Bank Loans and Financial Freedom in USA: The Illusion of Prosperity

Oct 24, 2024

In the United States, the pursuit of financial freedom is often tied to the concept of bank loans. Gustave Le Bon’s insights into the psychology of the masses reveal a profound truth about human nature’s susceptibility to illusion. He once said, “The masses have never thirsted after truth. They turn aside from evidence not to their taste, preferring to deify error if error seduces them.” This tendency is evident in the collective attitude toward bank loans, frequently perceived as stepping stones to prosperity.

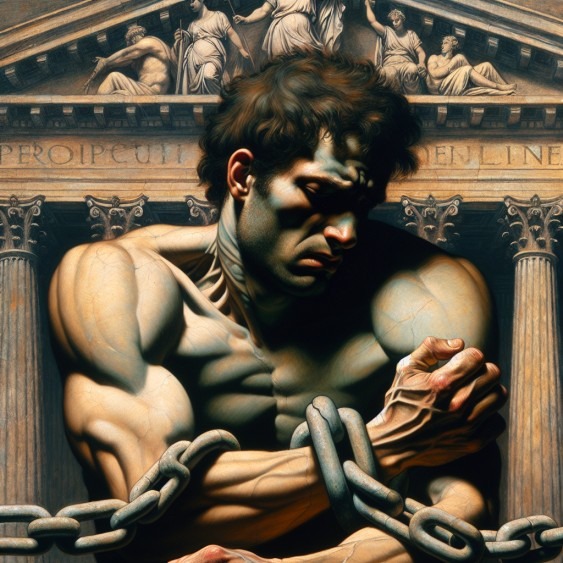

Le Bon would argue that the general public, acting as a crowd, may overlook the long-term implications of debt in favour of the immediate gratification that loans appear to offer. The collective mind, once seduced by the promise of easy credit, becomes less discerning of the chains that such financial obligations may forge. The civilization that prides itself on economic brilliance, much like the tower Le Bon describes, may not recognize its fragility—a fragility compounded by the weight of debt and the relentless pursuit of material wealth.

The concept of financial freedom through bank loans is thus a complex paradox. It is a mirage of wealth that can lead to an actual state of financial servitude, where the borrower becomes entangled in a cycle of repayment that can stifle true economic independence. The crowd, enchanted by the illusion of prosperity, may fail to appreciate the potential for enslavement by debt. It is a seductive error that promises liberation while potentially delivering bondage.

Le Bon’s perspective would urge a more critical examination of what constitutes genuine financial freedom. It would call for a discerning look beyond the immediate allure of loans and a thoughtful consideration of the long-term consequences of debt. In this light, the path to genuine financial autonomy may lie not in the accumulation of liabilities but in the prudent management of resources and the cultivation of financial acumen that sees beyond the crowd’s illusions.

The Upfront Interest Trap

Banks lend money to individuals, enticing them with the promise of financial freedom. However, they employ a cunning tactic: charging upfront interest. Philip Zimbardo, the American psychologist, explains, “The line between good and evil is permeable, and almost anyone can be induced to cross it when pressured by situational forces.” Banks pressure borrowers by front-loading interest payments, ensuring that most initial payments go towards interest rather than the principal. This leaves borrowers in a perpetual debt cycle, struggling to achieve financial freedom.

Real-life examples abound. Take the case of John, a small business owner who took out a $100,000 loan to expand his restaurant. Despite making regular payments for two years, John discovered that only a fraction of his payments had gone towards the principal. The bank had strategically structured the loan to maximize its profits at the expense of John’s financial freedom.

The Parasitic Nature of Banks

Cardinal Richelieu, the 17th-century French statesman, once remarked, “The art of politics is to make use of men, not to serve them.” Banks operate with a similar mindset, treating depositors as mere tools for their gain. When individuals deposit their hard-earned money into a bank, they receive negligible interest rates. However, when those same individuals seek to borrow money, banks are quick to charge exorbitant interest rates.

Sarah, a young professional, experienced this firsthand. After saving $20,000 over several years, she deposited her money into a savings account, earning a meagre 0.01% interest. When Sarah later needed a loan to purchase a car, the bank offered her an interest rate of 8%, a staggering difference compared to the interest they paid her on her deposit.

Fractional Banking and the Elimination of Reserve Requirements

Otto von Bismarck, the first Chancellor of the German Empire, once stated, “People never lie so much as after a hunt, during a war, or before an election.” Banks have been lying to the public about the true nature of fractional banking. In the past, banks were required to maintain a 10% reserve of deposits. However, this requirement has been eliminated, allowing banks to lend up to 100% of deposits.

This practice has severe consequences for financial freedom. Consider the story of Mark and Lisa, a couple who deposited their life savings of $50,000 into their local bank. Unbeknownst to them, the bank lent their entire deposit to multiple borrowers, creating money out of thin air. When Mark and Lisa attempted to withdraw their savings, they discovered that the bank had insufficient funds, as the money had been lent out multiple times.

The English statesman Thomas Cromwell once advised, “Do not meddle with the affairs of others, for he who does so will be meddled with in turn.” To achieve true financial freedom, individuals must take control of their financial affairs and not rely solely on bank loans.

This can be achieved through financial education, disciplined saving, and wise investments. By understanding the true nature of bank loans and the tactics employed by financial institutions, individuals can make informed decisions and work towards genuine financial independence.

Strategic Financial Maneuvering – A Machiavellian Approach to Banking

Machiavelli and Cardinal Richelieu, known for their intelligent political strategies, would likely appreciate the cunning required to navigate modern financial systems to one’s advantage. In the spirit of these historical figures, let’s explore some tactical approaches to outsmarting the banking system and advancing one’s financial freedom.

The Machiavellian Move: Leveraging Zero-Interest Loans

Machiavelli, who advocated for pragmatism and foresight in “The Prince,” might suggest taking advantage of zero-interest introductory offers on credit cards or loans. Using the bank’s interest-free money gives you a free loan for the promotional period. This could be used to purchase necessary items or invest in blue-chip dividend stocks, where returns could outpace borrowing costs. Cardinal Richelieu, a proponent of calculated risks, would advise this only if you’re confident you can repay the total amount before the promotional period ends, avoiding high interest rates that could negate any gains.

The Richelieu Route: Extra Mortgage Payments

Emulating Cardinal Richelieu’s strategic foresight and making extra mortgage payments can be a powerful tactic in homeowners’ financial arsenals. This method involves paying more than the required monthly instalment, directly reducing the loan’s principal balance. This effect is twofold: it diminishes the total interest accrued over the life of the loan and hastens the journey to outright homeownership.

The mechanics of this strategy are straightforward yet impactful. Each additional dollar paid towards the loan is a dollar less bearing interest, which can compound significantly over the typical span of a mortgage. This can result in a substantial reduction in the amount of interest paid over time. Furthermore, by accelerating the repayment schedule, borrowers can achieve financial freedom from their mortgage debt well before the standard term.

This approach does require a disciplined financial outlook. Homeowners must evaluate their budgets to ensure that the extra payments are feasible and sustainable over time. It’s a balancing act between current financial comfort and future financial gains. Those who can manage this balance may be free from the burden of mortgage debt ahead of schedule, opening up opportunities for other investments or economic pursuits.

Aggressive Debt Elimination: Modern Warfare

The Arbitrage Attack Strategy

– Use 0% balance transfer cards strategically

– Transfer high-interest debt to 0% cards

– Invest the interest savings in high-yield accounts (4-5% APY)

– Use earnings to accelerate debt payoff

– Example: $10,000 at 22% APR → 0% for 18 months saves $3,300 in interest

– Invest monthly savings of $183 at 4.5% APY = an additional $170 toward principal

The Payment Stacking Method

– Make bi-weekly payments instead of monthly

– Results in 13 monthly payments per year instead of 12

– Cuts 30-year mortgage to 26 years without refinancing

– Example: $300,000 mortgage at 6%

– Standard: $1,799 monthly

– Bi-weekly: $899.50 ($1,949 monthly equivalent)

– Saves $62,000 in interest

The Velocity Banking Technique

– Use HELOC or personal line of credit as a checking account

– Deposit entire paycheck against debt

– Use credit line for monthly expenses

– Money sits against the principal longer

– Can cut 30-year mortgage to 15-20 years

– Example: $200,000 mortgage with $8,000 monthly income

– Traditional: 30 years of payments

– Velocity: 17 years, saves $98,000 in interest

The Debt Recycling Strategy

– Convert non-deductible debt into tax-deductible debt

– Use home equity to invest in income-producing assets

– Rental property or dividend stocks

– Tax deductions + investment income accelerate debt payoff

– Example: $50,000 personal loan at 10%

– Convert to investment loan at 7%

– Tax deduction reduces the effective rate to 4.55%

– Investment returns of 8% create positive cash flow

These strategies require discipline and careful execution but can dramatically reduce debt burden without requiring additional income. The key is leveraging existing financial tools innovatively rather than just making regular payments.

Conclusion

The relationship between bank loans and financial freedom in the USA is complex, filled with hidden traps and deceptive practices. By shedding light on the upfront interest trap, the parasitic nature of banks, and the dangers of fractional banking, we can empower individuals to take control of their financial destinies and pursue true financial freedom.

Plato once remarked, “The measure of a man is what he does with power.” When applying this philosophy to financial dealings, one must act with integrity and foresight, using the ‘power’ of financial tools responsibly and strategically to build a stable future.

Key Strategic Imperatives:

– Understand and leverage consumer protection mechanisms

– Develop multiple income streams beyond traditional lending

– Build financial literacy as a cornerstone of wealth creation

– Maintain strategic control over debt utilization

The path to financial independence isn’t about avoiding the banking system entirely, but rather about using it strategically while maintaining vigilance against predatory practices. Success requires combining disciplined personal finance management with carefully utilising available financial tools and protections.

The future of financial freedom lies not in being debt-free alone but in building a robust financial foundation that can withstand market fluctuations and economic challenges while generating sustainable wealth. This requires defensive strategies against banking pitfalls and offensive moves toward wealth creation.

Other Reads