Stock Bubble: Machiavelli Meets Lynch Approach

Updated Feb 29, 2024

Riches come to those who seek them and not those who chase them. To those who pursue it, rags are the only reward. Sol Palha

In pursuing wealth, one must navigate with the cunning of Machiavelli and the insight of Peter Lynch.

In the grand chessboard of the stock market, the pawns often find themselves at the mercy of the queens and knights. The average investor, armed with passion but not a strategy, frequently ends up cornered, their financial aspirations checkmated by the volatile whims of the market. It’s a tale as old as trade itself—emotions clouding judgment, leading to hasty decisions and regrettable outcomes.

One must sever the strings that tie their fortunes to their fears to emerge victorious in this game. While an intrinsic part of our humanity, emotions should be spectators, not players, in the financial arena. Acknowledge them, but do not let them dictate your moves. Instead, adopt a contrarian stance—when the crowd zigs, it’s time to zag.

Remember, the path to prosperity is not a sprint but a marathon, a strategic dance of patience and precision. Let’s delve into how to sidestep the snares of stock bubbles with a blend of Machiavellian cunning and Lynchian clarity.

To win, you need to destroy this sequence. Emotions should have no place when it comes to investing in the markets. Yes, it is impossible not to feel the emotion, but you can control the reaction. Instead of panicking and becoming one with the crowd, the strategy should be to break free from the crowd and take a position that is in opposition to that of the crowd.

Outsmarting the Herd: A Maverick’s Approach to Navigating Stock Market Manias

In the swirling dance of the markets, heed the wisdom of Lynch, the cunning of Machiavelli, and the daring of Livermore.

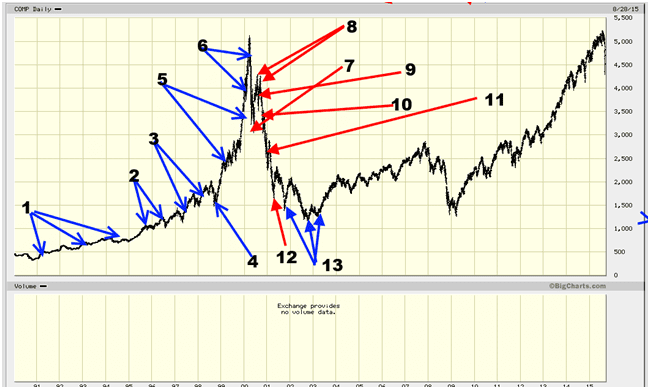

Greed and fear are the twin sirens of the stock market, luring the unwary trader onto the rocks of financial ruin. As we gaze upon the undulating waves of the NASDAQ’s long-term chart, we see the peaks and troughs of collective euphoria and despair. Yet, within these exaggerated movements lie the seeds of opportunity—or the makings of a debacle. It all hinges on the timing of your entry and the keenness of your market gaze, discerning whether a beleaguered stock will rise like a phoenix or continue to smoke in the ashes.

The chart (posted below) before you is more than a visual aid; it reflects the self-inflicted confusion and indecision plaguing the average investor. Though deceptively straightforward, the remedy is a bitter pill for the masses to swallow: cast your emotions out into the void. They have no seat at the table where fortunes are made and lost.

To invest with success is to perform an elegant pirouette away from the emotional cacophony. Ignore the siren calls of panic and euphoria; they are distortions far-flung from the reasoned centre of sound investment strategy. This principle holds across the expanse of financial indices and industry titans, whether GOOG, AAPL, or WMT.

Let us embrace a strategy that is at once simple and revolutionary: when the herd stampedes, stand still. When they cling to safety, they dare to explore uncharted territories. This is the path less traveled by, yet it is the one that leads to the storied realms of Livermore, the astute foresight of Lynch, and the timeless stratagems of Machiavelli.

Identify the emotion driving the markets & you can identify the trend

1. This stock is a dormant volcano, not a sprinter. Its fundamentals are as shaky as a house of cards. I must seek out the stallions of the stock market, not this sleeping snail.

2. Pure chance, nothing more. Those who leapt will soon lament. This breakout is a mirage in the desert of the market. This stock is destined to plummet to the abyss. My hard-earned wealth shall not be squandered on such fool’s gold.

3. Astonishingly, the stock climbs higher, defying the gravity of its dismal earnings and murky fundamentals. Yet, I shall not be swayed by this illusion. For in the grand tapestry of the market, one must look beyond the veil of emotion to see the accurate picture.

4. A sigh of relief escapes me; my intuition is correct. The stock takes a breath, and the untrained eye sees doom where I see a spring being coiled. Blinded by their shadows, the masses fail to see the opportunity for what it is—a chance to ascend.

5. The market defies the doomsayers, climbing ever higher. Now encouraged by the chorus of analysts, the latecomer decides to join the parade. Yet, the wise know that the music will soon fade, and the dance will end.

6. The market soars and the latecomer becomes the herald, proclaiming the time to invest is now or never. But history whispers a cautionary tale—when the crowd rejoices, the sage prepares for departure.

7. The market falters, and the investor, now seasoned by past missteps, sees not a trap but a trampoline. It’s time to double down, they think, ignoring the whispers of wisdom that caution against the seductive allure of averaging down.

8. The market rebounds, and the investor’s heart swells with regret for not investing more. Yet, in their euphoria, they overlook the warning signs—a lower high, a harbinger of a changing tide.

9. The market dips again, and the investor, now flush with confidence, sees a golden opportunity to invest heavily. Analysts sing songs of bullish forecasts, but the market is a fickle muse, and overconfidence often precedes a fall.

10. The market takes a nosedive, and the investor clings to hope like a shipwrecked sailor to a raft. They consider doubling down, their faith unshaken. Yet, the market cares not for faith—it is a beast that feeds on the rational and the irrational alike.

11. As fear grips the investors’ hearts, they question their choices. Should they have secured their gains, or is this just another test of their resolve? They wait, hoping for a reversal of fortune, but the market is not a phoenix—it does not rise at one’s command.

12. as if to mock their departure, the market hints at a recovery. Now driven by fear, the investor sells at the nadir, just as they once bought at the zenith. If only they had held on, the market was on the cusp of a rebirth.

Never let your emotions do the talking.

Emotions are nothing but perceptions, and these perceptions are based on the data your senses detect. However, one must not forget that perceptions are based on what appears to be real to you. Therein lies the problem, what appears real to you might not be real and could be just your distorted view of reality. Hence, if the data is flawed, the perception will be flawed, and the outcome will be negative. The only way to deliver your senses with clean data is to filter the emotional factor out of the equation.

when it comes to investing, emotions are the sly saboteurs of success, whispering sweet nothings of fear and greed, leading many traders to their financial demise. The market is a battlefield, and emotions are the enemy within, clouding judgment with the fog of war.

Emotions, those cunning tricksters, are but perceptions shaped by the senses, and perceptions can be as deceptive as a mirage in the desert. What seems real, what feels tangible, may be nothing more than a distorted shadow of truth. If the data is tainted, the perception is warped, and the outcome? It was a resounding defeat.

The market demands a warrior’s discipline, a Buffett’s stoic resolve, a Graham’s strategic foresight, and a Rothschild’s unyielding tenacity. These titans of trade knew that to let emotions hold court in mind was to surrender before the battle had even begun.

To navigate the treacherous waters of the stock market, one must steer the ship with a hand unshaken by the storm of emotions. Filter out the noise, and the pure signal of logic, reason, and strategic calculation remains.

The intelligent investor is a silent observer, a chess player in a world of checkers, always thinking three moves ahead. They know that the fools rush in where angels fear to tread, and they are led like lambs to the slaughter in their haste.

So, let your emotions sit this one out. Let them watch from the sidelines as you play the game with the cold, calculated precision of a Livermore. In the end, it is not the loudest voice that triumphs in the market, but the most measured, disciplined, and detached. It is the mind that wins, not the heart. And in this grand game, the spoils go to those who master their inner world as deftly as they navigate the outer one.

Regarding the Markets, never let your emotions do the talking. If your emotions do the talking, then your money will start walking, and it will walk away from and towards someone else. Misery loves company, but stupidity demands it.”

Fear, Timing, and Market Waves: Mastering the Art of Profitable Moves!

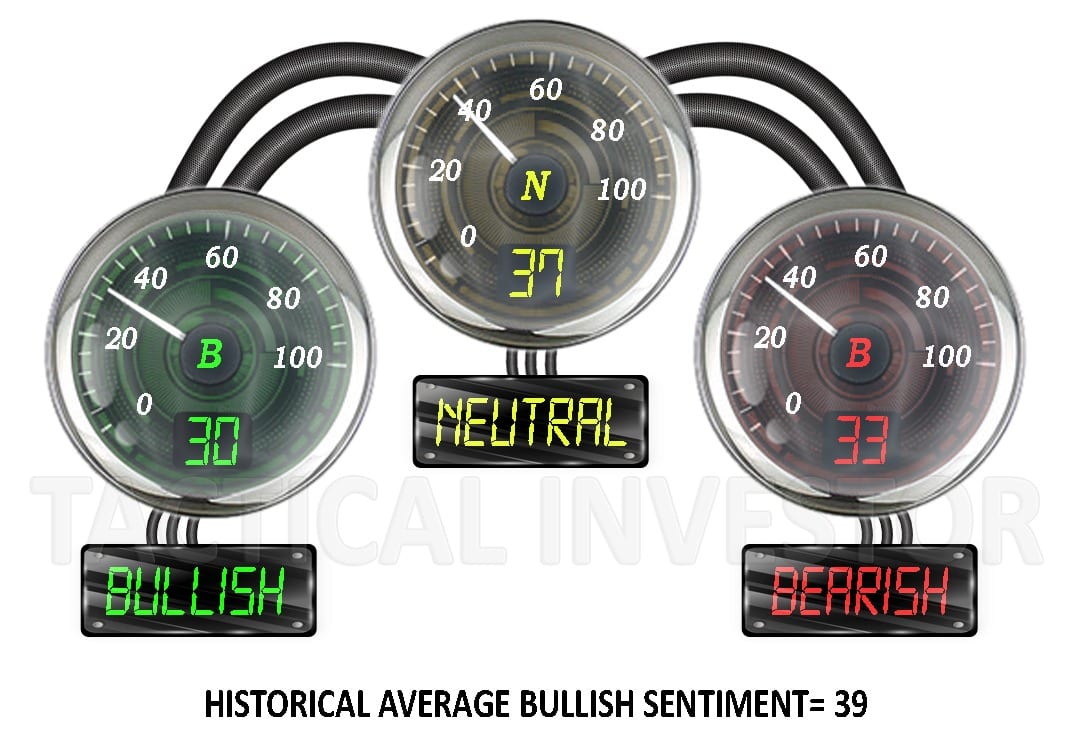

It is not advisable to focus on identifying a market’s exact top or bottom, as the data needed to do so is unreliable. As a result, any projections made based on such data will always be incorrect. Instead, the goal should be to look for subtle signals that indicate when the market is approaching a top or bottom. One way to do this is by measuring the market’s fear level. When fear levels are sky-high, it usually means that the market has reached a bottom. To refine this technique, you can master a few technical analysis tools.

This will help you identify whether the market is extremely oversold and whether this coincides with a significant spike in fear, which usually indicates that the market will bottom out soon. If you examine any long-term chart, you will notice that every significant correction or catastrophic event was a massive buying opportunity. Therefore, it is best to buy when the crowd panics and sell when the crowd is.

Confusion is a word we have invented for an order which is not yet understood.

Henry Miller

Mass Psychology & sentiment analysis provide insights into the stock bubble phenomenon.

New Commentary Sept 2019

There is no change in volatility readings this week, but we see significant shifts in sentiment, and the anxiety index confirms the move.

Once again, you see in real time that the best time to buy stocks is when the masses are panicking. It is in such moments that astute investors find real bargains. One needs to be patient with these opportunities and act when they present themselves. The last time this occurred was from October 2018 to January 2019. However, (as usual), most investors will panic and fee for the hills, when less than two weeks ago, they were begging for a chance to get into the very stocks they are now running from.

Nothing changes, and that is why the masses are destined to lose. The storyline is the same if you examine every single bubble in history. This is the most important lesson you must grasp if you are a new subscriber. This is mass psychology in action; never follow the masses unless you seek a quick end.

Random notes On stock Market Bubbles and Investing: May 2023

A solid grasp of technical analysis is critical as it empowers individuals to pinpoint market turning points and navigate the complexities of crowd behaviour, herd mentality, and the bandwagon effect.

These psychological phenomena can notably impact investment returns, often leading to unfavourable consequences. By incorporating the principles of Mass Psychology into your investment strategy and embracing a contrarian investing approach, you can mitigate the risks of blindly following the crowd.

These strategies will help you to avoid emotional biases that can cloud judgment and instead make informed decisions based on objective analysis.

This article published in March 2016 has undergone regular updates, most recently in May 2023. The updates keep the concise, impactful advice current and useful for optimizing marketing strategies.

Other related articles

Mob Mentality: How to Overcome it and win the investment Game

Herd Mentality: Dangers of following the Crowd

A clear illustration of the mass mindset