Fed is masking current rate of inflation

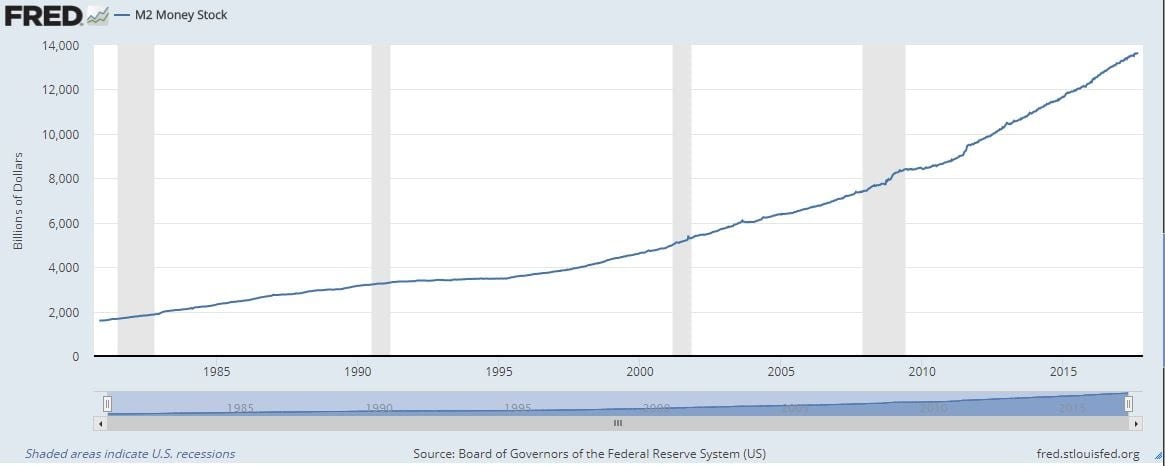

What’s strikes one immediately is that the Fed has been creating money hand over fist; one hand they create money, with the other hand they buy assets and put it on their books. All looks well until you realize this is something called monetization of debt; paper is buying more paper and in most nations, this leads to hyperinflation and a currency collapse. However as the Dollar is the world reserve currency, the Fed can create money magically out of thin air and use this newly created money to pay bills and or prop up markets as is the case with the Fed.

Must Read: Federal Reserve existence based on Fraud

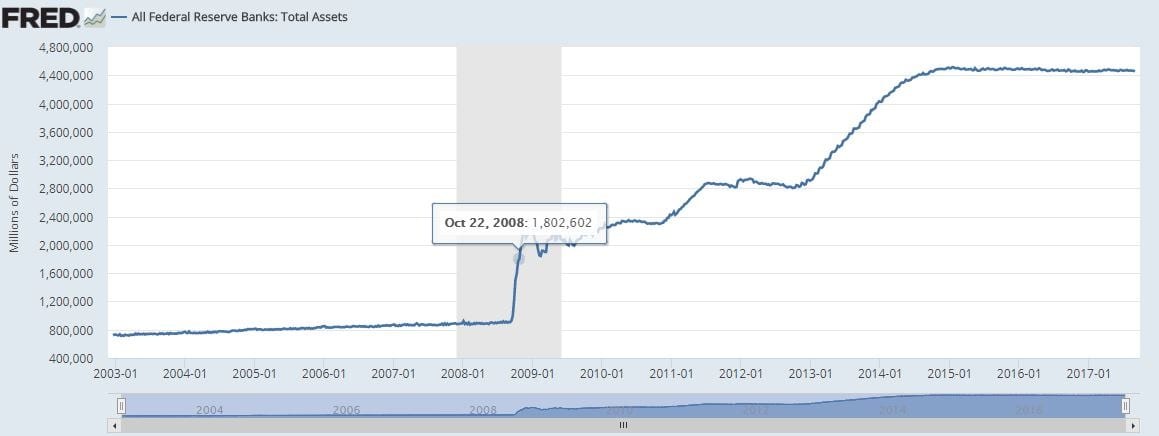

The total assets of the Fed have skyrocketed since 2008. Prior to that, we had nice channel formations where nothing happens for a while and then suddenly the Fed’s assets explode. One hand starts to print while the other hand uses this newly created money to buy treasuries, etc. It is nothing but one big Ponzi scheme. It has not collapsed because the masses are still asleep and show no signs of waking up so it will continue for a very long time as the masses show no signs of waking up.

Look how CNBC aired in 2009: in this video, one of the members openly describes what is essentially a Ponzi scheme, but the CNBC host goes on to say, well we have a better term for that it’s called “debt monetization” but that is just a kind word for outright robbery and theft.

The above chart provides extra data; notice that the Money stock goes ballistic after the 2008 financial crisis. Is that a coincidence? we think not

Do you still think the Fed is dumb? If they were that thick, they would not have managed to get away with murder for so many decades. Furthermore, they flooded the markets with volumes of money after 2008 and based on logic; Gold should have soared, the dollar should have crashed, and interest rates should have risen. Instead, the opposite occurred.

The reason for this unexpected reaction was that Fed wisely brought the velocity of money to a standstill. Money was not changing hands frequently. If you remember, they froze the credit market. Suddenly it was no longer easy to get credit before you could buy a house by only signing X on the signature line. Now we have another channel formation in the process, and it’s a pretty long channel formation. Thus, be ready for the Feds to open the spigots again and flood the markets with hot money; quantitative easing for the people perhaps.

The Current Rate of Inflation is being masked; simple strategy helps maintain your purchasing power

The market is going to trend higher in such an environment; sure it’s going to be a volatile ride up, but the markets will be spending more time to the upside than to the downside. Educate yourself or become a subscriber and let us do the work for you.

Other Articles of Interest:

Margin trading comeback could propel Chinese Markets Upwards (April 1)

Yuan surges past Canadian dollar for Global Payments (April 1)

Central Bankers Declare War on Cash; Time to Act (March 31)

Economic Crisis; Subprime Auto Loan disaster ready to strike (March 28)

China Punishes 300,000 Officials for corruption & U.S.A punishes none (March 28)

Fossil Fuel Era over End of Crude Oil (March 25)

Cheap Alternative energy will replace oil & other Fossil Fuel