Market Panic: Astute Investors Never Panic

Updated July 2023

Astute investors understand that market panic is often a time of opportunity rather than a cause for alarm. They recognize that the market’s inherent volatility is not a bug but a feature, a necessary component of the economic cycle. During these periods of heightened uncertainty, the seeds of future profits are often sown. The emotional rollercoaster of the market does not sway astute investors; they remain steadfast, guided by their long-term investment strategies and financial goals.

They understand market corrections are inevitable and healthy for the overall market ecosystem. These corrections serve as a reality check, preventing the formation of asset bubbles and ensuring that prices reflect the true value of the underlying assets. They also allow investors to buy quality stocks at discounted prices.

Embracing Market Panic: A Guide for Astute Investors

Astute investors also know the importance of diversification in their portfolios. They spread their investments across different asset classes and sectors, reducing their exposure to any single market event. This strategy helps them to weather the storm during market downturns and capitalize on the opportunities that arise.

While market panic can be unnerving, astute investors see it as a part of the investment journey. They remain calm, stick to their strategies, and often become more assertive on the other side. They know that the market’s direction is not determined by short-term fluctuations but long-term economic fundamentals. So, when the masses are panicking, the astute investor plans, strategises, and often celebrates.

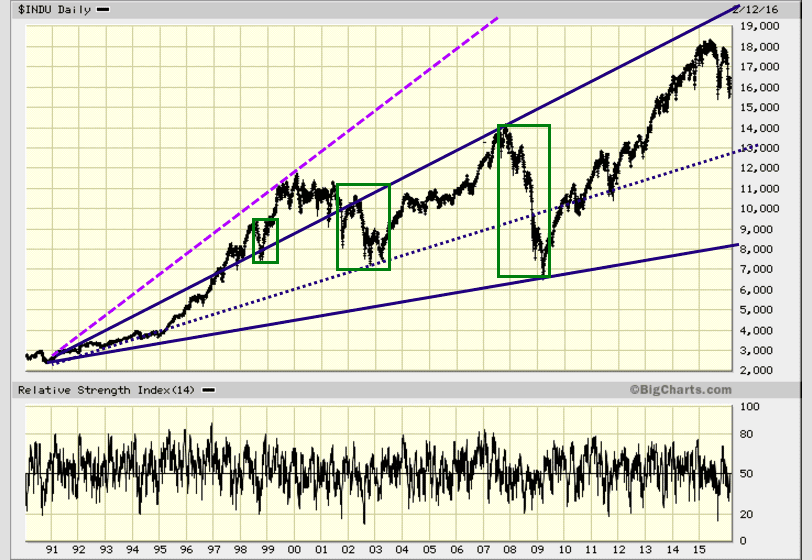

Look at any long-term chart, and the answer is always the same: when the masses are panicking and gnashing their teeth, you should be celebrating; end of the story.

The masses serve only one purpose: to be used as cannon fodder. You can choose to be one with the masses or be one with yourself.

As the trend is still up in two indices and neutral in one, very sharp corrections should be viewed as opportune moments to celebrate. In the short term, this might not be the case, and it is hard to do, but looking back at history, anything that is easy to do does not lead to huge profits. If it is easy, anyone can replicate it, and the masses never win.

Market Panic: Course of Action

The masses are stampeding for the exits, panic has taken over, and emotions are now doing the talking. It is Groundhog Day all over again, and when the dust settles down, they will once again regret having bailed out at precisely the wrong time. Learn from history or be doomed to repeat the same mistakes again and again. Panic is the code word for opportunity

originally published on Feb 23, 2016, updated repeatedly over the years. The latest update was conducted in July 2023

Other interesting articles:

SPY 200-Day Moving Average Strategy: Learn, Earn, and Prosper

Best Tech Stocks To Buy Now: Spotting the Trend

CPNG Share Price: Buy, Sell, or Hold?

Rolling Over Options: The Ultimate Guide to Mastery

Fearless Finance: Harnessing Stock Market Fear for Contrarian Victories

Market Timing Strategies: Debunking Flawless Predictions

Dow 30 Stocks with Dividends: A Winning Strategy for Income Investors

Collective Behavior Generally Takes Which of the Following Forms?

Market Psychology and Crowd Dynamics: Adapt, Adjust or Vanish

Harnessing Collective Behavior: Strategies for Investment Success

Unlocking Value in Equal-Weighted Index Funds: Benefits and Strategies

What Caused the 1987 Stock Market Crash: Could It Happen Again?

Active vs Passive Investors – The Power of Discipline

Investing allows you to beat inflation and maintain the purchasing power of your money over time

Mass Psychology of Fascism: Unmasking Bombastic News

Interest rate wars-Fed stuck between a hard place & Grenade (Feb 23)

Crisis investing: stock market crashes represent opportunity & not disaster (Feb 23)

Central banks declare war on Citizens (Feb 23)

India overtaking China just a pipe dream (Feb 22)

Top 10 investment resources for Novice Investors (Feb 20)

Central bankers will never lose war on Gold (Feb 18)