Disciplined Growth Investors Don’t Make Bearish Beats

21 Apr, 2023

Disciplined growth investors focus on long-term growth in their investments rather than short-term gains. They take a measured and strategic approach to investing, seeking to identify high-quality companies with strong fundamentals and long-term growth potential. They also tend to have a higher risk tolerance and are willing to weather short-term market fluctuations for the potential of long-term growth.

These investors generally do not short the Market as part of their disciplined approach. This is because the risk vs reward is not in their favor. Shorting can be profitable in the short term, but the profit potential is limited, and the risk is unlimited. Instead, these investors focus on identifying long-term investment opportunities that will provide sustainable growth over Time.

This approach is supported by the principles of mass psychology, which suggest that astute investors should not short the markets as it is akin to gambling. Instead, they wait until the masses are buying or experiencing FOMO (fear of missing out) before taking the opposite position. Conversely, when the masses are panicking and selling, these investors look for opportunities to buy quality companies at a discount.

It is important to note that this approach requires patience and discipline. When the Market experiences short-term pullbacks or corrections, disciplined growth investors stay the course and hold onto their investments, knowing that the Market will eventually recover. This approach is supported by historical data, which shows that over the long term, the Market tends to trend upward.

In contrast, those who short the Market may make quick gains in the short term but are more likely to suffer significant losses over Time. This is particularly true during a bull market when the odds of making a comeback after shorting are slim.

Let’s look at two examples:

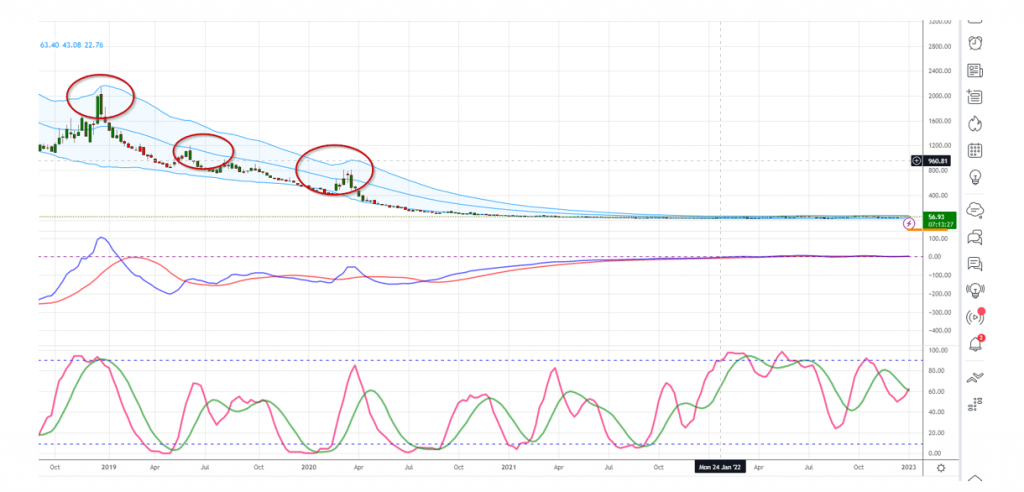

Monthly Chart of SQQQ (bearish fund)

If you held SQQQ through thick and thin, you would have been blown out of the water and probably out of this solar system. Despite all the pullbacks the Market has experienced, ranging from mild to insanely wild, SQQQ has dropped from 2,000 to 55.17. Contrast that with its sister fund, TQQQ.

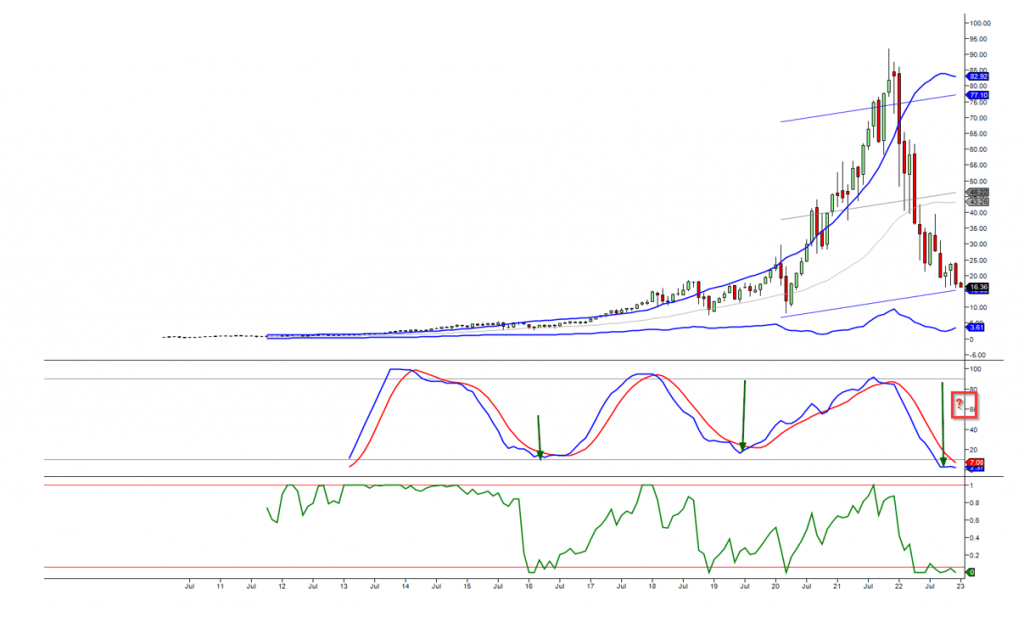

The Monthly Chart of TQQQ: A Nearly Assured Recovery

The odds of recovering are close to 90% if you don’t panic; look at the above chart. You can make even more if you open additional positions when the Market is trading in the highly oversold zone, as indicated by the green arrows.

Bears can make money, but they need to be fast and nimble, or they won’t last. On the other hand, bulls have Time on their side, a luxury no bear will ever have.

If we were doing the reverse, shorting in a bull market, we would be dead in the water as the odds of making a comeback would be extremely slim. TQQQ will recoup its losses and then some, but the same cannot be said of SQQQ, which has lost over 90% since Dec 2018.

Disciplined growth investors understand the value of Time in the Market versus timing the Market. They focus on identifying quality companies with long-term growth potential and avoid short-term trading strategies that carry significant risk. By taking a strategic and disciplined approach to investing, they can achieve sustainable growth over Time and avoid the pitfalls of short-term market fluctuations.

Conclusion

Disciplined growth investors understand the value of time in the market versus timing the market. By focusing on long-term growth and avoiding short-term trades like shorting, they can improve their odds of success. The risk-reward ratio of shorting is often not in their favour, as shorting carries significant risks and limited profit potential.

Mass psychology also plays a crucial role in the approach of disciplined growth investors. They recognize that waiting for the masses to exhibit FOMO (fear of missing out) before taking the opposite position can be a more strategic move. This approach aligns with the principles of contrarian investing, where investors seek opportunities when the masses are panicking and selling and look for quality companies at discounted prices.

It is important to note that investing with discipline and a long-term perspective requires patience and resilience. Short-term market fluctuations and pullbacks are expected, but disciplined growth investors stay the course, knowing that the market tends to trend upwards over the long term.

As the famous quote by Michael Montaigne suggests, “The greatest thing in the world is to know how to belong to oneself.” This sentiment resonates with disciplined growth investors who understand the importance of staying true to their investment strategies and not being swayed by short-term market noise.

In conclusion, disciplined growth investors prioritize long-term growth over short-term gains. They avoid shorting the market and instead focus on identifying quality companies with long-term growth potential. By taking a strategic and disciplined approach to investing, they can navigate market fluctuations and increase their chances of achieving sustainable growth over time.

FAQ’s

| Question | Answer |

|---|---|

| What are disciplined growth investors? | Disciplined growth investors focus on long-term growth in their investments rather than short-term gains. They take a measured and strategic approach to investing, seeking to identify high-quality companies with solid fundamentals and long-term growth potential. |

| Why do disciplined growth investors generally not short the Market? | Shorting can be profitable in the short term, but the profit potential is limited, and the risk is unlimited. Instead, these investors focus on identifying long-term investment opportunities that will provide sustainable growth. |

| What is the approach supported by the principles of mass psychology? | Astute investors should not short the markets as it is akin to gambling. Instead, they wait until the masses are buying or experiencing FOMO before taking the opposite position. Conversely, when the masses are panicking and selling, these investors look for opportunities to buy quality companies at a discount. |

| What is the key to success for disciplined growth investors? | This approach requires patience and discipline. When the Market experiences short-term pullbacks or corrections, disciplined growth investors stay the course and hold onto their investments, knowing that the Market will eventually recover. |

| Why is shorting the Market more risky than investing for long-term growth? | Those who short the Market may make quick gains in the short term but are more likely to suffer significant losses over time. This is particularly true during a bull market when the odds of making a comeback after shorting are slim. |

Discover More: Stimulating Articles That Will Captivate You

Investment Pyramid: A Paradigm of Value or Risky Hail Mary?

Contrarian Investing: The Art of Defying the Masses

Quantitative Easing: Igniting the Corruption of Corporate America

Blooms and Busts: Navigating the Tulip Bubble Chart Phenomenon

Uranium Market Outlook: Prospects for a Luminous Growth Trajectory

Stock Investing for Kids: Surefire Path to Success!

An Individual Who Removes the Risk of Losing Money in the Stock Market: A Strategic Approach

Palladium Forecast: Unveiling the Stealth Bull Market

I Keep Losing Money In The Stock Market: Confronting the Stupidity Within

Analyzing Trends: Stock Market Forecast for the Next 6 Months

AMD Stock Forecast 2024: How MACDs & RSI Signal a Bottom

Market Mastery: The Best Investing Books for Your Success

Example of Groupthink: Mass Panic Selling at Market Bottom

Contrarian Thinking: The Power of Challenging the Status Quo