Warning Signs: Trouble for the American Economy

Updated May 30, 2023

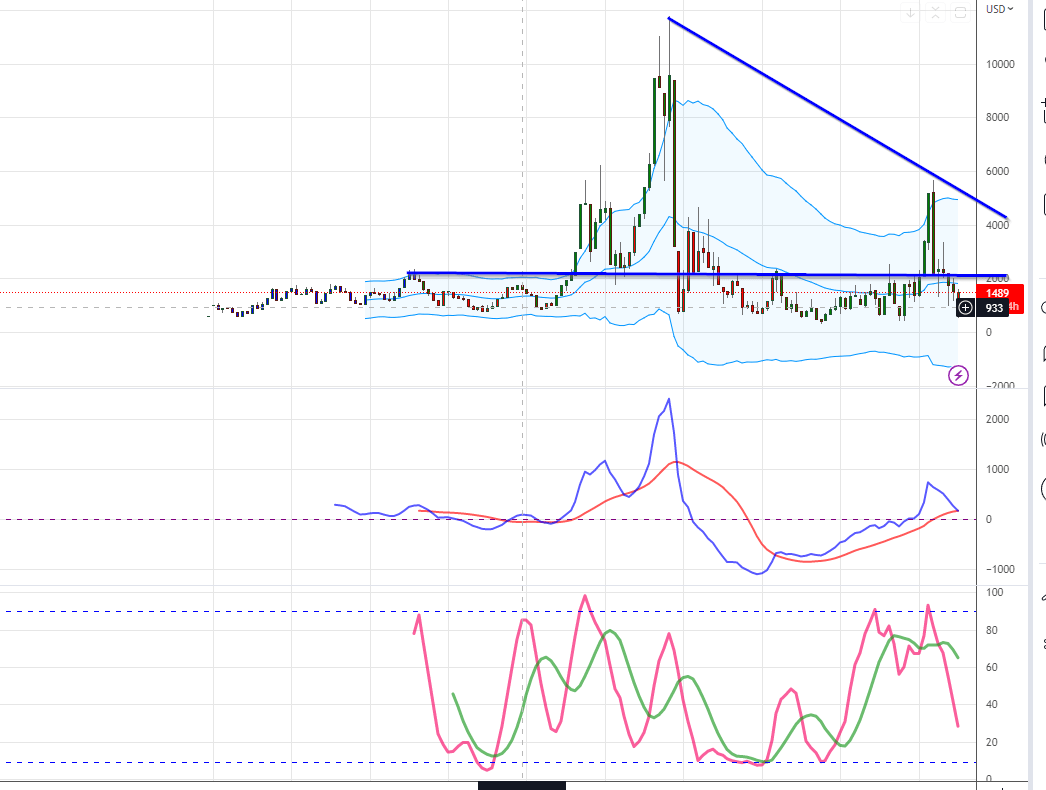

Utilizing a historical backdrop to reinforce this assertion, we find that little has shifted since our initial declaration years ago. The Baltic Dry Index is a steadfast economic gauge, yet it has consistently fallen short of revisiting its past peaks. This index, known as a pivotal leading indicator, unequivocally signals that without the infusion of liquidity, the Fed has undertaken since the 2009 financial crisis, we could have been mired in a severe recession.

Sustaining this economy’s vitality hinges on a continuous influx of funds. Although the Fed has momentarily halted its financial injections, it’s inevitable that they will curtail rate hikes, considering our annual interest payments already exceed a staggering 1 trillion USD.

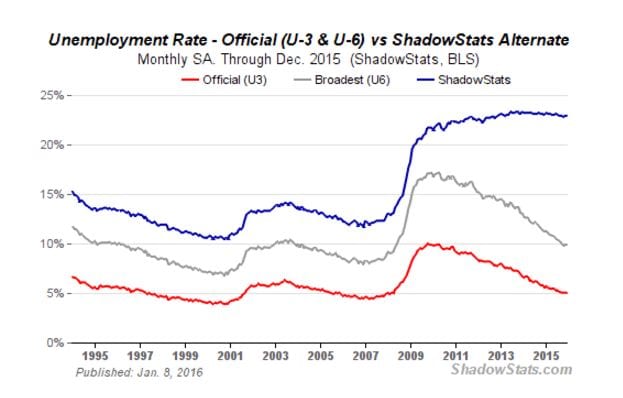

According to the BLS, the unemployment rate is roughly 5%. Shadow statistics, on the other hand, state that as of Dec 2015, the unemployment rate stands at 22.9%

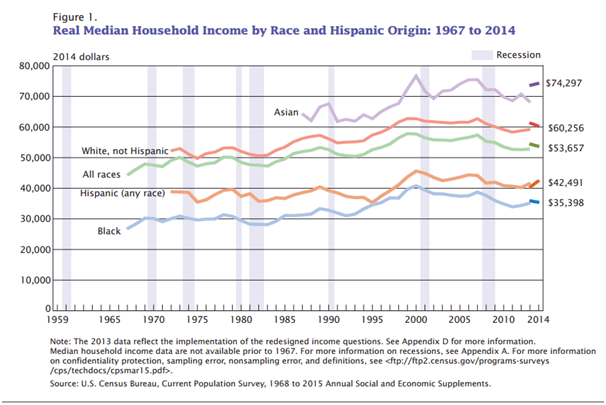

The American Economy and the Issue of Wage Stagnation

Real wages have been declining since 2000. In fact, $22.41 today has the same purchasing power as an hourly salary of 4.03 cents hand in 1973. Median Income continues to drop; the middle class has been decimated since the financial crisis in 2008. This trend is going to continue for the foreseeable future.

Another factor contributing to lower wages is corporate greed. Corporations use billions of dollars to buy back shares instead of investing and growing their companies. When you buy back shares, you artificially boost the earnings per share metric (EPS); this is alchemy at its best. This is done without spending money on new equipment or hiring new workers. It is fast, simple and fraudulent, but the government is not prosecuting anyone so that this trend will continue. We covered this recently in an article titled “share buybacks just another Wall Street Scam.”

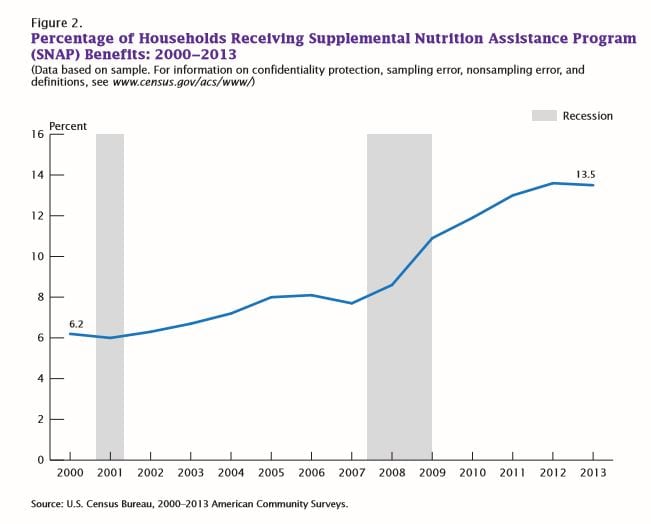

Assessing the Progress: Is the American Economy on the Upswing?

This chart vividly portrays the ongoing deterioration of the situation across the years, extending beyond solely the recession of 2008-2009. The count of individuals reliant on government aid to secure basic sustenance has consistently risen throughout this so-called economic recovery period. Contrary to the expected trend of fewer people seeking government assistance as the economy improves, this chart signifies a transition from unfavourable circumstances to even more dire conditions. Injecting the markets with surplus money disproportionately benefits the exceedingly affluent, establishing an atmosphere that penalizes savers while favouring speculators.

Lastly, the looming issue of student debt represents a ticking time bomb. This debt currently stands at $1.3 trillion and is expanding at an alarming pace of approximately $2,800 per second. As of June 2015, Bloomberg data indicated that 11.5% of this debt had remained overdue for at least 90 days. An alarming 40 million Americans now bear some form of student loan, with 70% of college students graduating while burdened by debt and no assurance of securing employment upon graduation. According to the Department of Education, by 2025, this debt is projected to surge to nearly $2.5 trillion. A substantial default in this domain could potentially dwarf the impact of the 2008 financial crisis, rendering it comparably mild.

Insights and Observations: Random Notes on the Markets – September 2019

It requires minimal effort to succumb to panic, yielding no rewards whatsoever. Those who react with panic in the face of challenges ultimately reap the consequences they have earned. This has even less than zero value in the market context, given that the masses consistently sell when the market hits its lowest point and buy when it peaks. On the contrary, individuals who exhibit astute behaviour by refraining from panic stand to gain substantial rewards. This pattern has persisted for millennia and is unlikely to change for another millennium.

In the realm of markets, there are no definitive laws or fixed regulations, except for the necessity to possess the skill to adapt to various situations. Emotions play a significant role, and chaos ensues when emotions spiral out of control. This is why the masses often engage in stampede-like behaviour when markets experience a downturn, and conversely, they eagerly jump in when a bubble is on the verge of bursting. Despite centuries passing since the Tulip Bubble, little has evolved in this regard.

Taking command of one’s life is imperative, without relying on the government or any private entity for rescue. This entails living within 1-2 standards below your means and channelling the surplus funds into the stock market. Consider it from this perspective: You would inevitably spend this money on unnecessary purchases aimed at impressing people you don’t truly value with money you can’t genuinely afford to pay.