Mastering Investing Psychology: Turning Negativity into Success

Updated May 2023

The most profound path to knowledge lies in our historical exploration. That’s precisely why we occasionally delve into topics through a historical lens. This approach imparts valuable insights and unveils our actions in real-time, demonstrating the alignment of our words and deeds.

We all know negativity sells, as the crowd loves misery. You hardly ever see a group of individuals happily sharing a nice story. Still, it is amazing how they will smile when recounting some tragic event and go to great lengths to give you all the unnecessary details. We also find it incredibly strange that people can talk about the losses they incurred during a stock market crash with such calm, but when the stock market is crashing they panic and dump the baby with the bathwater.

Why the change in attitude? Is there a difference? In one instance, you are losing the money in real time, and there is a chance to recoup these funds if you don’t give in to panic. In the former instance, you have already sold the position at a massive loss, and you have no plans of jumping into the market; well, at least that is what applies to those who follow the masses.

Unlocking Investing Psychology: Harnessing Negativity for Gain

The long list of headlines below, which appeared in Feb 2016 on various sites, highlights how negativity seems to peak around market bottoms. However, have the masses or the naysayers making these claims learnt anything from history; they have not.

Instead, they continue screaming even louder and louder, hoping their screams’ sheer volume will push the market lower. What happens instead is that the market always takes off. Look at Marc Faber last year; throughout this year, he has stated the market will crash. Look at this video; you can find much more by searching on YouTube. In Aug of 2015, he predicted Gloom and Doom and has continued to do so before and after that.

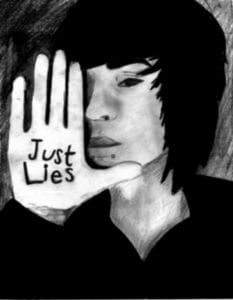

And as expected, he was dead wrong as he and other naysayers have been for years; they only make money by selling you bad advice they would never put to use. They would have been bankrupt long ago if they had listened to themselves.

Lesson 2 of Investing Psychology: Spotlight on the Crowd

Notice how misery loves companies; Google “US economy in trouble, US economy facing a recession” or any other negative topic, and you will find many new articles being pushed out almost daily. The consensus is for the economy to pull back and, consequently, for the markets to tank. The economy could sputter, but the markets will not tank as everyone leans toward that direction. Everyone usually knows next to nothing when it comes to the market. Unless the trend turns negative, you should not give two hoots to the doom scenarios these highly paid clowns come up with. Investment Psychology Explained

Well, the world did not end. The markets did not crash. They rallied in the face of extreme negativity. The Dow is still not out of the woods; a test of the August lows is expected unless the trend on the SPX suddenly turns positive. The volume of negative articles and manufactured harmful data continues to rise, setting the base for the Feds to sell “the prince rescues the poor damsel in Distress story”.

We use the word Manufactured because no data the government issues can be trusted. When crime incorporated is in charge, the assumption should be that the data issued is done to support whatever scenario the spin-doctors choose to create.

Embrace the Unconventional: Break Free from Yesterday’s Rubbish

To understand the future, you must understand what is happening right now. In one second, right now will become the past, and the next second will become the present. Focussing on the present allows you to shape the past and future. You only need to look at the masses to get a glimpse of the future.

Nothing has changed. The Drs of Doom continues with the same ploy; crap is wrapped up and marketed as Gold. This is a perfect example of “Groundhogs day” in action. The outfits and players have changed, but the theme is the same. Nothing has changed, and nothing will change for those who embrace the mass mindset.

Unconventional Signals and Market Anticipation: April 28, 2023

In our current situation, a fascinating development arises as our MOAB signal index nears an intriguing 99, just one point away from a full buy signal. Although this might appear perplexing, considering that a move to 93 has consistently preceded a full buy signal, we maintain our steadfast and disciplined approach as patient traders. We refuse to compromise our principles by modifying the triggering parameters for MOAB or FOAB signals, nor do we engage in curve fitting. We commit to staying true to our approach and diligently following our signals.

However, this unusual circumstance with the MOAB signals implies that we should expect a similar level of unpredictability in the markets. Despite being prepared for a significant correction due to the MOAB, we will not wait for it to occur. If the markets undergo a substantial correction, we are well-prepared. If not, we will continue moving forward.

It is worth noting that a MOAB buy signal would override nearly all other considerations except for a FOAB signal and a bearish indication from our trend indicator. Fortunately, there is no indication of the trend indicator turning bearish as it gradually approaches the bullish zone.

There are two potential scenarios that we find acceptable:

The first scenario entails a swift and decisive correction, accompanied by a surge in the number of bears, ideally reaching 65. The second scenario involves a moderate pullback with substantial volatility and fluctuation, leading to a rise in the number of individuals in the neutral camp, ranging from 50 to 55. I find the second setup more favourable. Why? Skittish skunks only exhibit brief sulking before changing course, whereas nervous nellies take months or even years to summon the courage to act. These anxious investors lay the foundation for a robust and enduring bull market.

World of Ideas: Articles That Will Expand Your Horizons

The Myth of the Jewish Genome Unveiled

Unraveling Long and Variable Lags in the Stock Market

Vulgar Words: A Psychological Perspective

Record Corporate Debt Garners Attention: A Concerning Development

Mastering Investment: Overcome Herd Mentality Bias

Impact of AI on Human Workforce: Navigating Change

CNQ Stock: Igniting Potential with an Exciting Market Pattern

What Is A Strong Currency: Its and Impact on Economic Stability

Why Is Student Debt A Problem? Simple Fixes

American Power and Gas: Revolutionizing the Energy Sector

Americans favor coffee to stock market investing

The Rich Get Richer The Poor Get Poorer: Socioeconomic Inequality

Overcoming Crowd Phobia: Understanding the Fear of Large Crowds

US dollar vs Japanese Yen: No Bottom In Sight For Yen