Psychological Phenomenon: The Madness of Crowds Still Wrecks Portfolios

March 31, 2025

Introduction: The Illusion of Consensus

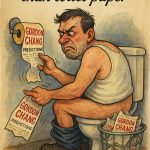

In modern finance’s vast, frenzied marketplace, the collective mind often falls into a hypnotic trance—a surrender to prevailing opinions that warps rational thought into a collective frenzy. Amid the overwhelming noise of market data, boardroom chatter, and the digital buzz, the Psychological Phenomenon of crowd madness takes over, driving individuals to follow the masses rather than trust their own judgment. This phenomenon is not a fleeting anomaly but a recurring force, as old as humanity itself. Time and again, it has proven that when the masses move in lockstep, they often steer the market off course, led not by reason but by emotion.

The impact of this psychological phenomenon is profound. When groupthink dominates, wealth is not built—it evaporates. Opportunities born of speculation and euphoria quickly dissolve, leaving behind a trail of regret and financial carnage. What was once a disciplined arena of investment becomes a chaotic spectacle, where irrational exuberance blinds even the most seasoned investors.

In this environment, the need for contrarian thinking becomes paramount. The call to “go against the grain” is not mere rebellion, but a recognition that, in moments of collective hysteria, opportunity lies hidden beneath the surface. By understanding the limitations of mass psychology and identifying its triggers, the contrarian investor can see through the veil of emotional manipulation, positioning themselves for long-term gain in a landscape of volatility. Today, we will explore this psychological phenomenon, examining how the frenzy of the crowd can distort markets and how a steady, independent mindset can navigate the chaos—transforming what others perceive as risk into opportunity.

✅ Green Check = Important Point ✅ Gold Check= Very important point

Crowd Psychology and the Carnage It Inflicts on Markets

When the herd moves, it doesn’t whisper—it stampedes. Markets, under the influence of collective euphoria, become breeding grounds for delusion. Price ceases to reflect value; it mirrors emotion, illusion, and reflex. The bigger the crowd, the dumber the signal. And when the story cracks, it’s not a correction—it’s a collapse.

✅ Gold Check: Speculative bubbles aren’t born of valuation—they’re born of emotional contagion.

The crowd builds cathedrals out of fairy tales. NFTs, meme stocks, dot-coms, housing—you name it. At the top, fundamentals don’t matter; belief does. Until it doesn’t.

✅ Green Check: Falling Dagger Theory—catch a crashing market too soon and it won’t just cut you—it’ll gut you.

The dagger doesn’t drift gently to the floor. It rips through fingers that mistake momentum for a “bottom.” Most traders trying to time panic end up as blood on the tape.

But that dagger? It’s also a signal. When the emotional flush ends, when fear has sterilized the crowd, the real entry point emerges. Not before. And not when everyone else feels “safe.”

✅ Gold Check: Burro Theory—when the market mule bucks, most investors cling tighter. That’s exactly when the intelligent few let go.

The burro, symbolic of stubborn, trend-chasing masses, always runs uphill chasing gold. But it always breaks its legs coming down.

The contrarian sees the slope before the stumble. While the herd doubles down, the outlier watches, waits, then acts.

When Euphoria Turns to Ash: Timing the Unwind

Crowd psychology is a time bomb with a variable fuse. It builds silently, rapidly—then detonates without warning.

✅ Green Check: Every market peak carries the DNA of its own demise.

The higher the mania climbs, the more inevitable the snapback. It’s not if, but when. And when it happens, rationality doesn’t return—it avenges.

What follows is chaos—margin calls, forced selling, public shame, and CNBC panels wondering how no one saw it coming. But some do. They always do.

✅ Gold Check: The contrarian doesn’t try to time the crowd—he times against it.

He waits for RSI to pierce the floor, not the ceiling. He sees negative gamma, exploding volatility, and volume spikes as signs—not of death—but of birth—the rebirth of logic in a market ruled by noise.

Tactical Warfare: Converting Mass Panic Into Edge

Let others flee; the contrarian builds. This isn’t just a mindset—it’s math, probability, and iron discipline.

✅ Green Check: Selling puts into peak volatility means harvesting maximum premium while the crowd offloads risk at any price. It’s playing chicken with fear—and winning.

✅ Gold Check: LEAPS offer asymmetric reward in chaos. Deep out-of-the-money calls during a market flush? Lunacy to the herd. Leverage to the strategic.

This is where volatility becomes a weapon, not a threat. And those trained to act when others cower don’t just survive—they compound.

Final Blow: Mastering the Madness

To ride the burro, you must first understand its nature: slow to learn, quick to panic, easy to lead—and always late to the party. The crowd, no matter how sophisticated, eventually becomes the burro. It forgets history, ignores signs, and repeats the cycle.

✅ Gold Check: The madness of crowds isn’t a theory. It’s a recurring market structure.

Study 1929. 1973. 2000. 2008. 2022. Different headlines. Same herd. Always the same echo.

The elite investor doesn’t fight the crowd—he maps it. Watches it. Understand the rhythm. Then steps in when the burro collapses under its own delusion.

The best trades are never obvious. They look insane when executed and brilliant in hindsight. That’s the paradox of contrarian success: If it feels comfortable, it’s probably already priced in.

So when the next wave comes—and it will—don’t chase. Don’t comfort yourself with consensus. Don’t try to catch the knife midair or ride the burro into a burning horizon.

Instead, wait. Sharpen your edge.

Then strike where the crowd is weakest—blinded by hope, cornered by fear, and too late to pivot.

That’s not just strategy.

It’s survival.

Architecture of Market Failure: Chaos as Catalyst

Markets don’t implode at random—they fracture when belief overrides logic. Emotional stampedes warp price from value. The structure cracks not from data, but from delusion. What begins as confidence mutates into mania—and the foundation gives way under the weight of collective denial.

✅ Gold Check: The crowd doesn’t see the crack—it dances on it.

Investors praise every tick up as “confirmation,” blind to the imbalance beneath. The system swells with leveraged hope until it snaps. And when it snaps, it’s not a pullback—it’s a reckoning.

✅ Green Check: This isn’t just a market event—it’s a mass psychological breakdown.

Euphoria drives prices, not profits. Rumors morph into conviction. The herd abandons valuation for velocity—and when gravity hits, they act shocked.

The collapse isn’t just destructive—it’s revealing. It strips away the noise. In the ruins lie setups no analyst dared pencil in.

✅ Gold Check: Chaos births clarity—if you know where to look.

Short-selling mania, selling premium during panic, or loading LEAPS on bloodied assets—all tactics forged in volatility, not shaken by it.

The Falling Dagger? You don’t catch it midair. You wait, then move when it’s embedded in the floor and the crowd’s too scared to pick it up.

The Burro? It bolts up the slope of greed, dragging fools with it. But the smart investor rides the backside of that collapse—where silence replaces hype, and price meets reality.

Harnessing the Rebel Spirit: Standing Where Others Panic

Being contrarian isn’t about being edgy—it’s about being early, disciplined, and unshaken when the world screams otherwise.

✅ Green Check: The louder the crowd, the greater the mispricing.

Excessive P/Es, laughable narratives, and parabolic charts are invitations for collapse—not confirmation of brilliance.

While others FOMO, the contrarian tracks signals: divergences, crowd sentiment, option flow. These aren’t contrarian feelings—they’re tools for action.

✅ Gold Check: Volatility isn’t danger—it’s leverage.

Sell puts when fear peaks. Buy LEAPS when time is cheap. Use crashes like slingshots. Panic creates premium. Carnage creates setup. Every market distortion births a moment of clarity—for those ready.

This isn’t reckless defiance. It’s surgical resistance.

The rebel investor doesn’t fight the herd out of spite—he disengages to preserve clarity, precision, and edge.

✅ Green Check: The herd follows heat—the contrarian follows structure.

That structure is built on mispriced risk, reversion potential, and emotional lag. Know when the burro’s knees are buckling. Know when the dagger has landed. Strike only then.

Succinct takeaway:

The crowd creates bubbles. Fear pops them.

Contrarians don’t survive chaos—they convert it.

Want to push this even sharper or visual-map it as a vector logic grid? Just say the word.

Conclusion: Where the Crowd Ends, Clarity Begins

Markets don’t fail because of missing data—they fail because minds move in unison, not thought. When the herd stampedes, truth gets trampled. And in that chaos, the sharpest edge isn’t speed—it’s independence.

This isn’t a dance. It’s a war between impulse and insight. Between emotional consensus and brutal logic. The crowd chases heat; the contrarian stalks structure. One seeks comfort, the other seeks asymmetry.

Mass psychology doesn’t just distort prices—it builds traps. Every bubble is bait. Every crash is a reset. What looks like destruction is just the curtain dropping before a new script gets written.

The real investor isn’t just playing numbers. They’re reading sentiment, dissecting fear, betting not on what is—but on what must break. In the wreckage, when the noise dies down, that’s where truth lives.

Victory goes not to the boldest, but to the clearest mind in the noisiest room.