Editor: Vladimir Bajic | Tactical Investor

Exploring the Connection Between Anxiety Disorders and Investing

Update Aug 2023

We will delve into this topic using historical context because history serves as the best teacher. Learning from history helps us avoid repeating mistakes, and it also demonstrates how we at Tactical Investor apply this concept in real-time.

Anxiety over investing or where the markets are going often leads to poor decisions. When anxiety is high, it clouds judgment and causes investors to make rash choices they later regret. The wise investor takes a contrarian approach, letting the anxiety of the masses serve as a gauge for opportunity. When collective anxiety is peaking, it often marks a bottoming in prices. The courageous buyer can exploit others’ distress to acquire assets at favourable prices.

Conversely, when euphoria is high and everyone seems optimistic, it often signals a market top. The wise investor trims positions and realizes some gains as others rush in greedily. While difficult psychologically, going against the crowd is key to investment success. Having a plan and sticking to it, rather than reacting emotionally, keeps one on the proper course. Patience and discipline are true investors’ greatest allies. Tuning out the noisy anxieties and exuberance of the crowd prevents being led astray by mass psychology. By objectively gauging mass sentiment, the astute investor profits from others’ lack of composure.

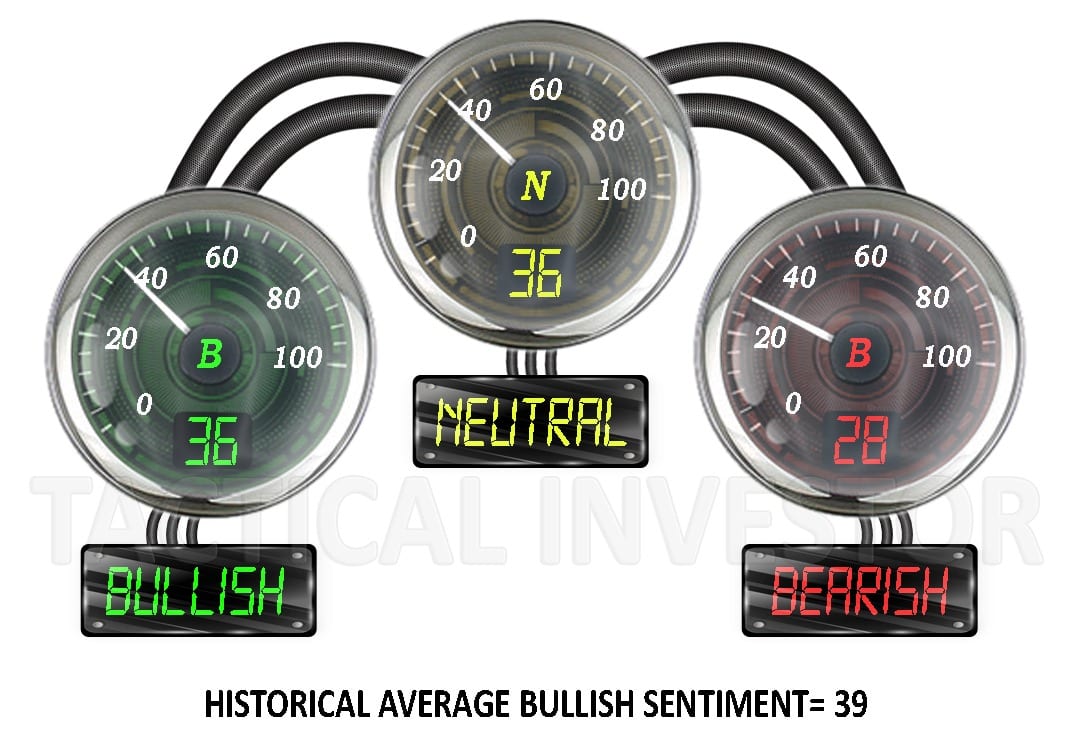

This Week’s Sentiment Readings

Notice a pattern here: the lowest reading is from the bulls, and when you combine the neutrals and bears, it totals 64. In the long run, the crowd’s uncertainty suggests that the markets may not crash, but they could experience a rapid and intense pullback. Many markets are trending upward, with certain ones like Bitcoin showing signs of a “feeding frenzy stage.” Additionally, V readings are still at all-time high levels, indicating that extreme volatility is something we should all be prepared for. Consequently, one could conclude that the Stock Market Forecast for the Next 3 Months is likely bullish, and any strong pullbacks should be viewed with a bullish perspective.. Continue reading

Anxiety and Obsessive-Compulsive Disorders Demystified

Anxiety disorders and Obsessive-compulsive disorders, while sharing some commonalities, are distinct in their manifestations and impacts on an individual’s life. Anxiety disorders encompass a spectrum of conditions characterized by pervasive, excessive fear and anxiety that disrupt daily functioning. These disorders manifest in various forms, including specific phobia, an irrational fear of a particular object or situation; social anxiety disorder, characterized by extreme fear and avoidance of social interactions; panic disorder, where individuals experience sudden, unprovoked episodes of intense fear; agoraphobia, marked by a deep-seated fear of situations where escape might be challenging; and generalized anxiety disorder, a chronic state of worry, tension, and unease.

On the other hand, Obsessive-compulsive and related disorders, such as body dysmorphic disorder and hoarding, are a distinct category in the DSM-5. These disorders are characterized by the presence of intrusive thoughts and/or repetitive behaviours, which often induce anxiety. The most well-known among these is obsessive-compulsive disorder (OCD). Individuals with OCD are plagued by persistent, unwanted thoughts or obsessions, leading them to engage in repetitive behaviours or mental acts, known as compulsions. These compulsions are often performed as a coping mechanism to mitigate the distress caused by the obsessions.

While both categories of disorders can cause significant distress and impairment, understanding their unique characteristics is crucial for accurate diagnosis and effective treatment. The journey to mental health recovery begins with knowledge and understanding, and this article aims to shed light on these often misunderstood conditions. Lumen Learning

Originally Published on: August 11, 2016, but updated multiple times, with the latest update in August 2023.

Captivating Stories Ahead

Clear Proof Millennials Are Dumbest Generation

Third Wave Feminism Criticism: Valid Points Amidst the Debate

Investor Sentiment in the Stock Market: Maximizing Its Use

Mastering the Art of Retirement: How to Start Saving for Retirement at 45 with Grace and Style

Third Wave Feminism is Toxic: Its Impact on America

What is the Average Student Loan Debt in the US? Understanding the Crisis

Student Debt Crisis Solutions: Halting the Madness is Essential

Financial Freedom Reverse Mortgage: A Sophisticated Strategy for a Comfortable Retirement

Early Retirement Extreme: A Philosophical and Practical Guide to Financial Independence

Student Loan Refinance: A Smart Move Towards Financial Freedom – Poise in Debt Reduction

How to Lose Money: The Dangers of Ignoring Market Trends and Psychology in Stock Investing

How much has the stock market gone up in 2023? -A Refined Analysis

Maximizing Gains: Mastering Market Sentiment Indicators

How to Achieve Financial Goals: The Midas Touch for Your Financial Dreams