Market Panic: Astute Investors Never Panic

Updated July 2023

Astute investors understand that market panic is often a time of opportunity rather than a cause for alarm. They recognize that the market’s inherent volatility is not a bug but a feature, a necessary component of the economic cycle. During these periods of heightened uncertainty, the seeds of future profits are often sown. The emotional rollercoaster of the market does not sway astute investors; they remain steadfast, guided by their long-term investment strategies and financial goals.

They understand market corrections are inevitable and healthy for the overall market ecosystem. These corrections serve as a reality check, preventing the formation of asset bubbles and ensuring that prices reflect the true value of the underlying assets. They also allow investors to buy quality stocks at discounted prices.

Embracing Market Panic: A Guide for Astute Investors

Astute investors also know the importance of diversification in their portfolios. They spread their investments across different asset classes and sectors, reducing their exposure to any single market event. This strategy helps them to weather the storm during market downturns and capitalize on the opportunities that arise.

While market panic can be unnerving, astute investors see it as a part of the investment journey. They remain calm, stick to their strategies, and often become more assertive on the other side. They know that the market’s direction is not determined by short-term fluctuations but long-term economic fundamentals. So, when the masses are panicking, the astute investor plans, strategises, and often celebrates.

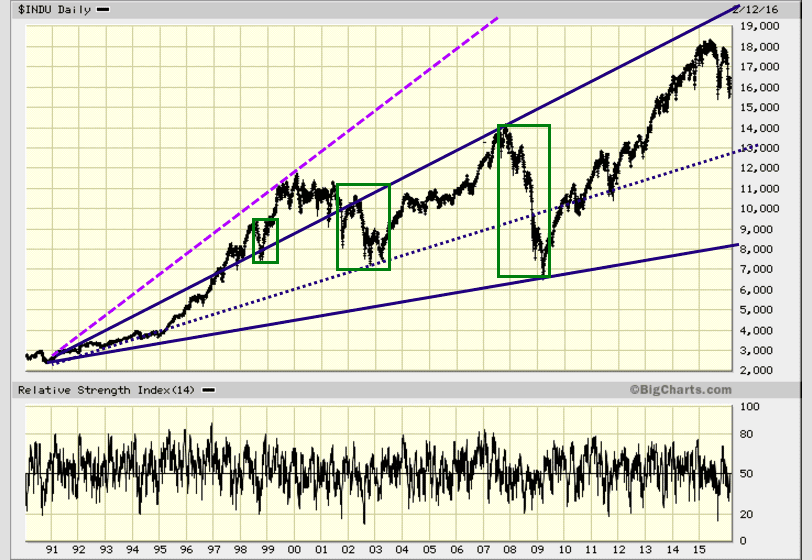

Look at any long-term chart, and the answer is always the same: when the masses are panicking and gnashing their teeth, you should be celebrating; end of the story.

The masses serve only one purpose: to be used as cannon fodder. You can choose to be one with the masses or be one with yourself.

As the trend is still up in two indices and neutral in one, very sharp corrections should be viewed as opportune moments to celebrate. In the short term, this might not be the case, and it is hard to do, but looking back at history, anything that is easy to do does not lead to huge profits. If it is easy, anyone can replicate it, and the masses never win.

Market Panic: Course of Action

The masses are stampeding for the exits, panic has taken over, and emotions are now doing the talking. It is Groundhog Day all over again, and when the dust settles down, they will once again regret having bailed out at precisely the wrong time. Learn from history or be doomed to repeat the same mistakes again and again. Panic is the code word for opportunity

originally published on Feb 23, 2016, updated repeatedly over the years. The latest update was conducted in July 2023

Other interesting articles:

Potential of Silver ETF-s: A Wise Investment Choice

USD Dollar Index Investing: A Posh Way to Hedge Against Currency Fluctuations

Are ESOPs Good for Employees? Weighing the Benefits and Risks

Copper ETF: The Great Investment Debate – Buy-In or Miss Out?

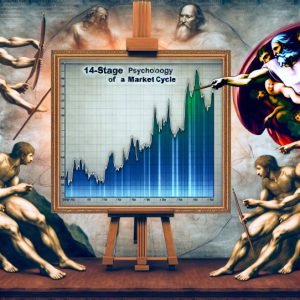

Stock Market Psychology Pdf: Mastering the Facts, Not the PDF

What Causes Mob Mentality: Unraveling the Psychology

Cracking Market Cycle Psychology: Navigating the Ups and Downs

Best Silver ETFs: Shining Bright in Your Investment Portfolio

Harnessing the Psychology of a Market Cycle: Thrive in Bull and Bear Markets

ETF Definition: A beginner’s guide to exchange-traded funds

What is a Bull Market Simple Definition: Understanding the Basics of a Thriving Market

Home Mortgage Interest Rates Forecast: Timing is Key

Why is investing in a mutual fund less risky than investing in a particular company’s stock?

Breaking Free: Embracing Early Extreme Retirement

What is a Bull Market? Unleashing its Power

Interest rate wars-Fed stuck between a hard place & Grenade (Feb 23)

Crisis investing: stock market crashes represent opportunity & not disaster (Feb 23)

Central banks declare war on Citizens (Feb 23)

India overtaking China just a pipe dream (Feb 22)

Top 10 investment resources for Novice Investors (Feb 20)

Central bankers will never lose war on Gold (Feb 18)