waiting for our indicators to pullback, and if the markets let out a dose of steam along the way, it would be a great bonus. There is a 75% chance that the markets will experience at least one strong pullback this year, it would be foolhardy to attempt to predict the exact date though it would be ideal if this event took place during the 1st quarter.

This market has yet to experience the “feeding frenzy stage; as the masses have taken so long to embrace this market, this stage is going to be spectacular. Expect the markets to take off vertically once the masses jump in; it seems hard to believe that the Dow could take off like a rocket, but the most unlikely scenario is likely to come to pass in this instance.

From a psychological perspective, the longer the masses resist, the better it is, for it means this bull will continue to trend higher. The feeding frenzy stage, while spectacular always leads to a backbreaking correction. For those that jump in towards the end, it will feel like the end of the world. We are still not at the feeding frenzy stage, so if we are lucky, the markets experience two sharp pullbacks before we get to that stage.

Our game plan remains unchanged; open up long positions in stocks that offer the best risk to reward options.

Other articles of interest

Stock Buying Opportunity Courtesy Of Coronavirus (May 31)

Market Trends: Focus on Fact And Not Fiction (May 30)

Insider Buying And The Coronavirus Pandemic (April 24)

Market Correction 2020; Long Term Trend Still Intact (April 15)

Stock Trends & The Corona Virus Factor (March 14)

Misdirection And Upcoming Trends For 2020 And Beyond (March 13)

Trading The Markets & Investor Sentiment (March 3)