Foreign Banks Dumping USD?

We will delve into this story within a historical context, as it offers valuable insights into the age-old concept of learning from history or facing the risk of repeating it.

Updated Aug 2023

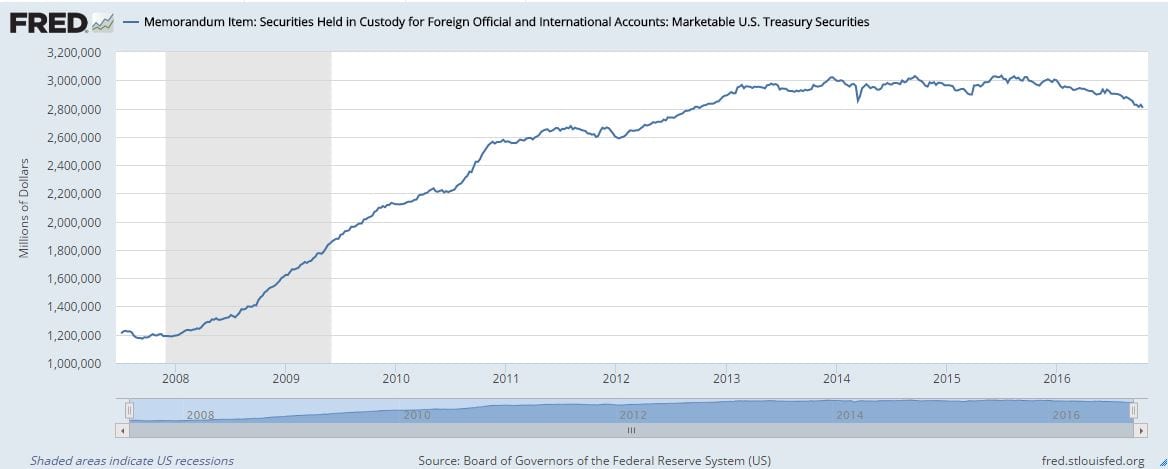

The chart below illustrates that Foreign Banks led by China and Saudi Arabia are busy dumping our debt. Our central bankers have been printing money like crackheads for the past decade, and the pace increased after the 2008 financial crisis.

The Illusion of Economic Recovery

The current economic recovery has been sustained by hot money and central bankers creating new debt to fund old debt, leading to the illusion that all is well. However, this is not the case, and foreign central banks are aware of the fraud being perpetrated on the American people, resulting in them bailing out of the market. Given their large positions, these banks need to start moving out early to avoid huge losses if everyone races for the exit simultaneously, causing the market to crash.

In the past week alone, foreign central banks have dumped $22.3 billion of US debt, bringing the total for the past 12 months to nearly $347 billion, an unprecedented number indicating that all is not well. China, which had holdings of US debt topping out at roughly $1.4 trillion in 2013, has been trimming its holdings and currently holds $1.18 trillion, the lowest level since 2012. Additionally, Saudi Arabia has sold almost $40 billion worth of debt, likely due to low oil prices and difficulty funding its terror operations.

Foreign Central Banks Dumping US Debt

The world understands that the US recovery is an illusion based on increasing total outstanding debt without producing results. The use of debt to create the illusion of economic strength is unsustainable, given that the US dollar is the world’s reserve currency. If the USD was not the world’s reserve currency, the US economy would be in the same position as Greece.

Investing in gold is wise to safeguard against this illusion’s uncertain end. Unfortunately, no one knows when this con will end, given that the Federal Reserve has done an excellent job of conning the masses. Until the masses awaken, the con will continue, possibly for another decade or ending next year. By following the masses, we can pay close attention to their actions, utilizing mass psychology to determine market tops and bottoms.

What Are Foreign Banks Doing in 2020

As the economic fallout of the coronavirus stifled liquidity and drove demand for dollars, central banks worldwide sold off US Treasuries through March. According to Federal Reserve data, foreign monetary institutions sold over $100 billion in Treasury notes in the three weeks leading up to March 25, just before the Fed opened a new repo facility.

Smaller Asian nations and oil-focused economies were among the sellers of global government debt, while foreign central banks primarily sold off older Treasury notes. Japan, holding $1.21 trillion, is the second-largest holder of US Treasuries, followed by China, with $1.08 trillion in its reserve. The sales are part of an ongoing effort to boost cash holdings amid a sharp downturn in economic activity. Full Story

Dollar Shortage During Coronavirus Pandemic

The Federal Reserve has launched a temporary lending facility to ease global market strains. The program will allow foreign central banks and international monetary authorities with Fed accounts to temporarily exchange their Treasury securities for U.S. dollars through a repurchase agreement.

This alternative source of U.S. dollars will support the smooth functioning of the U.S. Treasury market without the need for open market security sales. The announcement follows the Federal Reserve’s ongoing efforts to address economic disruptions and promote financial stability. Full Story

Helpful Ideas

Achieving financial freedom is essential to break free from the clutches of the top players who seek to enslave you. They want you to run in circles like a hamster on a spinning wheel, believing that the faster you run, the further you’ll go. Sadly, this leaves you going nowhere.

We can teach you how to use mass psychology to your advantage, view disasters as opportunities, and avoid being manipulated by the media into actions that could harm your overall well-being. Our website’s Investing for Dummies section offers a wide range of free resources covering the most important aspects of mass psychology.

Subscribe to our free newsletter to stay up to date with the latest developments. Remember, change begins now, not tomorrow, because tomorrow never comes. Nothing will change if you don’t alter your perspective and mindset. If you continue to cling to the mass mindset, the top players will continue to exploit you. The choice is yours: resist and break free or sit down and do nothing.

Overview and Summary of Foreign Banks Dumping US Debt

- The first section stresses the importance of achieving financial freedom to break free from the clutches of those who seek to exploit and enslave others. It recommends using mass psychology to gain an advantage and avoid media manipulation. By changing one’s mindset and resisting the mass mindset, success in the market is achievable.

- The second section highlights the trend of central banks worldwide selling off US Treasuries, indicating a significant downturn in economic activity due to the coronavirus. This ongoing effort to boost cash holdings amid market uncertainty may lead to a global shift in debt ownership and the potential collapse of the market.

- The third section discusses the illusion of economic recovery based on hot money and unsustainable economic growth. As foreign central banks begin to dump US debt and invest in other assets like gold, the world is starting to understand the reality of the US recovery. Investing in gold is recommended as a safeguard against economic uncertainty.

Originally Published on October 20, 2016.Updated on: August 2023

Other Stories of Interest

Where has the money gone?