Europe’s Energy Crunch: Navigating the Geopolitical News Dilemma

Updated Feb 2023

In Geopolitical news, Europe finds itself entangled in a pressing and escalating energy crisis stemming from implementing sanctions against Russia. While the intention to support Ukraine is commendable, it is crucial to consider the profound economic costs and hardships that these sanctions have inflicted and will continue to impose upon the citizens of these nations. Given this challenging scenario, a pragmatic compromise emerges as the optimal solution.

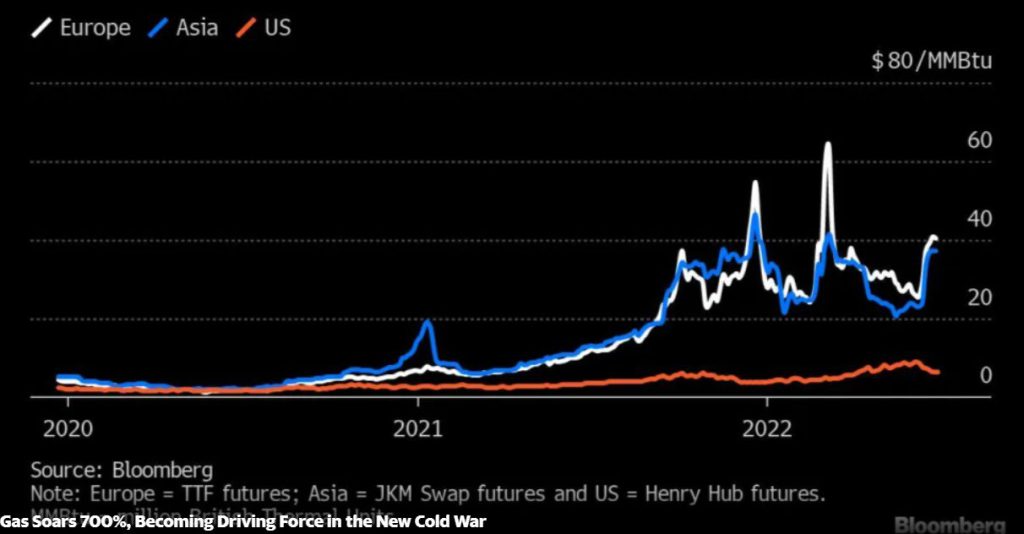

This alarming chart serves as a stark reminder of the troubles Europe faces. With a substantial reliance on natural gas and oil, Europe’s energy consumption has played a pivotal role in its industrial prowess for nearly six decades. Despite enduring tensions between the Western world and Russia, the latter has remained a steadfast and dependable energy supplier, ensuring Europe’s stability and progress.

The Complex Dynamics of Energy Geopolitics: Implications for Europe’s Future

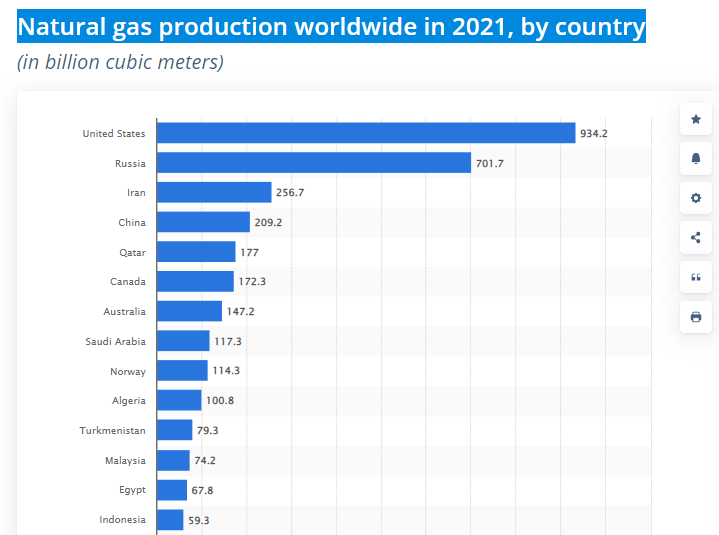

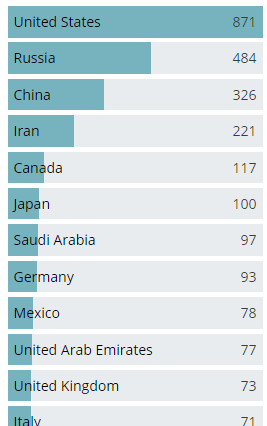

While the United States has emerged as the world’s leading producer of natural gas, with a potential increase in production under President Biden’s administration in 2022, it remains the largest consumer. As a result, Russia stands as the foremost global exporter of natural gas. With waning interest in Western alliances, Russia is inclined to retaliate against those who sought to undermine its influence. In this precarious situation, Europe confronts two options: defiance leading to dire consequences or seeking a compromise that may offer stability. Nonetheless, Europe’s golden era has significantly waned, and the energy conflicts unfolding within geopolitical news could catalyze a formidable downward spiral.

Source: https://www.statista.com/

Adapting to Uncertain Times: Exploring Alternative Options for Europeans Amidst Geopolitical Tensions

As Russia’s leaders exhibit an apparent lack of interest in negotiations, it becomes crucial to heed the rhetoric from their ranks. In light of this, European individuals who are retired or possess the flexibility to work remotely may find it prudent to consider spending their winters on the Mediterranean side of Turkey. Turkey presents an appealing alternative with its exceptional climate, delectable cuisine, and population accustomed to catering to Europeans. The rentals in this region are remarkably affordable, potentially enabling substantial savings by embracing such a plan.

For those unable to relocate, incorporating a wood-fired, wood pellet, or even a coal-fired stove into homes becomes a viable consideration to counter the impending harshness of the approaching winter. Failing to take proactive measures could result in challenging circumstances. Germany has already commenced the implementation of stringent restrictions, even before the arrival of winter. Measures such as the closure of public pools, regulated temperatures in buildings, and restricted hours for indulging in a hot bath are being enforced.

As geopolitical tensions persist, it becomes crucial for Europeans to adapt and explore alternative solutions to mitigate potential hardships.

Navigating the Nexus: The Significance of Geopolitical News in Trading

Geopolitical news plays a significant role in trading, providing crucial insights into the potential impact of political events and decisions on the global economy and financial markets. Here are some key reasons why geopolitical news is essential in trading:

1. Market Volatility: Geopolitical events can introduce significant volatility into financial markets. Sudden political developments, such as conflicts, trade disputes, policy changes, or sanctions, can lead to rapid shifts in investor sentiment and market prices. Traders who are aware of geopolitical news can anticipate and potentially profit from these market fluctuations.

2. Risk Assessment: Geopolitical news helps traders assess and manage risks associated with specific regions or countries. Political instability, geopolitical tensions, or regime changes can have far-reaching consequences for economies and markets. By monitoring geopolitical news, traders can evaluate the potential risks and adjust their portfolios or trading strategies accordingly.

3. Sector-Specific Impacts: Geopolitical events often have sector-specific implications. For example, energy-related geopolitical news can impact oil prices and companies in the energy sector. Similarly, trade disputes can affect industries dependent on global supply chains. Traders who track geopolitical developments can identify opportunities or risks within specific sectors and make informed investment decisions.

4. Currency Fluctuations: Geopolitical news can influence currency exchange rates. Political developments, such as central bank decisions, elections, or geopolitical tensions, can impact a country’s economic stability and its currency’s value. Traders who stay updated on geopolitical news can leverage currency fluctuations to execute profitable trades in the forex market.

5. Long-Term Investment Strategies: Geopolitical news helps traders and investors shape long-term investment strategies. By understanding geopolitical trends, such as shifting alliances, regional dynamics, or emerging markets, traders can identify potential growth areas or markets that may offer attractive investment opportunities.

6. Risk Hedging: Geopolitical news can provide insights for risk hedging strategies. Traders can use instruments like futures, options, or derivatives to hedge against potential adverse effects of geopolitical events on their portfolios. By analyzing geopolitical news, traders can develop effective risk management strategies to protect their investments.

Originally published in October 2022 and updated in March 2023, this article offers enhanced insights and analysis.

Other Articles of Interest

Rational Thinking Definition: Unleashing the Power of Reason

What Time is the Best Time to Invest in Stocks? When Fools Panic

How Does Your Account Growth Demonstrate The Importance Of Investing Early?

What Do People Buy During a Stock Market Panic?

Greater Fool Theory of Investing: The Endless Cycle of Folly

How to Read Candlesticks: Unlock Hidden Market Moves

Uncovering the Truth: Market Experts Clueless

Pavlov’s Theory in Action: Herds Act Like Fools, Not Wisemen

Where Does the Money Go When the Stock Market Crashes: A Contrarian Perspective

What Kinds of Behaviors Can Prevent People from Making Smart Investing Decisions?

How to Overcome Fear of Investing: Think Independently, Succeed Confidently

Wolf vs Sheep Mentality: Embrace the Hunt or Be the Prey

The Dummies Guide to Investing: A Practical Guide for Beginners

How much money do i need to invest to make $4,000 a month?

Define Contrarian Thinking: Challenging the Norms for Success

Breaking Free: How Avoiding Debt Can Lead to Financial Freedom & Hope

Flash Crash: Exploit the Chaos and Outperform the Crowd