Deflation economics: Data manipulation at its best.

Updated Aug, 2024

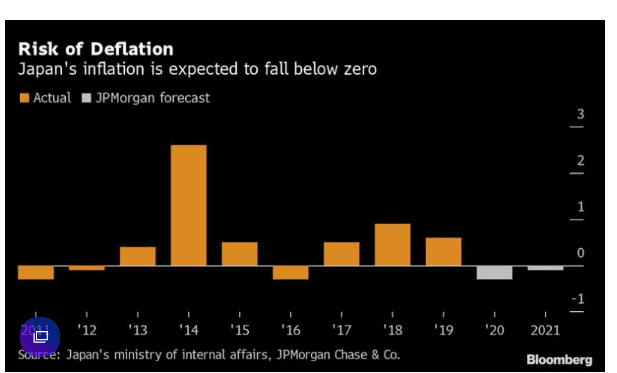

The Bank of Japan has long tried and failed to hit its target of 2% annual inflation. Still, the coronavirus means the topic has faded from a conversation, a sign a permanent shift in priorities is possibly underway.

“The price target has been put on the back shelf,” said economist Izuru Kato, president of Totan Research Co. “The target will probably become an even longer-term goal after the pandemic, which means the policy will likely be less focused on it.”

Recent, subtle shifts in the BOJ’s public communications suggest any new measures adopted at its April 27-28 meeting will likely focus on stabilizing financial markets and getting credit to companies rather than more measures meant to spur prices. https://yhoo.it/35iJkLg

This is the situation much of the world is going to find itself in despite all the claims the experts have been making about inflation raising its ugly head. We have been stating for quite some time now that inflation is not an issue, and the deflation argument that appeared insane yesterday will start to gain traction shortly. Market Update May 2, 2020

China’s factory gate prices fell the most in five months in March, with deflation deepening and set to worsen in coming months as the economic damage wrought by the coronavirus outbreak at home and worldwide shuts down many countries.

Friday’s National Bureau of Statistics data suggested a durable recovery was some way off. China’s producer price index (PPI) fell 1.5% from a year earlier, the biggest decline since October last year. It compared with a median forecast of a 1.1% fall tipped by a Reuters poll of analysts and a 0.4% drop in February. https://reut.rs/2xif2f8

Deflation economics: Supposedly, inflation is not an issue

Inflation will not be a real issue; by a real problem, we refer to the manipulated data the government has been putting out. Anyone with common sense can see that inflation is confirmed when you look at housing, education, health care, groceries, etc.; all these items have soared over the years. However, we are not concerned with what bright individuals can see; we focus on what the masses see and digest, for the mass’s misperception of a given situation leads to the next opportunity. Case in point, the groups thought the markets would crash on a Trump win, so we issued a buy signal in the event Trump won, for we did not know whether he would win. However, one will see the full force of inflation in the stock market as we expect the market to surge to levels never seen before.

What we did know was that if he won, it would create a great buying opportunity due to the shock effect. We used the same playbook for the coronavirus pandemic; this manufactured crisis has created an even greater buying opportunity. We are dangerously close to a “MOB” (mother of all buy) signal. Whatever outcome the masses latch onto, one thing is sure. The opposite will most likely come to pass.

Research on Deflation Economics

Deflation is when the general price level of goods and services in an economy falls. It occurs when there is a decrease in demand, an increase in supply, or a combination of both. Deflation is usually seen as a negative phenomenon because it can reduce economic output, lower profits, and even widespread debt defaults.

In deflationary environments, investors tend to become more risk-averse and favour assets that preserve their value over time. Cash, government bonds, and other safe-haven assets become more attractive as they tend to appreciate as prices fall.

One way to make money in deflationary markets is to invest in assets that have a low correlation with traditional asset classes. These assets include gold, cryptocurrencies, and alternative investments such as real estate and collectables. These assets may perform well during deflationary periods because they are seen as a store of value that can hold their purchasing power over time.

Investing in defensive or recession-proof stocks is another way to make money in deflationary markets. These stocks tend to be in sectors such as utilities, consumer staples, and healthcare, less affected by economic downturns. These stocks may perform well in deflation as consumers focus on essential goods and services.

It is important to note that deflationary environments can be unpredictable and difficult to time. Therefore, investors should continuously diversify their portfolios and not rely on a single asset or strategy.