Harry Dent Forecasts: Boom, Bust, or Blunder?

April 5, 2025

People are awful at predicting the future, but we still fall head over heels for anyone who sounds like they can. Harry Dent is the poster child of this paradox. He’s built a career on bold, apocalyptic market forecasts, wrapped in demographic theories and delivered with unshakable confidence. But behind the headlines and media hype lies a truth investors often ignore: Dent has been wrong more than he’s been right. And yet, the spectacle continues—fueled by cognitive bias, selective memory, and our obsession with certainty.

So, what’s the real story behind Harry Dent’s predictions? Let’s break it down—the good, the misses, and the wildly off-the-wall.

Demographics Done Right: The Early Wins

Dent didn’t come out of nowhere. His early work struck gold, especially in the late ‘80s and early ‘90s. He connected economic cycles with generational spending habits in a fresh and accurate way. In The Great Boom Ahead (1993), he predicted a long bull run powered by Baby Boomers hitting peak earning years. That was spot-on. Markets soared through the ’90s, and his thesis looked bulletproof.

His demographic focus gave investors a lens that sidestepped the usual noise about interest rates or inflation. For a time, it worked. His early books flew off shelves, he gained a loyal following, and the media loved him.

Why We Still Listen (Even When He’s Dead Wrong)

People don’t just want analysis—they want certainty. Dent gives them that in spades. His theories are simple, bold, and backed by what sounds like data-driven inevitability. That’s catnip for an audience desperate to make sense of a chaotic market.

Cognitive bias does the rest. Once someone nails a big call, we’re wired to give them the benefit of the doubt—even if they strike out repeatedly afterward. Recency bias, confirmation bias, and herd behavior all kick in. We want to believe. Dent delivers drama and confidence, which makes people tune out his track record and just hope he’s right this time.

While he’s gained attention for bold, media-friendly forecasts (like predicting massive crashes or booms), a deeper look reveals a pattern of dramatic predictions that often fail to materialize.

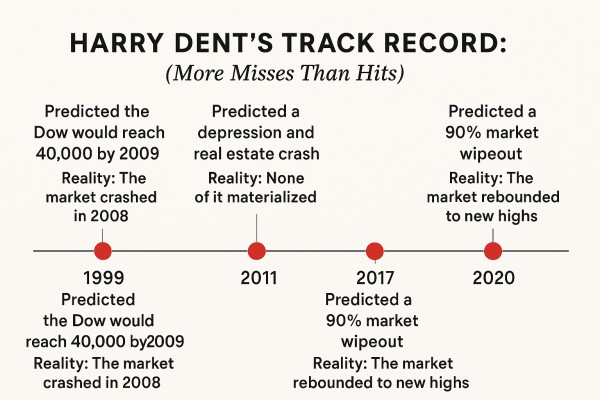

Dent’s Track Record: More Misses Than Hits

Now here’s where things get uncomfortable. Harry Dent’s forecasting record isn’t just spotty—it’s a full-blown highlight reel of overconfident predictions gone sideways. While his early demographic work earned him some legitimate credibility, his long-term track record reads like a case study in boldness unmoored from reality.

Let’s look at a few of the more memorable misfires:

- 1999–2009: Dow 40,000… or Not

In his 1999 book The Roaring 2000s, Dent predicted that the Dow Jones would skyrocket to 40,000 by 2009, thanks to Baby Boomers hitting peak spending power. The reality? The market hit a ceiling around 14,000 before the 2008 financial crisis wiped out years of gains. Instead of a roaring decade, investors got a recession, a banking collapse, and a painful market correction. Dow 40,000 never came close—he was off by a country mile. - 2011: Dow Crashing to 3,000

After the crash of 2008, Dent doubled down on the doom. In The Great Crash Ahead, he confidently predicted the Dow would plunge below 3,000 within a few years, setting off a historic collapse. But instead of a meltdown, the exact opposite happened: the market entered one of the strongest bull runs in history. By 2021, the Dow had tripled, blowing past 30,000. Dent wasn’t just wrong—he was facing the wrong direction entirely. - 2017: The Depression That Never Came

Not one to back off, Dent again forecasted a major economic depression in 2017. He warned of a global real estate crash and a collapse in equities, urging investors to flee risky assets. Instead, markets climbed steadily, real estate prices hit new highs, and global economies kept chugging along. It was yet another swing and a miss. - 2020: The COVID Crash Overkill

When COVID hit, Dent saw it as vindication. He predicted a massive 90% market collapse, claiming this was the long-awaited implosion he’d been warning about. The markets did crash—but only briefly. Within months, the Fed stepped in, stimulus rolled out, and the rebound was historic. The S&P hit new all-time highs in record time. Once again, Dent’s apocalyptic vision dissolved as quickly as it appeared.

What makes these misses even more jarring is not just their inaccuracy but the confidence with which they were delivered. Dent doesn’t hedge. He gives exact targets, hard timelines, and big pronouncements, often with the tone of inevitability. It’s this tone that hooks people, even when history suggests they should know better.

And yet, none of these spectacular misfires have knocked him out of the spotlight. Financial media still gives him airtime. Investors still buy his books. Podcasts still book him as a guest.

Why? Because Dent sells drama—and drama gets clicks, headlines, and attention. In a world where nuance doesn’t trend, his brand of bold, doomsday storytelling plays perfectly into the financial hype machine. His misses get buried, his hits get magnified, and the cycle repeats.

The lesson here isn’t just about Dent—it’s about how we consume financial predictions. We remember the few forecasts that land and conveniently forget the avalanche of those that don’t. Dent is one of the most visible examples of this phenomenon.

When Insight Turns Into Fixation

At some point, Dent’s work shifted from insightful to obsessive. His gold price forecasts, for example—calling for sub-$300 gold even as it broke $2,000—reflect a stubborn refusal to adjust to reality. The same goes for his market crash timelines, which he delivers with eerie precision… and consistent inaccuracy.

There’s a point where boldness becomes detachment. Dent often feels like he’s chasing the original high of his early wins, doubling down harder each time he’s wrong. And yet, people keep tuning in—hoping that this time, the cycle turns his way.

Why the Media Still Bites

The media loves drama. A calm, measured forecast doesn’t drive clicks, but “The Market Will Crash 80% by Next Summer” absolutely does. Dent knows this game and plays it well. And when he does hit a call—or even if the market dips briefly—it gets amplified everywhere. The misses? Forgotten.

It’s not just Dent. It’s a cycle of hype, selective memory, and crowd psychology. And it keeps working.

Final Thoughts: Separate Insight from Forecast

Dent’s demographic work had value—and still does. Generational spending patterns do influence macroeconomic cycles. But using that insight to slap down precise dates and dire outcomes has proven unreliable repeatedly.

Investors should take the lesson, not the prophecy. Use the lens—ignore the countdown clock.

Ultimately, Dent’s story is less about him and more about us. We crave certainty, reward boldness over accuracy, and return for another hit of financial drama—even when the narrator keeps getting it wrong.