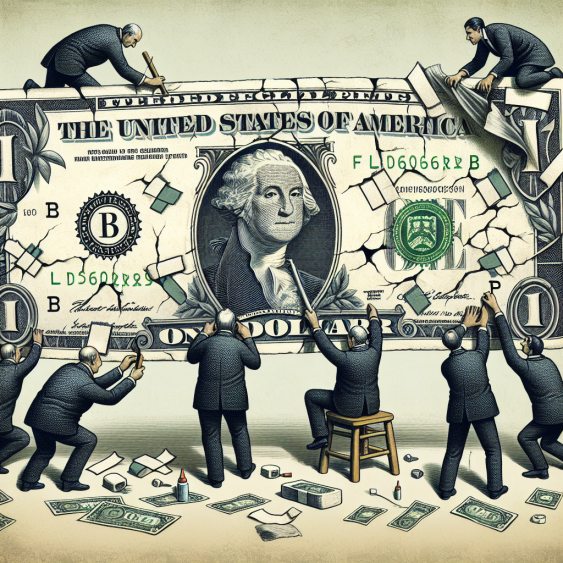

US Dollar Devaluation: How the Fed Quietly Robs Your Wealth

May 15, 2024

In the shadowy corridors of economic policy and monetary control, the Federal Reserve is an immense power figure. Since the United States abandoned the gold standard in 1971, the Federal Reserve has wielded its authority to manipulate the money supply, ostensibly to stabilize the economy. However, this manipulation has led to the devaluation of the U.S. dollar, effectively robbing the masses of their wealth.

This essay will delve into the insidious ways the Federal Reserve, with the tacit approval of the U.S. government, has been eroding the dollar’s purchasing power, imposing a “silent killer tax” on the populace, and creating an illusion of strength through currency manipulation. Additionally, we will explore how individuals can protect themselves through strategic investments that outpace the rate of monetary destruction.

The Great Devaluation: A Historical Perspective

The abandonment of the gold standard in 1971 marked a significant shift in U.S. monetary policy. Before this, the dollar was backed by a tangible asset, gold, limiting the government’s ability to print money indiscriminately. Once the gold standard was abandoned, the Federal Reserve could increase the money supply. This led to an era of fiat currency, where the value of money is not derived from physical commodities but from the government’s declaration that it holds value.

Renowned economist Milton Friedman once remarked, “Inflation is always and everywhere a monetary phenomenon.” By this, he meant that inflation results from increased money supply. Since 1971, the U.S. money supply has increased exponentially, leading to a corresponding dollar devaluation. To put this in perspective, the purchasing power of $1 in 1971 is equivalent to approximately $6.50 in 2024. This means the dollar has lost over 80% of its value in just over 50 years.

The Silent Killer Tax: Inflation as Double Taxation

Inflation acts as a “silent killer tax” that erodes the value of money over time. This phenomenon is particularly insidious because it affects everyone, regardless of income level, and is often unnoticed until its effects are devastating. When the Federal Reserve increases the money supply, the value of each dollar decreases. This devaluation means that consumers need more dollars to purchase the same goods and services, effectively reducing their purchasing power.

Experts like Nobel Laureate economist Milton Friedman argue that inflation is a form of double taxation. Not only do individuals pay taxes on their income, but they also lose purchasing power due to inflation. This “tax” is not legislated or debated in Congress; the Federal Reserve’s monetary policies impose it. The erosion of purchasing power is akin to the government dipping into citizens’ wallets without their consent.

The Illusion of a Strong Dollar

A common misconception is that the U.S. dollar is substantial compared to other currencies. While it is true that the dollar often performs well in foreign exchange markets, this strength is an illusion when considering domestic purchasing power. The dollar’s strength against other currencies does not reflect its ability to buy goods and services within the United States.

For instance, during the financial crisis of 2008, the U.S. dollar appreciated against many other currencies as investors sought a safe haven. However, domestically, the dollar’s purchasing power continued to decline. This paradox highlights the difference between exchange rate strength and real purchasing power. As inflation rises, the cost of living increases, and the average citizen finds their dollar buys less and less.

The Impact on Wealth

The dollar’s devaluation has far-reaching implications for individual wealth. Due to inflation, savings held in cash or low-interest-bearing accounts lose value over time. This devaluation disproportionately affects the middle and lower classes, who are less likely to own assets that appreciate.

Wealthier individuals often invest in stocks, real estate, and other investments that tend to outpace inflation, thereby preserving and growing their wealth. Therefore, the Federal Reserve’s policies contribute to the widening wealth gap in the United States. By inflating the money supply, the Fed devalues the currency, eroding the average worker’s savings while benefiting those who can invest in inflation-resistant assets.

Protecting Wealth through Strategic Investments

Given the Federal Reserve’s propensity to devalue the dollar, individuals must adopt strategies to protect their wealth. One practical approach is investing in assets that appreciate faster than the inflation rate. Stocks, real estate, and certain commodities have historically outperformed inflation, making them attractive options.

Mass Psychology and Market Crashes

Understanding mass psychology is crucial when navigating investments. Fear and panic often drive prices to artificially low levels during market crashes. Savvy investors recognize these downturns as opportunities to buy undervalued assets.

Warren Buffett, one of the most successful investors of all time, famously advised, “Be fearful when others are greedy and greedy when others are fearful.” For example, during the 2008 financial crisis, stock prices plummeted. Investors with the foresight and courage to buy during this period reaped significant rewards as the market rebounded. The same principle applied during the COVID-19 pandemic, when stocks initially dropped but then experienced a rapid recovery due to unprecedented monetary and fiscal stimulus.

Diversification and Asset Allocation

Diversification is another critical strategy for protecting wealth. By spreading investments across various asset classes, individuals can mitigate risk and reduce the impact of any investment’s poor performance. A well-diversified portfolio might include stocks, bonds, real estate, precious metals, and even cryptocurrencies. Precious metals, such as gold and silver, have long been considered safe havens during times of economic uncertainty. They tend to retain value when fiat currencies lose purchasing power. Cryptocurrencies, though more volatile, offer another avenue for diversification. Bitcoin, for instance, has been touted as “digital gold” due to its limited supply and decentralized nature.

Conclusion: The Need for Vigilance and Adaptation

The Federal Reserve’s manipulation of the money supply has led to the devaluation of the U.S. dollar, effectively robbing citizens of their purchasing power and wealth. This devaluation acts as a “silent killer tax,” eroding savings and disproportionately affecting those who cannot invest in inflation-resistant assets. The illusion of a strong dollar in foreign exchange markets masks the reality of declining domestic purchasing power.

To protect oneself from the ravages of inflation, individuals must adopt strategic investment approaches. Investors can preserve and grow their wealth despite the Federal Reserve’s policies by understanding mass psychology, recognizing opportunities during market crashes, and diversifying their portfolios. In a world where the value of money is continually undermined by those in power, vigilance and adaptation are essential. By staying informed and proactive, individuals can navigate the complexities of the financial system and safeguard their financial future from the silent erosion of their wealth.

Other Stories of Interest