End of USD As World Reserve Currency?

Updated July 29, 2024

The French Finance minister, the one-eyed man in the land of the blind, states that a dollar crash is imminent.

The era of the US dollar’s “exorbitant privilege” as the World’s primary reserve currency is ending. Then French Finance Minister Valery Giscard d’Estaing coined that phrase in the 1960s mainly out of frustration, bemoaning a US that drew freely on the rest of the World to support its over-extended standard of living. For almost 60 years, the World complained but did nothing about it. Those days are over.

Already stressed by the impact of the COVID-19 pandemic, US living standards are about to be squeezed as never before. At the same time, the World is having serious doubts about the once widely accepted presumption of American exceptionalism. Currencies set the equilibrium between these two forces—domestic economic fundamentals and foreign perceptions of a nation’s strength or weakness. The balance is shifting, and a crash in the dollar could well be in the offing.

Lacking domestic savings and wanting to invest and grow, the US has taken great advantage of the dollar’s role as the World’s primary reserve currency and drawn heavily on surplus savings from abroad to square the circle. But not without a price. To attract foreign capital, the US has run a deficit in its current account — the broadest measure of trade because it includes investment — every year since 1982. https://yhoo.it/3ffMkvN

Tactical Investor Take on the End of the USD as World Reserve Currency

Yawn, what a tedious argument—all talk and no action. One could have made the same claim decades ago, and yet the dollar reigns supreme. There are so many flaws with this argument that this chap would be better qualified for the post of janitor than finance minister. Everything stated is true regarding the US abusing its power due to the dollar’s status as the world reserve currency.

However, what currency is going to replace the dollar? The Euro, or the Yuan, are equally shaky as the economies in both regions are far from healthy. Moreover, most of the World is not ready for a replacement, and the trillion-dollar challenge is that if these nations sell their dollars and move into another currency, the dollar’s value will plunge, and in doing so, the reserves of all these countries will drop significantly. The collapse of the dollar without a valid successor will lead to a crisis that will make the 1929 crash look like a big party.

Now, all these comrades fail to consider that the US is the leader in almost all the key industries—AI, robotics, social media, weapons production, Semiconductors, etc. Having the biggest guns and all the top players in the AI sector, the US is positioned to dominate the future in an array of the most powerful industries. The US controls the media and AI sectors, and it has the world’s most powerful army. Oh, let’s not forget that the US dollar is still the World’s reserve currency, so sadly, it’s game over before even a bullet is fired.

On a side note, let’s not forget what happens to those challenging the Fed. Roughly, this is what occurred.

On June 4th, 1963, JFK ordered the printing of Treasury dollar bills instead of Federal Reserve notes (Executive Order 11110). He also ordered that once these had been printed, the Federal Reserve notes would be withdrawn and the Treasury bills put into circulation. A few months later, on November 22nd, 1963, he was killed in broad daylight.

Once again, history clearly illustrates that a good Samaritan always ends up as a dead Samaritan. Trying to help the masses always leads to a negative outcome. A look back at history clearly illustrates that the result is almost always negative when someone goes out of their way to help the blind and the deaf, AKA the crowd. How do you help the crowd when they don’t know the problem?

So, what is the fate of the dollar?

The dollar, by logic, should drop as the Fed is pumping out insane amounts of money, but let’s not forget that the Fed has forced almost every other nation to take the same route. Another argument that one could make is that the US debt is just too high. Well, that argument could have been made decades ago. Once upon a time, the deficit was less than a billion dollars

Around 1901 the total debt was 4.1 billion dollars, hence in comparison, today’s debt is already insane. It all comes down to perspective. We now live in an era where the masses are asleep; they are in a deep coma. Hence, as we have stated before, they are unlikely to notice anything until the debt touches the 100 trillion mark.

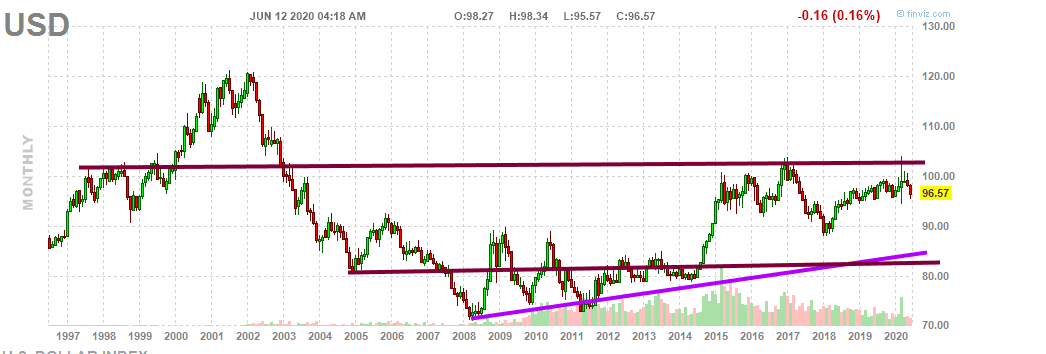

The dollar is currently consolidating, and our currency is much stronger as the US still offers the best rates in the industrialised world. We expect the dollar to mount a rally after this consolidation runs its course. A monthly close above 105.00 will pave the way for the dollar to test the 116.70 to 118 ranges, with an extreme possibility of trading to or past 120.00.