NKE Stock Price Chart & Business Model

Updated September, 2023

Soaring Success: Inside Nike’s Business Model and Rising Stock Price

If you’re intrigued by one of the most dominant brands in sports, you’ll want to take a close look at Nike (NKE). As the world’s largest athletic footwear and apparel company, Nike brings in over $44 billion annually and continues growing at an impressive rate. Their stock price reflects this momentum – up over 15% in the last six months alone.

At the heart of Nike’s success is a renowned business model focused on innovation, brand strength, and connecting with consumers globally. They lead the industry with cutting-edge product design in all the major sports categories from running and training to basketball, soccer, and beyond. Nike spends over $1 billion annually on research and development, ensuring they launch the hottest new technologies that athletes and casual fans alike crave.

Equally crucial is Nike’s marketing prowess. With a roster of stellar athlete endorsers like LeBron James, Serena Williams, and Cristiano Ronaldo, they turn sports heroes into cultural icons who boost the brand’s aspirational image worldwide. Nike spends over $3.5 billion on advertising each year across TV, digital, and venues at major sporting events. Their iconic “Just Do It” slogan has become one of the most memorable in corporate history after debuting in 1988.

Financially, Nike continues excelling with over 75% of revenue coming from international markets as of 2022. Growth opportunities abound in populous regions like China, where the company has partnered with retailers like Tmall to drive e-commerce sales. Nike’s Direct to Consumer segment, encompassing their acclaimed apps and website is another fast-growing sales channel, up 14% in the latest quarter alone.

Nike presents a compelling opportunity for investors keen on a stable, world-leading brand with a proven history of innovation and financial returns. With a P/E ratio of only around 30 despite consistent double-digit earnings growth, the stock remains reasonably priced relative to peers. By delving deeper into Nike’s recipe for success, long-term investors stand to soar alongside this iconic company for years to come.

Rising to New Heights: An Inside Look at Nike’s Growing Global Empire

Nike (NKE) has ascended to the top of the athletic industry by focusing relentlessly on innovation and expanding into new international markets. Let’s take a closer look at the segments powering their success and shares that broke $100 for the first time in early 2023.

Nike’s North American stores and websites remain vital, generating over 30% of revenue in fiscal 2022. However, growth has significantly outpaced this region in China and other Asian markets in recent years. The Asia Pacific & Latin America segment witnessed a 22% yearly gain as of November, reflecting Nike’s deepening roots across developing economies.

In Europe, the Middle East, and Africa as well, Nike has optimized partnerships and product lines and seen an 11% jump in sales year-over-year as of Q2 2023. A continued focus on connecting to diverse communities through culturally relevant designs will serve these areas well. Nike also owns the popular lifestyle brand Converse, which saw a 14% increase over the past 12 months.

The company’s Digital Services segment, including the revolutionary Nike app and compelling web content, empowers direct consumer relationships and led to over 20% revenue growth in Q2. Global Brand Divisions comprising categories like Nike Golf and the Jordan brand also delivered impressive double-digit sales surges.

Having transcended borders via its visionary co-founder Phil Knight’s original vision, Nike now rides high as a $100 billion global powerhouse. With ongoing product excellence and expanded reach into new growth frontiers, Nike shareholders should feel optimistic about the road ahead.

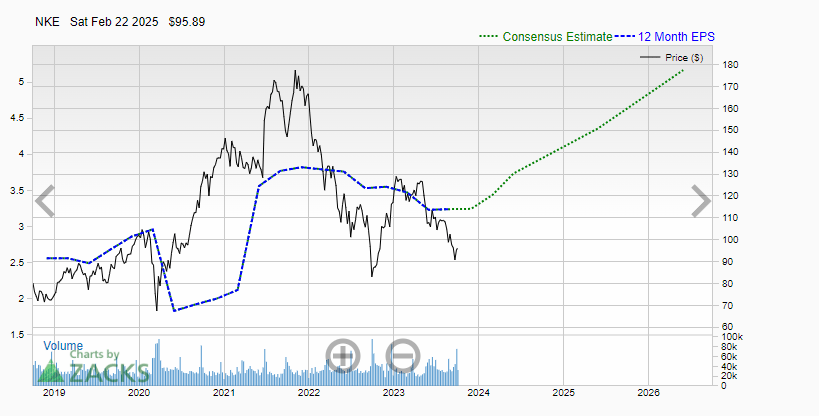

Nike EPS Earnings Projections Through 2026

Analyzing Nike’s EPS projections, it becomes evident that the ongoing market sell-off presents a golden opportunity to accumulate shares in this reputable company. Investors should embrace sharp corrections as enticing opportunities to bolster their positions. Projections indicate that Nike’s EPS will continue its upward trajectory until 2026, and a robust correlation exists between Nike’s EPS trend and its share price performance. Additionally, the absence of unusual insider selling signifies that insiders remain composed and confident in the company’s prospects.

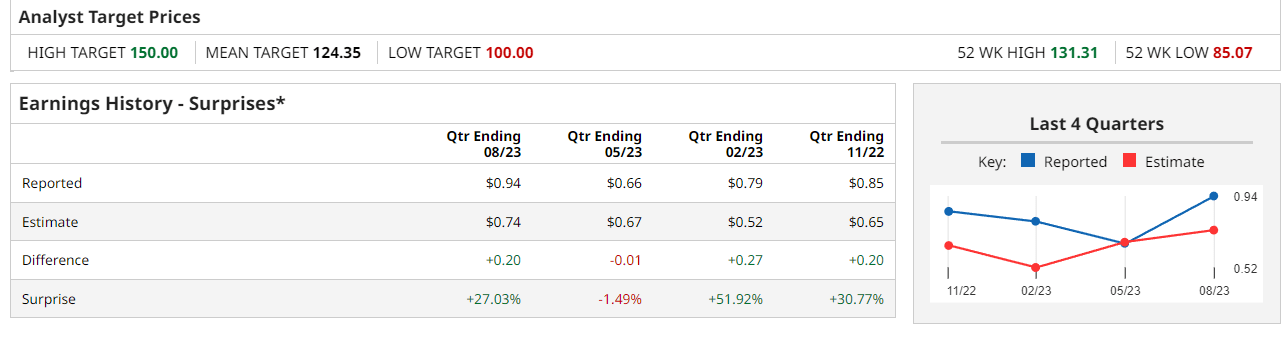

NKE Stock Price Projection By Analysts

Indeed, analysts have a reputation for being wrong more often than not, with accuracy rates as elusive as a mirage in the desert. This is a stark reminder to take their views with a grain of salt and, perhaps, a shot of tequila for good measure.

It’s worth noting that if these analysts possessed crystal-clear foresight into Nike’s future trajectory, they would be quietly capitalizing on that knowledge rather than peddling it to others. The stark reality is that only a minority of investors actually act upon their advice, and there’s a valid reason behind this scepticism.

In truth, most of these analysts are as clueless as a dart-wielding monkey when it comes to predicting a stock’s direction. Perhaps, in some instances, entrusting a monkey with darts to randomly select stocks from a dartboard might yield more reliable outcomes.

NKE Stock: Sell-Off Equals Buying Opportunity

So, what does the future hold for NKE? The tumultuous coronavirus pandemic has left investors on edge, triggering a frantic sell-off reminiscent of doomsday scenarios. Amid this chaos, discerning investors must sift through the noise and separate fact from fiction, as some self-proclaimed experts issue unfounded projections.

Delving into the monthly charts, we find NKE lingering in the depths of highly oversold territory. This signifies a promising long-term opportunity in the making. The stock appears to be in the final stages of establishing a substantial long-term bottom, a phase that savvy investors should seize to initiate new positions or bolster existing ones.

Taking a broader perspective, NKE is currently trading at a discounted rate. If Nike can secure monthly closes above the pivotal mark of 105, it could potentially set the stage for a series of impressive new highs. There’s a compelling likelihood that, in just 12 months, NKE could surge to the 165 to 171 range with a possible overshoot to 190.00. Investors are encouraged to perceive sharp pullbacks through a bullish lens, recognizing the potential for substantial gains.

Random Suggestions for Improving Investment Outcomes:

Understanding mass psychology and adopting contrarian investing strategies are crucial for achieving sustained gains over the long haul. Mass psychology emphasizes the importance of resisting herd behaviour and recognizing market extremes, while contrarian investing helps maintain rationality during market fluctuations.

Reflecting on our past experiences, it becomes evident that following the crowd or so-called ‘experts’ often led to financial hardships. The term ‘expert’ can even be seen as ‘EX Spurt,’ a relic of the past. True wisdom lies in adapting to evolving markets and employing strategies rooted in knowledge, discipline, and forward-thinking.

Rather than fixating on today’s hottest stocks, successful investors focus on companies with robust fundamentals and acquire them opportunistically. They maintain a long-term perspective and capitalize on opportunities during market corrections or bearish phases.

In conclusion, the most promising long-term investment opportunities aren’t always in the limelight. They possess sustainable growth potential and are often undervalued due to market shifts. By comprehending mass psychology, embracing contrarian investing, and concentrating on a stock’s long-term prospects, investors can make informed decisions that will yield rewards in the future. Remember, the stock market is a vehicle for building wealth over time, not for seeking quick gains.”

Contemplative Musings

The human mindset does tend to gravitate towards negativity, a phenomenon attributed to the brain’s inherent “negativity bias.” This bias is deeply ingrained, and its influence is detectable even in the earliest brain information-processing stages. Research conducted by John Cacioppo, Ph., formerly at Ohio State University and now at the University of Chicago, provides insights into this bias.

However, let’s shift our perspective to a more positive outlook. While it’s true that our brains have evolved to prioritize negative information as a survival mechanism, studies show that we can overcome these biases through mindful awareness and intentional focus.

Rather than dwelling on negativity, it’s beneficial for individuals to consider the remarkable progress humanity has made in promoting understanding among diverse cultures. Modern technology and connectivity allow us to share perspectives globally in real time, facilitating collective efforts to address critical issues such as human rights, environmental conservation, and global health.

Our inherently social nature also enables us to uplift one another. Friends, family, and role models can inspire personal growth and acts of kindness that have a positive ripple effect on entire communities—every small act of kindness matters. By consciously directing our attention toward life’s blessings rather than its shortcomings, individually and collectively, we can foster justice and well-being in a self-reinforcing cycle.

Embracing Positivity: How it Impacts Your Investments.

The challenges we face today call us to tap into our highest human qualities—compassion, courage, scientific inquiry, and democratic governance. I firmly believe in our capacity to rise to the occasion when we support one another with patience, wisdom, and a commitment to future generations. There are always alternatives to helplessness if we are willing to recognize them.

Cacioppo’s research further illustrates this bias in action. When people were shown images designed to evoke positive, negative, or neutral emotions, their brain’s cerebral cortex exhibited more robust electrical activity in response to negative stimuli. This heightened reaction to negativity underscores the greater impact of negative news on our attitudes than positive news. psychologytoday.com

Media outlets are aware of the human tendency to gravitate toward negativity, so they often provide three to five times more coverage of stories with a negative connotation. This phenomenon further highlights why the general public often struggles in the financial markets. They get absorbed in less meaningful information and miss out on the opportunities right in front of them.. negative thinking and how it affects your investments

This content was originally published on April 20, 2017, but it has been continuously updated over the years, with the latest update conducted in October 2023

Interesting Reads

How Do You Win the Stock Market Game? Effective Strategies

A Sophisticated Approach: Do Bonds Increase Returns When the Stock Market Crashes?

Mastering Your Finances: Why You Need to Learn How to Manage Your Money with Grace

Why is the US Dollar Not Backed by Gold? Unveiling its Deadly Impact

Best Ways to Beat Inflation: Inspiring Insights from Contrarian Investors

Unveiling Falsehoods: Which of the Following Statements About Investing is False

How to Win the Stock Market Game: Cracking the Code

Which of the Following is True When the Velocity of Money Falls? Economic Slowdown

Investor Sentiment and the Cross Section of Stock Returns: Exploring the Hot Connections

Investing for Teenagers: Laying the Foundation for a Financially Stable Future

Building a Resilient Investment Strategy with 40/60 Portfolio Diversification

IBM Stock Price Forecast 2024: Examining IBM’s Strategic Vision

US Stock Market Crash History: Lessons for Earning

What Is Price to Sales Ratio?: Understanding a Key Valuation Metric