Stock Market Forecast Next 6 Months: Analyzing Trends and Predictions

April 13, 2025

Market Checkpoint: Trends Are Tightening, But Sentiment Isn’t Peaking

The RUT is overbought—but it’s pacing, not overheating. The SPX, Dow, and NDX are deep in the red zone technically, but something’s missing: euphoric sentiment. That divergence matters. When the charts scream sell, but the crowd isn’t buying the rally, that’s not the time to panic. That’s the time to stalk.

We’re eyeing a key psychological marker: bullish sentiment cracking above 60. Until that hits and sticks, even an “extremely overbought” index can stretch further. The easy money may be gone, but disciplined traders still have setups—just not the lazy, momentum-chasing kind.

Expect a shallow pullback of 450–550 SPX points unless something truly anomalous breaks loose. A deep dive below that range would require a cocktail of overstretched sentiment, negative divergences on the monthly chart, and a black swan to stir panic. Right now, the emotional climate doesn’t justify collapse.

The Dow Jones Utilities generates a buy signal on the monthly chart, which adds texture. Utilities often pivot before the broader market—and this one’s late to the party. If it hits the 990–1020 zone before equities correct, expect turbulence. Not a crash, but a test.

Tactical Blueprint: What If SPX Hits 5400–5500?

If this market grinds higher into Q3 and breaches the 5500 mark with weekly/monthly overbought readings and sentiment hanging in the 56+ range for weeks—watch your six. That’s not just ripe—it’s rotting. Add in negative divergence? Expect a dive to the 3900–4100 zone, minimum. If panic spreads and liquidity drains, even 3600 is back on the radar.

But don’t blink. Until this scenario confirms, it’s a watchlist—not a war cry. No reason to bolt. Let the masses fear shadows. You prepare for opportunity.

Mind Over Market: The Psychological Arsenal

Markets are driven by emotion, not math. Charts help. Indicators point. But it’s crowd psychology that detonates moves. Aristotle trusted the wisdom of crowds—he never saw a Reddit short squeeze or a crypto mania.

When sentiment peaks and everyone’s a genius, get cautious. When fear is thick, start buying. This isn’t about being right—it’s about being early.

Contrarians Hunt Alone

Chaos isn’t danger—it’s data. When the herd rushes left, look right. When they dump quality because headlines spooked them, grab it. Be the one pulling the trigger while others are paralysed. As Heraclitus said: “Change is the only constant.” Learn to surf it or get crushed by it.

Power Stocks: The War Chest

Forget the “hot picks” nonsense. Build your arsenal methodically:

- Sectors with tailwinds: AI, energy, defense, rare metals

- Balance sheets with muscle: cash-heavy, low-debt killers

- Moats: monopolies, brand loyalty, patents—unassailable edges

- Valuations that lie in your favor: P/E, P/B, and DCF set to detonate under the right conditions

- Technical cues: breakout patterns, MACD turns, moving average clusters—when psychology meets setup

The crowd misses these every cycle. Their loss. Your gain.

Strategy Over Predictions: How Real Winners Think

Short-term predictions are noise. Most “analysts” flip coins dressed in suits. Ignore their forecasts. Watch the trend. Study the macro. Track sentiment cycles. The only “edge” is emotional control paired with strategy.

The VIX? It’s not just a volatility gauge—it’s a weather report for fear. When it spikes, opportunity often follows.

As Graham taught: You’re either an investor or a gambler. The gambler guesses. The investor waits.

Long-Term Chart Mastery: Where Giants Place Their Bets

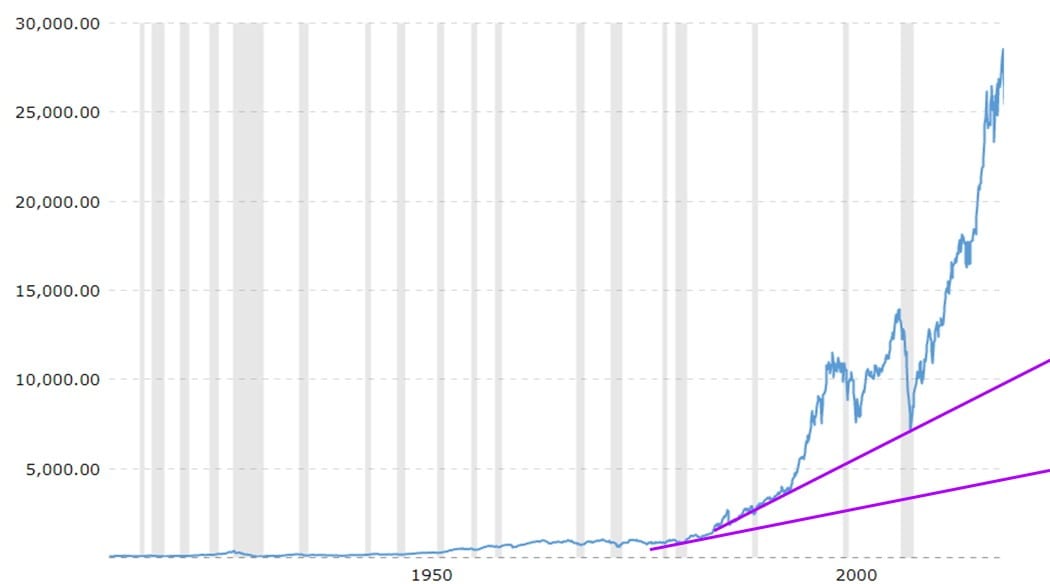

Draw a simple long-term trend line. That’s your map. Whenever price dips near or below it—especially in a 12–20 year chart—don’t hesitate. The bigger the deviation from the trend, the more outsized the opportunity.

Charts with decades of data—especially the one spanning 80+ years—highlight this clearly: pullbacks are rare moments of asymmetric reward. Use sentiment over 55 as your trigger. These are the moments you buy when others whimper.

Energy, Metals, and Bonds: Fuel for the Contrarian Inferno

When chaos reigns, energy becomes prophecy. Oil, coal, lithium, uranium, palladium—these aren’t just tickers, they’re the arteries of empire. The crowd scoffs at commodities while chasing digital ghosts, but the wise know: when the lights flicker, it’s the forgotten fuel that reclaims value.

This market isn’t efficient—it’s manic-depressive. Select sectors skyrocket on speculation while others rot in silence, smothered by media narratives and regulatory shadowplay. Perfect. Let them sleep. That silence? It’s where the alpha lives.

Bonds? They aren’t dead—they’re dormant predators. When yields spike and fear thickens, the crowd runs. That’s your cue to walk in. Not to play it safe—but to front-run the reversal. This is volatility as a weapon. This is timing over timidity.

Energy isn’t just a sector—it’s survival. Lithium feeds AI’s hunger, uranium powers the grid beneath the noise, and fossil fuels—reviled and essential—anchor the entire machine. Ignore the ESG lullabies. The contrarian sees through the green fog and loads up while the world hesitates.

The real play isn’t in momentum—it’s in anticipation. In the patience to wait while others flee, and the resolve to strike before the headlines catch up. Energy. Metals. Bonds. In this bipolar market, they’re not relics—they’re rocket fuel. But only for those with the guts to ignite them.

Conclusion: Mass Delusion, Whiplash, and the False Signal of Fear

Markets don’t crash in fear. They crash in overconfidence.

Panic isn’t the signal—it’s the purge after the signal was ignored.

The real move doesn’t start with terror. It starts with triumph.

When the crowd chants, “We figured it out. This time, we win.”

That’s the bait. That’s the beginning of the end.

COVID was the great rehearsal.

Fear was maxed. The crowd froze.

And yet… the market bottomed. Hard. Reversed. Exploded upward.

Because markets don’t collapse from fear. They collapse into it.

That’s the inversion nobody sees coming.

Everyone thinks fear = downside.

But in vector logic, fear is kinetic release. It clears the field.

True downside emerges when confidence ossifies—when belief calcifies into certainty.

Euphoria is the disease. Fear is the fever. And fever breaks.

And now?

The narrative grid is overloaded:

→ “End of empire.”

→ “Dollar is dead.”

→ “AI will eat the world.”

→ “Collapse is inevitable.”

Every new doomsday headline isn’t a warning—it’s an exhaust valve.

And when everyone is screaming collapse, it means something else entirely—

The selloff has already happened emotionally. The market is just catching up to the rebound.

Because bottoms aren’t logical. They’re emotional inversions.

And tops? They’re not euphoric parades.

They’re victory laps before vaporization.

You want to know when the hammer really drops?

When TikTok traders start lecturing the Fed.

When macro bros speak with the arrogance of prophets.

When retail doesn’t just play the game—they think they own it.

That’s the kill zone.

The vector lines converge: arrogance, over-leverage, false security.

But here’s the cruel trick—AI may buffer the blow.

The crash might not be cinematic.

It might be surgical, algorithmic, cold.

Less like a freefall.

More like an organ failure.

Still, there will be blood.

There’s always blood.

So what now?

Pullbacks = opportunities.

Because fear is trending.

Because doomsday is a brand now.

And when collapse becomes a narrative commodity, it’s no longer predictive—it’s priced in.

Crowds don’t chant bottoms. They scream past them.

And all those screaming prophets of doom?

They’re not ahead of the curve.

They are the curve.

A sine wave of herd mimicry, repackaged as insight.

They are not the ones calling the turn.

They’re the liquidity for the turn.

They’re not making noise.

They are the noise.