Which of the Following is/are Reasons Why Investors Might Choose to Invest in Mutual Funds?

April 4, 2024

Introduction:

Mutual funds have long been famous for investors seeking diversification, professional management, and accessibility. The ancient Greek philosopher Aristotle once said, “The whole is greater than the sum of its parts.” This principle aptly describes the essence of mutual funds, which pool money from numerous investors to create a well-diversified portfolio. This article will explore why investors, from college graduates to seasoned professionals, might choose to invest in mutual funds.

Diversification: Mitigating Risk in a Volatile Market

One of the primary reasons investors choose mutual funds is diversification. As the wise King Solomon of Israel stated around 900 BCE, “Divide your portion to seven, or even to eight, for you do not know what misfortune may occur on the earth.” By spreading investments across various sectors, industries, and geographical regions, mutual funds help mitigate the impact of market volatility on an individual’s portfolio. This strategy aligns with the principles of modern portfolio theory, developed by Nobel laureate Harry Markowitz in the 1950s, emphasising the importance of diversification in reducing risk.

Professional Management: Leveraging Expertise and Experience

Another compelling reason to invest in mutual funds is access to professional management. As the legendary investor Benjamin Graham, often considered the father of value investing, once said, “The individual investor should act consistently as an investor and not as a speculator.” Mutual fund managers possess the expertise and experience necessary to navigate complex financial markets, making informed decisions on behalf of their investors. This is particularly valuable for those who lack the time, knowledge, or inclination to manage their investments actively.

Accessibility and Affordability: Opening Doors to a Wider Range of Investors

Mutual funds have democratized investing by providing accessibility and affordability to many investors. As the renowned investor and mutual fund pioneer John Bogle once remarked, “The mutual fund industry has been built, in a sense, on the Canterbury pilgrimage. The pilgrims are individual investors.” With relatively low minimum investment requirements and the ability to purchase fractional shares, mutual funds have opened doors for investors who might otherwise be excluded from specific investment opportunities. This accessibility has been further enhanced by the rise of online investing platforms and the growing popularity of index funds, which offer low-cost exposure to broad market indices.

Liquidity and Flexibility: Adapting to Changing Financial Needs

Liquidity and flexibility are additional factors that draw investors to mutual funds. As the Taoist philosopher Lao Tzu said around 500 BCE, “Water is fluid, soft, and yielding. But water will wear away rock, which is rigid and cannot yield. As a rule, whatever is fluid, soft, and yielding will overcome whatever is rigid and hard.” Mutual funds embody this principle by allowing investors to easily buy or sell their shares as needed, adapting to changing financial circumstances or market conditions. This liquidity is precious during times of economic uncertainty or personal monetary strain.

Emotional Discipline: Overcoming Behavioral Biases

Mutual funds can help investors maintain emotional discipline and overcome behavioural biases. As the renowned investor and mutual fund manager Peter Lynch once observed, “The key to making money in stocks is not to get scared out of them.” By entrusting their investments to professional managers, investors can avoid the pitfalls of emotional decision-making, such as panic selling during market downturns or chasing hot stocks based on hype rather than fundamentals. This emotional discipline is essential for long-term investment success, as evidenced by the enduring wisdom of Warren Buffett, who famously advised investors to “be fearful when others are greedy, and greedy when others are fearful.”

Conclusion: Which of the Following is/are Reasons Why Investors Might Choose to Invest in Mutual Funds?

Investors might choose to invest in mutual funds for several compelling reasons. Firstly, mutual funds offer diversification, allowing investors to spread risk across various securities. According to a study by Vanguard, diversification can reduce portfolio volatility by up to 85%. Secondly, mutual funds provide professional management, with experienced fund managers making investment decisions on behalf of investors. Warren Buffett once said, “Risk comes from not knowing what you’re doing.” Professional management helps mitigate this risk.

Moreover, mutual funds are accessible to a wide range of investors, with low minimum investment requirements and the ability to invest in small increments. John Templeton, another renowned investor, emphasized the importance of accessibility, stating, “The best time to invest is when you have money. This is because history suggests it is not timing that matters but time.” Mutual funds offer liquidity, allowing investors to buy and sell their shares at the current net asset value (NAV).

Lastly, mutual funds can provide emotional discipline, as investors are less likely to make impulsive decisions when their investments are managed by professionals. According to a study by DALBAR, the average investor’s returns are significantly lower than market returns, primarily due to emotional decision-making.

However, it is worth noting that while mutual funds are a good investment option, Exchange-Traded Funds (ETFs) maybe even better. ETFs offer the same benefits as mutual funds, such as diversification and professional management, but with the added advantage of being traded like stocks. This means investors can buy and sell ETFs throughout the trading day, providing greater flexibility and liquidity. Additionally, ETFs often have lower expense ratios than mutual funds, which can lead to better long-term returns for investors.

FAQ: Which of the Following is/are Reasons Why Investors Might Choose to Invest in Mutual Funds?

1. Q: How do mutual funds help investors diversify their portfolios?

A: Mutual funds pool money from numerous investors to create a well-diversified portfolio, spreading investments across various sectors, industries, and geographical regions. This helps mitigate the impact of market volatility on an individual’s portfolio, aligning with the principles of modern portfolio theory.

2. Q: What are the benefits of professional management in mutual funds?

A: Mutual fund managers possess the expertise and experience necessary to navigate complex financial markets, making informed decisions on behalf of their investors. This is particularly valuable for those who lack the time, knowledge, or inclination to manage their investments actively.

3. Q: How do mutual funds provide accessibility and affordability to various investors?

A: Mutual funds have democratized investing by offering relatively low minimum investment requirements and the ability to purchase fractional shares. This has opened doors for investors who might otherwise be excluded from specific investment opportunities, further enhanced by the rise of online investing platforms and the growing popularity of index funds.

Provoking Articles for Curious Minds

What Is the Key to Successful Investing? Patience and Discipline

How Can Economic Crises Lead to the Acceptance of Totalitarian Governments?

Future Market Insights: Move Beyond, Embrace the Trend

Collective Behavior Is Easy to Study: Let’s Dive In

long term vs short term investing in stocks: Understanding Key Differences

SPX 200-Day Moving Average: Unlocking Profitable Trading Strategies

What Percent of 18-29 Year Olds Are Investing in the Stock Market?

What Top Stocks to Buy Now: Mastering Your Entry Timing

History of Stock Market Crashes: Embrace Fear, Ignore the Noise

Rise in Sexual Immorality: Alarming Trends

How To Get Financial Freedom Fast: Escape the Herd for Lasting Success

Giving Content to Investor Sentiment: The Role of Media in The Stock Market

Considering the impact of inflation, Why Is Investing Important?

Technical Analysis of Stocks and Commodities: Unveiling Insights

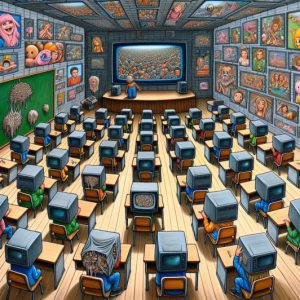

Why Is the US Education System So bad: Rubbish In, Rubbish Out Phenomenon

What is Index Investing? -A Sophisticated Approach to Portfolio Management