How can I learn more about mass psychology? Simple Rules for Success

Jan 13, 2024

Herd Mentality

The financial marketplace is a complex ecosystem where many decisions can inadvertently influence the individual’s actions. This is often referred to as the “herd mentality.” Just as a herd of animals move together for protection, investors usually follow the crowd, believing there’s safety in numbers. This behaviour can lead to financial market trends.

Optimism can be infectious in a bull market where prices are rising. As more and more people buy into the upward trend, the market continues to climb. The idea of ‘missing out’ on potential gains can lure even the most cautious investors. This can lead to an investment bubble that, when it bursts, can cause significant financial losses.

Conversely, a bear market, characterized by falling prices and growing pessimism, often triggers a mass exodus of investors. Panic selling ensues as investors rush to offload their holdings to avoid further losses. This mass selling can exacerbate the decline, deepening the bear market and causing a negative spiral that can be difficult to break.

Navigating these market trends requires a strong understanding of investment goals and risk tolerance. It’s crucial to resist the pull of the herd and make informed, individual decisions based on sound financial planning and analysis. The herd might not always be heading in the right direction.

Sentiment Analysis:

In investing, understanding the market’s mood can be as crucial as analyzing a company’s financials. This is where sentiment analysis comes into play. It’s a powerful tool that uses technology to gauge public sentiment, often by monitoring social media, news sentiment, and surveys.

The rise of social media has given investors a new way to measure market sentiment. By analyzing the tone and content of posts on platforms like Twitter and Facebook, investors can understand how the public feels about a particular company or the market as a whole. This is known as social sentiment analysis. It’s a way of taking the market’s pulse, so to speak, by listening to the collective conversation happening online.

On the other hand, news sentiment analysis involves examining the tone of news articles and financial reports. Positive news can increase investor confidence and a potential rise in stock prices, while negative news can have the opposite effect.

Surveys like the AAII Investor Sentiment Survey provide another way to gauge market sentiment. These surveys show the percentage of investors who are bullish, bearish, or neutral on stocks, providing a snapshot of investor sentiment at a given time.

High levels of optimism can sometimes indicate an overheated market, where prices may be inflated beyond what the fundamentals support. On the other hand, excessive pessimism can signal potential buying opportunities, as prices may be undervalued.

However, it’s important to remember that sentiment analysis is not a crystal ball. It can provide valuable insights but is just one piece of the puzzle. It should be used in conjunction with other forms of analysis and not relied upon as the sole indicator of market conditions.

Market Cycles:

The financial market is a living, breathing entity pulsating with the collective emotions of its participants. It ebbs and flows, rises and falls, in a rhythm known as market cycles. These cycles are the market’s heartbeat, and understanding them can provide valuable insights into the mass psychology of investors.

A complex interplay of factors drives market cycles, but at their core, they reflect the collective emotions of the market participants. These emotions can significantly influence investor behaviour, from optimism and euphoria during a bull market to fear and despair in a bear market.

During the upward phase of a market cycle, optimism reigns. Investors are confident, which fuels further investment, driving prices higher. As the market continues to rise, optimism can turn into euphoria. Investors may start to believe that the market will keep going up indefinitely. This irrational exuberance can inflate market prices beyond their actual value, creating a bubble.

However, what goes up must come down. Eventually, the bubble bursts and the market enters a downward phase. As prices start to fall, optimism turns to fear. Investors may panic and start selling their holdings to avoid further losses. This panic selling can accelerate the market’s decline, leading to a bear market.

But even in the depths of a bear market, there is hope. As prices fall, assets may become undervalued, presenting attractive buying opportunities for savvy investors. This buying can start to push prices back up, beginning a new upward phase of the market cycle.

Recognizing these market cycles and the emotions that drive them can help investors anticipate shifts in mass psychology. By understanding the emotional undercurrents of the market, investors can make more informed decisions, potentially avoiding costly mistakes and capitalizing on opportunities.

However, navigating market cycles is not easy. It requires discipline, patience, and a willingness to go against the crowd. It’s not about trying to time the market perfectly but understanding the market’s rhythm and making informed decisions based on that understanding.

Volume Analysis:

In financial markets, trading volumes play a pivotal role. They are the invisible strings that move the marionettes, providing clues about mass participation and the strength of price movements.

Trading volumes refer to the number of shares or contracts of a security that have been traded within a given period. It’s like taking the market’s pulse, measuring the heartbeat of buying and selling activity. A surge in volume often accompanies significant price movements, indicating widespread market interest.

Imagine a bustling marketplace. The more people there buy and sell, the more vibrant and dynamic the market is. The same principle applies to financial markets. High trading volumes can signal strong interest in a security, suggesting that the current price trend—whether up or down—may continue.

For instance, if a stock’s price rises and the trading volume increases, this could indicate favourable sentiment among investors. It’s as if a crowd is gathering, and their collective enthusiasm pushes the price higher. On the other hand, if the stock’s price is falling and the trading volume is rising, this could indicate worry among investors. It’s like a stampede, with everyone rushing to sell and get out of the way.

But what about low trading volumes? Well, they can be a bit like a quiet, empty marketplace. They might suggest that the market is losing interest in a security, which could indicate a potential change in price trend.

However, volume analysis is not a crystal ball. It’s a tool, one of many in the investor’s toolbox. It can provide valuable insights, but it should be used in conjunction with other forms of analysis. After all, the financial markets are a complex ecosystem influenced by many factors.

Behavioural Biases:

The financial markets are a mirror, reflecting the economy’s state and its participants’ collective psyche. Behavioural biases are at the heart of this psyche, deeply ingrained tendencies that can influence our decision-making process, often without us even realizing it.

Behavioural finance is a fascinating field of study that explores the intersection of psychology and finance. It delves into the cognitive biases and emotional tendencies that can impact our financial decisions. By understanding these biases, we can gain insights into market reactions and potentially improve our investment outcomes.

Fear and greed are two of the most powerful emotions that sway investor behaviour. Fear can make us overly cautious, leading us to miss potential opportunities. On the other hand, greed can make us take excessive risks in pursuing high returns. Both can lead to sub-optimal decisions that can negatively impact our financial health.

Overconfidence is another common behavioural bias. It’s a tendency to overestimate our abilities and the accuracy of our predictions. Overconfident investors may take on too much risk, believing they can outsmart the market. This can lead to poor investment decisions and potential financial losses.

But it’s not all doom and gloom. By recognizing these behavioural biases, we can take steps to mitigate their impact. We can strive to make more rational, informed decisions rather than being swayed by our emotions or biases. We can also use our understanding of these biases to anticipate market reactions, giving us a potential edge in our investment strategy.

So, the next time you’re about to make a financial decision, take a moment to reflect. Are you being driven by fear or greed? Are you overconfident in your predictions? You can uncover your behavioural biases and make better financial decisions by asking these questions.

Technical Indicators:

In investing, technical indicators serve as navigational tools, helping investors chart a course through the often turbulent waters of the financial markets. Investors can uncover patterns that reflect collective investor actions by analyzing charts with tools like moving averages, the Relative Strength Index (RSI), and the Moving Average Convergence Divergence (MACD).

Moving averages are a fundamental tool in technical analysis, smoothing out price data to identify trends over a specific period. They provide a snapshot of the average price of a security over a set number of periods, helping to filter out the ‘noise’ of daily price fluctuations and highlight the underlying trend.

The RSI is a momentum oscillator that measures the speed and change of price movements. It oscillates between zero and 100, with a reading above 70 typically considered overbought and below 30 considered oversold. This can help investors identify potential reversal points in the market.

The MACD is another momentum-based indicator that reveals changes in a trend’s strength, direction, and duration by comparing two moving averages of a security’s price. It consists of the MACD line, the difference between a short-term and a long-term moving average, and a signal line, which is an average of the MACD line. When the MACD line crosses above the signal line, it generates a bullish signal, suggesting it might be a good time to buy. Conversely, when the MACD line crosses below the signal line, it generates a bearish signal, indicating it might be a good time to sell.

These technical indicators can provide a comprehensive view of market trends and momentum when used together. They can help investors identify potential entry and exit points, gauge market sentiment, and make more informed trading decisions. However, like all tools, they are not infallible and should be used with other analysis and market information forms.

Ultimately, technical indicators are a bit like a compass, guiding investors through the financial markets. By understanding how to read and interpret these indicators, investors can confidently navigate the markets and potentially improve their investment outcomes.

Economic Indicators:

Economic indicators are vital statistics that can help investors, policymakers, and analysts better understand where the economy is headed. These indicators can influence mass psychology and market trends, providing valuable insights into the overall health of an economy.

Employment rates, for instance, are a crucial economic indicator. High employment rates can signal a strong economy, boosting investor confidence and potentially driving market trends upwards. Conversely, high unemployment rates can indicate economic weakness, potentially leading to market downturns.

Consumer confidence is another important economic indicator. It measures the degree of optimism that consumers have regarding the overall state of a country’s economy. High consumer confidence can indicate that consumers are willing to spend more, potentially driving economic growth and positive market trends. On the other hand, low consumer confidence can signal economic uncertainty, potentially leading to market volatility.

Economic indicators influencing market trends include the Consumer Price Index (CPI), gross domestic product (GDP), and market indexes. These indicators can provide a snapshot of the economy’s current state and explain its future direction.

However, it’s important to remember that economic indicators are just one piece of the puzzle. They should be used with other forms of analysis and market information. After all, the financial markets are a complex ecosystem influenced by many factors.

Conclusion

In conclusion, understanding the financial markets is a multifaceted endeavour. It involves recognizing market cycles, studying trading volumes, acknowledging behavioural biases, utilizing technical indicators, and interpreting economic indicators. Each of these aspects provides a unique lens through which to view the market, offering insights into the collective psychology of investors and the underlying market trends.

Recognizing market cycles can help anticipate shifts in mass psychology, from optimism and euphoria to fear and despair. Studying trading volumes can provide clues about mass participation, with a surge in volume often accompanying significant price movements. Understanding behavioural biases like fear, greed, and overconfidence can help anticipate market reactions and improve decision-making. Analyzing charts with technical indicators like moving averages, RSI, and MACD can reveal patterns that reflect collective investor actions. Finally, interpreting economic indicators such as employment rates and consumer confidence can provide insights into the economy’s overall health and influence market trends.

By incorporating these aspects into your financial market analysis, you can better understand the market’s dynamics and make more informed investment decisions. Remember, the financial markets are a complex ecosystem influenced by many factors. It’s not about predicting the market’s every move but rather about understanding its rhythm and making informed decisions based on that understanding.

Remember, investing is as much about understanding ourselves as it is about understanding the markets. By recognizing our biases and emotions, we can make better investment decisions and navigate the financial markets more confidently and successfully. Happy investing!

Unconventional Articles That Challenge Conventional Wisdom

Fragile Foundations: Central Banks Assault on Strong Currency

Chinese Recession 2016: Examining Its Impact on the Markets

Unveiling Mass Hysteria Cases: Insights into Noteworthy Examples

What is a Hedge Fund: Beyond the Basics, Embracing Volatility

Home Run with Homeschooling Ideas

Americans with No Emergency Funds: Progress & Challenges

Hookah Lounge: A Captivating Experience for Relaxation and Socialization

Anxiety Sensitivity Index Does Not Support Stock Market Crash

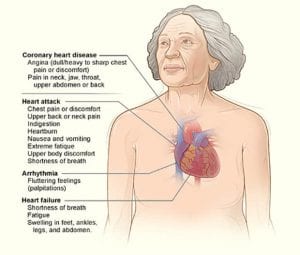

Unveiling the Silent Threat: Women and Heart Disease

Homeschooling Benefits: A Comprehensive Guide

Google News Trends Unveiled: Gossip Promoted as News

Benefits Of Homeschooling: US Education System Is Crumbling

Neocon Perceptions and the Illusion of Nuclear Warfare

Stocks To Buy Today Reddit – Focus on the Trend, Ignore the Noise