Understanding Gold and Inflation

Updated June 2023

In today’s interconnected global markets, gold occupies a unique position as a tangible asset that offers stability and security during economic turbulence. Its limited supply and universal appeal make it a sought-after investment for individuals, institutions, and central banks.

Throughout history, gold has held significant cultural and monetary importance, serving as currency and a symbol of wealth across borders and cultures. This rich legacy enhances its perception as a reliable store of value, particularly in times of economic uncertainty.

Furthermore, gold is increasingly recognized as a diversification tool in the modern economy. As financial markets become more interconnected and volatile, investors seek to reduce risk by diversifying across various asset classes. Gold’s low correlation with traditional investments such as stocks and bonds makes it an attractive option for diversification, potentially improving overall portfolio performance.

Inflation, a joint economic phenomenon characterized by a general increase in prices and a decline in the purchasing power of money, presents both challenges and opportunities. Amidst these economic dynamics, one question often arises: Is gold the best hedge against inflation?

Gold’s enduring value as a store of wealth spans thousands of years. Not directly tied to any specific economy, it holds a global appeal. During periods of rising inflation, when the value of currency declines, gold’s value often rises in response. This inverse relationship between gold and inflation renders gold an attractive investment choice during inflationary periods.

.

Gold as an Inflation Hedge

Gold is often considered a hedge against inflation because it retains its value even when the cost of living increases. When inflation is high, the real return on bonds and stocks may not keep up with the rising cost of goods and services. In contrast, gold prices typically rise in response to high inflation, providing a positive real return.

Historically, gold has proven to be a reliable hedge against inflation. For instance, during the inflationary period of the 1970s, when inflation rates in the U.S. were in double digits, the price of gold quadrupled. This historical performance underscores the role of gold as a protective asset during times of high inflation.

The Limitations of Gold as a Hedge Against Inflation

Using gold as an inflation hedge has its pros and cons. Gold is traditionally considered a safe haven during inflation, as its value tends to rise with increasing prices. However, it’s important to note that gold’s price can be volatile due to various factors beyond inflation, such as geopolitical events and market speculation.

Investors should be cautious about relying solely on gold for inflation protection. Its price volatility introduces additional risk, and the relationship between gold and inflation isn’t always straightforward. Economic factors and market dynamics can influence gold’s price, sometimes overshadowing inflation’s impact.

Moreover, gold doesn’t generate income like stocks or bonds, which may lead to missed opportunities for returns. Additionally, storing physical gold and transaction costs can incur expenses, affecting overall returns.

To address these limitations, diversification is key. Combining various assets like stocks, bonds, real estate, and commodities can spread risk and potentially enhance long-term returns. Seeking professional financial advice is also valuable in developing a well-rounded investment strategy based on individual goals, risk tolerance, and market conditions.

Gold and Inflation: A Strategic Investment Approach

Gold has long been considered a safe haven investment during times of inflation. Its value tends to rise when inflation is high, as investors seek to protect their wealth from the eroding effects of rising prices. By strategically incorporating gold into their investment portfolios, investors can potentially mitigate the negative impact of inflation on their overall returns.

The relationship between gold and inflation is complex and multifaceted. Historically, gold has often served as a hedge against inflation due to its intrinsic value and limited supply. When inflation is expected to rise, investors may choose to allocate a portion of their portfolio to gold to preserve purchasing power.

However, accurately predicting inflation trends can be challenging. Economic factors, such as government policies, interest rates, and global events, can all influence inflation rates. Therefore, investors should exercise caution when implementing a strategy that relies on timing the market based on inflation expectations.

It is important to note that while gold can act as a hedge against inflation, its performance is not solely dependent on inflationary pressures. Other factors, such as supply and demand dynamics, geopolitical tensions, and investor sentiment, can also impact the price of gold.

Investors should carefully assess their risk tolerance, investment goals, and time horizon when considering a strategic investment approach involving gold and inflation. Diversification across different asset classes, including gold, can help manage risk and potentially enhance overall portfolio performance.

In conclusion, gold can be a valuable asset for investors looking to hedge against inflation. However, it is crucial to approach this strategy with caution and consider the broader economic and market factors that can influence gold prices. By adopting a well-rounded investment approach and seeking professional advice, investors can make informed decisions about incorporating gold into their portfolios.

Gold & Inflation: The Myth

Now let’s debunk the myth of Gold being a great hedge against Inflation.

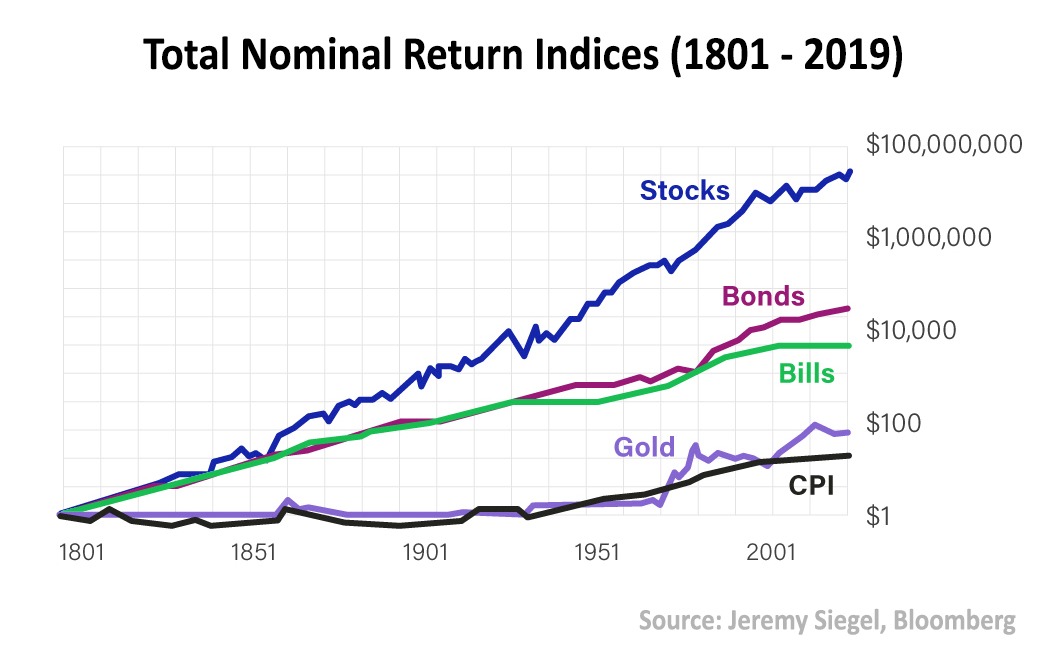

Proof that being a gold bug pays poorly. The argument that Gold is an excellent hedge against inflation is faulty. You have to know when to buy and when to sell. If you hold it forever, it means that emotions are talking and logic is walking. The graph below indicates that conservative investors usually get what they seek; steady but insignificant gains.

Inflation has risen roughly 200% since the 1990s, and Gold, supposedly the best hedge against inflation, has surged approximately 4.5 times more, definitely outpacing inflation. Still, bonds fared even better, increasing by almost 580%. Knocking the Gold is the best hedge against inflation argument right into the toilet. When it comes to Gold and inflation, many investments out sizzle gold.

But wait for stocks kicked Gold to the curb and generated returns of almost 2000%. As we are in the QE forever era, the argument for Dow 51K and beyond is gaining traction. If we take a longer-term view and, based on the current pattern, one could begin to build a case for Dow 99K. However, that is a story for another day. One needs to focus on the fact that sharp market corrections are buying opportunities. So-called crash-like events should be considered a screaming buy until the trend changes.

Other Articles of Interest

Contrarian Thinking: The Power of Challenging the Status Quo

Mastering Technical Analysis Of The Financial Markets

Unraveling the Enigma: The Dark Allure of Mob Mentality

Contrarian Outlook: A Pathway to Breakthrough or Breakdown

Financial Freedom Book: A Pinch of Salt, a Splash of Whiskey

Unleashing the Power of Small Dogs Of the Dow

Stock Market Forecast for Next 3 & 6 Months

Bank Loans and Financial Freedom in USA: US Financial Liberty Under Siege

Unmasking Deceit: Examples of Yellow Journalism

Mastering the Trading Range: Unlocking the Potential for Explosive Gains

Investment Journal: Charting the Course Toward Financial Triumph

Trading Success: From Riches to Rags and the Rise to Wealth Mogul

Dow theory Forecasts: Alternative could be better

Contrarian Definition: Tactical Investor Trading Methodology