Gleaming Heights: A Bullish Outlook in Our Gold Price Forecast

Updated Dec 2024

By seamlessly blending historical insights with the contemporary outlook, we embody the wisdom that learning from history prevents its repetition and showcase our commitment to walking the walk. The current perspective offers clear indications of the anticipated trajectory for gold.

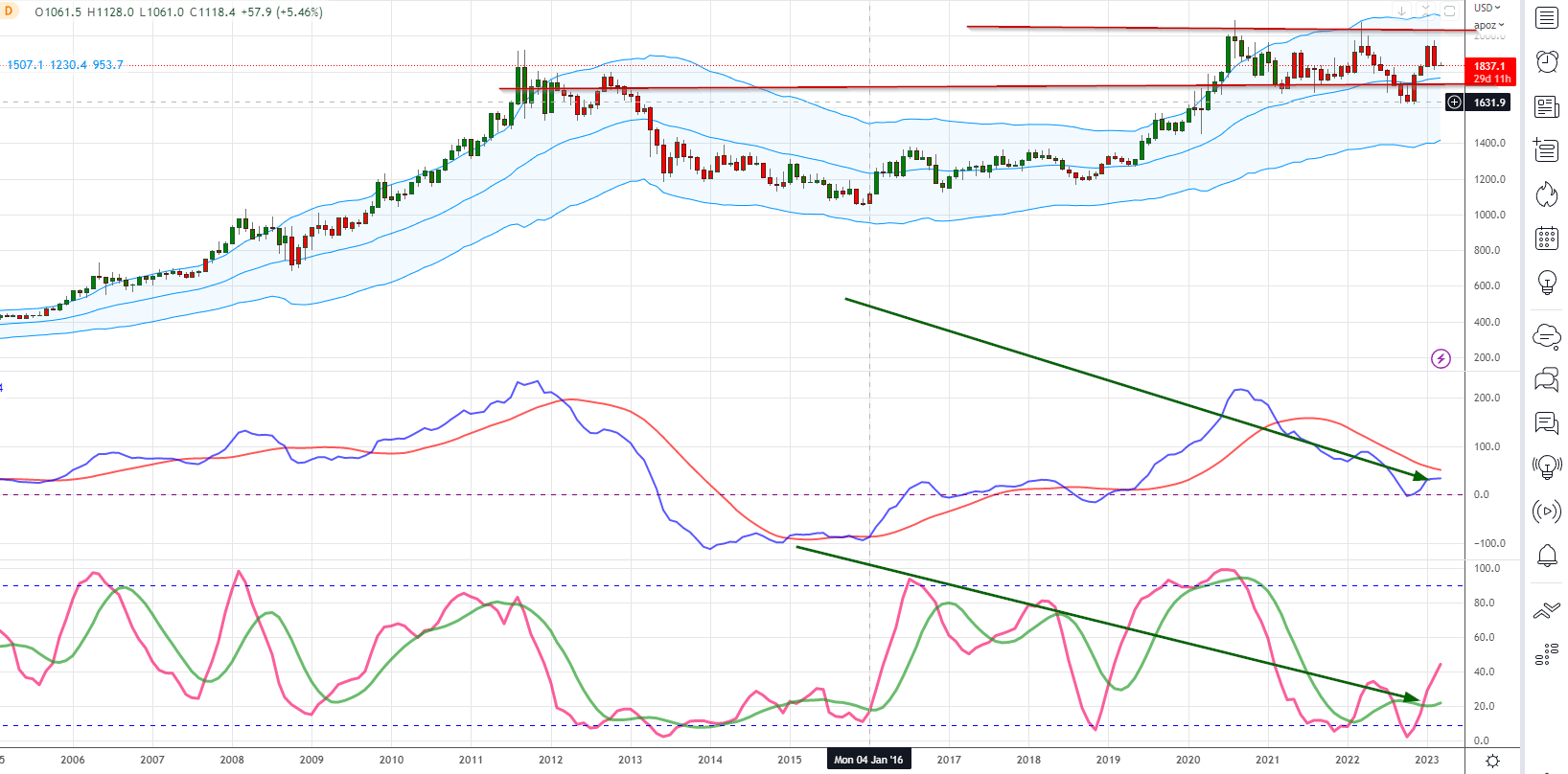

Gold prices have seen a resurgence in 2022, driven by high inflation and economic uncertainty. After hitting a low of around $1,700 per ounce in March, gold rallied to over $2,000 by August. Many analysts remain bullish on gold’s outlook, forecasting further gains in 2023.

Several factors point to continued strength in gold prices. Persistently high inflation will likely keep real interest rates low or negative, burnishing gold’s appeal as an inflation hedge. Geopolitical tensions like the Russia-Ukraine war also support safe-haven demand. There are risks of recession in major economies like the U.S. and Europe, which could spur more defensive positioning.

Given the uncertainty in financial markets, investment demand for gold should stay robust. Central banks are still buying large amounts of gold to diversify reserves. Retail investors have been steady buyers through exchange-traded funds (ETFs). Jewellery demand is recovering as economies reopen.

On the supply side, gold production is constrained and likely to lag demand growth. Environmental and geopolitical challenges have made it more difficult to bring new mines online. This supply/demand imbalance should provide fundamental support to prices.

Most analysts have raised their gold price targets for 2023. Big banks like Citigroup and UBS now forecast averages near $1,900 next year. Goldman Sachs sees gold reaching $2,500 within the next 12 months. This bullish outlook reflects gold’s role as a haven and inflation hedge. Barring an unexpected shock, the gold price trend points higher.

Gold Price Forecast 2023

At Tactical Investor, we are concerned that real inflation will emerge once the dollar peaks later this year. Our analysis indicates that the dollar is on the verge of a multi-year peak. The recent surge in copper prices, reaching new highs in 2022, serves as a subtle reminder that inflation will pose a significant issue in the future. The money supply is expected to increase exponentially, and the BRICS nations will continue to gain momentum. As more nations divest from the dollar, demand for the currency will diminish.

We anticipate that the price of Gold will hover between the range of 2500 to 2700 over the next 15 to 24 months. However, there is a possibility that Gold may surge as high as 3600 before reaching a multi-month peak.

Shifting our focus, I will now delve into the historical perspective, unravelling the intricacies of the situation from a time-tested lens. Let’s journey into the past and explore the historical context.

Debunking Jim Sinclair’s Gold Price Fantasy: A Tale of Unsubstantiated Targets and Historical Histrionics

Jim Sinclair’s Gold Price Forecast is insane, to put it mildly; we would like to know how he arrived at this calculation. If you Google his name, you will find he posts stuff on Gary North’s site. Google Gary North, and you will find out that he is the idiot who scared thousands of people to think the world would end due to the Y2K bug in 2000.

Gary North scared so many people into buying supplies they needed because, according to him, the world would go dark in 2000. 2000 came, and it was a non-event, but many ordinary folks who bought this nonsense lost small fortunes. At the very least, Gary North should have been fined, but instead, he is alive and thriving and probably pushing another product. We find the technique Sinclair uses to be distasteful in that he uses scare tactics to bait the uninformed. If he were so sure Gold would go to 50,000, why did he not sell everything he owned and dump it into Gold?

Pie in the sky targets

Gold has not even hit $2,400, so Jim is genuinely in a league of his own when he comes out with this insane target of $50,000. So what gives?

- He is looking at his crystal ball and getting the wrong message. Maybe the net connection to the other world is not up to standard.

- He is trying to sell you something by trying to scare you

He claims to be a gold expert, but he is more like a snake oil salesman, as it is unbecoming to issue such a target when Gold has not even made it to $2400. - Finally, what century is he talking about, 200 years from now or 300 years from now? Even if he is right, who would care, as one would be long gone by then?

He made the exact predictions in 2013, 2014, 2015, etc., and will continue until the end of time. He is a broken record chanting the same monotonous hymn repeatedly; eventually, he will be correct, but you could be dead and gone by then.

Intriguing Reads Worth Your Attention

Revamping the 60 40 Rule: Unleashing New Strategies for Success