He that can have patience can have what he will. Benjamin Franklin

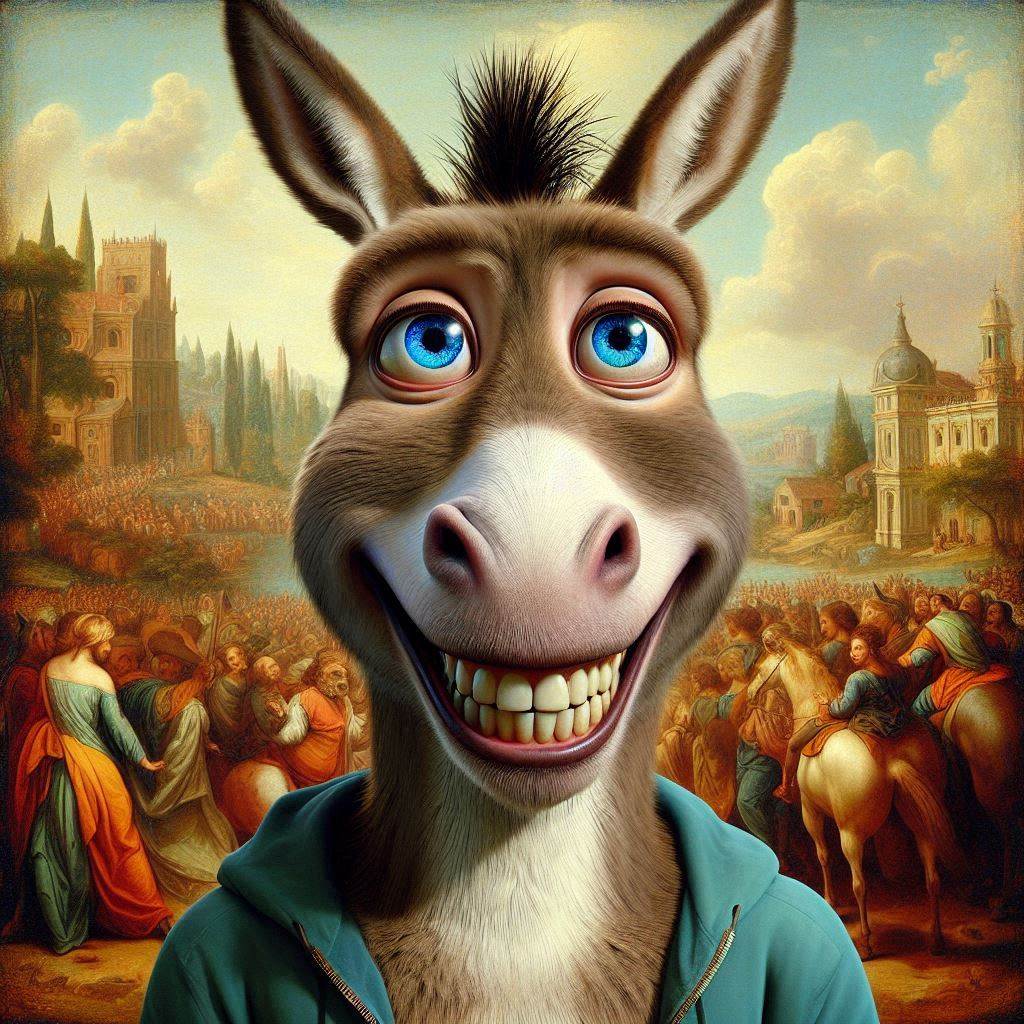

Top Financial Experts: Brilliant Minds or Burros

Sept 27, 2024

Introduction:

Despite the constant barrage of media attention surrounding financial experts, we remain unconvinced that these so-called “gurus” truly possess any exceptional foresight. Take the case of Gold, for instance: Peter Schiff, a well-known commentator, has been endlessly preaching since 2011 that it was a mistake to sell Gold and that rampant inflation was inevitable. He predicted mass layoffs, economic decline, and runaway inflation, painting a grim picture of the future. Yet, a decade later, the data shows that those who followed his advice would have suffered significant losses. Schiff’s unyielding adherence to his predictions, despite clear evidence to the contrary, raises the question: is he truly an expert or simply a glorified jackass chasing the same narrative?

Schiff’s insistence that holding Gold from 2011 was the right move has proven disastrous for those who listened. While the price of Gold has fluctuated, it never reached the meteoric rise he promised, and his continued failure to acknowledge this exposes a deeper flaw in the so-called “expert class.” He is not alone. Many financial pundits stick stubbornly to their predictions, refusing to admit error and doubling down on their misguided proclamations. This tendency to follow an ideological path rather than adapt to reality mirrors the behaviour of a pack of stubborn burros headed in the wrong direction. And Schiff isn’t the first, nor will he be the last, to lead the herd astray.

Historical Examples: How Financial “Experts” Have Acted Like Burros for 500 Years

This isn’t a new phenomenon. The history of finance is littered with examples of experts who, rather than blazing trails of innovative thought, have clung to old ideas, dragging their followers along with them. Let’s look at some of these “gurus” who were more burros than visionaries.

1. The Tulip Mania (1637) – A Herd Led to Ruin

In the early 1600s, Dutch investors were swept into a speculative frenzy over tulip bulbs, treated like modern-day tech stocks. Financial experts of the time proclaimed that the value of tulips would only rise, encouraging massive investment. Prices soared to ridiculous levels before collapsing overnight in 1637, ruining those who had trusted the experts. These “brilliant minds” failed to recognize they were following a speculative herd straight to disaster, much like modern-day Schiff followers did with Gold.

2. The South Sea Bubble (1720) – Inflated Promises, Devastating Consequences

Fast-forward to 1720, when the South Sea Company promised huge profits from trade in South America. Financial elites, including Isaac Newton, believed in the company’s boundless potential, fueling a massive stock bubble. Newton famously lost a fortune, lamenting, “I can calculate the movement of stars, but not the madness of men.” The so-called experts failed to foresee the inevitable collapse, proving again that their wisdom was collective hysteria.

3. The Great Depression (1929) – False Security

In the lead-up to the 1929 stock market crash, many of the leading financial minds assured the public that prosperity was here to stay. Notable economists and bankers dismissed concerns of an impending collision, encouraging continued investment as the market peaked. When the market collapsed, it became clear these “gurus” were no different from the blind, leading the blind too caught up in their own beliefs to see the warning signs.

4. Dot-Com Bubble (1999-2000) – Irrational Exuberance

In the late 1990s, financial experts fueled the dot-com frenzy by proclaiming that internet companies, even those with no revenue, were the future. Legendary investors, tech analysts, and economic publications hyped the sector, encouraging others to jump in. When the bubble burst in 2000, countless investors were left with losses. The experts had followed the crowd, blinded by short-term gains, much like the exuberant behaviour we see in speculative assets today.

Financial experts are Burros in the world of investing.

As long as man does not evolve, man will find a way to rob Peter and Paul. So Gold standard or rubbish standard matters not, for you need to change the mindset of the beings that control either medium. That is why the Fed gave the hard money crowd a thrashing they will never forget. It inflated the money supply to mind-boggling levels, strengthened the dollar and Hammered Gold.

How did they achieve this feat? They controlled the velocity of money, and they could have their cake and their pie. Now they are buying up Gold at a lower price with the extra worthless paper they created while the hard money experts keep chanting nonsense that the Fed is backed into a corner. If it’s a corner, it must be a pretty cushy corner with all the comforts of a five-star hotel. The trend is still neutral, but as it moves from negative to neutral, we will not be satisfied until it turns bullish. Gold will experience

The trend for Gold is still neutral, but as it moves from negative to neutral, we will not be satisfied until it turns bullish. Gold will experience another strong correction. This correction will knock all the early bulls out and force a lot of die-hard bulls to throw the towel in and call it quits, and that is when Gold will bottom.

Listening to s0-called financial experts is the best formula for economic loss.

Conclusion: Question the Experts, Question the Herd

The history of finance has repeatedly shown that even the most renowned financial minds often act more like herd-following burros than true visionaries. From the Tulip Mania to the Dot-Com bust, the behaviour of these experts frequently reflects a stubborn refusal to adapt to reality, preferring instead to stick to outdated or speculative predictions. Peter Schiff’s stance on Gold is another example of how blindly following such individuals can lead to financial ruin. True financial wisdom comes from questioning the crowd, not blindly following those who claim to lead it.