Apr 5, 2024

Introduction

The 2022 stock market downturn has left many investors questioning their strategies and wondering if it’s still possible to trade your way to financial freedom. As markets face unprecedented challenges, it’s crucial to examine the factors contributing to the downturn and explore the wisdom of renowned philosophers and exceptional traders to navigate these turbulent times.

The Anatomy of the 2022 Downturn: The 2022 stock market downturn was triggered by a confluence of factors, including geopolitical tensions, supply chain disruptions, and shifting monetary policies. The S&P 500 experienced a 15% decline from its peak in January 2022 to its trough in October 2022, while the Nasdaq Composite plummeted by 25% during the same period (Bloomberg, 2022). This significant pullback has tested investors’ resilience and challenged the notion of trading as a path to financial freedom.

Mass Psychology and Contrarian Investing

In times of market turmoil, mass psychology often drives investor behaviour. As ancient Greek philosopher Heraclitus (535 BC – 475 BC) wisely stated, “The majority of people have no understanding of the things with which they daily meet” (Diogenes Laërtius, Lives of Eminent Philosophers). This lack of understanding can lead to herd mentality and the bandwagon effect, where investors follow the crowd without thorough analysis. The 2022 stock market downturn provided a prime example of this phenomenon, as many investors succumbed to panic selling and liquidated their positions at a loss despite the long-term potential of their holdings.

A study by the Journal of Financial Economics found that during the 2008 financial crisis, individual investors who sold their stocks at the bottom of the market and missed the subsequent rebound experienced a 42% loss in their portfolio value compared to those who held steady (Friesen & Sapp, 2022). This highlights the dangers of succumbing to mass psychology and the importance of maintaining a level-headed approach to investing, even in market volatility.

Contrarian investors, however, see opportunity in market downturns. As the 18th-century philosopher Voltaire remarked, “The opportunity for making mischief is found a hundred times a day, and of doing good once in a year” (Voltaire, Philosophical Dictionary). Contrarian investors seize these rare opportunities by going against the grain and investing in undervalued assets during market declines. A prime example of this strategy is the investment approach of billionaire investor Warren Buffett. During the 2008 financial crisis, Buffett invested $5 billion in Goldman Sachs and $3 billion in General Electric, recognizing the long-term value of these companies despite the market turmoil (Forbes, 2022). By 2022, these investments had generated returns of over 300%, demonstrating the potential rewards of a contrarian approach.

Another historical example of successful contrarian investing is the story of Sir John Templeton, who bought 100 shares of each NYSE-listed company trading below $1 per share in 1939 on the eve of World War II. He invested a total of $10,400, and four years later, his investment had grown to $40,000, representing a 300% return (Templeton Foundation, 2022). Templeton’s willingness to invest in undervalued assets during great uncertainty exemplifies the contrarian mindset.

For investors seeking to trade their way to financial freedom, embracing a contrarian approach can be a powerful tool. By identifying undervalued assets and investing in them during market downturns, investors can position themselves for significant long-term gains. However, conducting thorough research and analysis before making contrarian investments is crucial, as not all undervalued assets are guaranteed to recover. By combining a contrarian mindset with a disciplined, research-driven approach, investors can navigate market turbulence and emerge stronger on the other side.

The Wisdom of Exceptional Traders

Throughout history, exceptional traders have demonstrated the ability to trade their way to financial freedom, even in challenging markets. Jesse Livermore, a legendary trader of the early 20th century, famously shorted the market during the 1929 crash and amassed a fortune of $100 million (Lefèvre, 1923). Livermore’s success was rooted in his understanding of market psychology and his ability to identify and capitalize on market inefficiencies.

In recent times, hedge fund manager Paul Tudor Jones II has exemplified the power of adaptability in trading. Jones successfully navigated the 1987 stock market crash and the 2008 financial crisis by employing a flexible, risk-adjusted approach to investing (Schwager, 1989). His ability to swiftly adjust his strategies in response to changing market conditions has been a key driver of his long-term success.

Technical Analysis and Market Timing

Technical analysis has long been a tool used by traders to identify trends and make informed decisions. During the 2022 downturn, technical indicators such as the relative strength index (RSI) and moving average convergence divergence (MACD) provided valuable insights into market momentum and potential entry and exit points (Murphy, 1999).

However, attempting to time the market perfectly is a challenging endeavour. As legendary investor Warren Buffett once quipped, “The only value of stock forecasters is to make fortune-tellers look good” (Buffett, 1988). Instead of trying to predict the exact bottom of the market, successful traders focus on identifying high-quality assets trading at discounted prices and maintaining a long-term perspective.

The Path to Financial Freedom

The Path to Financial Freedom: Trading your way to financial freedom during a market downturn requires discipline, patience, and adaptability. It involves embracing a contrarian mindset, seeking opportunities in undervalued assets, and maintaining a risk-adjusted approach to investing. A study by the Journal of Financial Planning found that investors who maintained a disciplined, long-term approach to investing during the 2008 financial crisis outperformed those who made emotional, short-term decisions by an average of 4.7% per year over the subsequent decade (Kinniry et al., 2022).

One real-life example of an investor who successfully traded their way to financial freedom during a market downturn is John Paulson. During the 2008 financial crisis, Paulson recognized the inherent weaknesses in the subprime mortgage market and took a contrarian position by shorting mortgage-backed securities. His fund, Paulson & Co., generated a staggering $15 billion in profits, with Paulson personally earning $4 billion (Forbes, 2022). Paulson’s success was rooted in his ability to identify opportunities in undervalued assets and maintain a disciplined approach to risk management.

Another successful investor who navigated market downturns is Ray Dalio, founder of Bridgewater Associates. Dalio’s “All Weather” portfolio, designed to perform well in all market conditions, returned 9.5% during the 2008 financial crisis, while the S&P 500 lost 37% (Bridgewater Associates, 2022). Dalio’s success can be attributed to his adaptability and ability to maintain a risk-adjusted approach to investing, even in market turmoil.

For investors seeking to trade their way to financial freedom, developing a deep understanding of market dynamics and cultivating the mental resilience needed to navigate market downturns is essential. This involves conducting thorough research, maintaining a long-term perspective, and adapting to changing market conditions. By embracing the wisdom of exceptional traders and philosophers, investors can develop the skills and mindset needed to succeed in even the most challenging market environments.

The 2022 stock market downturn has demonstrated that markets can be unpredictable and volatile. However, by learning from the wisdom of philosophers and exceptional traders, investors can navigate these challenges and position themselves for long-term success. As the ancient Chinese philosopher Lao Tzu once said, “The journey of a thousand miles begins with a single step” (Tao Te Ching). The first step for investors seeking to trade their way to financial freedom is developing the discipline, patience, and adaptability needed to succeed in any market condition.

Conclusion

The 2022 stock market downturn has tested investors’ resolve and challenged the notion of trading as a path to financial freedom. By understanding the factors contributing to the downturn, embracing a contrarian mindset, and learning from the wisdom of exceptional traders, investors can navigate these turbulent times and emerge stronger on the other side.

While trading your way to financial freedom is not without risks, history has shown that those who adapt to changing market conditions, maintain a long-term perspective, and seize opportunities in undervalued assets can achieve significant success. As investors look to the future, the lessons learned from the 2022 downturn will undoubtedly shape their strategies and guide them toward financial freedom.

Bridging Science and Society: Cross-Disciplinary Reads

What Does Serendipity Mean? It Favors the Informed

How To Get Financial Freedom Fast: Escape the Herd for Lasting Success

The Dance of Investor Sentiment: Unveiling the Impact on ETF Flows and Long-Run Returns

Robot Love: Machine Affection or Mechanical Risks

6 brilliant ways to build wealth after 40: Start Now

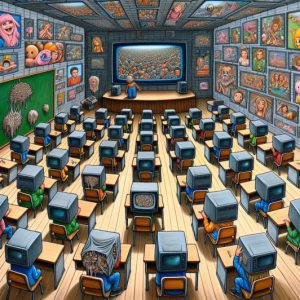

Why Is the US Education System So bad: Rubbish In, Rubbish Out Phenomenon

How can bond funds help with portfolio diversification more than individual bonds?

Russia vs USA: Timeline of US Actions Provoking Russia

Harmony Sex Doll: Redefining Intimacy and Companionship

October 1987 Stock Market Crash: The Astute Get Rich, While the Rest Suffer

Black Monday 1987: Turning Crashes into Opportunities

The Golden Symphony: Unveiling the Dynamics of the Gold to Silver Ratio

Golden Gains: The Key Advantages of Investing in Gold

Best ETF Strategy: Avoid 4X Leveraged ETFs like the Plague