Unveiling the Impact: Exploring Investor Sentiment Data Manipulation

Unveiling the Impact: Exploring Investor Sentiment Data Manipulation

Aug 12, 2023

The significant manipulation of sentiment data has serious long-term consequences. For the first time, the big boys/sharks have successfully altered perceptions from both bearish and bullish angles for an extended period.

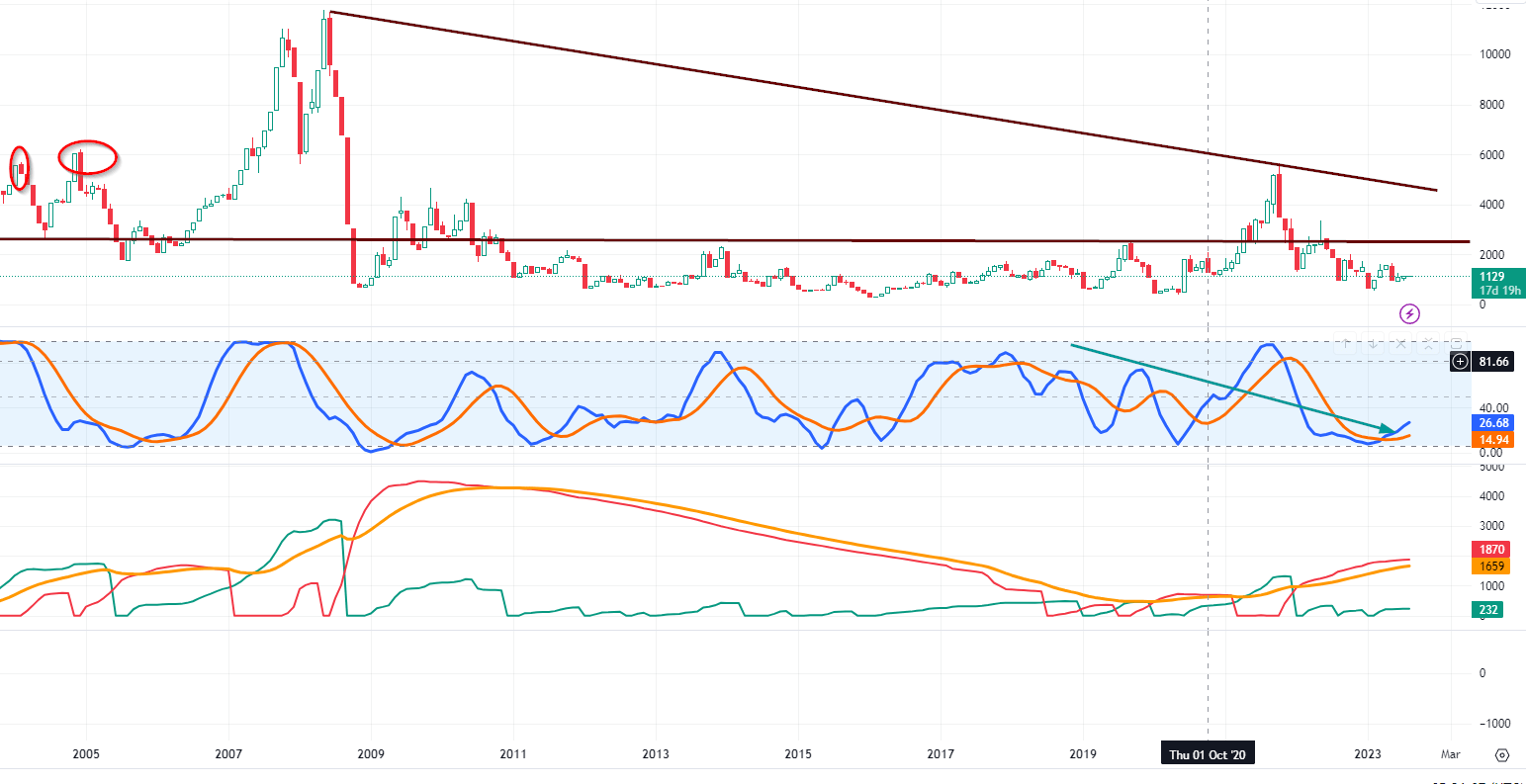

The phenomenon of bullish sentiment trading below its historical average for an unprecedented duration of 17.5 months deserves careful consideration. To put this into perspective, our comprehensive data analysis indicates that such a trend has never been observed before. In addition, it’s worth noting that the bearish readings did not exhibit an extended surge; instead, they experienced a brief uptick before returning to a more stable state. This created a scenario akin to range trading within the realm of sentiment.

This intriguing pattern persisted until the latter part of May 2023, when a notable shift occurred. Bullish readings finally surged above their historical average, marking a significant transition. However, the enduring impact of the prolonged low readings left a noticeable impact, causing the historical average to decrease from 39 to 38.5. This subtle but noteworthy alteration underscores the complex interplay between sentiment and market dynamics, highlighting the need for a nuanced approach to understanding investor behaviour.

Unravelling a Sinister Agenda: Tech-Controlled Perceptions

This means the big players/sharks are making a full-fledged effort to control how people perceive almost everything that is important. If something has value, they will try to change your perception of it. This concept is further elaborated in the following article. : Psychological Manipulation Techniques: Directed Perception.

These players do not take such risks without reason, and manipulating sentiment data is only the beginning of a much broader and more sinister agenda. They aim to control how you perceive things, allowing them to make the imaginary seem real. In other words, they could even make the masses believe in something as implausible as the tooth fairy. Whether you accept this narrative or not is irrelevant, as critical thinkers cannot alter the outcome. Their aim is to change the perceptions of non-critical thinkers; unfortunately, these individuals constitute about 90% of the population.

People still associate freedom and anonymity with Bitcoin, so don’t be surprised if these crush it and other technologies that seem to give the public an advantage. This suppression will likely continue until Artificial Intelligence (AI) reaches a level of superintelligence (AGI). At this stage, those who believed they could use technology to enhance their control over the masses might encounter challenges. The tables could turn, and the ones in control might find themselves pursued and confronted by the very technology they once thought they could manipulate.

Unveiling the Impact: Interest Rates’ Influence on Markets

Another crucial factor to consider is the impact of interest rates on the markets. Typically, these effects take 6 to 24 months to influence the overall economy. For example, during the previous rate hiking cycle from June 2004 to June 2006, interest rates increased by 425 basis points. The consequences of these rate hikes became noticeable in December 2007 when the markets started to peak. This was followed by the 2008 crisis, which persisted until March 2009.

We advised our subscribers to exit the housing market in late 2006, almost 12 months before the markets peaked. Our subscribers were sceptical and critical for those 12 months. When the markets eventually crashed, it became evident that the decision to take a defensive stance was wise. However, before the crash happened, we received constant criticism every month for adopting a defensive posture.

Interest rates have risen by more than 525 basis points in approximately 16 months, reaching the highest level since 2001. From a very long-term perspective, this situation will not end well. However, we will pause for now and continue that discussion later.

Despite Investor Sentiment Skew: Long-Term Bullish Outlook

The BDI, a measure of the global economy’s health and shipping industry, indicates that economic growth is likely to stall without easy money access. Note the index is currently trading well below its all-time high. One argument is that the previous surge was due to low-interest rates set by Alan Greenspan. Surprisingly, the $5 trillion injection during the COVID-19 crash did not lead to a similar spike. Although it briefly reached the highs of January 2004, it fell short of December 2004’s highs. Nonetheless, positive signs include a bullish MACD crossover and trading near the insanely oversold levels, suggesting the Fed may slow or pause rate hikes. Moreover, the BDI predicts an economic rebound, supporting the idea of embracing market pullbacks.

The long-term outlook based on 20-30-year charts is bullish, suggesting no rush as the confirmed bullish pattern will persist for years. However, caution is advised as the initial strong upward move can sometimes be deceptive, as seen in instances like October 2008 when a market pullback and new lows followed a rally. Although history doesn’t repeat exactly, it teaches us that being prudent during such moments usually leads to significant long-term gains.

The market is somewhat unstable as a few stocks drive the recent rally. It is wise to wait for signal confirmation before making decisions, as even a tiny trigger could lead to a market downturn.

A decline in mega-cap stocks, which significantly contributes to the gains of the S&P 500, has the potential to initiate a rapid pullback in the market. However, such a pullback would present a buying opportunity for investors.

If we had to sum up our stance, it would be:

Overall, we are neither bearish nor neutral but cautiously bullish.

Conclusion

In conclusion, manipulating investor sentiment data holds far-reaching implications that extend beyond the financial markets. The ability to control perceptions, alter beliefs, and influence decisions has been wielded by powerful entities, impacting both bullish and bearish sentiments. This manipulation signifies a broader agenda aimed at shaping how individuals perceive reality, often steering them away from critical thinking. While some associate freedom with certain technologies, the landscape may shift as Artificial Intelligence advances, challenging those who once sought to control through technology.

Moreover, the connection between interest rates and market dynamics emphasizes the importance of anticipating economic shifts. Historical examples remind us that market effects following interest rate changes can take time to materialize, requiring prudent foresight. As we navigate these intricate webs of manipulation and market forces, embracing a critical approach and staying vigilant will remain essential tools for investors and the wider public. The complexities at play may obscure our view, but with an informed and discerning perspective, we can strive to uncover truths amid the layers of influence and control.

Discover Exceptional and Informative Reads

Financial Mastery: Time in the Market Trumps Timing

Investment Pyramid: A Paradigm of Value or Risky Hail Mary?

Quantitative Easing: Igniting the Corruption of Corporate America

Blooms and Busts: Navigating the Tulip Bubble Chart Phenomenon

Uranium Market Outlook: Prospects for a Luminous Growth Trajectory

Stock Investing for Kids: Surefire Path to Success!

An Individual Who Removes the Risk of Losing Money in the Stock Market: A Strategic Approach

Palladium Forecast: Unveiling the Stealth Bull Market

I Keep Losing Money In The Stock Market: Confronting the Stupidity Within

Copper Market News: Distilling Long-Term Patterns

Analyzing Trends: Stock Market Forecast for the Next 6 Months

AMD Stock Forecast 2024: How MACDs & RSI Signal a Bottom

Market Mastery: The Best Investing Books for Your Success

Example of Groupthink: Mass Panic Selling at Market Bottom

Unveiling the Impact: Exploring Investor Sentiment Data Manipulation

Unveiling the Impact: Exploring Investor Sentiment Data Manipulation