Dow Jones Average Chart: Trading Strategies for Winning

May 11, 2024

Only those who know what they are doing should entertain the idea of trading futures. The average person is drawn to futures because they have delusions of hitting the big one; usually, they take a monumental beating. You can make thousands of dollars a day or lose it all too, and that’s what one should focus on the “loss factor”. Hence, the order of battle should look something like this.

Stocks, Options, and Futures; however, ensure you have mastered stock and options trading before you get into futures. Secondly, make sure you are banking profits in both markets. Some of these profits can then be diverted towards the future.

Futures trading provides you with an endless array of markets.

One of the main benefits of playing the futures market is that there is always a bull market at any given moment. As so many markets are covered, it is virtually impossible not a segment to invest in. Bulls can find bull markets, and bears can find many markets to be short. However, that is about the only benefit associated with futures for the novice player. After that, it is all downhill for the novice player, and that is why only less than 10% of market participants succeed in the future.

Dow Jones Average Futures: Focus on More Than Just Dow Futures

A futures contract is a legally enforceable agreement to make or take delivery of a specific quantity and grade of a particular commodity during a designated delivery period. Making a delivery is a “short” position, while taking delivery is considered “long”. The specified delivery period is also called the “contract month”.

Each commodity has different expiration months, though the most common are March, June, September, and December. It is rare for futures products to trade every calendar month, so it is essential to note your chosen product’s cycle and expiration dates before executing your trades.

The amount you could lose is unlimited and, therefore, could exceed what you initially deposited. Why?

The reason is that trading is highly leveraged, with a small amount of money used to establish a position in assets with much greater value. But, while trading futures is associated with risk, and it’s essential to be conscious of that risk, it also promises a potential for unlimited income, and therein lies the reason for the risk. The key is balancing the two (and trading education always, always, always helps). Full Story

Futures Trading demands persistence and perseverance.

In no other market are your endurance skills tested as much as they are here. Novice traders should focus on markets with low margin requirements and small drawdowns; you need money to jump into the markets again.

For example, avoid the natural gas and palladium markets. Oats, corn, wheat, cocoa, cotton, coffee, sugar, orange juice, pork bellies, individual currencies (look under margin requirements below for more info), etc., do not require huge margins. Additionally, potential drawdowns are less.

Tread and trade cautiously, for it’s elementary to lose 10-50K; for many, that could represent their entire savings.

Dow Jones Average Futures Trading Update, Aug 5, 2019

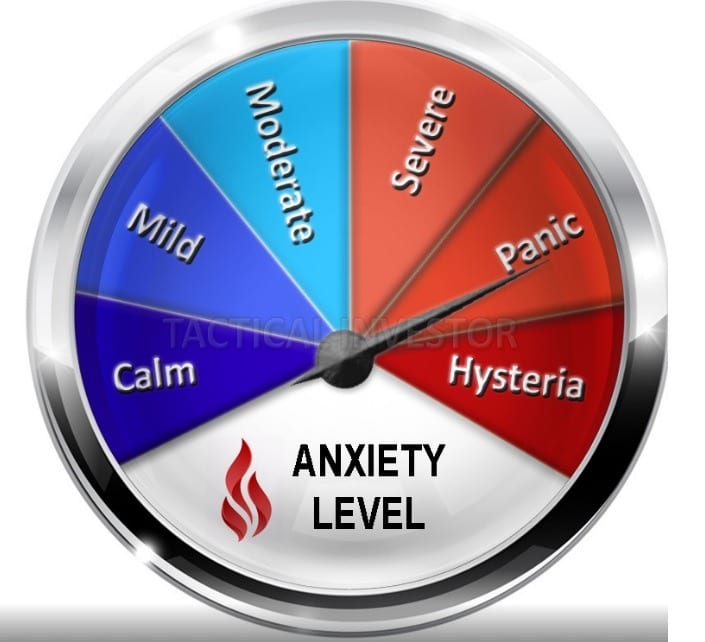

The markets are pulling back, and we are getting triggered into some of these plays. Don’t let market volatility change the angle of your perception. The masses complain about better prices when their wish comes true; they panic and flee to the hills, which they call investing. They either oscillate between misery or euphoria, and both have a dangerously short lifespan.

The trend is your friend. Anything that falls outside or in between is your enemy. Never fight the trend, for the outcome is always the same; if you have not figured it out yet, you will end up on the losing end. We monitor the weekly charts closely as a bullish MACD crossover could lead to an explosive upward move. However, if the crossover fails to complete, the markets will finally let out a nice dose of steam.

According to the TI Dow Theory

The Dow is the utilities that lead the way, and then the Dow industrials or transports follow. In the current setup, the Dow industrials triggered the second buy signal, and now the Dow transports are close to initiating a buy signal. After this buy signal is triggered, it will pave the way for the Dow to blast well beyond 29K and possibly well past 30K. For the next 6-12 months, stocks in the transportation sector should outperform the overall market. Risk-takers (and we mean risk-takers) can look into getting into TPOR, a 3X leveraged ETF that seeks to return 3X the daily returns of IYT. It could easily trade north of 45 over the next 6-9 months.

Other Articles of Interest

Investing for dummies: Trade Stock Markets successfully

Why market crashes are buying opportunities