Is Now the Time to Buy Stocks? An Overview of the Current Market Situation

Updated March 2023

Introduction:

The question of whether it is the right time to buy stocks is common among investors. Making informed decisions in the stock market requires understanding the prevailing market conditions and assessing various factors that can influence stock prices. This overview aims to provide insights into the current market situation and offer guidance on whether now is an opportune time to invest in stocks.

Assessing Market Conditions:

Investors must evaluate multiple factors to determine the optimal timing for stock purchases. These include economic indicators, corporate earnings reports, interest rates, geopolitical events, and market sentiment. Analyzing both short-term market trends and long-term economic outlooks is crucial to understand the investment landscape comprehensively.

Considerations for Investment:

Several factors should be considered when deciding whether to buy stocks. Market valuation, such as price-to-earnings ratios, can help assess whether stocks are overvalued or undervalued. A company’s financial health, growth potential, and competitive position should also be evaluated to gauge its long-term prospects.

Expert Opinions:

While experts may hold differing views, many suggest that a diversified portfolio and a long-term investment horizon are key to navigating market volatility. They also emphasize the importance of thorough research and considering individual risk tolerance before investing in stocks.

Is Now the Time to Buy Stocks? A Historical Analysis of Market Opportunities

Many individuals become fixated on which stocks to buy, spending significant time compiling lists of stocks they hope to invest in. However, they often overlook the crucial aspect of determining the optimal time to make their purchases. Even if someone invests in a top-rated company, they can still lose money if they buy the stock at the wrong time. It’s important to understand that no stock keeps rising indefinitely, and failing to grasp this concept can result in substantial financial losses.

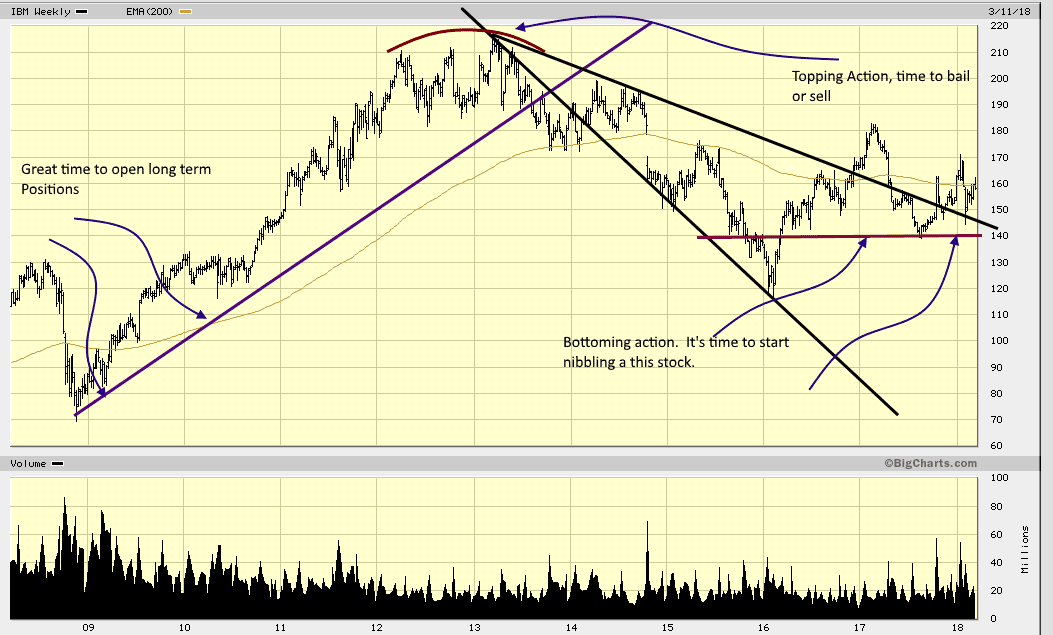

For instance, let’s consider IBM as an example. It was an excellent investment option from 2009 until around March 2013. However, if one had invested fresh capital in IBM after March 2013, they would have essentially experienced a loss.

Therefore, it’s crucial to not only focus on selecting promising stocks but also to pay close attention to the timing of your investments. Understanding when to enter and exit the market can significantly impact your financial outcomes.

Timing the Market: Unveiling Profitable Opportunities Beyond Stock Selection

While building a list of great stocks is essential, it should not be the sole focus. The timing of buying and selling stocks holds greater significance. Market sentiment, influenced by Mass psychology, is crucial in determining when to make investment decisions. One opportune time to buy stocks is after a stock market crash.

During such periods, the masses panic and sell off their holdings indiscriminately. This presents an opportunity as valuable stocks can be undervalued due to the market’s pessimism. Notably, Warren Buffet himself reduced his position in IBM in early 2018. Only time will reveal the wisdom of this move. However, analyzing the charts suggests that IBM could form a long-term bottom formation as of March 2018, indicating a potential for a favourable long-term investment.

The key point emphasized here is that the quality of a stock is not the sole determining factor for success; timing plays a crucial role. Even mediocre stocks can yield substantial profits by entering the market at the right time. Conversely, entering at the wrong time can lead to significant financial losses.

Capitalizing on Market Crashes: Seizing Prime Opportunities to Buy Stocks

The right time to buy stocks depends on your investment outlook and strategy. If you have a long-term investment perspective, it is essential to view strong pullbacks and market crashes from a bullish perspective.

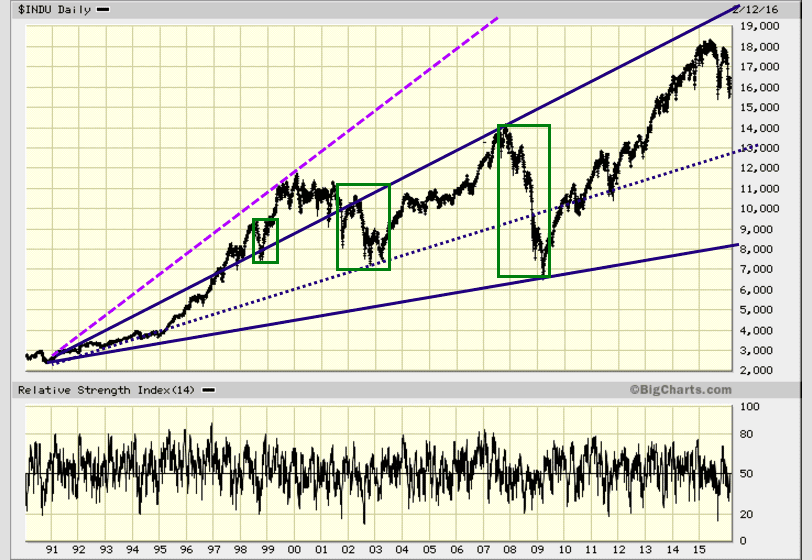

This point is exemplified in the image below, where the purchase of solid stocks like AAPL, AMZN, NFLX, NTES, GOOG, FB, ABMD, etc., during significant market pullbacks would have yielded excellent results. Even investing in mediocre companies during these pullbacks could have led to favourable outcomes in just a few months, and substantial gains could have been realized over the following years. It is advisable to create a “Best Stocks to Buy” list to prepare you to take advantage of market pullbacks when they occur.

Chart Analysis: Exploiting Buying Opportunities and Dispelling Pessimism

The main uptrend line is depicted by the solid blue line (the last line in the chart above), while the dotted navy blue line represents an alternative placement for the uptrend line, as some may argue. Regardless of the specific placement, the chart demonstrates that the greater the deviation from the uptrend line, the better the buying opportunity. Observing the chart above, it becomes evident that from 1990 to 2016, the bulls emerged victorious over the bears. This chart clearly illustrates that the pessimistic voices often profit by selling subpar products to the masses, products they would never consider using.

This chart clearly illustrates that the Doctors of Doom only make their money by selling the masses crap they would never dream of using.

In addition to the previously mentioned trend lines, a purple dotted line on the chart (the 4th line from the top) serves as a guideline for potential future market price action. To exercise caution, two more lines have been drawn on the chart. The navy blue line (the 3rd line) indicates that the Dow can reach levels above 19,500 shortly as long as the trend remains upward. The 4th line, represented by the purple dotted line, suggests that the Dow could even surpass 25,000 before the conclusion of this bull market.

Fresh Insights: Noteworthy Updates from March 14, 2018

Since the article’s publication two years ago, the Dow has indeed reached the suggested targets and is currently in a consolidation phase, gathering momentum for a potential upward trend. Once this consolidation period concludes, there is a strong possibility that the Dow could continue to achieve a series of all-time new highs. As the market progresses, what may have seemed improbable before could now become probable. A target of Dow 30,000 might no longer appear to be an overly ambitious or unrealistic goal.

When Opportunity Knocks: Building Your ‘Stocks to Buy’ List During Market Downturns

During market crashes or strong pullbacks, a prevailing negative sentiment typically leads to investors rushing to exit their positions. This results in the indiscriminate selling of quality stocks at significantly reduced prices. Investors essentially sell valuable stocks for much less than their actual worth. However, astute investors recognize these situations as once-in-a-lifetime opportunities and take advantage of them. It is not easy to make such decisions amidst the panic, as the market may be in a perpetual downward spiral.

To navigate such challenging times, various tools have been developed to identify crucial market turning points. One of the most essential tools is the “Trend Indicator”.” This indicator helps investors determine the prevailing trend in the market, providing insights into potential turning points. Using such tools, investors can make more informed decisions during market downturns and capitalize on the opportunities presented.

Staying Cool in Stock Market Crashes: Don’t Panic, Stay on Track!

In such situations, it is advisable to adopt a strategic approach. Rather than panicking, reflecting on past opportunities where you wished you had invested more in certain stocks before their prices surged is essential. Now, you have the chance to capitalize on a similar scenario. Instead of succumbing to panic, focus on the list of solid stocks you have identified and have always wanted to purchase at a lower price.

Technical analysis and mass psychology can provide tools to identify potential market bottoms and tops. This knowledge enables you to make more informed decisions when buying stocks near their lowest points and selling them close to their peaks. Therefore, rather than panicking, take out your list of stocks to buy now and begin acquiring the companies you had previously desired to own, but at a substantial discount.

The Trend Indicator: The Trend Is Your Friend

The trend indicator serves as a valuable tool in removing the guesswork from trading. Identifying the trend in advance, it allows for sufficient time to build a well-curated list of stocks to buy. This list can be narrowed down from a larger pool of potential candidates to the best 10 or 20 stocks for investment. Furthermore, the focus can shift towards identifying the optimal entry points for each stock, rather than concerning oneself with timing the exact top or bottom of the market.

This strategy has proven to be highly successful for our team for over 15 years and continues to yield positive results. It is essential to distinguish between bottoming or topping action in the market and attempting to precisely time the exact top or bottom, as the latter is often challenging. We aim to enter the market when there are signs of a potential bottom forming, and we assess this by gauging the level of fear and anxiety in the market using our proprietary sentiment tools. To further refine the process, we employ custom technical indicators. However, it is worth noting that our primary tool remains the trend indicator.

This article, originally published in February 2016, has undergone multiple updates to ensure its relevance. The most recent update was performed in March 2023, providing you with the latest information available.

FAQ

Q: What factors should I consider when deciding whether to buy stocks?

A: When determining the optimal timing for stock purchases, it is important to assess various factors, including economic indicators, corporate earnings reports, interest rates, geopolitical events, and market sentiment.

Q: What should I consider before buying stocks?

A: Factors such as market valuation, a company’s financial health, growth potential, and competitive position should be evaluated to gauge its long-term prospects. Conducting thorough research and considering individual risk tolerance before making investment decisions is essential.

Q: What do experts recommend when it comes to investing in stocks?

A: While experts may have differing opinions, many suggest maintaining a diversified portfolio and adopting a long-term investment horizon to navigate market volatility successfully. Thorough research and understanding of individual risk tolerance are also emphasized.

Q: How important is timing when buying and selling stocks?

A: Timing plays a crucial role in stock market investing. Buying stocks at the right time can lead to favourable outcomes while entering at the wrong time can result in significant financial losses. Understanding market sentiment, particularly during market crashes or pullbacks, can present valuable opportunities for buying quality stocks at discounted prices.

Q: What is the significance of the trend indicator?

A: The trend indicator is a valuable tool that helps investors identify the prevailing trend in the market. By utilizing the trend indicator, investors can have ample time to build a list of stocks to buy and focus on identifying optimal entry points. While it is challenging to time exact tops or bottoms, the trend indicator aids in making more informed investment decisions.

Q: How can sentiment tools and technical indicators help with market timing?

A: Sentiment tools gauge the level of fear and anxiety in the market, helping investors determine potential optimal entry points. Technical indicators provide additional insights for refining the investment process. While these tools can be helpful, it is essential to recognize that investing carries inherent risks and seeking professional guidance is recommended.

Q: What are the risks of overlooking timing when buying stocks?

A: Focusing solely on selecting promising stocks without considering the timing of investments can lead to financial losses. Understanding that no stock rises indefinitely is crucial, and market timing is crucial in overall economic outcomes. By entering the market at the right time, even mediocre stocks can yield substantial profits, while entering the wrong time can result in losses.

Q: Is now a good time to buy stocks?

A: The answer to this question depends on individual circumstances, investment outlook, and market conditions. It is advisable to conduct thorough research, assess market factors, and consider expert opinions to make informed investment decisions. Professional guidance can also help align investments with individual financial goals and risk tolerance.

Expand Your Mind: A Selection of Intriguing Articles: