Extracted from the September 6, 2012, Market Update

Gold Stock Market Trend

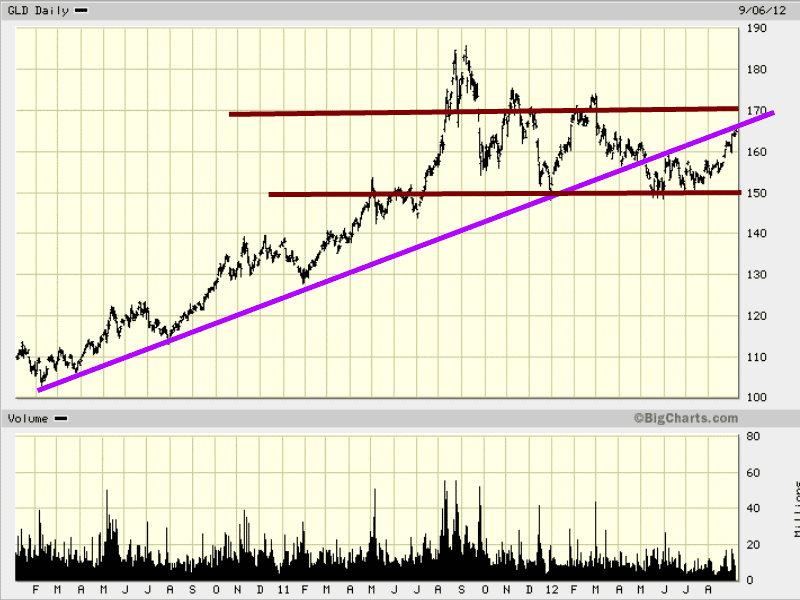

Gold Heading Higher Before A Stronger Correction Takes Hold:

It appears to be on course to test the 1750-1780 ranges. Those who took a risk and opened up a position in several gold stocks should look to close these positions out when it trades in the above ranges. Place a stop at 1650. In other words, if bullion drops to 1650, before hitting the above targets close your positions out.

The price of Gold bullion is going to serve as your overall stop. GOLD (the stock) has performed quite well and should lead the way up, but the same will/should apply on the way down. It is one of the stocks that trade in tandem with Gold. Another stock with a similar pattern is RGLD.

GLD is one of several Gold Stocks that serve as a good proxy for Gold bullion, indicates that it is ready to test the 170 plus ranges again, which could correlate roughly with Gold trading to the 1750-1800 ranges. The 170 ranges represent quite a solid level of resistance for GLD as does the 1750-1800 ranges for Gold. We do not think Gold has the staying power to remain above this level for a long time, and thus all long positions should be closed at this level. Aggressive traders can look into opening short positions. However, for those who are looking for less stress moving that money into the dollar or dollar-denominated assets might prove to be a better option. The dollar is expected to mount a multi-year rally and as such opening positions in Stocks listed on the NYSE and other US exchanges could prove to be very rewarding.

Great Read: Unlocking the Power of the Best Stock Market Indicators

Other Articles of Interest

the Level Of Investments In A Markets Indicates

How to win the stock market game

Next stock market crash predictions