2008 Market Crash vs Today: Seizing Wealth-Building Opportunities

Updated Oct 023

Before delving into the article, let us briefly explore the incredible opportunities from the 2008 market crash. The financial turmoil of that period proved to be a once-in-a-lifetime chance for those who understood mass psychology and dared to swim against the current. While the masses panicked and succumbed to fear, a select few could retire wealthy by seizing the moment.

The key to success during this tumultuous time was recognizing that market crashes are not signals to flee but rather opportunities to embrace. Those who understood this concept could pick up undervalued shares at bargain prices. These seemingly cheap investments then skyrocketed in value over the years, generating substantial wealth for those with the foresight and courage to take action.

This valuable lesson serves as a reminder that every crash should be viewed as a buying opportunity. At The Tactical Investor, we embody this approach. Instead of succumbing to panic, we capitalize on market downturns by strategically acquiring assets when they are most undervalued. We firmly believe that the younger one is, the more aggressively they should invest during a crash, as time is a crucial ally in reaping long-term rewards.

In conclusion, the 2008 market crash showcased the potential for immense wealth creation by going against the grain, leveraging mass psychology, and capitalizing on undervalued assets. Let this be a guiding principle for future market downturns: view them as opportunities to buy rather than reasons to sell.

Comparing the 2016 Crash Hype to the 2008 Market Crash Frenzy

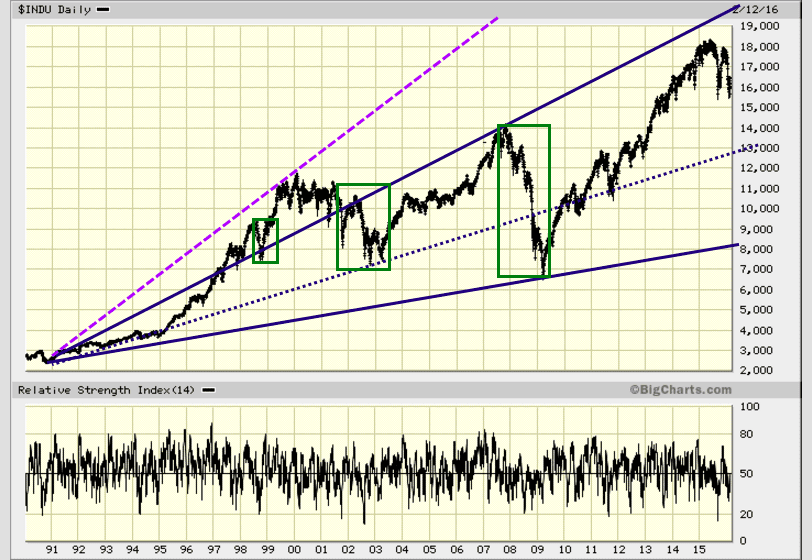

While experts continuously caution that the markets are venturing into dangerous territory and the possibility of a Market Crash in 2016 looms, its actuality remains uncertain. However, what remains undeniably true is that since the intervention of the Fed and its vigorous market support measures initiated in 1987, every crash or correction has ultimately presented itself as an opportune time to make profitable investments.

Should the scenario of a Market Crash in 2016 materialize, seize it as the smart money has done since 1987, and capitalize on the potential to amass substantial wealth. While fear yields meagre returns, causing individuals to scramble for employment, let the masses succumb to panic and dispose of valuable opportunities. Discerning investors revel in moments when the groups panic, while the inverse holds true. Adopting this perspective can lead to success, whereas adopting the pessimistic outlook is akin to repeating history’s mistakes. Pursuing the latter path will only leave you with empty promises and inch you closer to the abyss. What happens when the stock market crashes? It always makes for a great long-term buying opportunity; end of story.

Mass Media: An Epidemic of Noise Pollution

Market Crash 2016 has been pushed many times, and the outcome has always been the same. The only thing that crashed was the egos of the loudmouths making these silly proclamations. From a long-term perspective, one could argue that every crash has proven to be a buying opportunity for the astute investor. The silly investor that flees for the hills (the mass mindset) has always lost his shirt and pants in the process. One should buy when the masses are crying and flee when they are singing. The market crash in 2016 or 2017 is not what you should focus on; focus on the trend, as everything else is just noise.

Fear is in the air, and the masses have just moved to the border of the Hysteria zone. The trend is still up on the NASDAQ and the Dow, so the outlook remains bullish. As volatility levels are very high, view very strong pullbacks as buying opportunities. A test of the August lows is likely, with a possible overshoot to the 14,800-15,000 ranges to destroy the last of the ardent bulls. The RSI has generated an excellent series of positive divergence signals too.

Mob Psychology: The Prophecy of Hollow Stock Market Predictions in 2016

Enduring Lessons: 2008 Market Crash & Simplified Investing

The 2008 market crash hype continues to persist, as the big players learned a crucial lesson during that turbulent period. They recognized the power of amplifying fear to drive the masses into panic, leading to massive sell-offs. Consequently, given the handsome rewards it bestowed upon these astute money handlers, we can anticipate a recurrence of such an event.

Unending Hype: Big Players’ Valuable Lesson from the Meltdown

We have simplified one of the most critical aspects of investing: identifying market trends. If you were to ask any investor who has dabbled in the markets, they would unequivocally state that determining the movement is the most challenging part of the investing process. It requires significant time and effort to pinpoint the direction the markets are headed successfully. This complex process involves analyzing and integrating various factors to determine the prevailing trend.

Embracing Simplicity: Nailing Market Trends for Successful Investing

Once the trend has been identified, the subsequent steps in the investing process become relatively straightforward. We provide a plethora of investment opportunities for a specific reason. Each new trader can choose plays that resonate with their preferences and investment goals. It is difficult to let go of past preconceptions and embrace new ideas; this transition takes time. Hence, we aim to facilitate this transition by offering various investment plays.

Rather than feeling overwhelmed by the sheer number of options, it is crucial to recognize that there is no obligation to open a position in every play. Select the plays that align with your interests and gradually become accustomed to our methodology. You can allocate more substantial capital to your chosen plays as you gain confidence.

Psychological Insights: Unveiling Market Sentiment for Optimal Decision-Making

The anxiety sensitivity index serves as a powerful tool to gauge extreme euphoria or widespread stress/fear in the market. Striking a balance within the extremes of this spectrum is crucial. When combined with sentiment indicators encompassing bears, bulls, and neutral individuals, it becomes possible to identify significant market turning points.

Market trends often witness significant shifts when bullish sentiment hovers within the 50-55 range, with higher readings carrying greater significance. Elevated bullish readings typically accompany market tops, while extreme bearish sentiment indicates potential market-bottoming activity. A reading of 50-55 suggests a state of collective panic, presenting a possible long-term buying opportunity.

A noteworthy scenario arises when neutral readings surge into the 50-55 range, with higher readings carrying more weight. This surge signifies extreme uncertainty as both bears and bulls become unsure of their next moves, leading them to avoid market participation. It reflects a form of learned helplessness observed from 2009 until almost 2018, when the housing collapse’s stress and shock left many investors paralyzed by fear, resulting in prolonged market avoidance.

Incorporating mass psychology alongside these indicators enhances their effectiveness. Understanding the collective behaviour of investors through mass psychology sheds light on market dynamics. Investors can gain deeper insights and make more informed decisions by considering psychological factors such as fear, greed, and sentiment in conjunction with these indicators. Mass psychology adds a valuable layer of understanding to the market analysis process, thereby improving the predictive power of these indicators in anticipating market movements.

FAQ:

Q: What were the opportunities presented by the 2008 market crash?

A: The market crash of 2008 provided incredible opportunities for wealth-building. Understanding mass psychology and going against the crowd allowed astute investors to seize undervalued assets that soared in value over time.

Q: Should market crashes be viewed as buying opportunities?

A: Absolutely. The key lesson from the 2008 crash is that market downturns should be considered buying opportunities rather than reasons to panic. At The Tactical Investor, we capitalize on market downturns strategically to acquire undervalued assets.

Q: Why is it important to identify market trends?

A: Identifying market trends is crucial because it guides the investing process. Determining the direction of the markets is often considered the most challenging aspect of investing. It requires analysis and integration of various factors to identify the prevailing trend accurately.

Q: How does The Tactical Investor approach market downturns?

A: We view market downturns as opportunities rather than succumbing to panic. By strategically acquiring undervalued assets during these periods, we aim to capitalize on their potential for long-term growth.

Q: What should be the mindset during market crashes?

A: The mindset during market crashes should be one of opportunity. Fear-driven selling by the masses presents the chance to buy assets at discounted prices. It’s essential to resist panic and focus on long-term wealth-building strategies instead.

Q: How can one benefit from market crashes?

A: One can benefit from market crashes by adopting a contrarian approach and leveraging mass psychology. Going against the grain and capitalizing on undervalued assets during these times can create substantial wealth.

Q: What can be learned from comparing the 2016 crash hype to the 2008 market crash?

A: The comparison highlights the persistent nature of market crash predictions and the potential opportunities they present. By understanding the lessons from the 2008 crash, investors can navigate the hype and make informed decisions.

Q: Why is simplicity essential in investing?

A: Simplifying investing by identifying market trends reduces complexity and improves decision-making. The Tactical Investor provides various investment plays to cater to individual preferences and goals.

Q: How can one make the most of investment plays?

A: It is unnecessary to open a position in every play offered. Instead, investors should choose plays that align with their interests and gradually gain confidence in the methodology. As confidence grows, more significant capital can be allocated to selected plays.

Q: What is the overall takeaway from the 2008 market crash?

A: The 2008 market crash taught us that market downturns should be considered buying opportunities. By capitalizing on undervalued assets and adopting a contrarian mindset, investors can position themselves for long-term wealth creation.

Other articles of interest

Defining Contrarianism: The Art of Elegant Dissent