Apr 25, 2024

Introduction

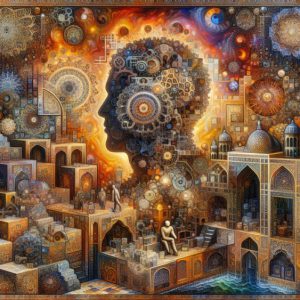

In the ever-changing landscape of the stock market, the IBM stock price today, NYSE, has captured the attention of investors worldwide. As we delve into the intricacies of financial movements and the factors influencing the IBM stock price, we must consider the insights of wise investors and philosophers from various eras. This article will explore the concepts of mass psychology, contrarian investing, technical analysis, and the bandwagon effect, drawing wisdom from notable figures such as Cato the Elder (234-149 BC), Ptahhotep (2400 BC), and Ray Dalio (1949-present).

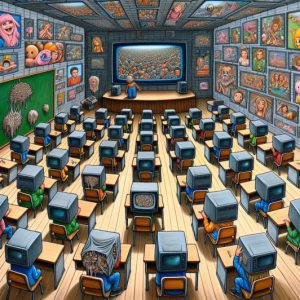

Mass Psychology in the Stock Market

One of the most striking examples of mass psychology in the stock market is the dot-com bubble of the late 1990s. During this period, investors flocked to technology stocks, driven by the belief that the internet would revolutionize how businesses operate. The collective enthusiasm led to a massive surge in stock prices, with many companies achieving sky-high valuations despite lacking solid fundamentals. The IBM stock price today, NYSE, while not immune to the overall market sentiment, remained relatively stable compared to many other technology stocks during this period.

The bubble eventually burst in 2000, leading to a sharp decline in stock prices and significant losses for many investors. This event demonstrates the dangers of succumbing to market hype and the importance of maintaining a level-headed approach to investing, even when the crowd is racing towards a particular sector or stock.

Cato the Elder’s contrarian approach to investing is rooted in the idea that irrational factors, such as fear or greed, can often drive market sentiment. By going against the prevailing market trend, contrarian investors aim to capitalize on opportunities that the masses may overlook. This strategy can be particularly effective when applied to the IBM stock price today, NYSE, as the company’s solid fundamentals and long-term growth prospects may be undervalued during periods of market pessimism.

However, it is important to note that contrarian investing is not simply about doing the opposite of what the crowd is doing. Instead, it involves carefully analyzing market trends, company fundamentals, and investor sentiment to identify situations where the market may have overreacted or undervalued a particular stock. By combining a contrarian approach with thorough research and analysis, investors can potentially make more informed decisions when considering the IBM stock price today NYSE and other investment opportunities.

Contrarian Investing Strategy

Contrarian investing involves going against the prevailing market sentiment and making investment decisions that oppose the majority. When applied to the IBM stock price today NYSE, contrarian investors would look for opportunities to buy when others are selling, and sell when others are buying. Warren Buffett, the legendary investor, echoed this sentiment in his 1965 letter to Berkshire Hathaway shareholders, stating, “Be fearful when others are greedy, and greedy when others are fearful.”

Ptahhotep, an ancient Egyptian philosopher from around 2400 BC, offered timeless wisdom that resonates with the contrarian investing approach. In his teachings, he emphasized the importance of independent thinking and caution in decision-making. Ptahhotep advised, “If you are a man of worth, beware of following the majority, for often the majority is wrong.”

Technical Analysis in Trading

Technical analysts employ various tools and techniques to study the IBM stock price today NYSE, including moving averages, relative strength index (RSI), and Bollinger Bands. These indicators help identify trends, momentum, and potential entry and exit points for trades. For example, if the IBM stock price today NYSE crosses above its 50-day moving average, it may signal a bullish trend and prompt technical traders to consider buying the stock.

One of the most famous examples of successful technical analysis in action is Jesse Livermore’s trading during the stock market crash of 1929. By studying market trends and applying his understanding of price patterns, Livermore could anticipate the crash and sell his holdings before the market collapsed. He later capitalized on the market’s recovery by buying stocks at low prices and selling them as the market rebounded, generating massive profits.

In the case of IBM stock price today, NYSE, technical analysts might look for specific chart patterns, such as head and shoulders or cup and handle formations, to predict future price movements. They may also consider the stock’s trading volume, as high volume can indicate strong investor interest and potentially confirm a trend.

Ray Dalio’s emphasis on embracing reality and dealing with it is particularly relevant to technical analysis. By objectively studying the IBM stock price today NYSE and other market data, technical analysts can identify trends and make informed trading decisions based on what is happening in the market, rather than relying on emotions or subjective opinions.

However, it is important to note that technical analysis is not foolproof and should be used with other forms of analysis, such as fundamental analysis, to make well-rounded investment decisions. Additionally, past performance does not guarantee future results, and technical indicators can sometimes produce false signals. As with any investment strategy, it is crucial to exercise caution and thoroughly assess the risks before making trading decisions based on technical analysis of the IBM stock price today NYSE.

Bandwagon Effect and Investment Decisions

The bandwagon effect can significantly impact investment decisions, particularly when it comes to high-profile stocks like IBM. In the case of IBM stock price today, NYSE, investors may be tempted to buy or sell based on popular opinion rather than fundamental analysis. For example, during the dot-com bubble of the late 1990s, many investors jumped on the bandwagon and invested in technology stocks without thoroughly evaluating their financial health or growth potential. As a result, when the bubble burst, these investors suffered substantial losses.

To avoid falling victim to the bandwagon effect, conducting independent research and analysis is essential when considering the IBM stock price today NYSE. This includes examining the company’s financial statements, assessing its competitive position in the market, and evaluating its management team and strategic direction. By relying on objective data and analysis, investors can make more informed decisions and avoid the pitfalls of herd mentality.

Benjamin Graham’s cautionary words in “The Intelligent Investor” remain as relevant today as they were in 1949. He argued that investors should focus on a company’s intrinsic value rather than market sentiment or popular opinion. Graham’s value investing approach involves identifying companies with strong fundamentals that are trading at a discount to their intrinsic value. By adhering to this approach and thinking independently, investors can capitalise on opportunities others may overlook, such as undervalued stocks or contrarian plays.

In the case of IBM stock price today, NYSE, value investors would carefully examine the company’s financial health, growth prospects, and competitive position before making an investment decision. They would also consider the stock’s valuation relative to its peers and the broader market. By focusing on these fundamental factors rather than succumbing to the bandwagon effect, investors can potentially make more rational and profitable investment decisions over the long term.

Conclusion

Navigating the complexities of the stock market and understanding the factors influencing the IBM stock price today on the NYSE requires a combination of wisdom, strategy, and independent thinking. We can gain valuable perspectives on mass psychology, contrarian investing, technical analysis, and the bandwagon effect by considering the insights of wise investors and philosophers from different eras, such as Cato the Elder, Ptahhotep, and Ray Dalio.

As we strive to make informed investment decisions, it is essential to remember the words of these influential figures and apply their wisdom to our own financial strategies. By embracing reality, thinking independently, and exercising caution, we can navigate the ever-changing stock market landscape with finesse and resilience.

Ultimately, the key to success in investing lies in our ability to adapt, learn, and make decisions based on sound analysis rather than succumbing to the whims of the crowd. As we watch the IBM stock price today on the NYSE, let us remember the timeless wisdom of those who came before us and use their insights to guide us towards profitable and sustainable investment practices.

Breaking Conventions: Challenging Articles

Considering the impact of inflation, Why Is Investing Important?

Technical Analysis of Stocks and Commodities: Unveiling Insights

Why Is the US Education System So bad: Rubbish In, Rubbish Out Phenomenon

Investor Sentiment in the Stock Market Journal of Economic Perspectives

Real Doppelgangers: The Risks in the Age of AI

The Intelligent REIT Investor: How to Build Wealth with Real Estate Investment Trusts

TGB Stock Forecast: Rising or Sinking

Reasons Why AI Is Bad: The Dark Truth?

The Inflationary Beast: Understanding What Inflation is and What Causes It

Identifying Trends and Buying with Equal Weighted S&P 500 ETF

Psychology of Cursing: Why Do People Curse So Much?

Spy 200-Day Moving Average: Covert Financial Indicator Unveiled

TGB Stock Price: Riding the Copper Wave with Taseko Mines

Why is the US dollar the Strongest US currency: its deadly effects