India vs China Economy

Editor’s note: The National People’s Congress (NPC), China’s top parliamentary body, and the Chinese People’s Political Consultative Conference (CPPCC), China’s full political advisory body, convene its annual sessions, known as the “two sessions” on March 3-15 2016, which marks a pivotal year as the nation continues on to embark with its reforms and opening-up policy, shifting towards a “New Normal” for economic growth rates, starting its 13th Five-Year Plan for social and economic development over the next five years and confronting challenges on the foreign policy front.

How will the NPC address those concerns? What do foreign experts and Overseas Chinese say? The Panview Column of CNTV has invited some of them to express their views on significant issues to be discussed at the two ongoing sessions.

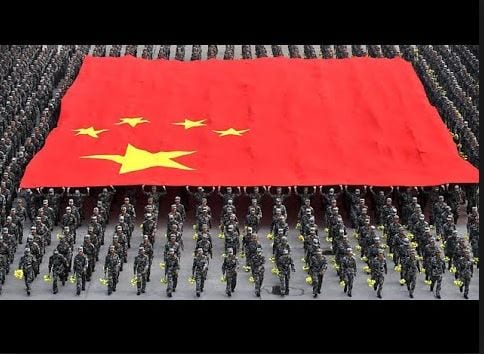

The countries -China and India – share a common land border, and as such, they enjoy historic relations of friendship. Yet, regarding Major Country diplomacy, there are moments when disagreements ensue between Beijing and New Delhi. Nevertheless, both sides support peaceful development and mutual respect and winning benefits helps both nations strengthen their economies.

The two countries respect each other’s sovereignty, traditions, and customs. As China, the world’s second-largest economy continues to rise in prosperity and status in the international community, it’s inevitable that India will also seek to boost its economy and global influence as well.

Perhaps an economic rivalry has developed between Beijing and New Delhi. Still, it’s a “neighbourly friendship” competition that encourages both sides to rise to the challenge of developing their economies to achieve more substantial results.

India vs China Economy: India is Catching Up But Not Fast Enough

Now, India, which has witnessed higher annual gross domestic product (GDP) growth rates in recent years, is beginning to feel confident that it could possibly have a more robust economy than China in the near future. But is that possible? Well, let’s take a closer look.

India holds aspirations to overtake China, but this may not be realistic. When you consider the traffic jams and urbanisation problems in parts of Mumbai and New Delhi, investing in India loses some of its appeal.

Indian Prime Minister Narendra Modi’s government has enjoyed the strongest mandate of any government, yet he has failed to implement any noteworthy reforms yet.

This century belongs to China, and the world recognises this.

No one flinches when Indian markets are crashing, but if the Chinese markets fall or there is some bad news coming out of China, the world’s financial markets react in a powerful manner.

From a mass psychology perspective, this tells us that the financial markets recognise China as the de facto leader. If lucky, India might hold onto some position in the top 5. India will not take out China in the near future, but that does not mean one should not invest in Indian companies.

There are still some Indian companies that are worth investing in. We would wait for strong pullbacks before committing money to these stocks.

India vs China Economy: The Conclusion

While the Indian economy has expanded nicely over the years, we think the tiger will have difficulty dethroning the Golden Dragon. India has a GDP of roughly $2.1 trillion, far from China’s current GDP of $11.3 trillion.

It’s not even a close race. The odds are higher that China will displace the US as the top economy India, overtaking China. While there are some great companies in India from a long-term perspective, China makes for a better investment as the market is highly oversold; great companies are selling for a fraction of their former prices. For example, CHH, HNP and BABA are some companies worth closely examining.

Other Stories:

Perfect Scam; Central Banks Print Money & buy bullion with it (March 10)

Achieve Financial Independence & retire Young by not being a Lemming (March 9)

Fed Will Shock Markets; Expect Monstrous Rally in 2016 (March 6)

How to Profit from Misery & Stupidity (March 4)

Religious wars set to Rip Europe Apart (March 4)

Oil prices: bottomed out or oil prices heading lower (Feb 28)