Is Collective Euphoria Fuelled by Hidden Agendas?

Jan 8, 2025

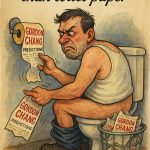

Why do supposedly rational individuals often cling to mainstream headlines, all the while missing clues that point towards looming trouble? Media outlets, at times, seem to broadcast an endless wave of positivity when share prices climb. The phrase “buy now or miss out” appears in bold, capturing the public imagination and nudging many towards fraught decisions. Yet, when panic arrives, the same voices can flip, stirring waves of terrified selling. In this climate, one cannot help but wonder: are media sources quietly steering investor behaviour through selective reporting? Whether it is the promise of a new technological golden age or a series of interviews featuring “expert” analysts who sing the same tune, there is often more bubbling beneath the surface than meets the eye.

Information manipulation draws on a powerful tool: human emotion. In finance, few forces override reason as effectively as excitement and fear. When everyone is winning or thinks they are, an atmosphere of harmony builds, and dissenting voices are cast aside. Critical facts may be concealed or downplayed in these moments of bliss, feeding a sense of security. Later, when the tide changes and stock prices tumble, stories of risk and danger suddenly fill the airwaves, amplifying the dread that sets in. The swift and dramatic shift raises suspicions about whether the tone had been artificially managed all along.

This essay will chart a path through mass psychology, behavioural finance, and technical analysis, examining how well-timed trades often prove superior to rash reactions. We will look at the dot-com craze of the late 1990s and the 2008 housing collapse, two notable events that revealed the huge gap between public message and reality. By exploring how media narratives might guide a crowd towards frenzy or despair, we can better understand the cunning role of selective knowledge. Ultimately, a careful trader who observes both obvious statements and what remains unspoken is far more likely to prosper.

The Looming Crash: Lessons from Dot-Com Delusions

Remember the late 1990s, when internet-based shares soared to unfathomable heights? Fresh-faced users embraced email, online chat rooms, and digital storefronts convinced that physical shops would soon be obsolete. The media turned young entrepreneurs into legends, fuelling the idea that any business with a “.com” at the end of its name was a guaranteed winner. Day after day, headlines cheerfully predicted unlimited growth for internet ventures. Meanwhile, warnings about untested profit models and flimsy financials were often relegated to page twelve or brushed aside as doom-mongering.

Did certain outlets intentionally conceal the shaky fundamentals of these start-ups, or was it a simple matter of chasing popular stories? Either way, the results were predictable. Countless everyday investors, drawn by the promise of massive returns, jumped in at steep prices. Media platforms gained audiences by echoing the hype, seldom taking the time to question the surge. One might argue that they had little incentive to test the validity of these valuations, as optimism drew clicks and viewership. The moment the hype overpowered logic, the bubble was primed to pop.

Yet some observers stood on the sidelines, pointing out that many dot-com companies lacked actual revenue streams. Behavioural finance suggests that a crowd in full euphoria often squashes alarm bells. Early doubters may have tried to sound the alert, but the roar of the mass imagination drowned them out. Meanwhile, those with a degree of wariness—who scanned market charts and saw how irrationally prices had risen—exited the party at handsome profits. Once the mania finally snapped, share prices crashed, wiping out enormous sums. For the well-prepared, though, there were times to buy brilliant companies at a fraction of their former price. The dot-com collapse thus offers a perfect template: when the press is uniformly upbeat, that can be an unintentional warning signal.

When the Media Rewrites the Story: 2008 Housing Fallout

A decade later, the pattern repeated, although the product was different: property. Many media sources sold viewers on the notion that house prices would climb forever, unaffected by the usual cycles. Homebuyers were encouraged to borrow heavily, while banks repackaged risky mortgages as attractive assets. Television interviews regularly featured industry spokespeople who promoted home ownership as the safest route to riches. At the same time, deeper concerns—skyrocketing household debt and questionable credit ratings—were either glossed over or reported with minimal emphasis.

Once again, the crash was severe. Large financial giants crashed to their knees, entire economies reeled, and as with the dot-com era, some asked: could better, more balanced reporting have lessened the crisis? Perhaps repeated coverage of real unemployment numbers or potential waves of mortgage defaults might have slowed the frenzy. Instead, many channels leaned towards optimism because grim news drives away viewers until it is too late. That created an echo chamber of positivity, within which promises of never-ending growth drowned out warnings.

For investors who understood mass psychology, however, the bubble signalled opportunity. When panic took hold in 2008, shares of reputable banks and various solid corporations were put on sale. Traders who had studied how herds behave fared better, knowing that media-fuelled despair can suppress values below realistic levels. They waited, sometimes quietly, as public fear peaked. Meanwhile, those who relied on daily coverage found themselves trapped in a doom loop, selling assets at a loss because headlines steered them to believe that the financial system was on the brink of utter ruin. The same media that had once praised the housing market now unleashed horrifying stories, often with minimal nuance, intensifying the rush to liquidate.

Mechanics of Influence: Strategic News Releases

How do large corporations and market movers synchronise media stories to sway public sentiment? One method is gradually releasing seemingly positive data while concealing important drawbacks. Imagine a pharmaceutical company championing a new drug’s potential, broadcasting success rates or preliminary trials while withholding any mention of side effects. By the time the reality emerges—perhaps in the form of serious complications discovered later—many investors have already poured money into the firm. Another approach is the timely leak of negative details about a competitor, orchestrated to coincide with that rival’s product launch or major announcement. Media pick up on the controversy, drawing eyeballs, while the original issues may be overblown or lacking proper context.

Such manoeuvres do not stop at corporate press releases. Government agencies can also influence how data are framed. Economic indicators—unemployment reports, inflation measures—may be presented in ways that mask underlying trouble. A shift in the calculation method for the cost of living can make inflation seem less severe. If media outlets fail to probe beyond the official figures, the public remains unaware of the full story. In doing so, authorities can keep citizens feeling calmer, possibly delaying a sell-off in financial markets.

These tactics work because of a quirk in human psychology: we often accept the first piece of information we see or hear, then filter all subsequent news through that initial view. If the main headline screams “Economy Booming,” readers may shrug off smaller articles that challenge such optimism. Once enough individuals adopt the same stance, the crowd effect takes over. Everyone scrambles to buy or hold, believing that negative chatter is just paranoid gossip. Eventually, if the problem is serious, it bursts out into public view, causing shock. The same outlets that once trumpeted success transform into harbingers of doom. The cycle repeats, ensuring that those who can cut through the noise have a notable advantage.

Behavioural Biases: Euphoria, Fear, and Herd Conduct

While it may be tempting to see media manipulation as a deliberate plot, it often aligns conveniently with audience cravings. In bull markets, viewers crave good news, with experts championing a fantasy of unstoppable gains. Optimistic coverage garners higher ratings and encourages sponsorships. In bear markets, dramatic warnings prompt anxious readers to keep clicking, feeding a thirst for every snippet of commentary that might hint at an end to the pain. Media houses, chasing engagement, respond accordingly. At times, the outcome looks like a subtle dance, with outlets catering to what the public expects and the crowd reinforcing that narrative.

Behavioural finance describes how this cycle enforces an extreme pattern: euphoria escalates fast while fear descends with equal force. Both extremes can destroy investment portfolios. Buying during euphoric surges frequently results in overpaying, while panic selling after catastrophic news can lead to losses just before a market recovery. Technical analysis, with its chart-based signals, helps skilled traders identify moments when the market is likely overbought or oversold. For example, suppose a certain technical indicator shows that a stock is trading well above its usual range. That might be a sign that the media’s praising coverage is inflating prices unrealistically. Conversely, if the charts suggest a stock is in a solid support zone while press coverage is uniformly bleak, courageous contrarians see a tempting entry point.

A telling moment occurs when commentators shift from unbridled optimism to gloom in days. This abrupt turnaround often stems from new information hitting the public space. However, that data did not magically pop into existence; insiders or certain analysts may have been aware of the details well beforehand. Their earlier silence raises questions about why these facts were not shared sooner. Whether intentionally or not, withholding that knowledge shaped the choices of thousands or even millions of traders who followed the daily commentary. This links directly to the power of editing what the public sees—and when they see it.

Technical Patterns: Reading Between the Headlines

Charts do more than show price movement; they mirror the collective ups and downs of public emotion. When financial outlets repeatedly proclaim that a stock or an asset class “cannot fail,” one often sees steep rallies on those charts, accompanied by trading volume surges. This indicates that many have jumped onto the bandwagon, perhaps guided by glowing reports. Eventually, the rally meets resistance—a technical indication of heavy selling as more savvy players lock in profits. If the media continues to amp up enthusiasm, naive buyers may pile in, pushing the price beyond sustainable limits. Experienced chart readers keep calm, observing that no asset ascends forever.

When the reversal hits, it can be swift and brutal. The media storyline pivots, flipping from triumphant headlines to stark warnings. The same voices that promoted unstoppable growth started discussing bankruptcy risks. The chart, meanwhile, displays a series of lower highs, confirming that major players are selling. During these moments, contrarian traders see the promise as frightened sellers drive prices below fair value. By recognising patterns such as capitulation—a massive sell-off on huge volume—they time their buy orders to catch the turnaround. Later, when headlines calm down, these contrarians reap the rewards, having refused to follow the panic that the press and the crowd generated.

One might ask: if technical indicators are so effective, why does not everyone use them to avoid losses? Reading charts requires discipline, an open mind, and the ability to block out the hype. Moreover, it demands a willingness to accept that public information is not always complete or fully accurate. When mainstream outlets broadcast that a stock is unstoppable, the contrarian wonders, “Who benefits from suppressing the other side of the story?”

Practical Strategies: Navigating Media Narratives

Given that selective reporting is likely to persist, how can an individual guard against harmful decision-making? One crucial step is to consult multiple sources. If reputable finance journals, sceptical bloggers, and independent analysts are all describing a market top while mainstream programmes remain cheerfully bullish, that discrepancy is a clue. Instead of jumping to buy, it might be wise to watch from the sidelines, waiting for a better entry point or at least confirming the real state of play. Conversely, if market headlines shout impending doom and gloom is thick, but quiet specialists are highlighting improvement in fundamentals or chart signals, that might be a cue to begin loading up on undervalued assets.

Another approach is to record your trading decisions and the headlines that accompany them. Examining past trades can reveal patterns of media-driven mistakes. For instance, perhaps you frequently bought near ultimate market peaks because a television pundit proclaimed that a certain sector was “unstoppable.” By identifying those errors, you become more attuned to hype or gloom, boosting your ability to separate fact from polished narrative. This process of reflection helps you stand firm when others are bounced around by daily bulletins.

Additionally, an appreciation for mass psychology is vital. Newspapers, television channels, and internet sites are well aware that sensational headlines attract more readers. On volatile days, “Markets in Turmoil” is likely to get more attention than a balanced headline. This sensational approach repeated consistently, can shift moods across entire populations. The difference in outcomes between those who act on these moods and those who observe them from a distance can be huge.

Closing Thoughts: Beyond the Soundbite

In the end, media manipulation—be it purposeful or incidental—can be an enormous force in shaping market swings. Recognising that some pieces of news are amplified while others are buried allows an investor to remain vigilant. Whether the spotlight is on dot-com mania or an overheated property boom, these episodes share a common thread: selective emphasis on certain data. This selective emphasis may create temporary illusions of safety or unstoppable growth, trapping those who trust every optimistic headline or panic-driven flash bulletin.

Timing proves crucial in seizing opportunities. Strategic buying during a wave of fear can yield impressive returns, provided one has examined the true merits of the assets in question. Similarly, securing profits while media sources continue to hail unstoppable growth can protect one’s capital from a dramatic fall. Indeed, what sets the most successful speculators apart is less about perfect guessing and more about an understanding that the public can be steered by whichever voices are amplified.

Individuals can rise above the noise by combining mass psychology, behavioural finance principles, and the reading of technical signals. Instead of being rattled by headlines, they can use those headlines as reverse indicators of where the market may be headed next. Gaining this perspective requires scepticism and patience, traits that stand in opposition to a media cycle driven by the fastest deadlines and boldest statements. If investors remember that headlines can hide as much as they reveal, they stand a better chance of thriving even when everyone else is rushing like lemmings to the edge.

Ultimately, the finest investors and traders build their methods around a powerful core principle: question everything. Do not assume the nightly news is complete. Take a step back, examine the charts, and tune into those who look past the roar. Who knows? That contrarian spark could lead to the next great opportunity—one found by thinking beyond the well-trodden path of popular opinion.