Contrarian Thinking: How to Challenge the Status Quo and Succeed

Sept 30, 2025

Introduction: Contrarian Warfare: Vector Power Against the Sleeping Crowd

The Shape of Rebellion: When the crowd sleeps, it isn’t resting. It’s surrendering. Consensus is a narcotic. It numbs the senses, dulls the blade, and breeds a dangerous illusion: that safety lies in numbers. But the market, like power itself, is not democratic. It rewards clarity, not conformity. It crowns those who see when others stare.

Contrarian thinking is not rebellion for its own sake. It’s a weapon forged through friction—a disciplined instinct to probe where the collective mind refuses to look. It’s not walking against the herd; it’s cutting through it with the precision of a strategist who understands the battlefield is psychological before it’s financial.

The crowd worships comfort—contrarians study pressure. Where most see smooth trends, the contrarian sees the hidden vector beneath—sentiment compressing like a coiled spring, waiting for a catalyst to release it. This is not guesswork; it’s a trained reading of mass behaviour, where conviction turns into blindness and narratives ossify into traps.

Psychological Terrain: Where the Crowd Loses Its Edge

Mass psychology follows a timeless arc. First comes euphoria, where perception outruns reality. Then, narrative ossification, where stories replace analysis. Then stillness: the herd freezes, convinced of its safety. That is the most dangerous moment—not the crash, but the quiet before it, when the vector shifts beneath their feet.

Great strategists throughout history understood that wars are won before the armies clash—through positioning, deception, and tempo. Contrarians do the same. While the crowd is busy interpreting price as truth, the contrarian watches how people interpret price. Sentiment becomes signal.

Contrarian thinking begins with a refusal to accept inherited assumptions. It questions everything, including its own bias. This is not romantic defiance; it’s the psychological discipline of walking into fog with eyes wide open. Like a seasoned commander assessing the terrain before the first arrow flies, the contrarian maps the mental battlefield—fear clusters, greed peaks, complacency plateaus.

Breaking the Status Quo Before It Breaks You

The status quo is never neutral. It’s a force, a current pulling minds toward the path of least resistance. To challenge it is to fight inertia itself. The crowd mistakes the current for destiny; the contrarian recognises it as a temporary structure.

Strategic dissent is not loud; it’s surgical. It identifies where the crowd’s confidence is built on sand. It isolates weak pillars—valuation stretched by story, liquidity supporting narratives that no longer have cash flow beneath them, foreign capital flowing in as if gravity has been repealed.

This is the essence of contrarian warfare: attack where conviction is strongest and reality is weakest. You don’t challenge everything. You pick your points—vectors where psychology is most brittle.

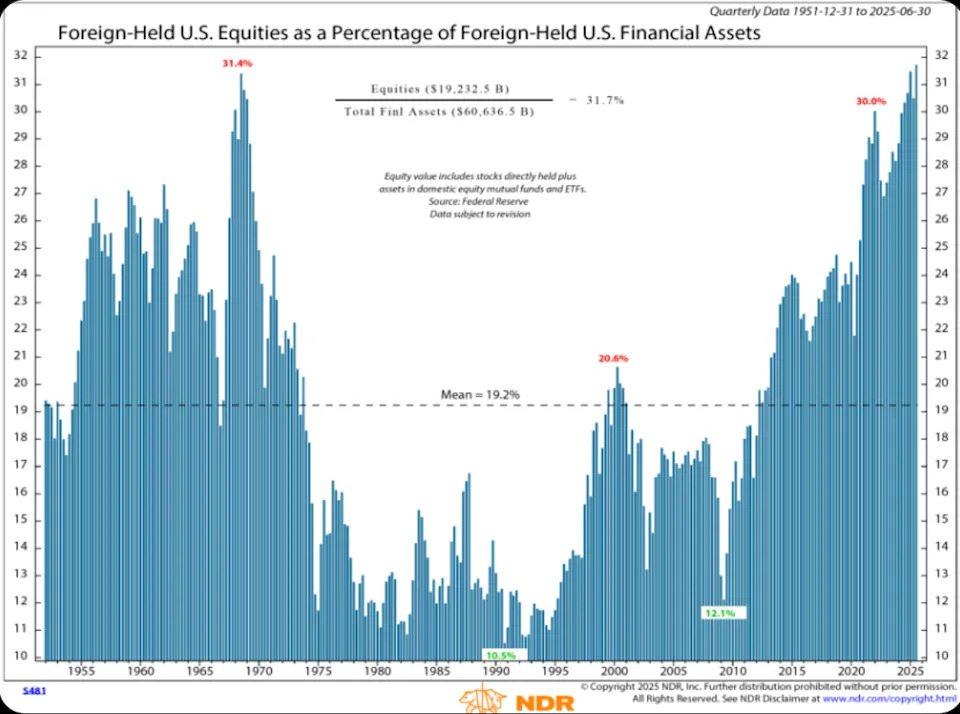

When inflation doubled and deficits swelled in the late 1960s, most investors ignored it. Narratives were thick; sentiment was euphoric. A small minority positioned ahead of the turn, not through clairvoyance, but through disciplined dissent. The same patterns reemerge again and again: crowd overconfidence, foreign capital concentration at extremes, policy crosswinds, currency inflexion points. These are not random. They are psychological fingerprints.

The Vector Mind: Thinking Like a Commander, Not a Spectator

Contrarian thinking requires more than scepticism; it demands vectoral clarity—understanding both magnitude and direction of psychological flows. Most investors are spectators. They watch prices. Contrarians operate like battlefield commanders, assessing terrain, morale, timing, and supply lines.

Where the crowd sees a rising market, the contrarian dissects why it’s rising. Is it genuine earnings power or narrative momentum? Is liquidity expanding or being recycled? Are foreign flows entering because of conviction or because everything else looks worse?

Commanders don’t march headlong into fortified lines; they probe for weak flanks. Contrarians don’t short bull markets blindly—they look for points where mass conviction has no oxygen behind it. Then they strike with timing, not emotion.

This is why the best contrarian thinkers combine intellectual ferocity with emotional detachment. They understand that mass psychology moves in waves, and their job is not to moralise about it but to position ahead of it. The crowd reacts; the contrarian anticipates.

The Crowd’s Blind Spot: Comfort as Death

The crowd doesn’t fall because it’s stupid. It falls because it’s human. It seeks comfort in sameness, authority, and repetition. The more people agree, the safer they feel, and the more dangerous the structure becomes.

When foreign allocations to U.S. equities climb to historic extremes, when deficits widen while narratives stay bullish, when cash flows trail price but nobody cares—that’s not strength. That’s altitude. And altitude is not neutral. Altitude dictates what happens next.

Contrarian warfare begins the moment you stop treating consensus as truth and start treating it as terrain. The herd is not your enemy; it’s your map. Their comfort shows you where the cracks will appear.

Historical Echoes: Patterns Beneath the Noise

Every era believes it’s unique. Every crowd thinks “this time is different.” Yet the psychological vectors repeat. When foreign concentration peaked in 1972, the market drifted upward, while inflationary pressure quietly intensified. The pullback that followed wasn’t random—it was structural. In 2000, concentration reached similar heights, and narratives about a “new economy” drowned out basic arithmetic. The turn came suddenly, not because of a single shock, but because mass psychology flipped—from unshakable belief to collective doubt.

The present moment hums with similar frequencies. The Joy indicators are flat, sentiment is suspended, foreign holdings are back at extreme altitudes, and liquidity props up stretched valuations. The crowd isn’t euphoric; it’s anaesthetised. And anesthetized crowds are brittle.

Turning Pressure into Position

Mass psychology is like tectonic plates: movement builds slowly, pressure accumulates invisibly, then everything shifts in a single violent motion. Most traders stand on the surface listening to narratives, not feeling the tremors beneath. Contrarians live underground. They map the fault lines, they measure the strain, they wait for the snap.

This is not mysticism. It’s strategic patience. Every great commander understood that battles are not won by charging early but by waiting until the enemy is overextended, blind to their own vulnerability. Contrarian investors apply the same discipline: they wait for the crowd’s conviction to outpace reality, then they act with precision.

The Contrarian Playbook: Precision Against the Crowd

Contrarian investing isn’t about reflexively opposing the majority. That’s as shallow as blindly following it. True contrarianism is vectoral: it measures sentiment, liquidity, valuation, and narrative strength like a commander assessing troop morale, supply lines, terrain, and timing.

Step One: Identify Psychological Extremes

Look for moments when market behaviour no longer matches economic or structural reality. Examples: foreign holdings of U.S. equities at record concentrations; deficits ballooning while investors dismiss inflation as “transitory”; valuation stretched on the back of seven stocks carrying the entire index. These are not signs of strength; they are pressure points.

Step Two: Separate Narrative Momentum from Structural Support

Crowds follow stories. Contrarians follow cash flows and policy crosswinds. Liquidity is the sculptor, valuation is the marble. When price rises because liquidity swells, the crowd mistakes that for fundamental validation. The contrarian knows better. They don’t fight the trend too early—they position for the turn.

Step Three: Deploy with Surgical Discipline

Contrarian positions aren’t sledgehammers; they’re scalpels. Size gradually, scale in at vector inflection points, and use liquidity traps to your advantage. When the crowd panics at shadows, contrarians buy selectively. When the crowd becomes euphoric again after a relief rally, contrarians quietly prepare for the next break.

Mass Misreads: How the Crowd Trips on Its Own Conviction

The crowd misreads two critical moments almost every cycle: the sharp pullback and the true fracture. The first is violent but temporary. It’s designed to flush weak hands, test conviction, and redistribute assets from the emotional to the strategic. Most mistake this for the end. They sell in fear, certain the world is collapsing, blind to the fact that the real break is still ahead.

The second moment, the true fracture, comes later—when liquidity fades, narratives crack, and foreign capital starts sprinting for the exits. By then, the crowd is exhausted. They already panicked earlier. Their emotional ammunition is spent. This is where contrarians strike hardest, not because they are braver, but because they are better prepared.

We’re approaching one of those setups now. The next pullback may look vicious, but it’s likely a feint, not the fracture. The real dislocation is more probable in 2026, when fiscal and monetary crosswinds, stretched foreign exposure, and valuation gravity converge. The crowd will see the first tremor and scream “crash.” Contrarians will see the vector and sharpen their knives.

Discipline and Patience: The Twin Blades

Contrarian success is not built on prediction; it’s built on discipline and patience. These are the twin blades that cut through the crowd’s noise.

Discipline means following mass psychology, not opinion. It means acting on signals, not ego. It means accepting that you can be early, wrong, or alone—but never sloppy.

Patience is what turns knowledge into profit. Most cannot wait. They chase momentum, fear missing out, or capitulate under pressure. Contrarians wait for the tide to shift in their favour. It always does, but only for those who can hold their ground while the crowd fidgets.

History is littered with brilliant contrarians who were right too soon and broke themselves on timing. The art lies in vector discipline: not fighting the wave, but positioning for when it breaks.

Strategic Scenarios: Mapping the Battlefield Ahead

- Mean Reversion Scenario

Foreign equity allocations drift back toward the 19% historical mean from 31%. Valuations compress, narratives weaken, but liquidity support softens the descent. This is controlled withdrawal—a grinding market that punishes both impatience and euphoria. - Stress Scenario

Dollar peaks unwind, margins compress, and foreign allocations reverse sharply, echoing the 1973–74 slide. Allocations revisit 10–12%, valuations collapse, and narratives implode. The crowd calls it a black swan; the contrarian calls it a map playing out. - Stabilization Scenario

Aggressive liquidity support and coordinated fiscal action slow the unwind. Multiples compress, but panic is contained. Foreign flows adjust more gradually. A slower vector shift, but the pressure remains—it doesn’t vanish.

Contrarians prepare for all three, but position emotionally for the second. Not because it’s guaranteed, but because it’s where the most fragile beliefs break.

The Edge of Dissent

Contrarian warfare is not glamorous. It’s uncomfortable, lonely, and psychologically brutal. It means standing still while the crowd stampedes, keeping your blade sharp while others chase easy narratives. But history is unequivocal: every era of extreme concentration, complacent sentiment, and currency inflexion ends not with a whimper, but with a snap.

Foreign flows follow price until the terrain shifts. Then they reverse fast. The Fed can mitigate the impact, but it cannot suspend the laws of gravity. Altitude dictates the script. Right now, we are at rarefied heights.

This is not about fear. It’s about clarity. The crowd seeks comfort; contrarians seek vectors. The crowd reacts; contrarians anticipate. The crowd survives cycles; contrarians shape them.

The next sharp pullback will scare the masses. The real fracture will test everyone. Those who’ve mapped the psychological terrain and positioned with discipline will not just endure—they will strike.