Editor: Vladimir Bajic | Tactical Investor

Flash Crash: Seize the Opportunity and Leave the Crowd Behind

Updated June 30, 2024

In the high-stakes arena of financial markets, few phenomena capture the imagination and strike fear into the hearts of investors, quite like the flash crash. This essay delves into the psychology behind these rapid market plunges, exploring how savvy investors can leverage these moments of panic to their advantage.

The Anatomy of a Flash Crash

Financial experts define a flash crash as a sudden, severe drop in security prices within an extremely short period. These events often result from a perfect storm of algorithmic trading, high-frequency trading systems, and human panic.

Dr. Andrei Kirilenko, former chief economist at the Commodity Futures Trading Commission, explains, “Flash crashes are like tsunamis in the financial ocean. They build up quickly, cause massive disruption, and recede almost as fast as they appeared.”

Historical Perspective

The May 6, 2010, flash crash is a watershed moment in market history. Within minutes, the Dow Jones Industrial Average plummeted by over 1,000 points, only to recover most of its losses shortly after. This event exposed the vulnerabilities of our interconnected, technology-driven markets.

More recently, the cryptocurrency world experienced its flash crash on June 22, 2017, when Ethereum’s price on the GDAX exchange plummeted from over $300 to a mere $0.10 in minutes. These incidents are stark reminders of the volatility inherent in modern financial systems.

The Psychology of Panic

Understanding the psychological underpinnings of flash crashes is crucial for investors seeking to capitalize on these events. Dr Richard Peterson, a psychiatrist and financial behaviourist, notes, “During a flash crash, the amygdala – the brain’s fear centre – overrides rational thought processes. This leads to panic selling and can create a self-reinforcing downward spiral.”

This insight aligns with the observations of legendary investor Warren Buffett, who famously advised, “Be fearful when others are greedy, and greedy when others are fearful.” Flash crashes represent the epitome of fear in the market, creating unique opportunities for those who can maintain their composure.

Tactical Approach to Flash Crashes

Contrarian investor and market analyst Sol Palha argues, “Flash crashes are not disasters; they’re opportunities disguised as disasters.” This perspective challenges the conventional wisdom of fleeing the market during turbulent times.

To capitalize on flash crashes, consider the following strategies:

1. Maintain a Watch List: List high-quality stocks you’d like to own at lower prices. This way, you’ll be prepared to act swiftly when a flash crash occurs.

2. Use Limit Orders: Place standing limit orders below market prices. These may be triggered during a flash crash, allowing you to acquire shares at a significant discount.

3. Focus on Fundamentals: Prices often disconnect from fundamental values during a flash crash. Use this opportunity to acquire fundamentally sound companies at bargain prices.

4. Manage Risk: While flash crashes present opportunities, they also carry risks. Never invest more than you can afford to lose, and consider using stop-loss orders to protect your positions.

The Role of Technology

The rise of algorithmic and high-frequency trading has fundamentally altered market dynamics, contributing to the frequency and severity of flash crashes. Dr. Dave Cliff, a professor of computer science specializing in financial markets, warns, “The interaction between multiple automated trading systems can create feedback loops, amplifying price movements in ways that were rare in human-dominated markets.”

This technological factor underscores the importance of understanding market microstructure and preparing for rapid, unexpected movements.

Long-term Perspective

While flash crashes can be unsettling, it’s crucial to maintain a long-term perspective. Dr. Burton Malkiel, author of “A Random Walk Down Wall Street,” reminds us, “The stock market is a device for transferring money from the impatient to the patient.”

Historical data supports this view. Despite numerous flash crashes and market corrections, the stock market’s overall trend has been upward over the long term. Investors who panic and sell during these events often miss the subsequent recoveries.

Tactical Investor’s Perspective on the Flash Crash Debate – August 2019

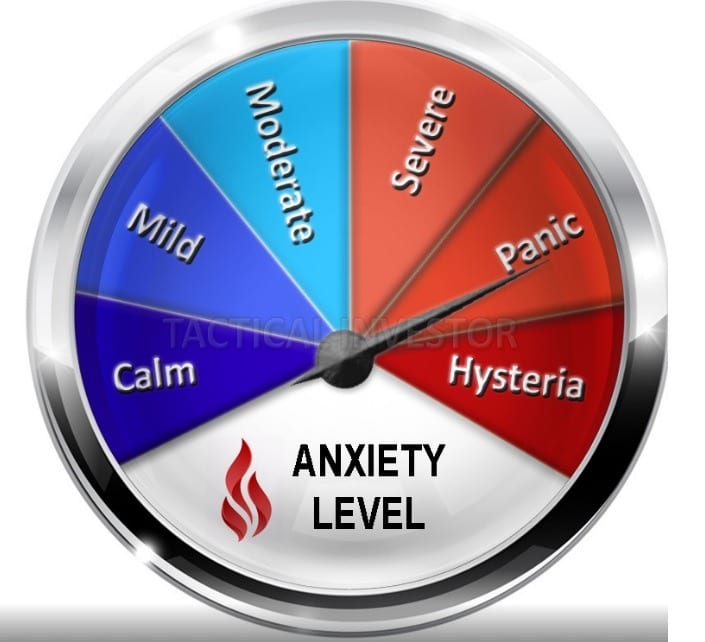

Forget the term “flash crash” and concentrate on the “opportunity factor.” Historically, every stock market flash crash has been a prime buying opportunity. Current mass sentiment indicates that a flash crash now would represent a significant chance to buy (see the images below).

Market sentiment remains far from bullish.

Examining the gauges below, it’s clear that those who are most fearful tend to perform the worst historically. Those following the herd mentality fall into this category. In essence, market followers often end up as mere cannon fodder.

The long-term outlook for the Dow and the overall markets remains unchanged. On the monthly charts, the Dow is still trading in the oversold ranges, so this current pullback must be viewed through a bullish lens despite the gnashing of teeth.

Conclusion: Mastering Market Psychology

Flash crashes represent the confluence of technology, psychology, and market dynamics. By understanding the mechanisms behind these events and the psychological factors driving them, investors can position themselves to capitalize on the irrational behaviour of the masses.

As Dr. Daniel Kahneman, Nobel laureate in economics, observes, “The combination of loss aversion and narrow framing is deadly, leading to terrible choices. It is the greatest obstacle to the rational evaluation of risks and opportunities.”

Overcoming this obstacle—to reason when others panic—can lead to extraordinary investment opportunities in the face of a flash crash. By maintaining a clear head, focusing on fundamentals, and having a strategic plan, investors can turn these moments of market chaos into stepping stones for long-term financial success.

In the end, mastering the psychology of flash crashes is not just about understanding market dynamics; it’s about understanding ourselves and our reactions to extreme events. Those who can remain calm in the storm and see opportunity where others see only danger will ultimately thrive in the unpredictable world of financial markets.

Other Stories of Interest