Will the Stock Market Crash? Resilience Amidst Uncertainty

Nov 28, 2024

Debunking Stock Market Crash Fear: Why It’s Nonsensical

For as long as markets have existed, a cadre of so-called financial seers thrive on the prophecy of catastrophe. They are the modern-day soothsayers, cloaked in the guise of experts, perpetually warning of the next great financial apocalypse lurking just beyond the horizon. They spin tales of impending doom, fanning the flames of fear among investors and the public alike. But pause for a moment and ask: Is this incessant drumbeat of disaster grounded in reality? Will the next hiccup in the markets truly spell the end of the financial world?

History, the ultimate arbiter of truth, tells a different story—a story of resilience, rebirth, and opportunity seizing those who dare to defy conventional wisdom. At the same time, sensational and headline-grabbing stock market crashes are anomalies rather than regular occurrences. They are the exceptions, not the rule. Yet, the fearmongers would have you believe that collapse is inevitable and imminent. This narrative is not just misleading; it’s a distortion obscuring market dynamics’ true nature.

Consider the great upheavals of the past—the Great Depression of the 1930s, Black Monday in 1987, the bursting of the dot-com bubble at the turn of the millennium, the financial meltdown of 2008, and the swift, brutal downturn triggered by the global pandemic in 2020. Each event was heralded as the final unravelling of the economic tapestry. Commentators declared that prosperity was a relic of the past, eclipsed by the shadows of financial ruin.

Yet, what transpired in the aftermath? Not only did the markets recover, but they surged to unprecedented heights. They metamorphosed, adapted, and rewarded those with the foresight and fortitude to swim against the tide of pessimism. These weren’t mere recoveries but renaissances that redefined wealth and opportunity for a new generation.

The real catastrophe befell those who succumbed to the siren song of doom, who allowed fear to dictate their actions. They liquidated assets at the worst possible moments, locking in losses and forfeiting the gains that awaited just over the horizon. Their quest for safety became a self-fulfilling prophecy of failure. Meanwhile, the sagacious few who recognized the cyclical nature of markets and understood that downturns are moments in time seized the opportunity to acquire undervalued assets, positioning themselves for massive gains when the inevitable rebound occurred.

To cling to the dread of stock market crashes is to shackle oneself to a myth—a phantom menace propagated by those who stand to gain from widespread panic. Crashes are not the precursors of the end but the catalysts for new beginnings. They are the crucibles in which fortunes are forged for those bold enough to challenge the status quo.

So, when the harbingers of disaster proclaim that the sky is falling, look at the lessons of history instead. Recognize that fear is the currency of those who lack understanding. Embrace the ebb and flow of the financial tides with a critical mind and a steadfast spirit. In the depths of uncertainty lies the wellspring of opportunity. The choice is clear: Be swayed by the cacophony of unfounded fears or rise above it to seize the prosperity that awaits the discerning and the daring.

Let us delve into the annals of history, for wisdom resides there. Those who heed its lessons are not doomed to repeat the follies of the past but are empowered to chart a course toward enduring success.

.

Let’s examine the topic from a historical perspective. Those who learn from history are less likely to repeat mistakes.

Will the Stock Market Crash: Inevitable, But Here’s Why It’s Not The Endgame

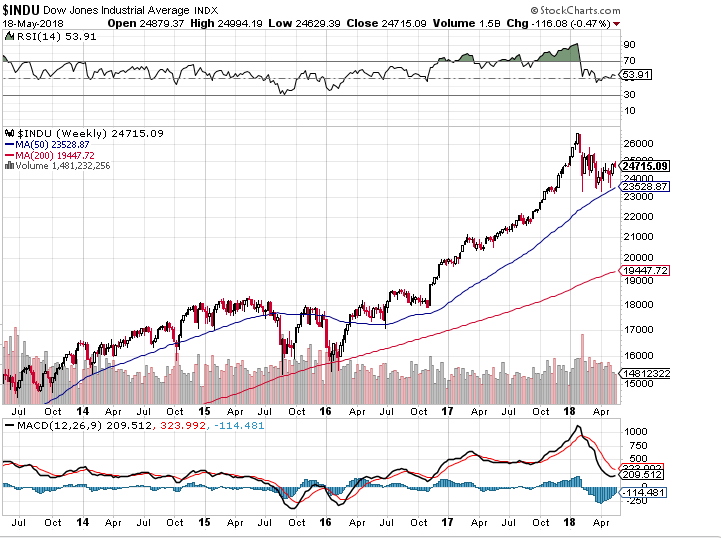

The main factor that confirms all is well is our trend indicator. It is bullish, so all market pullbacks must be considered buying opportunities.

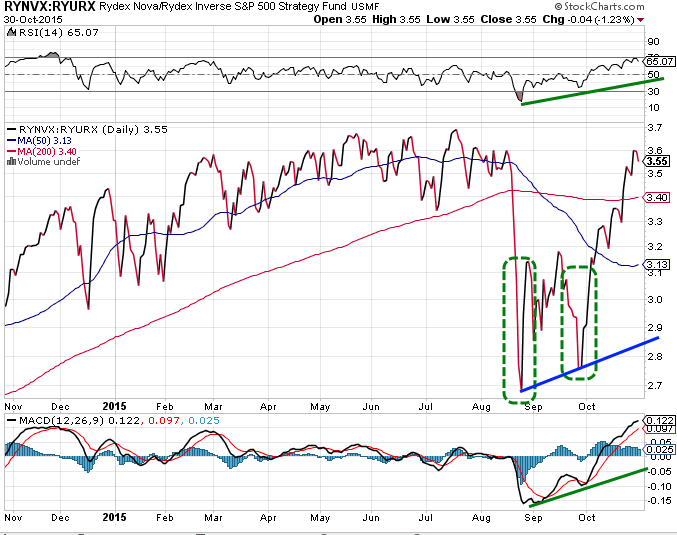

Secondary indicators confirming that Dow is not going to crash

When the ratio moves to the extreme, as shown above, when you see that, it is a signal to pay attention. Used with several other indicators, it could provide (advance) warning of a bottom or top. It has put in an excellent higher low formation, but the ascent up was too fast, so a pullback to the 2.9-3.2 ranges is warranted. This pullback will coincide with a pullback in the markets. A stock crash occurs when the masses are euphoric. Until that moment, the markets are unlikely to crash. However, individual stocks will crash in a bull or a bear market as that event depends on what management does or does not do.

The Dow has a minor zone of resistance in the 17250 range; if it closes above this level, then it should be able to trade to the 17500-17600 range. At that point, the Dow should reverse course and trade down to the 16500-16700 range. Market Update, Oct 17th, 2015

Dow is looking to let out steam.

The Dow has been performing exceptionally well, and it’s expected to have a slight correction soon. As the overall trend is strongly positive, any pullbacks would be an excellent opportunity to buy high-quality stocks at discounted prices. We would be thrilled if the market corrected significantly, giving us a chance to purchase stocks at even lower prices. The market could even test the 17700 range, and we could analyze it further from that point. We are ready to make the most of the market’s temporary decline and take advantage of the panic that will cause most investors to sell their stocks. We could buy quality stocks at a low price.

The V-readings have also increased significantly, indicating that the trading ranges have widened. The market’s direction is determined by its trend, and as the current trend is bullish, we expect the Dow to rise significantly more than it would fall. If the Dow pulls back, we expect it to drop to at least the 16500 range, but if it drops even lower, we consider it a blessing.

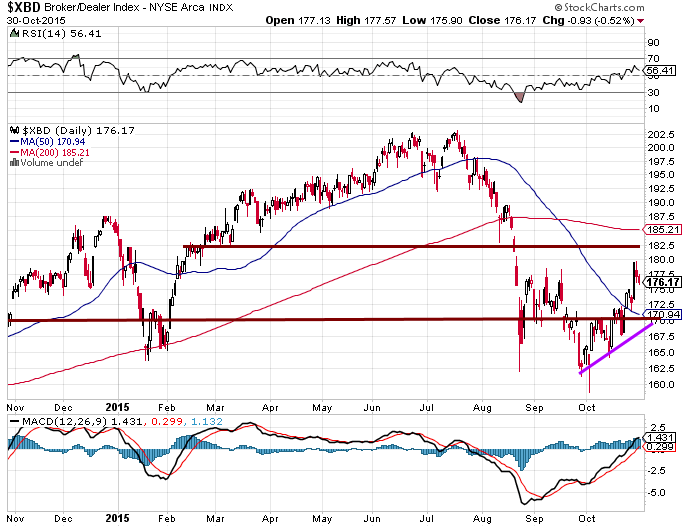

It is sitting right at resistance now; the 170 ranges provide a decent resistance zone. It needs to close above this on a weekly level. If it can achieve this, it will set the way for a move up to the 180 and, subsequently, 190 plus ranges. Market Update, Oct 17th, 2015

Broker-Dealer index flashing a long-term bullish signal.

The XBD trade has closed above 170 on a weekly basis, which is a positive sign for the market. The next resistance level is at 183.00, and there is a high probability that it could break through that zone in the short term and even double before experiencing a firm pullback. Although the index trades lower than its highs, there is no need to worry. This healthy correction will help build momentum for a significant upward trend. According to the Tactical Investor Dow Theory, the Dow utilities are also performing well, indicating a positive outlook for the future.

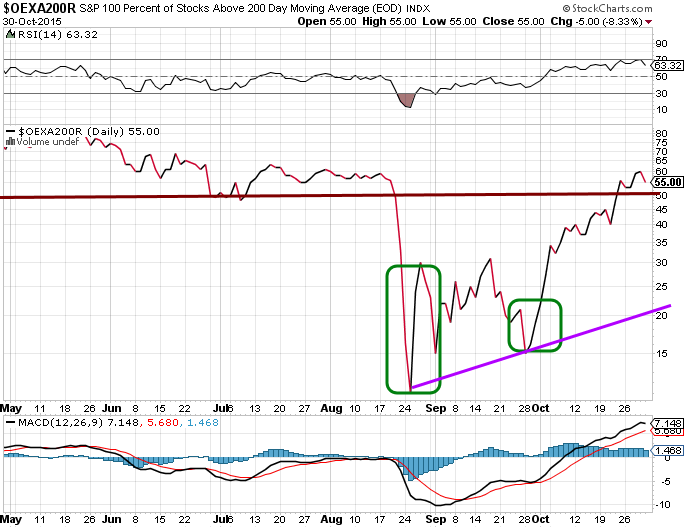

SP 100 development is a Bullish Development.

Experts will have you believe it’s a bad omen if more than 50% of the SP 100 stocks are trading below their 200-moving average. It’s faulty advice at best and rubbish at its worst; when the trend is up (and the trend is up), this development has to be viewed through a bullish lens. Why? Because it allows the astute investor to purchase top-quality stocks at a discount. We have never had a stock crash when the trend is up. Once again, your best options are to focus on the trend and ignore the noise from commercial outlets.

Should you fear a stock crash in 2018?

According to the market sentiment, it is unlikely that there will be a stock crash. Even though the bullish sentiment is around 41%, the combined score of the neutral and bearish indicators suggests that the market may experience a pullback at most. While a correction would not be surprising, it would be a welcome development. Most people tend to make the wrong decisions, such as bailing out when they shouldn’t or buying when they should sell. Don’t follow their lead if you don’t want to lose money.

The Trend is Positive

The trend is positive, so all sharp pullbacks should be embraced. As soon as the markets start to let out some steam, bullish sentiment will plunge, and bearish sentiment will soar. For the masses, it grounds Hogs Day every day; they never learn; Their solace is that misery loves company, and stupidity demands it. A stock crash is not in the works and will not be in the works until the masses embrace this bull market.

Conclusion

History is a treasure trove of lessons, a vast repository of precedents that can guide us in the present and future. This is particularly true in the realm of financial markets. As we navigate the tumultuous seas of investing, the compass of historical perspective can be our most reliable guide.

The adage, “Those who cannot remember the past are condemned to repeat it,” rings particularly true in the context of stock market crashes. We’ve repeatedly seen the cycle of boom and bust play out, accompanied by the same chorus of doomsday predictions. Yet, each crash has invariably been followed by a recovery, often leading to new market highs.

The Great Depression, the Black Monday of 1987, the dot-com bubble burst, the 2008 financial crisis, and the COVID-19 market crash were unique, yet they all shared a familiar pattern. Initial panic, followed by recovery and growth. Those who understood this pattern and learned from history, instead of being swayed by fear, were able to turn these crises into opportunities.

The key to this understanding lies in taking a historical perspective. This means knowing what happened in the past and understanding why, the underlying factors, and how people reacted. It’s about recognizing the patterns and learning from them.

For instance, one of the recurring themes in market crashes is the role of fear and herd mentality. Fear takes over when the market starts to tumble, leading to panic selling. This herd behaviour often exacerbates the crash, turning a market correction into a full-blown crash. However, history has shown us that this is usually the best time to buy when prices are low and the market is poised to rebound.

Another lesson from history is the importance of diversification. The dotcom crash of the early 2000s was largely due to overinvestment in tech stocks. Those who had diversified their portfolios were better able to weather the storm.

In conclusion, while we cannot predict the future, we can learn from the past. By taking a historical perspective, we can avoid repeating the same mistakes and make more informed decisions. So, the next time you hear predictions of a market crash, remember the lessons of history. Don’t let fear dictate your choices. Instead, use the wisdom of the past to guide your future actions.

Other Articles of Interest

Stock Market Crash: Imminent, or does this Stock Market Bull still have legs?