Mar 14, 2024

Investing can often seem like an intricate dance between opportunity and risk, a game where the rules are seemingly complex and the stakes are always high. As we look at “Investing for Dummies 2023,” we delve into the nuance and strategy required to navigate the financial market with confidence and savvy. Like the best AI-enhanced chess players, investors must anticipate moves, consider the influence of mass psychology, and position their assets to secure victory despite the market’s volatility.

The Chessboard of Investments: Understanding Market Dynamics

Investing is not unlike a grand chess match. Each piece on the board represents different asset classes, ranging from the pawns of bonds and CDs to the knights and bishops of stocks and real estate. The rooks, perhaps, are commodities, while the queen might be the ever-powerful mutual funds, capable of moving in multiple directions with substantial influence. At the helm is the king, representing your financial security – the game’s ultimate goal.

Just as a chess player must understand the role of each piece and the ways they can move, an investor must recognize how different assets behave and interact. The market is a dynamic battlefield, influenced by economic reports, geopolitical events, and corporate earnings. It’s essential to stay informed and adapt to the changing environment, just as a chess player must adapt to their opponent’s strategy.

Mass Psychology: Moving with the Pawns

Mass psychology is not a new phenomenon in the financial markets. It has been a recurring theme throughout history, where the collective behaviour of investors has led to significant economic events. Understanding the psychological forces is a cornerstone of “Investing for Dummies 2023,” empowering novice investors to navigate the markets with a more informed perspective.

For example, the Dutch Tulip Mania of the 17th century is one of the earliest recorded instances of a speculative bubble. Tulip bulbs became a coveted luxury item, leading to a heated market where prices soared absurdly. The collective belief was that the trading prices would continue to rise indefinitely. However, when reality set in and confidence waned, the market collapsed, leaving many investors in financial ruin. This historical example is a classic illustration of how mass psychology can lead to irrational investment decisions.

Similarly, the South Sea Bubble in the early 18th century is another testament to the power of mass sentiment. The South Sea Company’s shares rose sharply based on unrealistic expectations about the potential wealth generated from trade with South America. Investors, driven by greed and the fear of missing out, ignored fundamental economic indicators. The bubble burst resulted in a significant loss of wealth and had far-reaching consequences for the British economy.

Fast forward to the modern era, the late 1990s and early 2000s dot-com bubble is a more recent example where mass psychology played a critical role. The advent of the internet and the potential for new tech companies led to excessive speculation. Many investors, from experienced to novices guided by the principles akin to “Investing for Dummies 2023,” poured money into internet startups with no proven track record or earnings. The NASDAQ Composite Index, heavily laden with tech stocks, peaked in March 2000 before dramatically declining. The following crash saw many investors lose significant amounts of money, with some companies losing 80% or more of their value.

In these situations, herd behaviour was prevalent: investors collectively bought into the hype without due diligence, and the fear of missing out overrode rational judgment. These historical examples highlight the importance of recognizing when market dynamics are driven more by the emotions of the masses than by the underlying economic realities. It is a critical skill for anyone engaging in “Investing for Dummies 2023” to cultivate to avoid similar pitfalls.

The principles in “Investing for Dummies 2023” stress the importance of doing homework before investing. This involves analyzing financial statements, understanding the business model, and assessing the company’s leadership. It also means paying attention to market indicators and not being swayed by the prevailing sentiment. By doing so, investors can make calculated decisions based on facts and logic rather than getting caught up in the emotional waves that can lead to market bubbles and subsequent crashes.

Maintaining a level head in the face of public sentiment is easier said than done, but it is essential for long-term success in investing. The markets will always have their ups and downs, and while it’s impossible to remove emotion from investing altogether, being aware of mass psychology’s impact can help investors make more informed decisions. In this way, “Investing for Dummies 2023” serves as a beacon, guiding investors through the ever-changing tides of market sentiment with a steady hand.

Contrarian Investing – The Bold Knight’s Gambit

In the investing world, contrarians are like the knights on the chessboard – they move in unexpected ways, often catching their opponents off-guard. Contrarian investors go against the market consensus, buying assets when others sell and vice versa. They believe that the crowd is usually wrong at extremes and that significant opportunities lie in going against the grain.

To succeed in contrarian investing, one must thoroughly understand market fundamentals and be firm in their analysis. This approach can be advantageous but carries risks, as timing the market is notoriously challenging. It’s akin to executing a knight’s gambit—a move that can lead to a strategic advantage if played correctly but can leave you vulnerable if not carefully calculated.

Conclusion

Investing requires a blend of knowledge, strategy, and psychological insight. Whether you are a seasoned investor or a newcomer looking for guidance through “Investing for Dummies 2023,” the key is approaching the market with the calculated precision of a chess grandmaster. By understanding the game’s dynamics, mastering your emotions, and sometimes taking the contrarian path, you can navigate the market with confidence and savvy.

This article has begun to map out the complex and fascinating world of investing, where financial acumen meets psychological understanding. As we continue, we will delve deeper into the strategies that can help investors of all levels turn the chessboard of the market to their advantage.

Nourish Your Intellect: Dive In!

What is a Hedge Fund: Beyond the Basics, Embracing Volatility

Home Run with Homeschooling Ideas

Americans with No Emergency Funds: Progress & Challenges

Hookah Lounge: A Captivating Experience for Relaxation and Socialization

Anxiety Sensitivity Index Does Not Support Stock Market Crash

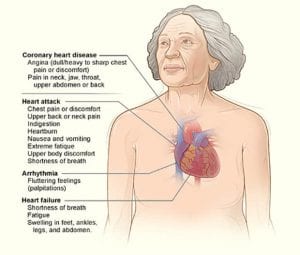

Unveiling the Silent Threat: Women and Heart Disease

Homeschooling Benefits: A Comprehensive Guide

Google News Trends Unveiled: Gossip Promoted as News

Benefits Of Homeschooling: US Education System Is Crumbling

Neocon Perceptions and the Illusion of Nuclear Warfare

Stocks To Buy Today Reddit – Focus on the Trend, Ignore the Noise

12 Best Tropical Paradises to Visit for Your Dream Getaway

Neocon 2023: Debunking the Nuclear War Myth

Gold Spot Price History: Will Gold Continue Trending Upwards