Stock Market Fear Index & Murphy’s Law

Dec 23, 2023

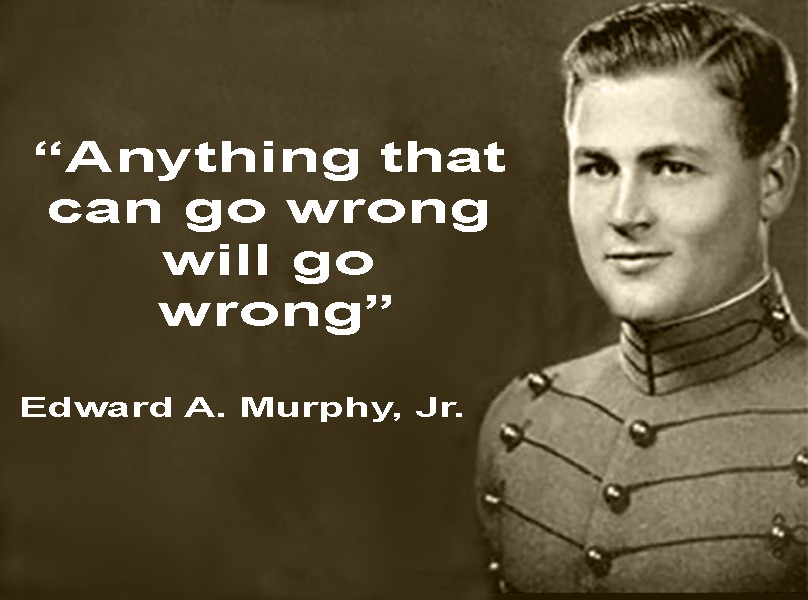

The behaviour of investors during bullish and bearish market phases has long been a topic of interest in finance. Investors often raise their risk tolerance in bullish phases and pursue more speculative investments. Conversely, during bearish or corrective stages, investors are known to adopt a more cautious approach and lower their risk exposure. However, Murphy’s law states, “Anything that can go wrong will go wrong; it becomes apparent that some individuals who make investment decisions based on market conditions may not be true investors but speculators or gamblers.

Murphy’s law suggests that individuals who change their risk tolerance based on market conditions may be unconsciously driven by the desire to lose. This phenomenon is often called the “secret desire to lose syndrome.” It is a psychological trait common among gamblers and speculative investors, who take on more risk in the hopes of striking it big, only to lose more than they gain.

Disciplined Approach to Risk Management

In contrast, true investors are characterised by their disciplined approach to risk management. They have a well-defined investment strategy not influenced by market conditions or emotions. This strategy is based on their personal risk tolerance, investment goals, and long-term outlook.

Low-medium-risk individuals must establish a clear investment strategy to avoid the pitfalls of speculative investing and minimise the risk of Murphy’s law. This strategy should consider personal risk tolerance, investment goals, and long-term outlook. It is important to note that what one Individual believes to be high risk, another may view as low or medium risk. Therefore, it is crucial to determine one’s risk profile accurately.

One effective way to determine your risk profile is by considering your investment goals. For example, if your primary goal is to preserve capital and generate a stable income, you may be more inclined to invest in low-risk, low-return assets such as bonds and fixed-income securities. On the other hand, if you have a higher tolerance for risk and are focused on maximising returns, you may choose to invest in equities or other high-risk, high-return assets.

Defeat Murphy’s Law: Accurately Assess Your Risk Profile

Creating a well-diversified investment portfolio is essential once you have determined your risk profile. Diversification helps to minimise the impact of market fluctuations and reduce the risk of loss. By spreading your investments across different asset classes, sectors, and geographic regions, you can ease your overall portfolio risk and increase the likelihood of achieving your investment goals.

In conclusion, applying Murphy’s law to investment decisions highlights the importance of having a clear investment strategy and avoiding speculative or gambling behaviour. By determining your risk profile and creating a well-diversified investment portfolio, you can minimise the impact of market fluctuations and increase the likelihood of achieving your investment goals. True investors understand that investing is a long-term commitment and that success requires discipline, patience, and a willingness to weather the ups and downs of the markets.

Tactical Investor Stock Market Fear Index

The Hysteria Zone: A Sign of a Long-Term Market Bottom?

When the anxiety index approaches the hysteria zone, it may indicate a potential long-term market bottom. However, relying on a single tool or indicator is never recommended. Utilizing the stock market fear index in conjunction with other tools can assist in determining optimal entry and exit points.

Stock Market Fear Index Conclusion

As the Market experiences a bullish phase and our indicators approach the “overbought zone”, we may adjust the cash requirements for those in the low to medium-risk category. This shift ensures that we effectively manage risk and avoid potential drawbacks. Changing risk profiles based on market trends can classify an individual as a gambler rather than an investor. Therefore, taking the time to assess and accurately determine your risk profile is crucial, as what one perceives as high risk, another may consider being low or medium risk. Avoid altering your strategy in response to market fluctuations, and trust the investment plan established for you.

FAQ: Stock Market Fear Index & Murphy’s Law

What is the Stock Market Fear Index?

The Stock Market Fear Index, also known as the VIX or the CBOE Volatility Index, is a tool used to measure investor sentiment and market volatility. It is calculated based on the prices of options contracts on the S&P 500 index and is often used as a barometer of fear in the market.

What is Murphy’s Law in relation to investing?

Murphy’s Law suggests that anything that can go wrong will go wrong. About investing, it highlights the importance of having a clear investment strategy and avoiding speculative or gambling behaviour. It implies that individuals who change their risk tolerance based on market conditions may be unconsciously driven by the desire to lose.

How can I avoid the pitfalls of speculative investing?

To avoid the pitfalls of speculative investing, it is essential to have a disciplined approach to risk management. Establish a clear investment strategy based on your personal risk tolerance, investment goals, and long-term outlook. Determine your risk profile accurately, create a well-diversified investment portfolio, and avoid altering your strategy in response to market fluctuations.

What is the Hysteria Zone in relation to the Stock Market Fear Index?

The Hysteria Zone is a term used to describe high market volatility and extreme investor fear. When the Stock Market Fear Index approaches the Hysteria Zone, it may indicate a potential long-term market bottom. However, relying on a single tool or indicator is never recommended. Using the Stock Market Fear Index with other tools is advisable to determine optimal entry and exit points.

Why is it important to avoid changing risk profiles based on market trends?

Changing risk profiles based on market trends can classify an individual as a gambler rather than an investor. It is crucial to assess and accurately determine your risk profile as what one perceives as high risk. Another may consider being low or medium risk. Trust your investment plan and avoid altering your strategy in response to market fluctuations.

Embark on New Narratives: Explore Further

Quantitative Easing: Igniting the Corruption of Corporate America

Uranium Market Outlook: Prospects for a Luminous Growth Trajectory

Stock Investing for Kids: Surefire Path to Success!

An Individual Who Removes the Risk of Losing Money in the Stock Market: A Strategic Approach

Palladium Forecast: Unveiling the Stealth Bull Market

I Keep Losing Money In The Stock Market: Confronting the Stupidity Within

Analyzing Trends: Stock Market Forecast for the Next 6 Months

Market Mastery: The Best Investing Books for Your Success

Example of Groupthink: Mass Panic Selling at Market Bottom

Contrarian Thinking: The Power of Challenging the Status Quo

Mastering Technical Analysis Of The Financial Markets

Contrarian Outlook: A Pathway to Breakthrough or Breakdown

Financial Freedom Book: A Pinch of Salt, a Splash of Whiskey

Unleashing the Power of Small Dogs Of the Dow