Imagination is more important than knowledge. For knowledge is limited to all we now know and understand, while imagination embraces the entire world and all there ever will be to know and understand.

Albert Einstein, 1879-1955, German-born American Physicist

May 22, 2024

The Euro/Dollar Death Dance: A Trend Change Is In The Works

In the last two weeks of December, we made the following comments

In short to intermediate time frames, we would like to point to several new factors that suggest that Gold could pull back more, and the dollar could mount a stronger-than-expected rally, which should lead to a rather strong pullback in the Euro and other competing currencies. Indeed, the dollar’s rapid move from 74.57 to a high of 78.50 has caught a lot of traders with their trousers down.

In short to intermediate time frames, the dollar is projected to mount a rally; it has already mounted a somewhat decent rally from its lows. Gold and most competing currencies are expected to pull back. Our recent article “The Gold Bull; Time for a breather or? ” mentioned this. Since then, gold has already shed 100 bucks, and the Euro has dropped from a high of 151.37 to 145.33 in a few days, which is a massive move for any currency. The sentiment against the dollar is extraordinarily negative and has hit an extreme note; extreme movements always produce countermoves that are equally extreme if not stronger. Thus, the dollar could mount a strong rally, surprising even the most bullish optimists.

In fact, in December alone, we published three articles on gold, the Euro, and the dollar, which is a rare anomaly as we usually do not post more than one article per month on a given topic. Since then, the Euro has pulled back tremendously; from low to high, it has shed over 7%. This is a huge move, considering it occurred in less than 30 days. The dollar has tacked on over 6% from low to high, and Gold has shed roughly 137 dollars.

So, where do we stand now?

The dollar is very close to hitting a critical point; it needs to close above 78.50 on a weekly basis. A weekly close above 78.50 will be the first sign that the dollar is potentially getting ready to mount a much stronger rally. In previous articles, we repeatedly warned our subscribers that a stronger dollar would eventually affect the equity markets. Initially, the markets ignored the dollar’s strength and traded higher in tandem with it, but now the tide has turned, and the action of the last three days indicates that the markets are long overdue for a correction.

The Euro demonstrated further weakness by being unable to retest the 146 range; instead, after trading as high as 145, it reversed course and traded as low as 140 before stabilising.

A monthly close over 81 and a weekly buy signal from our indicators (weekly buy signals are based on 4-6 years’ worth of data, with each bar representing one week’s worth of data) would be one of the most reliable signals; we could get regarding the dollar mounting a stronger than expected rally.

Similarly, a weekly sell signal with a monthly close below 140 for the Euro would indicate that the Euro could trade down to the 130 range and possibly spike as low as 125 before attempting to put in a bottom.

If Gold trades below 1080 for 2-3 days in a row, it should lead to a test of the 980-990 ranges. A weekly close below the 950-970 ranges would be the first sign that Gold could mount a much stronger correction than most expect.

The Euro is facing a host of problems, and rather than repeating them all, we have attached an extract from the Jan 5th market update titled “Euro woes” sent out to our subscribers that covers this topic in detail.

Euro Death Woes Are Growing

The European Union established the Growth and Stability Pact, which imposed the following conditions on all members.

- Deficit spending cannot exceed 3% of the GDP

- Total Government debt should not exceed 60% of the GDP

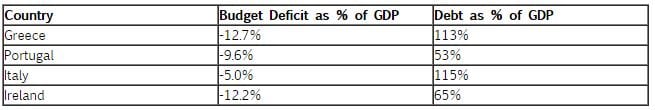

The table below clearly illustrates that many members are blatantly ignoring these rules.

Spain’s budget deficit could reach 90% of GDP by 2011. It is roughly 60% and rising, so another contender is joining the troubled nations list. S&P has already downgraded Spain’s sovereign AAA credit rating. In fact, at this point, Germany is the only country in the EU that deserves the AAA rating. The rest all face varying degrees of trouble.

The head honcho, Germany is in no mood to lend money or help its fellow members as they have problems. A strong currency makes it hard for struggling countries to make their exports attractive by devaluing their currency. Under the one currency umbrella, they no longer have this option. For example, Italy had a history of systematically devaluing the lira when faced with harsh economic conditions; this option is no longer available. Thus, the next step is to flaunt the rules simply oand penly. If no punishment for breaking these rules is forthcoming, nothing can stop other members from joining the party.

Thus, there is a good chance that something could crack here and that the Euro might not be as safe as so many make it be. While the US has problems, the EU’s problems are starting to look even more daunting. Look at the table above; all four nations are openly flaunting the rules laid by the growth and stability pact. When we add Spain to the list, the count rises to 5.

This situation will create rifts in the EU as weaker nations now have to adhere to a fixed standard without having any flexibility to adjust monetary policy based on their own needs; the only option then is to flaunt these rules openly. This, in turn, will aggravate the larger, stronger players, such as Germany and France, which could lead to one of the following outcomes.

Some members could be kicked out (theatrical move and not likely right now)

Members could start to openly revolt against these rules and make demands to ease them or ask for lengthy time extensions before coming into compliance.

Finally, the wealthier members might be forced into bailing out their weaker neighbours.

Either of the developments could have a powerful negative impact on the Euro. So when we look out the window, what we stated many times in the past might become a reality. “Every currency is rotten”, and the rats jump from one sinking ship to another. We are also very close to entering the competitive devaluation stage or what we have coined as “the devalue or die era”, where every nation starts to devalue its currency to gain an exporting edge.

Thus, individuals should not smugly gloat over the demise of the dollar, for they might miss the real trouble that is taking place in their backyard. This problem facing the EU is another reason why the dollar could potentially mount a more substantial rally than most expect and might even potentially surpass all our posted targets. When the ship is sinking, panic takes over, and people jump before they look. Thus, if anything out there makes investors feel skittish about the Euro, it could trigger a mad rush for the exits. Are we saying this is going to occur? No, we are not, but given the large deficits five members in the EU are running, it’s safe to say that all is not well and that the situation could take a turn for the worse very rapidly. Greece could turn out to be another Iceland if they do not get their act together very, very fast.

The Crucial Factor

For all its current woes, the US dollar is at least backed by the full faith of the US government; the Euro, in contrast, is backed by nothing. No one nation backs it; it’s supported by a group of countries whose economic conditions could/might force them to eventually abandon the Euro (strong examples right now are Greece and Italy; Spain and Portugal are not far behind). As we advance, the currency markets will become increasingly complex and entangled. This is why we have pushed our subscribers over the years to ensure they have a core position in bullion (Palladium, Silver and Gold).

Conclusion

The potential for the dollar to mount a powerful rally increases with the passage of each, especially in light of the recent adverse developments in Greece. A breakdown in Greece could trigger a domino effect by first affecting other weak countries such as Italy, Ireland, Spain and Portugal. A strong rally in the dollar by default will lead to a substantial pullback in the Euro, which could, in turn, lead to a much stronger-than-expected pullback in Gold.

However, the bright spot is that a strong pullback in Gold should be viewed as a tremendous buying opportunity if it comes to pass. The long-term trend of the dollar is still down and is not likely to change, but it could produce a lot of acid for those betting against it in short to intermediate time frames. The long-term in the Gold is up, and the pattern is projecting much higher prices in the future, though in the short term the volatility will give short-term traders a headache. The Euro, on the other hand, is the one where things could potentially fall apart. Several members are in trouble, and thus, one has to be open to the potential for the Euro to fall apart. The keyword to focus on is potential.

Remember, if you ever need a helping hand, you’ll find one at the end of your arm … As you grow older, you will discover that you have two hands. One for helping yourself, the other for helping others.

Audrey Hepburn

Originally published May 23, 2015