Gold and Inflation: The Eternal Duel of Wealth and Power

January 14, 2025

Gold is no ordinary commodity. It is a symbol, a weapon, and a fortress. It has stood as a silent witness to empires’ rise and fall, economies’ collapse, and the cyclical turmoil of human ambition. In the modern financial world, gold is hailed as the ultimate hedge against inflation—a bulwark against the erosion of purchasing power, a shield for wealth. But does it truly deserve this veneration?

In truth, gold is not the invincible saviour it is often made out to be. Its value shines brightest under specific conditions, but it also falters, misleads, and underwhelms. The narrative of gold as the supreme hedge against inflation is as much myth as reality, a tale rooted in history but complicated by the intricate forces of today’s global markets. Let us dissect this enigma with a warrior’s precision, a philosopher’s wisdom, and a strategist’s cunning.

Gold: The Eternal Symbol of Wealth

Gold’s allure is not accidental. It has been synonymous with power, prosperity, and permanence for thousands of years. Unlike currencies or paper assets, gold’s value is intrinsic—its scarcity and physical properties make it universally desirable. This universal appeal has enshrined gold as a store of value across cultures and centuries.

In times of crisis, the masses turn to gold. When governments falter, currencies collapse, and uncertainty reigns, gold becomes the refuge of the cautious and the prudent. This is its great strength. In 2008, during the global financial crisis, gold surged as panicked investors sought stability. In the volatile 1970s, as inflation spiralled out of control, gold quadrupled in value. But the crux lies: gold’s brilliance is situational, not universal.

Gold as a Hedge Against Inflation

The theory is simple: when inflation rises, the value of currency declines. Gold, with its intrinsic value, is immune to this devaluation. This makes it an attractive hedge against inflation, preserving purchasing power.

History provides compelling evidence. In the 1970s, when inflation in the United States reached double digits, gold’s price skyrocketed. It seemed like the ultimate protector of wealth in an era of economic chaos. Even in the 2000s, during periods of loose monetary policy and inflationary fears, gold surged, reinforcing its reputation as a safe haven.

But this reputation is not without cracks. Gold’s relationship with inflation is not a simple one-to-one correlation; it is influenced by a constellation of factors that often complicate its performance as an inflation hedge.

The Illusion of Invincibility: Gold’s Limitations

To blindly worship gold as the ultimate inflation hedge is a dangerous mistake. Gold is neither flawless nor invincible. Its price is influenced by many factors beyond inflation, including geopolitical tensions, the dollar’s strength, interest rates, and market speculation.

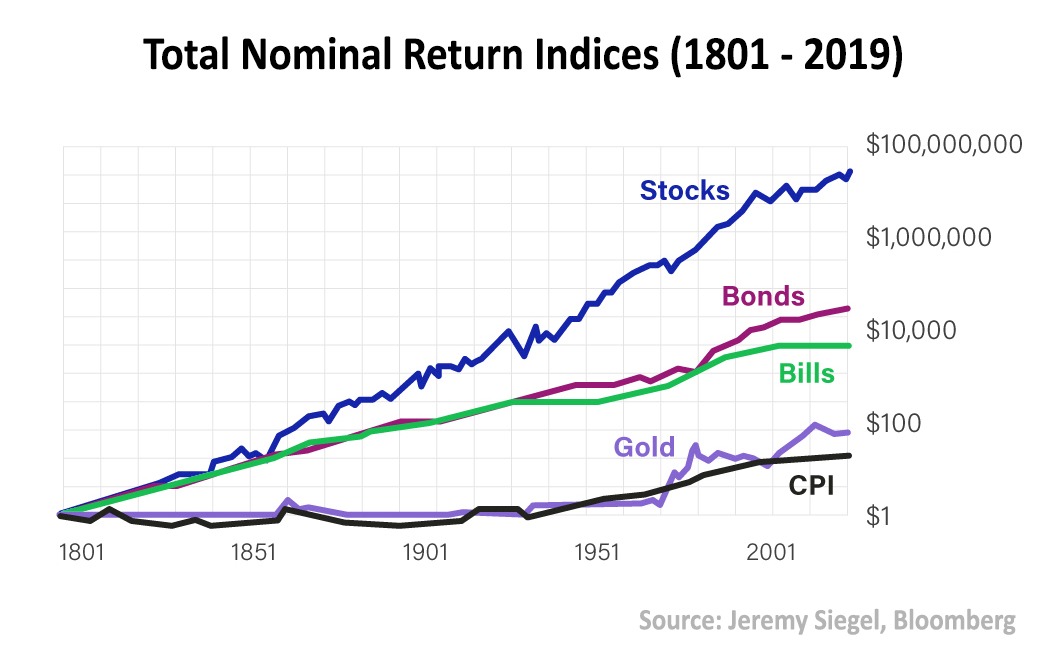

Consider this: over the past three decades, inflation in the United States has risen roughly 200%. During the same period, gold’s value has increased by approximately 450%. On the surface, this seems like a victory for gold. But compare this to bonds, which rose by nearly 580%, or stocks, which skyrocketed by almost 2000%. Gold’s performance pales in comparison.

In truth, gold is only as effective as its purchase and sale timing. Those who hold gold indefinitely, believing it to be a perpetual safeguard, are ruled by emotion, not logic. The reality is that gold’s value fluctuates, and its price can stagnate or even decline for years, waiting for the right economic conditions to rise again.

The Complexity of Inflation

Inflation is not a single, monolithic force. It is a complex phenomenon shaped by multiple factors, including government policies, supply chain disruptions, and global events. Predicting inflation trends with precision is notoriously difficult, and even the most sophisticated investors often get it wrong.

Gold’s performance as an inflation hedge depends on how inflation manifests and how markets react. For instance, during periods of moderate inflation, gold’s price may barely budge as other investments—stocks, real estate, or even certain commodities—offer better returns. It is only during extreme inflationary periods when currencies are in freefall, that gold tends to shine.

This unpredictability demands caution. Gold cannot be relied upon as the sole guardian of wealth against inflation. Its value is too dependent on external factors and too volatile to serve as the foundation of a robust investment strategy.

Stupidity Kills Wealth: The Danger of Blind Faith

To treat gold as a flawless inflation hedge is not just naïve—it is reckless. Blind faith in any asset, gold included, is a prescription for financial ruin. The markets are not kind to those who cling to myths and ignore reality.

Consider the mistake of the “gold bugs”—investors who hoard gold with religious fervour, convinced it is the ultimate haven. These individuals often hold gold through thick and thin, refusing to sell even when market conditions suggest otherwise. This emotional attachment blinds them to opportunity and locks them into mediocrity.

The truth is simple: no asset, not even gold, deserves blind loyalty. Wealth is built through strategy, adaptability, and discipline, not clinging to outdated narratives.

The Role of Mass Psychology

Gold’s value is as much a product of mass psychology as economic fundamentals. The gold market is driven by fear, greed, and perception. Investors flock to gold when they fear inflation, financial collapse, or geopolitical instability, driving up its price.

But this psychological dynamic is a double-edged sword. When the fear subsides, when stability returns, gold’s price often retreats. This is why gold’s performance can be so inconsistent. It is not just a hedge against inflation—it is a barometer of collective sentiment, rising and falling with the emotional tides of the market.

Understanding this psychological component is crucial. To successfully invest in gold, one must analyse economic conditions and anticipate how the masses will react.

Strategic Use of Gold

Gold’s true value lies not in its myth but in its strategic use. It is not the be-all and end-all of inflation protection, but it can be a valuable component of a diversified portfolio.

Diversification Is Key

Gold’s low correlation with other asset classes makes it an excellent diversification tool. Investors can reduce overall portfolio risk and improve resilience by including gold alongside stocks, bonds, real estate, and other investments.

For example, during the 2008 financial crisis, gold surged while stocks plummeted, providing a counterbalance that helped portfolios weather the storm. Similarly, in 2020, as the COVID-19 pandemic rattled markets, gold reached new highs, offering stability in a sea of uncertainty.

Timing Matters

The timing of gold purchases is critical. Gold is most effective as a hedge when bought during periods of economic stability before inflationary pressures take hold. Waiting until inflation is already high often means paying a premium for gold, reducing its potential returns.

Balance and Discipline

Gold should never dominate a portfolio. Its role is to complement other investments, not replace them. By maintaining a balanced allocation—typically 5-10% of a portfolio—investors can benefit from gold’s protective qualities without overexposing themselves to its limitations.

The Other Side of the Coin: Investments That Outshine Gold

While gold has merits, other investments often outperform it in the long run. Stocks, for instance, have historically delivered far superior returns. Over the past century, equities have generated average annual returns of around 7-10%, vastly outpacing gold.

Bonds, too, have proven to be more reliable inflation hedges than gold. During the past three decades, bonds have outperformed gold and provided steady income in interest payments—an advantage gold cannot offer.

Real estate, commodities, and even cryptocurrencies have emerged as viable alternatives, each with its strengths and weaknesses. The key is to evaluate these options based on individual goals, risk tolerance, and market conditions, rather than clinging to the outdated notion that gold is the ultimate safeguard.

Conclusion: The Golden Path Forward

Gold is neither a hero nor a villain. It is a tool to be wielded with care, strategy, and wisdom. In the battle against inflation, gold can play a valuable role, but it is not the sole solution. To rely on gold alone is to fight with a single weapon in a war that demands a full arsenal.

The path to wealth and security lies not in blind faith but in mastery. Understand gold’s strengths and limitations. Recognize the role of crowd psychology. Embrace diversification, discipline, and adaptability. Above all, gold should be approached not as a saviour but as a strategic ally—one piece of a broader, well-rounded investment strategy.

The markets reward the bold, the cunning, and the prepared. Do not fall prey to the myths that ensnare the masses. Forge your path, armed with knowledge and strategy, and let gold serve you—not the other way around. In this eternal duel between gold and inflation, victory belongs to those who think, adapt, and act with purpose.