Nov 2, 2023

Market Bottom Mastery: Crush the Crowd, Claim Victory!

Introduction

In finance and investment, the concept of the “market bottom” holds profound significance in the minds of astute investors. This elusive juncture marks the nadir of stock prices, symbolizing a potential turning point in the market’s trajectory. However, deciphering and navigating this critical phase transcends chart analysis and data scrutiny. It demands a profound comprehension of collective behavior and its nuanced impact on the intricate tapestry of financial markets.

Within the pages of this exhaustive guide, we explore the intricate relationship between collective behavior and the art of investing, with a laser focus on the enigmatic market bottom. Our journey delves into the intricacies of market participants’ psychology, the pivotal role of prevailing social trends, and the profound influence these factors exert on the intricate dance of investment decisions. By the conclusion of this article, you will gain a heightened understanding and a refined mastery of leveraging collective behavior to your advantage when navigating the opportune moments within market downturns.

Understanding Market Bottoms: The Crucial Turning Point

At the heart of successful investing is the ability to identify market bottoms. This term refers to the point in a market cycle where prices have fallen to their lowest, and there’s a potential for a reversal. Investors who can pinpoint this critical moment can seize opportunities for substantial gains. However, this is easier said than done. Market bottoms can be shrouded in uncertainty, and investing at such a point is often fraught with risks.

The Role of Collective Behavior in Market Bottoms

Psychology of the Crowd

To comprehend market bottoms fully, we must first understand the psychology of the crowd. Collective behavior is deeply rooted in the human psyche, and it plays a pivotal role in driving market dynamics. As investors, we’re not always rational decision-makers. Emotions often cloud our judgment, leading to herd behaviour that can influence the market’s direction.

Fear and panic often prevail when the market is on a downward spiral. Investors, driven by the fear of losing money, tend to sell off their holdings, causing a domino effect of falling prices. This irrational behavior creates a self-fulfilling prophecy as the collective fear drives the market to its bottom. To make informed investment decisions at the market bottom, one must be aware of this psychological phenomenon and its impact on the market’s trajectory.

Social Trends and Media Influence

In today’s interconnected world, social trends and media influence play a crucial role in shaping collective behavior and, subsequently, the market’s movements. The rise of social media platforms and 24/7 news coverage has made information more accessible. As a result, investors are often bombarded with a constant stream of news and opinions.

The influx of information can lead to herd behavior, where investors follow popular trends and react emotionally to headlines. When negative news dominates the headlines, it can exacerbate the fear in the market, causing a rapid decline. Understanding how social trends and media influence impact collective behavior can help investors differentiate between market noise and critical information when navigating the market bottom.

Historical Perspectives on Market Bottoms

Lessons from the Great Depression

To truly understand the intricacies of market bottoms and the profound influence of collective behavior, one need look no further than the annals of history. The Great Depression of the 1930s stands as a timeless case study in market dynamics, bearing witness to the power of fear, uncertainty, and the resilient spirit of investors. During this tumultuous era, market behavior was profoundly shaped by widespread panic and trepidation. Investors, gripped by the relentless spectre of economic collapse, swiftly liquidated their stock holdings, sending the market into a devastating freefall. Yet, amid the chaos and despair, a select few managed to keep their wits about them, identifying this occurrence, which is elusive, and subsequently seizing the opportunity for substantial gains during the eventual recovery.

The Great Depression: A Glimpse into Collective Fear

The Great Depression of the 1930s was a catastrophic economic downturn that left an indelible mark on the history of the United States and the global financial landscape. Triggered by the 1929 stock market crash and exacerbated by a series of misfortunes, it remains one of the most significant and enduring examples of a market bottom. Fear and uncertainty ran rampant as the very foundation of the economy crumbled, leaving millions jobless, homeless, and hopeless. Once a symbol of prosperity, the stock market became a stark reflection of despair.

Fear-Driven Collective Behavior

The defining feature of the Great Depression was the all-encompassing fear that gripped both individual and collective behavior. As news of economic devastation spread, investors were consumed by panic and anxiety. The rush to the exits was relentless, as individuals from all walks of life scrambled to sell their stocks at any cost. This frenzy of selling created a self-perpetuating cycle of declining prices, further intensifying the collective fear that seemed to know no bounds.

Investors, driven by the fear of losing their hard-earned savings, overlooked rational analysis and followed the prevailing sentiment of the crowd. This herding behaviour, while understandable in the face of such profound uncertainty, contributed to the market’s downward spiral. It’s a stark reminder of how collective behavior, often irrational and emotional, can overwhelmingly influence market dynamics.

In the throes of the Great Depression, the prospect of identifying a market bottom seemed like an impossible task. However, history has shown that even in the darkest of times, opportunities can emerge for those who maintain composure and rationality.

The individuals who recognized it during this tumultuous period often possessed an unwavering belief in the resilience of the American economy. They understood that despite the unprecedented challenges, the nation’s fundamentals remained intact. In the face of fear, they saw a glimmer of hope.

These investors recognized that the market had reached a shallow point, where stocks traded at historically low valuations. This presented an opportunity to purchase shares in well-established companies at a fraction of their intrinsic value. They had the foresight to understand that while the road to recovery might be long and arduous, the economy would eventually rebound, and stock prices would follow suit.

The Power of Patience and Fortitude

Investors who identified it during the Great Depression demonstrated remarkable patience and fortitude. They didn’t expect instant gratification or a quick turnaround. Instead, they had a long-term perspective, willing to weather the storm and withstand the economic turmoil that surrounded them.

These astute investors were selective in their choices, focusing on companies with solid fundamentals and a history of resilience. Their strategy wasn’t based on speculation or emotion but on a rational assessment of the intrinsic value of the assets they were acquiring.

Their actions serve as a testament to the importance of emotional resilience in investment. They didn’t allow the prevailing fear to dictate their decisions. Instead, they used fear as an opportunity, a signal that the market had reached an extreme point of pessimism.

A Timeless Lesson

The Great Depression remains a powerful testament to the interplay between collective behavior and market dynamics. It illustrates the profound impact of fear and panic on investor decision-making and the potential for those who maintain rationality, patience, and a long-term perspective to uncover opportunities amidst the chaos.

While each market bottom is unique, the lessons from the Great Depression are a timeless reminder of the importance of maintaining a rational approach and a belief in the economy’s resilience, even in the face of the most daunting challenges. It is a testament to the enduring spirit of investors who, in the darkest of times, found a path toward the light of recovery.

The Dot-Com Bubble Burst

Another significant market bottom event occurred during the dot-com bubble burst in the early 2000s. The euphoria surrounding internet-related stocks had driven prices to astronomical levels, but it was unsustainable. As the bubble burst, collective behaviour shifted from irrational exuberance to panic selling. Those who recognized the market bottom during this period could purchase tech stocks at a fraction of their previous prices, capitalizing on the eventual recovery.

The Role of Technology in Analyzing Collective Behavior

Big Data and Machine Learning

Technology advancements have revolutionised how we analyze and understand collective behavior in the financial markets. Big data and machine learning algorithms have made it possible to process vast amounts of data and identify patterns that may have previously gone unnoticed. These tools can help investors gauge market sentiment and make more informed decisions, especially during times of market turbulence like a market bottom.

Sentiment Analysis

Sentiment analysis is a powerful tool that leverages natural language processing and machine learning to assess market sentiment from news articles, social media posts, and other sources. By tracking public sentiment and identifying trends in real-time, investors can gain valuable insights into how collective behavior is evolving. This information can be invaluable in anticipating market movements, including potential market bottoms.

Algorithmic Trading

Algorithmic trading, often referred to as “quantitative trading,” involves the use of computer programs to execute trades based on predefined criteria. These algorithms can incorporate sentiment analysis and other indicators of collective behavior to make split-second investment decisions. Algorithmic trading can be particularly effective in volatile market conditions, such as those surrounding market bottoms.

Behavioral Biases and Market Bottoms

Overreaction and Herding

Two common behavioural biases that come into play during market bottoms are overreaction and herding. Overreaction occurs when investors panic and sell assets at steep discounts, causing prices to plummet further than warranted. Herding is the tendency to follow the crowd, even when it may not be rational. Recognizing these biases can help investors resist the urge to participate in collective behavior and make more rational decisions during market bottoms.

Loss Aversion

Loss aversion is another psychological bias that influences investor behavior during market bottoms. It’s the tendency to strongly prefer avoiding losses over acquiring equivalent gains. As the market approaches its bottom, investors may become more risk-averse and make decisions that are overly cautious. Understanding this bias can help investors strike a balance between preserving capital and seizing opportunities.

Real-Life Success Stories

Warren Buffett’s Bold Moves

Warren Buffett, one of the most successful investors of all time, has made several bold moves during this occurrence. He famously said, “Be fearful when others are greedy, and be greedy when others are fearful.” During the 2008 financial crisis, he invested billions of dollars in distressed assets, including major banks. His contrarian approach paid off handsomely, and Berkshire Hathaway reaped significant gains when the market eventually recovered.

George Soros’ Legendary Short

George Soros, known for his legendary shorting of the British pound in 1992, is another example of an investor who recognized a market bottom. Soros saw that the pound was overvalued, and collective behavior drove it to unsustainable levels. He took a massive short position against the currency, betting on its decline. When the pound ultimately crashed, Soros made approximately $1 billion in profits.

The Emotional Rollercoaster of Investing

Emotional Resilience

Investing during market bottoms can be an emotional rollercoaster. The fear and uncertainty in the market can take a toll on investors’ emotional well-being. Developing emotional resilience is crucial for navigating these turbulent times. It involves maintaining a long-term perspective, staying disciplined, and avoiding impulsive decisions driven by fear or greed.

The Role of Education

Education plays a vital role in enhancing emotional resilience. When investors understand the factors driving collective behavior, they are less likely to succumb to emotional decision-making. Investors can approach market bottoms with greater confidence and composure by staying informed and continuously learning about the markets.

Building a Diverse Portfolio

Risk Mitigation

Diversifying your investment portfolio is an essential strategy for mitigating risk, especially during this market phenomenon. A diversified portfolio includes a mix of asset classes, such as stocks, bonds, real estate, and alternative investments. When one asset class experiences a downturn, others may remain stable or even appreciate in value. This diversification helps spread risk and reduces the impact of collective behavior on your overall portfolio.

Rebalancing

Rebalancing is the process of realigning your portfolio with your target asset allocation. It involves periodic reviews and adjustments to ensure that the weightings of various asset classes in your portfolio remain in line with your long-term goals and risk tolerance. During a market bottom, this becomes particularly crucial, as the pronounced fluctuations in asset values can lead to a skewed distribution.

The core principle behind rebalancing is simple: sell assets that have outperformed their target allocation and use the proceeds to purchase assets that have fallen below their intended proportion. In other words, you’re systematically buying low and selling high. This disciplined approach helps maintain your portfolio’s desired risk profile and positions you to benefit from future market upswings.

Market Bottom and the Long-Term Perspective

The Importance of Patience

Investing with a long-term perspective is vital when considering market bottoms. While it can be tempting to try to time the market and make quick gains, successful investors understand that the market’s short-term fluctuations are less important than the long-term growth potential. By adopting a patient approach, investors can weather market bottoms and capitalize on the eventual recovery.

Staying Informed

Staying informed about economic trends, market indicators, and geopolitical events is essential for making informed decisions during market bottoms. Knowledge is power, and investors who stay well-informed are better equipped to recognize potential opportunities amid the turbulence.

Conclusion

Investing during this market phenomenon requires a deep understanding of collective behaviour and the ability to navigate the complex interplay of emotions, trends, and information. By recognizing the psychological factors that drive collective behavior, adopting proven strategies, and staying informed, investors can position themselves to make informed decisions during turbulent times. Remember that market bottoms are not the end; they can mark the beginning of significant opportunities for those who are prepared and resilient. Embrace the challenge, stay disciplined, and harness collective behavior to your advantage in investing.

Compelling Pieces Worth Your Dive

What Is a Contrarian Investor? Embrace Unconventional Thinking

Unlocking Real Estate Investing for Beginners with No Money

Potential of Silver ETF-s: A Wise Investment Choice

USD Dollar Index Investing: A Posh Way to Hedge Against Currency Fluctuations

Are ESOPs Good for Employees? Weighing the Benefits and Risks

Copper ETF: The Great Investment Debate – Buy-In or Miss Out?

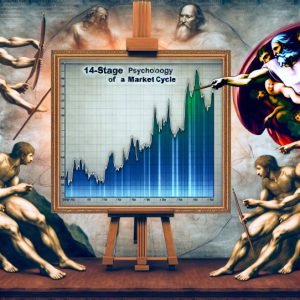

Stock Market Psychology Pdf: Mastering the Facts, Not the PDF

What Causes Mob Mentality: Unraveling the Psychology

Cracking Market Cycle Psychology: Navigating the Ups and Downs

Best Silver ETFs: Shining Bright in Your Investment Portfolio

Harnessing the Psychology of a Market Cycle: Thrive in Bull and Bear Markets

ETF Definition: A beginner’s guide to exchange-traded funds

What is a Bull Market Simple Definition: Understanding the Basics of a Thriving Market

Home Mortgage Interest Rates Forecast: Timing is Key