Reality Check: The Myth of Fed Tapering and the Inevitable Economic Fallout

The COVID narrative is about to end. This last stage is akin to a selling climax before a bottom takes hold. The big players are already working on the next disaster. Perhaps it will be a combo of mini-disasters. For example, they could start hyping the Natural gas crisis Europe is facing, the temporary oil shortage, or start pushing the inflation narrative, etc. However, one narrative that is virtually guaranteed to take hold is “The coming race (ethnicity) wars”. To be addressed in a future update. As we stated over the years, the end game is always the same: to keep the masses polarised.

The easiest person to rob in the world is a polarised man or woman. So the narrative that the Fed will taper and raise rates next year should be viewed in the same light as Grimm’s fairy tales. https://cutt.ly/XEOqYBy Fantastic yarns that only apply when one is in Lala land. Fed Tapering is wishful thinking over the long run. If interest rates rise significantly, not only will the US economy collapse but there will be a World Wide Economic catastrophe. At that point, wealth will mean nothing unless you live on the top of a mountain or in a cave stocked with food and guns. While there might be some upward pressure from time to time, rates will never be allowed to rise significantly, for the fallout will be.

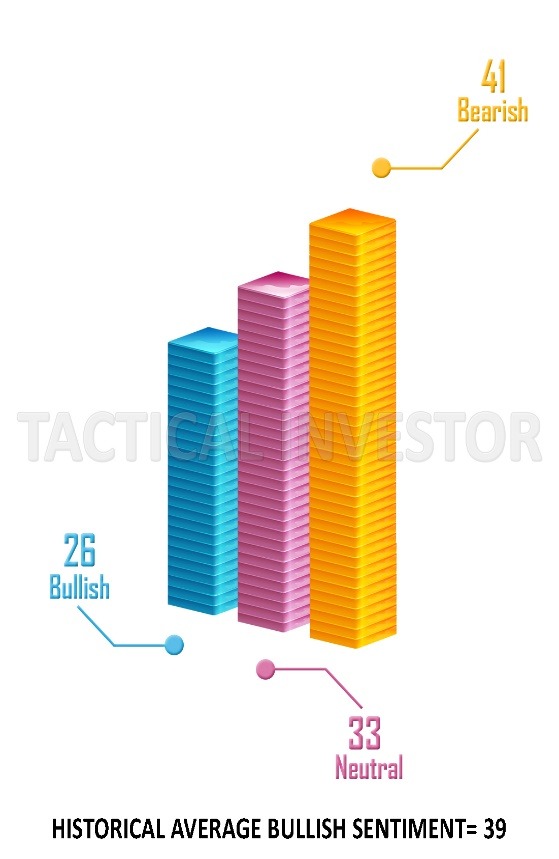

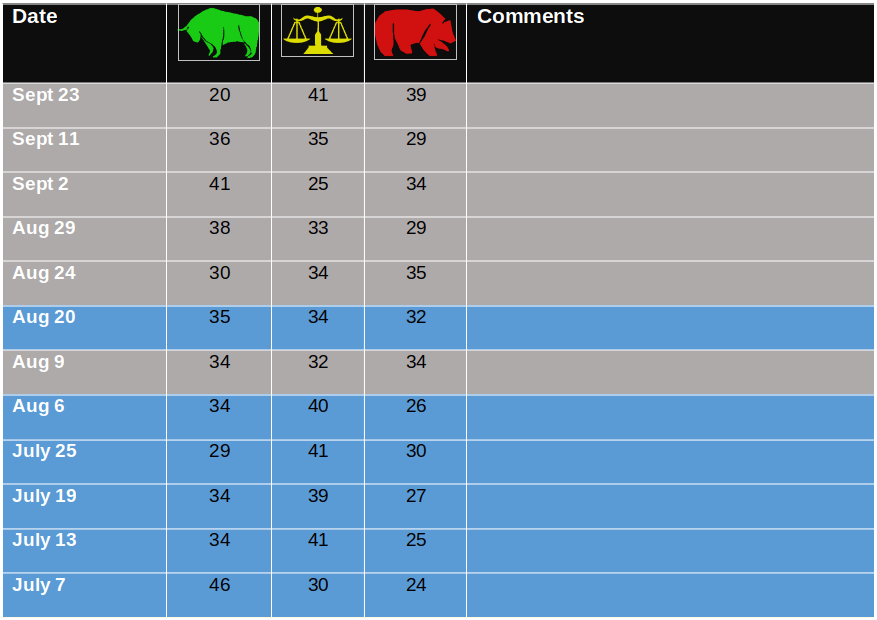

Bearish sentiment surged upwards, so the markets could/should rally for another 3 to 6 days. The clock started on Friday.

While bullish sentiment rose from the last reading, it is trading well below its historical average. Secondly, looking at the past 13 data points, bullish sentiment traded past its historical average only twice. Over the long run, this is a rather bullish development.

Bearish sentiment surged upwards, so the markets could/should rally for another 3 to 6 days. The clock started on Friday

Historical Sentiment values

Navigating the Volatility: The Impact of Fed Tapering on Markets and Tech Stocks

September has, in part, lived up to its name as being one of the worst months of the year. While September might be the worst month of the year, the most volatile month is October. This year, the volatility might extend to early November. Hence, traders should prepare themselves to deal with an extra dose of volatility. Still, after this phase, the markets are expected to mount a robust rally.

The silent correction theory continues to gain traction. Note how many Technology stocks are taking it to the chin. Now many experts are hyping the “value stock” theory as they falsely assume that Tech stocks are dead. Tech stocks (especially those in the AI sector) will recoup all these losses and more twice as fast. There are virtually no natural forces left in the market. Everything now comes down to perception (that is heavily manipulated by the big players courtesy of the press) and the Fed. Central bankers worldwide have one common goal; debase the currency. Destroying the currency is the best way to enslave 90% of the populace. This is also known as the race to the bottom. The goal is to finish last instead of first. In that aspect, the US dollar is likely to lose the race (come in close to last) but win the war.

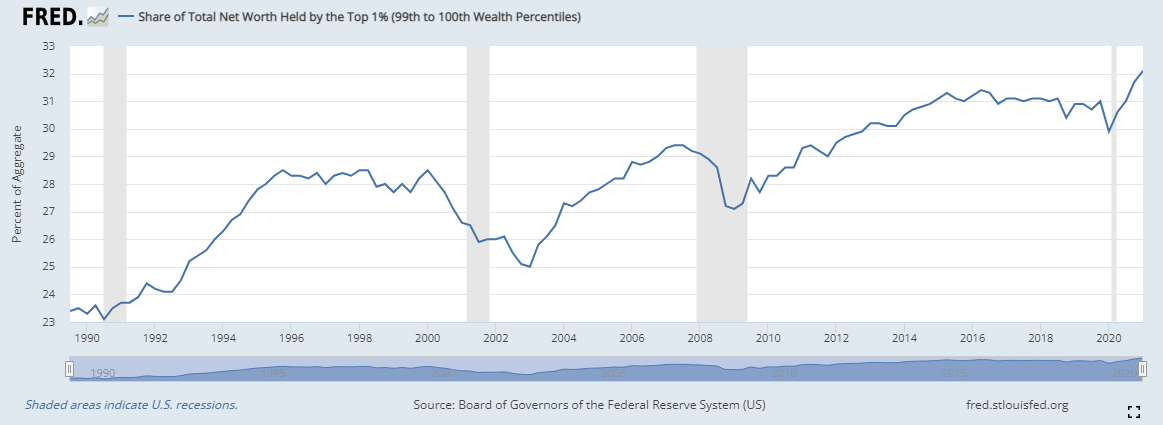

When you debase a currency, you provide those in the know-how with the means to make 10X to100X more. Hence the debasement process is actually a net positive to the super-elite. Take a look at the super-rich (look at the chart above). They keep getting richer and richer.

The wealthiest 1% of Americans controlled about $41.52 trillion in the first quarter, according to Federal Reserve data released Monday. Yet the bottom 50% of Americans only controlled about $2.62 trillion collectively, which is roughly 16 times less than those in the top 1%. https://cutt.ly/PEOu4pk

Notice the trend (above chart). Despite the dips, the top 1% continue accumulating more and more wealth. The recovery rate keeps rising after each disaster, validating our argument that the Fed will keep throwing more money to deal with each disaster. Hence Fed tapering is a myth at best. Until the masses wake up (if they ever do), the Fed will keep creating money out of thin air, for they conned the masses that fiat is more valuable than Gold. We don’t think the crowd will smell the coffee until the national debt hits 100 trillion, suggesting that Dow 100K might actually be a possibility one day. That’s a discussion for another day, as that target is still a long way off.

For now, investors should understand that volatility is a trader or investors best friend. Given that V readings are still at sky-high levels, the Rage index is at a new high, and the GP (Gnosis Panoptes) index is dangerously close to putting in a new high, the odds are high that the next few weeks will be filled with volatility

Conclusion

From a conventional perspective, nothing that is taking place makes sense. And as we predicted over 24 months ago, this market will confound all the experts of yesteryear, for they continue to rely on tools that no longer work. Market Update September 24, 2021

This theme will continue to gain traction. Individuals need to understand that prior patterns or tools cannot be relied on, as up until 2009, some free-market forces were allowed to operate. After that, the Fed became the market. The Fed not only controls the money supply, but it is the buyer of last resort. In essence, it is now the lender and buyer of last resort. Against this backdrop, free-market forces don’t stand a chance. In other words, you either embrace the Fed, or you are dead.

The ideal scenario would be for the Dow to rally to the 34,800 to 35,400 ranges and then experience a sharp short plunge to the 33,600 to 33,900 ranges. If these levels hold, it should be in a position to mount a strong reversal taking out the 35,400 ranges in record time and positioning itself for a test of the 37K ranges (plus or minus 600 points). The second scenario is that it continues to trend higher from current levels. This will lead to an even more pronounced correction next year. Market Update September 24, 2021

The Dow almost traded to 35K after the September 24 update was sent and then pulled back. The tech-heavy Nasdaq seems to be shedding more weight. If this continues, the tech companies will recoup their losses 2X faster on the rebound. So, let’s see if the markets follow the ideal setup or not.

Fed tapering is not something investors should worry about. The Fed will pull the brakes, but they will never slam them for worldwide debt is simply too high. A hard landing and this fragile, illusory recovery will crumble faster than it began. Low rates are here to stay until at least the masses wake up and reject fiat. Don’t hold your breath for that day.

When uncertainty rules the roost, market volatility is a traders/investors best friend. The trend is your friend; everything else is your foe.

Other Articles of Interest

Unleashing the Future: The Epic Evolution of AI into Personal AI Powerhouse

Unlocking the Mysteries: What Are Economic Indicators?

Lagging Economic Indicators: Time to Thrive or Perish

Why Doesn’t Anybody Help Us Stop Losing Money In The Market

Investing in a Bear Market: Ignore the Naysayers

Stock Market Crash Today: Should You Be Concerned?

Buy the Dip: Dive into Wealth with this Thrilling Strategy

Risk vs Reward vs Folly: Navigating Investment Choices

Stock Market Basics: Out with the Old, In with the New

Germany’s Economic Woes: The Sick Man of Europe

DSX Stock: Roar or Retreat

Mastering Market Moves: The Investor Sentiment Cycle

Stock Market Prediction: Avoiding the Herd Mentality

How to Build Wealth in Your 30s: Financial Success Unveiled

Market Sell-Off Survival: Act or Perish

NKE Stock Price Projections and Long Term Targets