The Working Poor The Price of the American Dream: A Harsh Reality

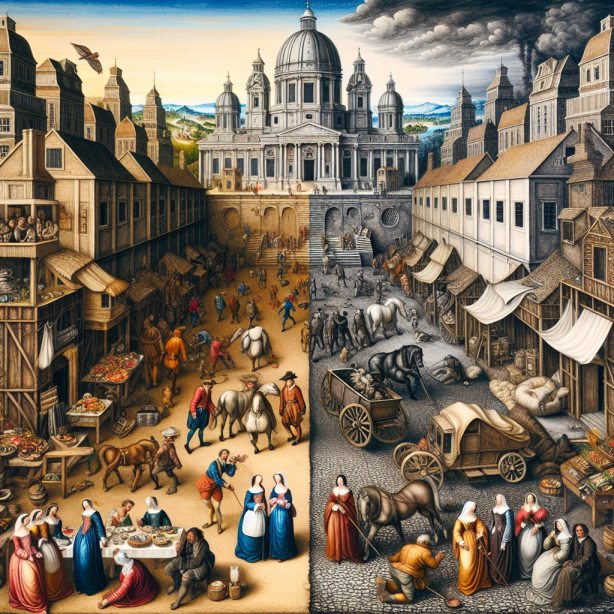

A disturbing paradox has emerged in the land of opportunity: the working poor. Once known as the middle class, a growing segment of the American population finds itself trapped in a cycle of low-wage jobs and financial instability, their dreams of prosperity shattered by economic realities. This essay explores the plight of the working poor, examining the factors contributing to their struggles and the broader implications for the American Dream.

The Erosion of the Middle Class

The “working poor” concept represents a stark departure from the post-World War II era of widespread economic prosperity. According to a 2023 report by the Pew Research Center, the percentage of American adults living in middle-income households has decreased from 61% in 1971 to 50% in 2021. This decline reflects a broader trend of income inequality and wage stagnation that has reshaped the American economic landscape.

As the ancient Greek philosopher Aristotle (384-322 BC) observed, “The most perfect political community is one in which the middle class is in control and outnumbers both of the other classes.” The erosion of the middle class in America raises profound questions about the health of its democracy and the sustainability of its economic model.

The Federal Reserve’s Role

The Federal Reserve’s monetary policies have significantly shaped the current economic landscape, with far-reaching implications for national debt and income inequality. In fiscal year 2023, the Federal Reserve remitted approximately $76 billion to the U.S. Treasury, fluctuating based on various economic factors. However, the broader impact of Fed policies extends far beyond this direct transfer.

The U.S. federal debt stood at approximately $33.1 trillion as of December 2023, with the annualized cost of servicing this debt reaching $726 billion in July 2023. The Congressional Budget Office projects that annual net interest costs will total $870 billion in 2024 and could rise to $1.4 trillion by 2033. This escalating debt service burden has profound implications for the working poor and the broader economy.

As economist Joseph Stiglitz (1943-present) noted, “The national debt is a transfer from the poor to the rich.” This statement encapsulates how the growing debt burden disproportionately affects lower-income individuals in several ways:

1. Reduced Social Spending: As more of the federal budget is allocated to debt service, less is available for social programs that benefit the working poor.

2. Regressive Taxation: Governments may rely more heavily on regressive taxes that disproportionately burden lower-income individuals to service the debt.

3. Economic Drag: High national debt levels can slow economic growth, limiting job opportunities and wage growth for the working poor.

4. Intergenerational Burden: Today’s debt becomes tomorrow’s tax burden, potentially limiting economic opportunities for future generations.

The Fed’s policies, aimed at controlling the money supply and inflation, have had the unintended consequence of slowing the velocity of money – the rate at which money circulates through the economy. As economist Milton Friedman (1912-2006) noted, “Inflation is always and everywhere a monetary phenomenon.” However, the Fed’s actions have created a situation where massive liquidity injections have not translated into widespread inflation, primarily because banks have not lent this money to the broader population.

This dynamic creates a paradoxical situation where the Fed’s efforts to stimulate the economy through low interest rates and quantitative easing may inadvertently contribute to income inequality. The wealthy and financial institutions can benefit from these policies through increased asset prices, while the working poor often see little direct benefit and may even be harmed by reduced interest income on savings.

Furthermore, the low interest rate environment, while beneficial for government borrowing, has encouraged increased debt accumulation at all levels of the economy. This debt-driven growth model poses significant risks, particularly for the working poor, who have less financial cushion to weather economic downturns or sudden changes in monetary policy.

The Deflationary Pressure and Commodity Markets

The deflationary pressures resulting from these policies have significantly impacted commodity markets, including precious metals. Gold and other commodities have struggled to rally in an environment where official inflation measures remain low. While many economists and market observers dispute the accuracy of these measures, the market’s acceptance of these figures has shaped investment behavior.

Technical analysis of the copper market, often seen as a barometer of economic health, reveals a potentially bullish pattern. As John J. Murphy, a renowned technical analyst, states in his book “Technical Analysis of the Financial Markets” (1999), “The copper market is often viewed as having PhD in economics because of its ability to predict turning points in the global economy.” A bullish breakout in copper could signal broader economic strength, potentially benefiting the working poor through increased economic activity and job opportunities.

The Negative Interest Rate Experiment

Central banks’ adoption of negative interest rates in countries like Japan and Sweden represents a new frontier in monetary policy. This approach aims to stimulate economic activity by making it costly to hold cash, effectively forcing individuals and institutions to spend or invest.

However, this policy is not without its critics. As the 18th-century Scottish philosopher David Hume observed, “The heights of popularity and patriotism are still the beaten road to power and tyranny.” Manipulating interest rates to such extremes could be seen as a form of financial coercion, potentially exacerbating the challenges faced by the working poor, who may lack the resources to navigate these complex financial waters.

The Specter of a Market Bubble

The ultra-low interest rates, massive liquidity injections, and potential future lending could set the stage for a significant market bubble. As the 17th-century Dutch philosopher Baruch Spinoza noted, “Those who are believed to be most abject and humble are usually most ambitious and envious.” This insight into human nature helps explain why markets can be driven to irrational extremes, as investors’ ambition and fear of missing out (FOMO) override rational decision-making.

The potential for a market bubble presents opportunities and risks for the working poor. While some may benefit from rising asset prices, many could find themselves further priced out of homeownership and other forms of wealth accumulation.

Strategies for the Working Poor

Given these challenges, what strategies can the working poor employ to improve their financial situation? Here are some critical approaches:

1. Live Below Your Means: As Warren Buffett famously advised, “Do not save what is left after spending, but spend what is left after saving.”

2. Avoid Unnecessary Debt: Prioritize paying off high-interest debt and avoid taking on new debt except for essential purposes like education or homeownership (when it’s cheaper than renting).

3. Invest in Education and Skills: Continuously upgrade your skills to remain competitive in the job market.

4. Take Advantage of Market Corrections: When possible, use market downturns as opportunities to invest in quality assets at discounted prices.

5. Embrace the Power of Compound Interest: Start saving and investing early, even if in small amounts, to harness the power of compound growth over time.

The Psychology of Investing and Market Behavior

Understanding mass psychology and cognitive biases is crucial for navigating the financial markets, especially for those with limited resources. The phenomenon of panic selling, often driven by fear and herd mentality, can be particularly damaging to small investors.

Gustave Le Bon, in his seminal work “The Crowd: A Study of the Popular Mind” (1895), observed that “The masses have never thirsted after truth. They turn aside from evidence not to their taste, preferring to deify error if error seduces them.” This insight helps explain why markets can experience irrational exuberance or panic, often to the detriment of individual investors.

To overcome the tendency towards panic selling, investors should:

1. Develop a Long-Term Perspective: As Benjamin Graham, the father of value investing, noted, “In the short run, the market is a voting machine but in the long run, it is a weighing machine.”

2. Embrace Fear as a Contrarian Indicator: Warren Buffett’s famous advice to “be fearful when others are greedy and greedy when others are fearful” encapsulates this approach.

3. Use Technical Analysis to Maintain Objectivity: While not infallible, technical analysis can provide a more objective view of market trends, helping to counteract emotional decision-making.

4. Practice Emotional Regulation: Mindfulness meditation can help investors maintain composure during market volatility.

The Future of Work and the American Dream

As we look to the future, the concept of the working poor challenges us to reconsider the nature of work and the meaning of the American Dream. The rise of automation and artificial intelligence threatens to displace many low-wage jobs, potentially exacerbating the challenges the working poor face.

However, these technological advancements also present opportunities for those willing to adapt and learn new skills. As the ancient Chinese philosopher Confucius (551-479 BC) advised, “The man who moves a mountain begins by carrying away small stones.” This wisdom encourages a patient, persistent personal and professional development approach, even when facing daunting challenges.

Conclusion: The Working Poor The Price of the American Dream

The plight of the working poor represents a critical challenge to the American ideal of upward mobility and shared prosperity. As we grapple with this issue, we must consider economic policies and the broader social and cultural factors that shape our understanding of success and fulfilment. The working poor and the price of the American Dream are not just catchy phrases but are also a stark reality for millions of Americans struggling to make ends meet while chasing an increasingly elusive ideal.

Perhaps the solution lies not in clinging to an outdated vision of the American Dream but in reimagining it for the 21st century. This new dream might prioritize financial security, work-life balance, and personal growth over the relentless pursuit of material wealth. For the working poor, the price of the American Dream has often been too high, demanding sacrifices that undermine the very quality of life the dream promises.

As we navigate these complex issues, let us heed the words of Martin Luther King Jr., who reminded us that “The arc of the moral universe is long, but it bends toward justice.” By working collectively to address the challenges faced by the working poor, we can strive to create a more equitable and sustainable economic system that truly reflects the ideals of opportunity and prosperity for all.

In the words of economist Hyman Minsky (1919-1996), “The more stable things become and the longer things are stable, the more unstable they will be when the crisis hits.” This warning reminds us of the need for vigilance and proactive measures to address the underlying economic vulnerabilities that disproportionately affect the working poor, even in apparent stability. Only by acknowledging and addressing these systemic issues can we hope to redefine the American Dream in a genuinely inclusive and attainable way for all members of society.

Cerebral Adventures: Exploring Unique Intellectual Terrain

Negative Thinking: How It Influences The Masses

FAQ: The Working Poor The Price of the American Dream

1. Q: Who are the “working poor” in America?

A: The working poor are individuals and families who, despite being employed, struggle to meet basic needs due to low wages, limited job opportunities, and rising living costs. They often work full-time but remain below or near the poverty line.

2. Q: How has the Federal Reserve’s monetary policy affected the working poor?

A: The Federal Reserve’s policies, such as low interest rates and quantitative easing, have had unintended consequences. While aimed at stimulating the economy, these policies have contributed to income inequality by benefiting asset holders more than wage earners, potentially exacerbating the challenges the working poor faces.

3. Q: What strategies can the working poor employ to improve their financial situation?

A: Some strategies include living below one’s means, avoiding unnecessary debt, continuously upgrading skills to remain competitive in the job market, taking advantage of market corrections to invest in quality assets when possible, and embracing the power of compound interest by starting to save and invest early, even if in small amounts.