Stay Informed with Copper News Today and Beyond: Unveiling Insights and More

Updated Jan 12, 2024

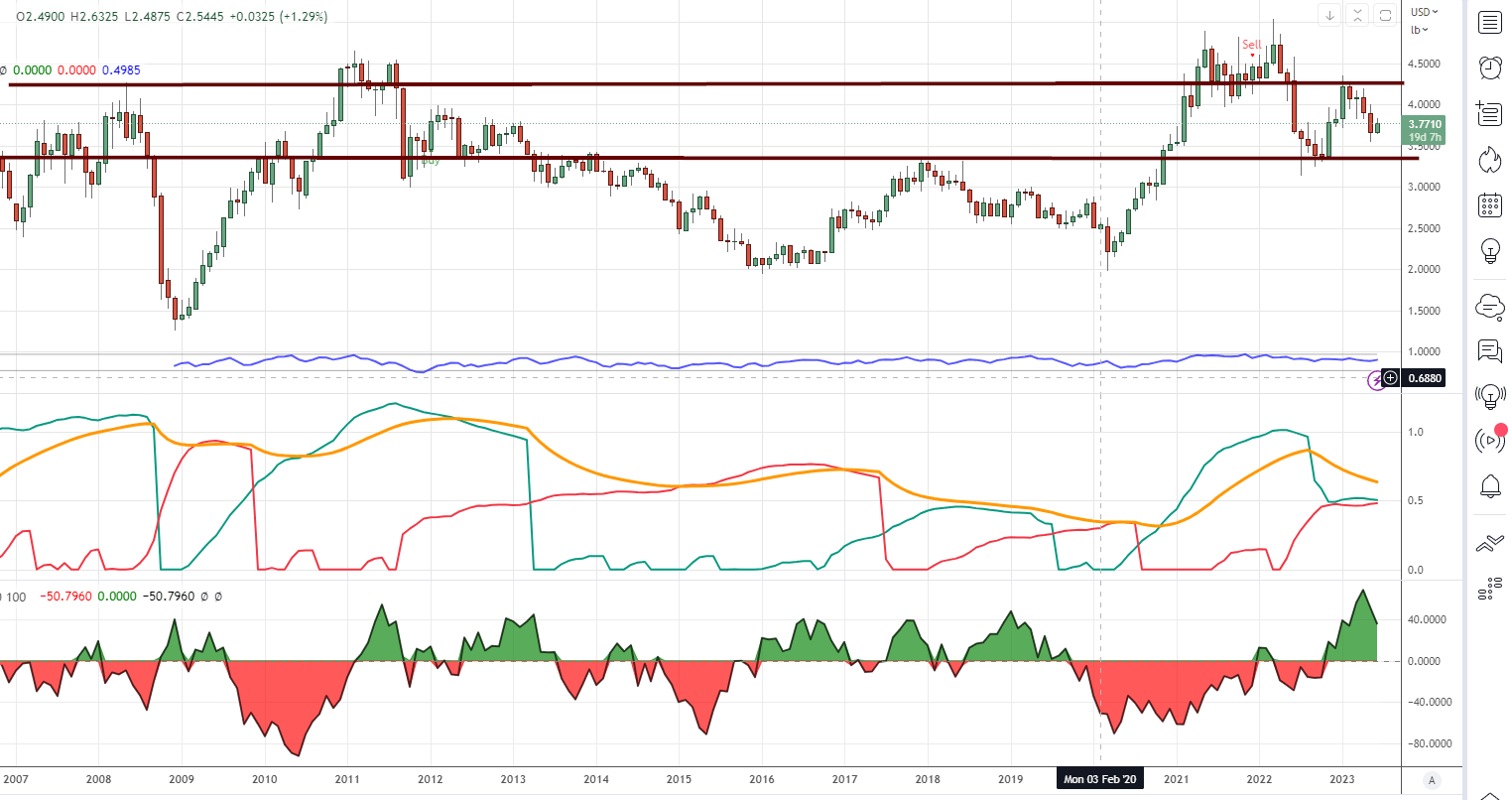

Copper is presently undergoing consolidation, gathering strength for its upward movement. The overall outlook remains positive as long as it maintains a monthly closing above 3.70. Should it achieve a closing price at or above 4.35, we can anticipate a sequence of new record highs. Furthermore, the weekly charts indicate that copper trades in a significantly oversold range, showing a strong potential for a breakout.

For individuals seeking to participate in the copper market, investments in FCX, JJC, COPX, and other stocks within this sector present viable options.

Copper News Today: Navigating Challenges and Opportunities in a Dynamic Market

The future is already here, and it brings with it an unprecedented demand for copper. This demand is driven by burgeoning industries such as renewable energy and electric vehicles, and it is set to outstrip supply. The looming copper shortages and the lengthy and uncertain timelines for new mines paint a clear picture: copper is not just a commodity but an increasingly scarce resource.

The global copper market is currently grappling with a supply-demand imbalance that is expected to persist throughout 2024 and potentially beyond. This imbalance is driven by a combination of factors, including strained South American supply streams, escalating demand pressures, and the application of machine learning to mineral-processing control.

The supply challenges in South America are multifaceted, encompassing a global freight recession, ongoing global supply chain problems, a labour shortage in the supply chain industry, and potential challenges in South American power markets due to predictions of a moderate El Niño pattern. These factors, combined with the ongoing effects of the pandemic and extreme weather events, pose significant challenges to South American supply streams in 2024.

On the demand side, copper, a vital economic indicator due to its widespread use in electrical equipment and industrial machinery, is grappling with a worldwide shortage. This deficit is fueled by surging demand, potentially signaling worsening global inflationary pressures. The shortage might prompt central banks to maintain their hawkish stances for an extended period.

Furthermore, the world is experiencing a global copper shortage, with projections suggesting the shortfall could persist into the remainder of the decade. This aligns with copper’s role as a key economic indicator integrated into various technologies. A copper scarcity may indicate a worsening global inflationary environment, influencing central banks to extend their hawkish positions.

Applying machine learning to mineral-processing control over the past six years has added precision and consistency to the copper production process. By optimizing processing plant performance consistently, machine learning can enhance metal recoveries by an additional 2 to 4 per cent and increase throughput by 5 to 15 per cent.

In light of these factors, the long-term outlook for copper is bullish. The anticipated increase in demand for copper due to its usage in diverse technologies, coupled with the expected decline in supply, sets the stage for potential high returns for those investing in copper. However, it’s important to note that this outlook is subject to change based on various factors, including geopolitical developments, technological advancements, and changes in market sentiment.

Conclusion

The future is not just knocking on our doors; it’s here, bringing an unprecedented demand for copper. Fueled by burgeoning industries like renewable energy and electric vehicles, this demand is set to outstrip supply. The looming copper shortages and the lengthy and uncertain timelines for new mines paint a clear picture: copper is not just a commodity but an increasingly scarce resource.

Amid these market dynamics, Copper Exchange Traded Funds (ETFs) are a beacon of opportunity. They represent a doorway to a bullish market, a chance to ride the wave of a commodity essential to our future. ETFs offer the benefits of diversification and risk mitigation, shielding investors from the volatility of individual copper stocks while presenting a pathway to potentially lucrative returns.

As we stand on the brink of a new era in the commodities market, the case for investing in copper and copper ETFs isn’t just compelling; it’s commanding. It’s time to watch the future unfold and actively participate in shaping it. With its potential and challenges, the copper market is ripe with opportunity. For the discerning investor, copper ETFs and large-cap copper stocks could be the key to unlocking this potential. The future of copper is here. The question is, are you ready to seize it?

Copper News Today: Is Dr Copper still a leading indicator?

Dr Copper, once known as a leading indicator, has been relegated to the dustbin of time, not because it has lost its value as a leading indicator, but because hot money is masking the accurate signal this market is issuing. In an article titled Dr Copper, we covered this: economy and stock markets no longer dance to the same beat. Copper’s massive divergence from the stock market indicates that this market is held up by spit and mud, albeit quite sticky spit, and that the Fed’s rate hike was just a trick to fool the masses into thinking that all is well.

Ultimately, the Fed will have to find some way to flood this market with more money. We are now in the “devalue or die” era. The best way to achieve this is to pretend you have the interest of the masses at heart and come out with a new stimulus program. However, the stimulus is always directed towards banks and large corporations and never at the individuals who need it.

Let’s switch gears and talk about something different from Copper News.

This update will be short and sweet. We will focus on the latest copper news and discuss the Fed’s latest action. Before the Fed meeting, we warned our subscribers that the masses would panic and do the wrong thing at the right time. Individuals started pulling money out of the markets and ploughing into money markets. We advised our subscribers to view all strong pullbacks as buying opportunities:

The trend in all major indices is now positive, and this means that the 17150 low sets on the 12th will most likely not be taken out. At this point, the simple strategy should be to use all strong pullbacks to open new positions or add to your existing positions. Market Update Nov 30, 2015

Our Previous Statement Before Anticipated Interest Rate Rises

The Fed might raise rates or not; a rate hike is already priced in. However, it will not alter the outlook that hot money is what is propping this market up. The philosophy of using strong pullbacks to open new positions continues to pay off. As long as the trend is up. Market Update Dec 7, 2015

The markets started to rally before the Fed announced its decision and then sold off afterwards. This sort of action is normal when volatility is high, and based on our V-indicator, which measures market Volatility, the readings are sky-high at the moment. So, such extreme action is to be expected. As long as the trend indicator remains bullish, we will view all strong pullbacks as buying opportunities.

If all the data is bleak, what does the future hold?

Against this backdrop of negative news, one would think that the only way out is to jump out of stocks and short the markets. That is precisely what you should not be doing; the markets are being driven up by hot money, and the stock market operates independently of the Economy. Thus, despite what your gut instincts tell you, shorting this market is the last thing you should do.

Mass psychology clearly states that markets only top when the masses are euphoric; the masses are nowhere near jubilant. One could argue they are either pessimistic or sitting in a neutral camp.

The Fed hike is nothing to fear, and as we have stayed all along, it is a non-event as, as we indicated in the article titled “Oops, we did it again; the Fed is setting up the masses for another stimulus program” and in a follow-up article titled when the Fed will raise interest rates.

Interest rates were raised and proved to be a non-event, just as we predicted. They raised rates to make the masses think they believe the crap they are dishing out about an improving economy.

Americans prefer coffee over Investing.

For crying out loud, more Americans drink coffee than have money invested in the market. It is estimated that, on average, Americans spend $1200 on coffee. If that money had been invested in the stock market in 2009, it would have grown to $3600.

Our latest sentiment poll shows that over 73% of investors fall into the neutral and bearish camps. A market never tops out when the masses are not bullish.

Therefore, while many fundamental factors state that the markets are destined to crash, the only thing that will hit is the egos of those making these stupendous claims.

The stock markets will not crash; they are destined to trend a lot higher. Our mantra to our subscribers in 2015 was to view every pullback as a buying opportunity as the trend (per our proprietary trend indicator) is up. Until it turns negative, the market will not crash.

The ride-up will be volatile as our V indicator has just surged to new highs; this indicator measures market volatility.

The latest reading stands at a whopping 3820; the extreme range is 2700, so this indicator trades over 1120 points above the severe range. We have raised the extreme range several times, but this indicator keeps soaring to new highs. While the markets are expected to trend upward into 2016, many sectors will get decimated, so you need to know which industries and what stocks to focus on for the next leg up.

Originally published on Jan 10, 2016, and subsequently updated in Jan 2024, this article offers enhanced insights and analysis.

Other articles of interest:

Meet the dollar vigilantes

How To Be Happy: Epicurus Had The Answer 1700 Years Ago