Stock Market Opportunity: Embrace Catastrophes Like a Long-Lost Love

Feb 19, 2025

Introduction: Embrace Market Chaos Like a Lost Love

History doesn’t whisper; it roars. Market crashes aren’t black swans—they are the inevitable tides of financial history, predictable in their recurrence and ruthless in their execution. Yet, for those who understand the game, these moments of chaos are not to be feared but embraced—like a lost love returned, bearing gifts of opportunity.

“The time of maximum pessimism is the best time to buy.” — Sir John Templeton

This isn’t a cliché. It’s an immutable law of market cycles. Fear and greed are the twin forces that have governed financial markets for centuries, and within them lies the key to unlocking generational wealth. Those who freeze in fear become the casualties of market carnage; those who act with calculated aggression become the architects of financial empires.

History’s Playbook: Learn or Perish

The past does not repeat—it rhymes with merciless precision. Consider:

- 2008 Financial Crisis – While the masses panicked, those who bought into giants like Apple and Amazon at rock-bottom prices saw their investments multiply tenfold over the next decade.

- 1987 Black Monday – A single-day market collapse of 22%. A catastrophe? No. A gift. The market rebounded within two years, and those who bought into the fear positioned themselves for decades of gains.

- The Great Depression – A historic wipeout? Yes. But those with the insight and patience to accumulate assets in the 1930s set the foundation for unimaginable wealth when the recovery came.

Each crash was a test. Some failed. Others emerged as kings.

Buffett, Keynes, Graham: The Holy Trinity of Crisis Investing

The greatest investors don’t panic; they exploit.

- “Be fearful when others are greedy, and greedy when others are fearful.” — Warren Buffett

- “The stock market is a beauty contest where judges must guess what others will find attractive.” — John Maynard Keynes

- “In the short run, the market is a voting machine, but in the long run, it is a weighing machine.” — Benjamin Graham

These are not just words. They are battle-tested strategies that separate the informed from the ignorant. When the herd sells, liquidity dries up, and valuations plummet, kings are crowned.

Mastering the Art of Crisis Investing

- Ignore the Noise – The media thrives on fear. Train yourself to see beyond the hysteria.

- Know the Patterns – Markets crash, markets recover. The script doesn’t change. Be ready when the curtain drops.

- Strike with Precision – Identify prime assets, assess their intrinsic value, and deploy capital aggressively at the right moment.

- Think Like a Predator – The best opportunities arise when panic-driven selling creates deep mispricings. Move fast, move smart.

- Play the Long Game – The impatient chase short-term moves; the wise accumulate wealth over cycles.

Common Sense & Out-of-the-Box Thinking

“Common sense is not so common,” quipped the French philosopher François de La Rochefoucauld in the 17th century. His observation remains apt in investing, where rationality and level-headed thinking are often in short supply during market crashes.

Common sense dictates that we should not allow our decisions to be driven by fear or panic. Yet, time and again, we see investors succumbing to the herd mentality, selling at the worst possible times, and missing out on potential gains. This is where out-of-the-box thinking comes into play—the ability to step back, analyze the situation objectively, and make decisions that may counter the prevailing sentiment.

“Buy when there’s blood in the streets.” – Baron Rothschild, 18th-Century British Nobleman & Investor

Baron Rothschild’s famous advice encapsulates the essence of out-of-the-box thinking. During times of crisis and market turmoil, when others are fleeing, the astute investor recognizes the opportunity to buy at discounted prices.

Practical Strategies for Embracing Market Crashes

So, how can investors embrace market crashes and turn them into opportunities? Here are some practical strategies:

Maintain a Long-Term Perspective: Market crashes can be unsettling, but keeping a long-term view is essential. Historical data demonstrates that markets recover and reach new highs. By focusing on the long game, you can avoid making impulsive decisions driven by short-term fears.

Dollar-Cost Averaging: This strategy involves investing a fixed amount of money in a particular vehicle at regular intervals, regardless of the share price. By doing so, you buy more shares when prices are low and fewer when prices are high, naturally creating a favourable average cost per share over time.

Incremental Buying: During market crashes, consider buying in increments. Start with a small position and add to it as the market declines. This approach helps average your entry price and reduces the risk of buying at the exact bottom.

Technical Analysis & Risk Management: Utilize technical analysis tools such as support and resistance levels, moving averages, and risk-to-reward models to identify suitable entry points and manage your risk.

Focus on Intrinsic Value: During market crashes, prices may deviate significantly from a company’s or asset’s intrinsic value. Look beyond the short-term noise and assess the underlying value. If the fundamentals remain strong, the price correction presents a buying opportunity.

Diversification: Ensure your portfolio is well-diversified across different asset classes, sectors, and regions. Diversification helps to mitigate the impact of market crashes and reduces the risk of being overly exposed to any single investment.

Maintain a Contrarian Mindset: Cultivate a contrarian mindset and be willing to go against the crowd. Market crashes often create a herd mentality, with investors following each other over the cliff. Be prepared to embrace uncertainty and take calculated risks when others are fearful.

Final Thoughts: Turning Crashes into Opportunities

Market crashes are an inevitable part of the investing landscape, and they can be emotionally challenging for even the most seasoned investors. However, by adopting a historical perspective, understanding mass psychology, and employing prudent strategies, it is possible to turn these moments of chaos into opportunities for long-term financial gain.

As we’ve explored through the words of ancient sages and modern investors, the key lies in maintaining a level head, thinking independently, and recognizing that market crashes are often born out of mass hysteria. By embracing crashes like a lost love, with a mix of wisdom, courage, and strategic thinking, investors can position themselves to reap the rewards when the markets inevitably recover.

“The four most expensive words in the English language are, ‘This time it’s different.'” – Sir John Templeton

Sir John Templeton’s warning reminds us that market dynamics and human behaviour tend to repeat themselves. By heeding past lessons and embracing a prudent and opportunistic mindset, investors can turn market crashes into moments of fortuitous entry or strategic expansion within their investment journeys.

Random thoughts

Top players strategically wield terms like “bear market” and “stock market crash” to elicit a Pavlovian response. They understand that when these words echo, the masses often react predictably: selling hastily and discarding potential opportunities. Yet, history tells a different tale. Despite the initial panic, markets have a knack for rebounding, revealing these moments as potential buying windows.

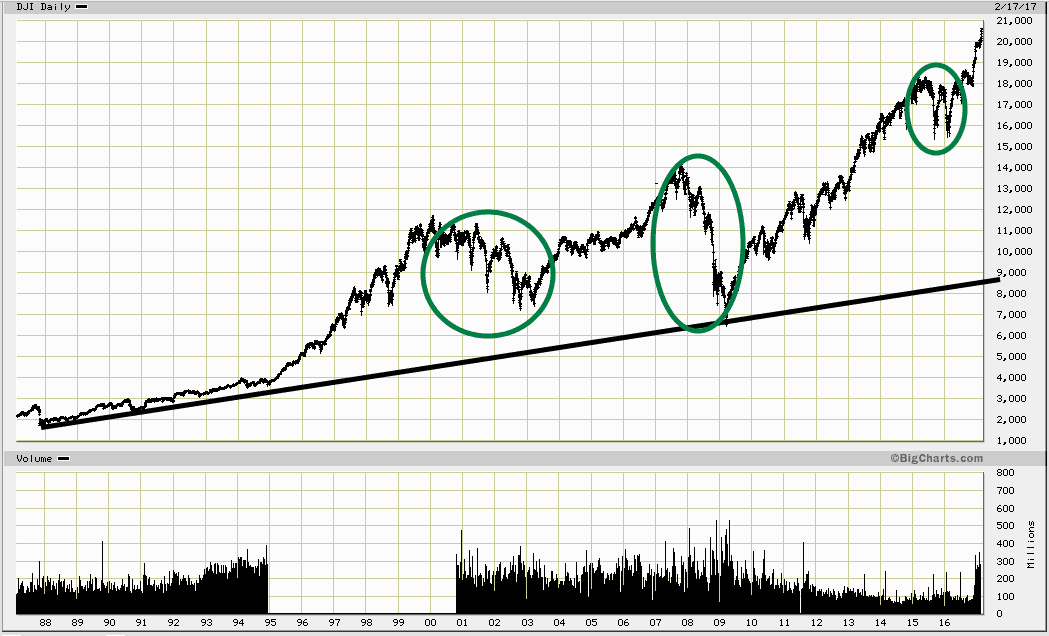

A deeper analysis unveils a truth: stock market crashes are ripe with opportunity. Consider the crashes of 1987 and 2008; though daunting at the time, they now appear as mere blips on the long-term chart. Amid the chaos, savvy investors spot signals of impending turnaround amidst panicked selling and oversold conditions.

A stock market crash can be viewed as an unexpected retirement gift. By discerning the trend amidst the noise, investors can seize opportunities when they arise, turning crisis into opportunity.

Final Truth: You Either Seize the Moment or Become a Statistic

Market crashes don’t destroy wealth—they transfer it. From the weak to the strong. From the emotional to the strategic. From the fearful to the bold.

The next time catastrophe strikes, ask yourself: Will you run? Or will you embrace the chaos, like a lost love returned, bringing fortune to those who dare to welcome it?

Other Stories of Interest

How to Win the Stock Market Game 2024: Ride the Wave to Victory