Unveiling Market Secrets: Investor Sentiment Cycle

Sept 27, 2023

Investing in the financial markets is a journey that involves navigating through various market phases and understanding the ever-changing landscape of investor sentiment. In this article, we will explore the stages of the investor sentiment cycle and their interplay with market phases. We will also delve into the concepts of mass psychology and contrarian investing, highlighting how they can assist investors in positioning themselves on the right side of the sentiment cycle.

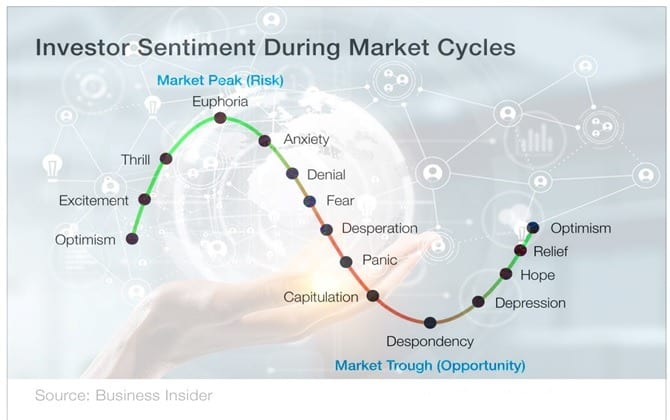

The investor sentiment cycle is a fascinating phenomenon that mirrors the emotional rollercoaster experienced by market participants. It encompasses stages like reluctance, optimism, denial, fear, and capitulation. Each of these phases reflects the collective emotions driving market behaviour.

In investing, emotions often play a pivotal role in decision-making. When markets are on an upswing, the optimism and excitement can lead to irrational exuberance, causing investors to flock to the market in a euphoric frenzy. Conversely, fear and panic can grip even the most seasoned investors during market downturns, leading to hasty decisions driven by emotion rather than reason.

Understanding the sentiment cycle and its connection to market phases is crucial for making informed investment choices. It allows investors to recognize when the market may be overheated and when opportunities might arise amid pessimism. Mass psychology, the study of how crowds influence individual behaviour, further sheds light on why investors tend to move in herds, often amplifying market extremes.

Contrarian investing, conversely, is a strategy that involves going against the crowd. It’s about having the courage to swim against the tide of prevailing sentiment. Contrarians seek opportunities when others are fearful and exercise caution when the masses are exuberant. This approach can be valuable for investors looking to capitalize on market mispricing driven by sentiment swings.

In the following sections, we will dissect the investor sentiment cycle, exploring the nuances of each stage and how they relate to market cycles. We will also delve deeper into the principles of mass psychology and contrarian investing, providing insights into how these concepts can be harnessed for more effective decision-making in finance. Join us on this enlightening journey as we unravel the secrets of the investor sentiment cycle and unveil the strategies that can lead to greater market success.

Phase One: Hesitancy

During the initial phase of the sentiment cycle, many potential investors approach the market hesitantly and cautiously. This hesitancy is often driven by a fear of making incorrect investment decisions. However, as the market experiences sustained upturns and consistent stock gains, this hesitancy can transform into a fear of missing out (FOMO). Investors may be tempted to chase past successes, reminiscent of the enthusiasm seen during the tech boom and subsequent bust in the early 2000s.

As the market shows signs of growth and positive momentum, investors question whether they should join in and capitalize on the upward trend. They may feel a sense of urgency to not miss out on potential gains, fearing that they might be left behind while others profit. This fear of missing out can be a powerful motivator, driving individuals to take action and enter the market.

During this phase, investors must approach the situation with a balanced perspective. While it is natural to feel the pressure of FOMO, it is crucial to make informed decisions based on thorough research and analysis. Rushing into investments without proper evaluation can lead to impulsive and potentially detrimental choices.

To navigate this phase successfully, investors should develop a solid investment strategy aligning with their financial goals and risk tolerance. It is essential to resist the temptation to chase quick gains and prioritize long-term growth and stability. By maintaining a disciplined approach and avoiding impulsive decisions driven by FOMO, investors can position themselves for more sustainable and successful outcomes.

It is worth noting that market conditions do not solely drive the sentiment cycle but are also influenced by external factors such as economic indicators, geopolitical events, and investor behaviour. Therefore, staying informed and adapting to changing circumstances is crucial throughout the investment journey.

Investors can approach the sentiment cycle with a balanced mindset by recognizing the initial hesitancy and the subsequent fear of missing out. Combining thorough research, disciplined decision-making, and a focus on long-term goals, investors can navigate this phase successfully and set themselves up for a more prosperous investment journey.

Phase Two: Positivity, Enthusiasm, and (Illogical) Euphoria

The initial hesitancy diminishes as the market performs well, and a sense of positivity and enthusiasm takes hold. Positive media coverage and anecdotal evidence from friends and colleagues entice more people to participate in the market. During this phase, investors find comfort in following the crowd and become less concerned about losses or perceived risks. However, it is important to note that this phase often coincides with the peak of the market cycle. Buying at high points can reduce potential returns. To mitigate volatility, a disciplined investment plan and regular contributions are essential.

During this phase, investors may experience a surge of optimism and a belief that the market will continue to rise indefinitely. This sentiment can be fueled by success stories and the fear of missing out on further gains. As a result, investors may become less cautious and more willing to take on higher levels of risk.

However, it is crucial to approach this phase with a level-headed mindset. While positive market conditions can be enticing, it is important to remember that markets are cyclical and can experience downturns. It is essential to maintain a disciplined investment strategy and not get carried away by the euphoria of the moment.

Regular contributions to investments, such as through systematic investment plans or dollar-cost averaging, can help mitigate the impact of market volatility. By consistently investing a fixed amount at regular intervals, investors can take advantage of market fluctuations and potentially lower their average cost per share.

Additionally, conducting thorough research and analysis is vital before making investment decisions. Relying solely on positive media coverage or anecdotal evidence may lead to irrational investment choices. It is crucial to consider the underlying fundamentals of the investments and assess their long-term potential.

Phase Three: Disbelief, Apprehension, Desperation, and Panic

Reality often sets in after a period of sustained market gains, and investors may enter a state of disbelief. They hesitate to sell their investments, rationalizing minor losses as part of the normal dynamics of the market. This mindset can sustain artificially high prices while negative news accumulates. Eventually, forced selling occurs, leading to a shift from disbelief and fear to desperation and panic. This phase can be emotionally challenging for investors as they witness the erosion of their investment values.

During this phase, investors may question their investment decisions and feel apprehensive about the market’s future. The initial disbelief can give way to a sense of desperation as losses accumulate and negative news continues to impact market sentiment. Investors may feel compelled to take drastic actions, such as selling their investments at significant losses, driven by fear and panic.

However, it is essential to approach this phase with a rational mindset. While feeling apprehensive during market downturns is natural, it is crucial to avoid making impulsive decisions based on short-term fluctuations. Instead, investors should focus on the long-term prospects of their investments and consider the underlying fundamentals.

During times of panic, it can be beneficial to seek guidance from trusted financial advisors or experts who can provide objective insights and help navigate through the challenging market conditions. They can offer a fresh perspective and help investors make informed decisions based on their financial goals and risk tolerance.

It is also important to remember that market downturns are a normal part of the investment cycle. Historically, markets have shown resilience and have eventually recovered from downturns. By maintaining a long-term perspective and staying disciplined, investors can position themselves to take advantage of potential market recoveries.

Phase Four: Surrender, Hopelessness, Dismay, Apathy, Indifference… and Hesitancy Anew

In times of crisis, the typical reaction is to sell investments out of fear rather than necessity. This move is often driven by a desire to alleviate the anxiety of staying invested in a declining market. However, selling at this stage involves acknowledging losses and incurring trading costs. While some selling decisions may be valid, such as when a fund manager’s performance falters, or a company’s fundamentals deteriorate, regaining confidence after cashing out is challenging. Investors often undergo a rollercoaster of emotions, transitioning from surrender to hopelessness, dismay, apathy, indifference, and hesitancy. This process can span years, causing investors to miss potential recoveries.

During this phase, investors may feel a sense of surrender as they witness the continued decline of their investments. Hopelessness and dismay can set in as they grapple with realising losses and the uncertainty of when the market will recover. This emotional turmoil can lead to apathy and indifference, where investors may become disengaged from the market and lose interest in making further investment decisions.

However, it is crucial to recognize that this phase also presents an opportunity for reflection and reassessment. Investors can use this time to evaluate their investment strategies, review their risk tolerance, and identify potential adjustments that align with their long-term goals. It is crucial to avoid making impulsive decisions driven by fear or desperation.

Hesitancy may arise once again as investors contemplate re-entering the market. After experiencing losses and emotional turmoil, it is natural to approach investing cautiously. However, it is important to remember that market recoveries can present opportunities for potential gains. By conducting thorough research, seeking professional advice, and maintaining a disciplined approach, investors can position themselves to take advantage of potential market upturns.

In conclusion, the phase of surrender, hopelessness, dismay, apathy, indifference, and hesitancy in the investor sentiment cycle can be emotionally challenging. However, by using this phase as an opportunity for reflection and reassessment, investors can make informed decisions and position themselves for potential recoveries. Maintaining a disciplined approach and seeking professional guidance when needed to navigate this phase and increase the chances of long-term investment success is crucial.

Mass Psychology in the Investor Sentiment Cycle

Understanding mass psychology and contrarian investing can be valuable tools for investors to position themselves on the right side of the sentiment cycle. Mass psychology refers to market participants’ collective behaviour and emotions, which can drive market trends and sentiment. It is the understanding that the actions of a large group of investors can influence the direction of the market, creating trends and momentum.

Investor sentiment is often driven by fear, greed, and herd mentality. When most investors exhibit similar emotions and behaviours, it can create a self-reinforcing cycle that amplifies market movements. Mass psychology plays a significant role in shaping market trends and can lead to periods of irrational exuberance or excessive pessimism.

Contrarian investing, conversely, involves taking positions opposite to the prevailing market sentiment. Contrarian investors recognize that market sentiment tends to be most extreme at turning points. When most investors are overly confident and optimistic, it may indicate an impending market correction. Conversely, when fear and pessimism dominate the market, it may present an opportunity for contrarian investors to enter at attractive valuations.

Contrarian investing requires a firm conviction in one’s analysis and the ability to withstand short-term market fluctuations. It involves conducting thorough research, analyzing market trends, and identifying potential mispricings or opportunities the majority may overlook. By going against the crowd, contrarian investors aim to capitalize on market inefficiencies and potentially achieve superior returns.

However, it is essential to note that contrarian investing is not without risks. Market sentiment can persist longer than expected, requiring careful analysis and timing to identify the right entry and exit points. Investors must have a well-defined investment strategy, risk management techniques, and a long-term perspective.

Navigating Contrarian Investing Through the Sentiment Cycle

Contrarian investing is a strategy that requires discipline and a contrarian mindset. It involves conducting thorough research, analyzing market trends, and understanding the underlying fundamentals of investments. By avoiding herd mentality and making informed decisions, investors can position themselves to take advantage of market opportunities.

Contrarian investors recognize that market sentiment tends to be most extreme at turning points. When most investors are overly confident and optimistic, it may indicate an impending market correction. This excessive optimism can lead to inflated asset prices and potential market bubbles. Contrarian investors, on the other hand, take a different approach. They seek opportunities when fear and pessimism dominate the market.

To successfully implement a contrarian strategy, investors must conduct thorough research and analysis. This involves studying financial statements, evaluating industry trends, and assessing the overall market conditions. By understanding the underlying fundamentals of investments, contrarian investors can identify potential mispricings and undervalued assets.

Contrarian investing requires discipline and the ability to go against the prevailing market sentiment. Swimming against the tide can be challenging, especially when most investors are moving in the opposite direction. However, by maintaining a contrarian mindset and sticking to their investment thesis, contrarian investors can position themselves to take advantage of market inefficiencies.

It is important to note that contrarian investing is not without risks. Market sentiment can persist for longer than expected, and timing the market accurately can be difficult. Therefore, contrarian investors must have a long-term perspective and a well-defined investment strategy. Contrarian investors can increase their chances of achieving superior returns by staying disciplined and making informed decisions based on thorough research.

In conclusion, contrarian investing is a strategy that requires discipline, research, and a contrarian mindset. By avoiding herd mentality and making informed decisions, investors can position themselves to take advantage of market opportunities and potentially achieve better investment outcomes.

Conclusion:

As we conclude our journey through the intricate landscape of the Investor Sentiment Cycle, one thing becomes abundantly clear: emotions are the driving force behind market movements. From the initial hesitancy to the euphoria of positive trends, the disbelief in downturns, and the surrender during crises, emotions shape our investment decisions more than we often realize.

However, armed with knowledge and a disciplined approach, investors can rise above the emotional rollercoaster. Mass psychology teaches us that the crowd can lead to both exuberance and panic, but contrarian investing offers a way to navigate through these extremes.

Contrarians recognize that at the peak of optimism lies a potential correction, and amid fear and pessimism, opportunities may emerge. By going against the grain and making informed decisions based on research, they aim to capitalize on market inefficiencies.

In this ever-evolving financial landscape, understanding the sentiment cycle and employing contrarian strategies is not just an option; it’s a necessity for success. By staying disciplined, avoiding emotional biases, and embracing a contrarian mindset, investors can position themselves on the right side of the sentiment cycle and increase their chances of achieving long-term investment success.

As you navigate the dynamic world of finance, remember that knowledge is your most potent tool, and rational decision-making is your compass. Happy investing!

Other Articles Of Interest

Unraveling the Enigma: How Do Savings Bonds Work and Mature?

Clear Proof Millennials Are Dumbest Generation

Third Wave Feminism Criticism: Valid Points Amidst the Debate

Investor Sentiment in the Stock Market: Maximizing Its Use

Mastering the Art of Retirement: How to Start Saving for Retirement at 45 with Grace and Style

Third Wave Feminism is Toxic: Its Impact on America

What is the Average Student Loan Debt in the US? Understanding the Crisis

Student Debt Crisis Solutions: Halting the Madness is Essential

Financial Freedom Reverse Mortgage: A Sophisticated Strategy for a Comfortable Retirement

Early Retirement Extreme: A Philosophical and Practical Guide to Financial Independence

Student Loan Refinance: A Smart Move Towards Financial Freedom – Poise in Debt Reduction

How to Lose Money: The Dangers of Ignoring Market Trends and Psychology in Stock Investing

How much has the stock market gone up in 2023? -A Refined Analysis

Maximizing Gains: Mastering Market Sentiment Indicators